Canadian Hydrogen Observatory: Insights to fuel…

1000+ biomethane plants in operation and a sector facing major regulatory changes

In March 2022, the European Commission announced a target of 35 billion cubic meters (bcm) of biomethane production in the EU by 2030 as part of the REPowerEU plan. Increasing biomethane production will reduce the EU’s dependence on natural gas imports as well as significantly accelerate the achievement of climate objectives. Achieving this ambition, which implies a tenfold increase in the amount of biomethane injected into the gas grid, will require upgrading the existing biogas plants for injection where it is possible, but also a significant increase in production.

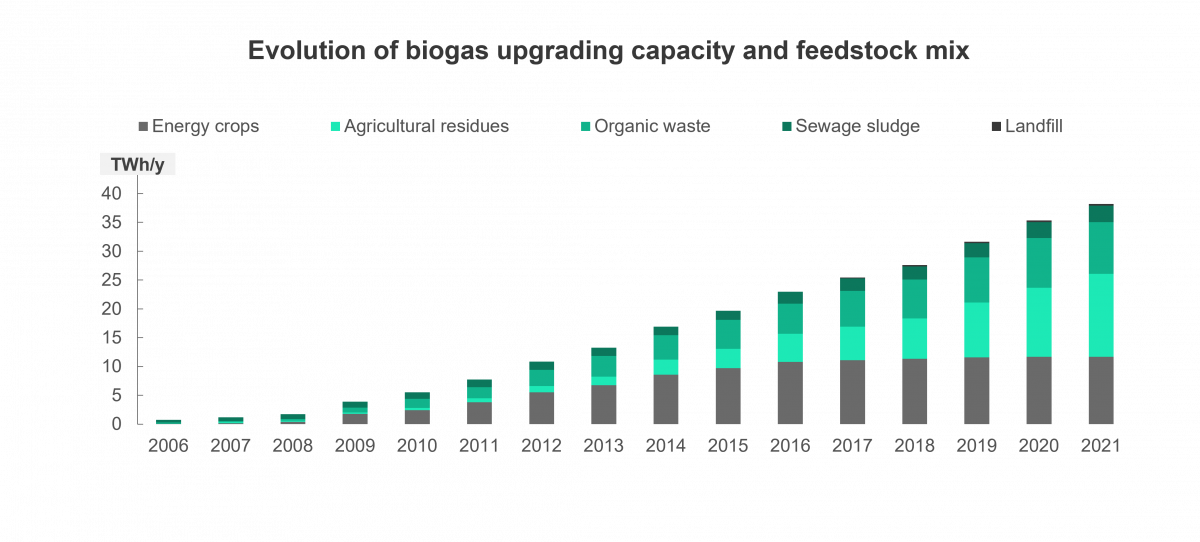

More than 1000 biomethane plants have been registered in the main producing European countries at the end of 2021. Of these operating units, 90% are found to inject their biomethane into the gas grid with a total biogas upgrading capacity of 855 000 Nm³/h (3.6 bcm) and a volume of 30 TWh biomethane injected in 2021. European biomethane producers have now reached 10% of the 2030 target of 35 bcm. There is huge scope to expand biomethane production, as only 5% of biogas plants in the EU have registered a biogas upgrading unit, which is required to produce biomethane. The majority of these biogas plants are supplied by agricultural residues, energy crops and organic waste. Agricultural residues including manure, crop residues and intermediate crops, amount to 38% of the feedstocks used and represent a promising way to reduce methane emissions from agriculture, causing today more than half of EU methane emissions. On the other hand, dedicated energy crops, mainly located in Germany and the UK, still account for 31% of the feedstocks. Energy crops are low-cost and low-maintenance crops grown solely for biofuel or biogas production. Next to their ecological advantages over fossil fuels, these inputs also carry a sustainability risk of competing with food crops, polluting water and air, losing soil quality, enhancing erosion and reducing biodiversity.

Over the past few years, the biomethane sector experienced steady growth in most of the European producing countries, with biogas upgrading capacity increasing with 21% in 2 years, growing from 708 000 Nm³/h (3.0 bcm) in 2019 to 855 000 Nm³/h (3.6 bcm) in 2021. This growth mainly results from dynamic growth in major producing countries like France or the Netherlands. Smaller players like Italy and Finland appear to follow that same dynamic trend. In France alone, 241 new biomethane units have been commissioned in the past two years, almost tripling its total biogas upgrading capacity to 6.4 TWh/y (0.6 bcm) in 2021. On the other hand, established countries like Germany, Austria, Switzerland and Sweden remained stable over the past years. In Germany, which still has the highest number of biogas units and biomethane production capacity in Europe, the evolution of the biomethane sector remains stable around 240 biomethane units and a biogas upgrading capacity of 280 000 Nm³/h (1.2 bcm). Concerning feedstocks, the proportion of energy crops used in biomethane production has noticeably decreased by 20% over the past decade, while the increasing share of agricultural residues has reinforced the overall positive trend in the biomethane sector.

Countries with developed biomethane industries are transitioning from investment subsidies and feed-in tariffs to tendering systems that encourage the industry to reduce its costs and be less dependent on support mechanisms. Some countries are also stimulating demand for biomethane used as fuel through consumption and carbon tax exemptions, as well as increasing quotas for renewable fuels as required by the Renewable Energy Directive (RED II). Meanwhile, an increasing number of national registers tracking biomethane production are enabling the development of Guarantees of Origin (GOs) and Renewable Transport Fuel Certificates. The trade of those certificates is limited because of incompatibilities between countries choosing different ruling bodies: ERGAR (European Renewable Gas Registry) or AIB (Association of Issuing Bodies) for the issuing of their GOs. These bodies are working on enabling compatibility between their certificates within the REGATRACE and FaStGo projects. In addition, the possibility of using GOs in the EU ETS as introduced by the Monitoring and Reporting Regulation (MRR) Directive and the potential implementation of the Union Database in 2023 as quoted in RED II, could boost respectively the development of the two types of certificates.