Carbon Accounting Management Platform Benchmark…

From 2021 to 2022, Sia Partners conducted a global benchmarking study with Cadwalader, Wickersham & Taft to provide market feedback on the status and progress of climate risk, and its impact on the financial services industry.

Over 70 financial market respondents across banking, institutional investors, insurance companies and corporations participated in the study from the U.K., Europe, the Middle East, the Asia-Pacific, Canada and North America. Peer groups benchmarked against each other included Global Systemically Important Banks (G-SIBs), U.S. Regional Banks, European Banks, Foreign Banks, and Investment Managers.

Participant Profiles:

The study is broken down into the following topics:

We will publish our full analysis on the above topics each week.

Risk Strategy

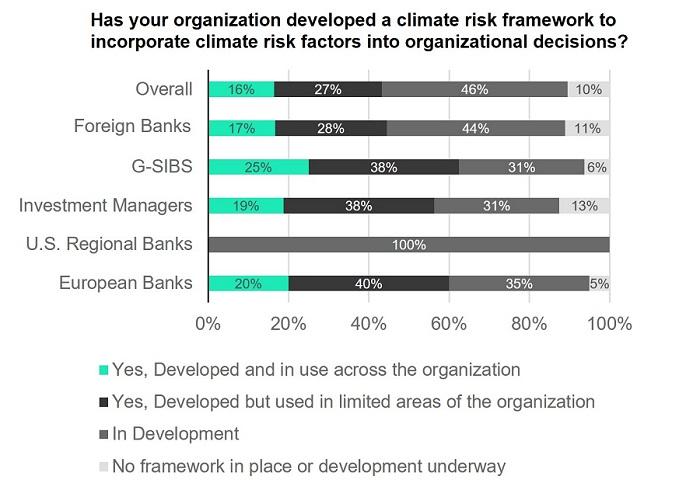

Globally, institutions have recognized the importance of developing climate risk frameworks. However, the maturity of these efforts is subject to significant disparity in maturity across geographical regions. Given the historical and ongoing differences between the U.S., Europe and Asia in terms of prioritization of carbon reduction among regulators, public policy markets, corporate citizens and general populations, there are differences in timing and maturity across regions.

KRIs/KPIs

Participants noted a series of obstacles in developing climate risk metrics. First, many firms had yet to identify, let alone collect the necessary data to build out risk or performance indicators. Second, numerous participants pointed out the lack of a standardized approach to metrics. Third, operationalizing the data capture and system workflow to produce the metrics requires upgrades to platforms which have not yet been developed. Finally, participants conveyed hesitation for establishing performance indicators due to the reputational pressure in achieving objectives.

Risk Assessments

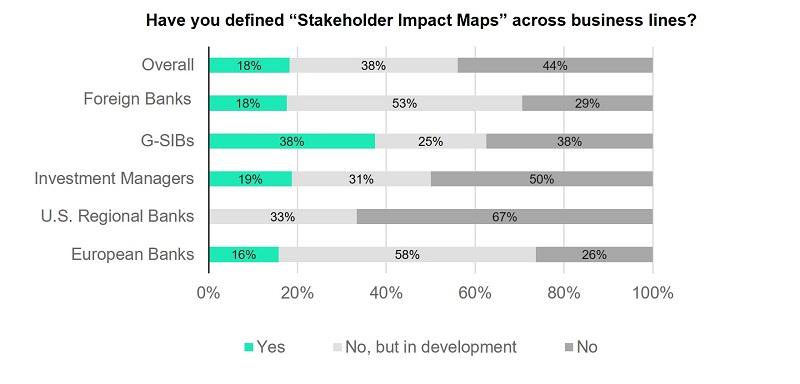

Less than 20% of the overall participant population had engaged business lines to perform risk assessments. While almost 40% of participant have begun the process, almost half of the participants have still not started the process. Efforts for conducting risk assessments and exposure mapping can take many forms with both top-down and bottom-up approaches as well as a hybrid approach including both, the process is heavily reliant on granular data sets and coordination across business units to manage risk correlations.

The low percentage of firms who have been able to define stakeholder impact maps across business lines is indicative of several factors:

Governance

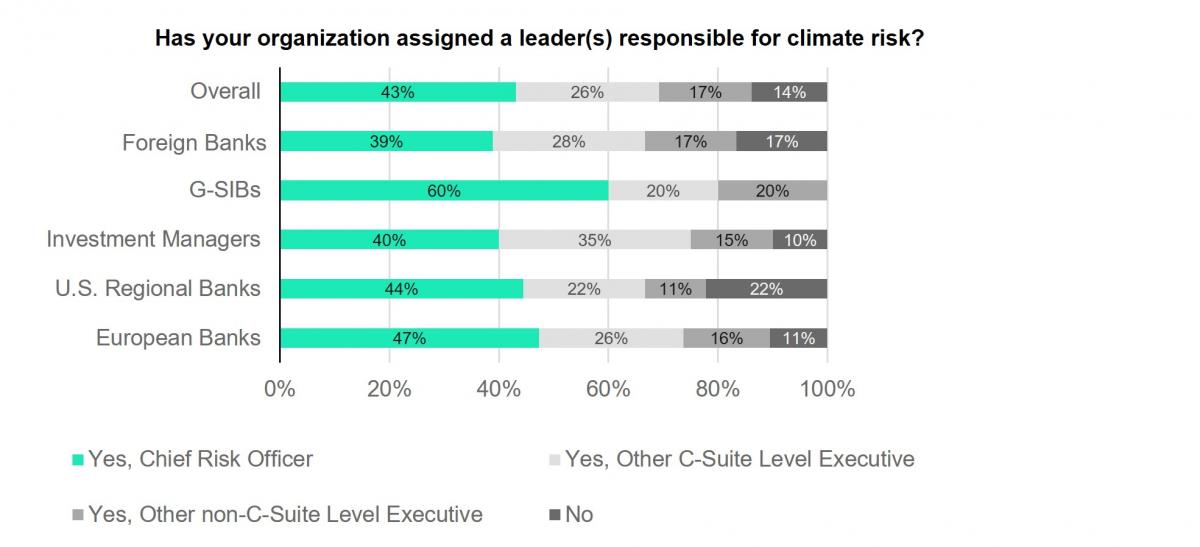

The majority of the participants in the study, approximately 86%, have designated a corporate leader for climate risk. The G-SIB peer group consistently maintained a best practice, where all participants indicated a designation for a leader of climate risk.

A large group of organizations began strategy development in the front office without alignments from the 2nd / 3rd lines of defense. For example, the Investment Manager peer group identified significant responsibilities for management of climate risk to be placed in the hands of individual portfolio managers and would likely have limited formal responsibilities for anyone in the C-Suite.

43% have assigned the responsibility for climate risk to the Chief Risk Officer (CRO).

26% of participants having delegated climate risk to another C-Suite-member.

17% have designated the ownership role to another group.

U.S. Regional banks are behind the rest of peer groups in establishing a governance structure. Factors contributing to the latency include slow reaction to social sentiment, lack of regulatory pressure and a smaller level of climate risk exposures.

Only 11% of European Banks indicate not to have appointed a leader for climate risk.

83% of Foreign Banks had assigned a leadership team for their climate risk efforts, however, several foreign banks noted organizations structures may not be identical in each region in which they operate and likely are modeled around the current or anticipated regulatory approaches.

Internal Reporting

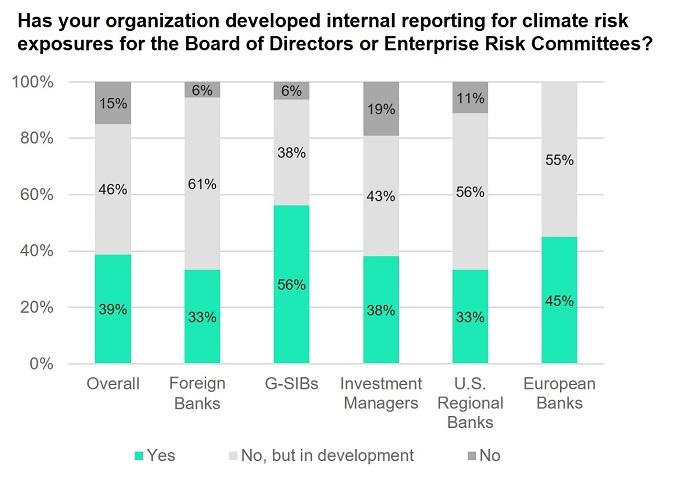

Collectively, firms were challenged in a few respects and while the infrastructure for traditional reporting exists, institutions are still identifying the suitable reporting formats and type of data to provide. Moreover, organizations with less advanced frameworks were concerned a formal process for distributing to the appropriate stakeholders may not exist, whereas for other public policy or regulatory requirements there would be clarity from working groups and committees as to the distribution of this reporting.

39% of participants have fully matured a process for internally reporting climate risks.

44% of G-SIBs distribute their reports at least, quarterly.

71% of Investment Managers distribute internal reporting annually.

Relatively few foreign banks, 33%, have finished the development of internal reporting for climate risks, although the vast majority have begun the change process, likely attributed to their domicile in a region with advanced regulatory agendas.

Only 11% of European Banks indicate not to have appointed a leader for climate risk.

All European Banks have at least begun the process to develop internal reporting.

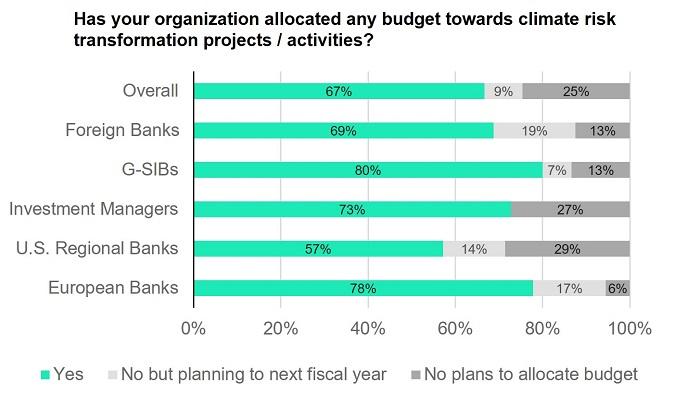

Budgeting

A category which all peer group responded with majority affirmations, however, some institutions noted program mobilization tended to begin with the C-Suite, and not a specific risk category or line of business and therefore it often presented challenges for the initial funding of programs. Some institutions leveraged cost centers assigned to their ESG efforts, others specifically for climate risk, and some participants noted costs were absorbed in head count outside of a sustainable project budget. Participants beginning to mobilize large-scale program identified budget requests as being difficult.

80% of G-SIBs and 78% of European Banks have allocated budget towards climate risk transformation projects or activities.

Investment Managers had a high response rate indicating they have no plans to allocate budget, however, many of those firms’ identified existing efforts with business units were already in place and as a result the governance efforts and budgeting has and will be part of the business growth strategy to expand product and the capacity for current first lines of defense to handle those issues.

29% of U.S. Regional Banks have no plans to allocated budget towards Climate Risk activities.

Risk Identification & Mitigation

The vast majority of participants recognized both physical and transition risk as drivers of the traditional level-1 risks—credit (most prominent for firms that lend capital), market, liquidity (for those who are more market focused) as well as operational and reputational. However, participants underscored the public sector would unquestionably play an important role in climate investments and decision-making. Issues with risk metrics from the measurement of CO2 mitigation strategies for transition risks as well as identifying client progress will require significant effort going forward and participants are concerned about making substantial policy judgments without meaningful data improvements in place.

Scenario Design & Stress Testing

Only a small percentage of participants have conducted scenario analysis in a meaningful way. This reflects less on preference and more on the ability to build the models and obtain the necessary data to publish confident figures. While there is not a unified view on behalf of the largest prudential regulators worldwide, the U.K., EMEA and APAC regulatory bodies have been leading the legislative efforts and, consequently, the participant responses on this topic and the value of capital buffers for credit, market & liquidity risk are now open to substantial debate.

While only 8% of participants have a robust scenario designs for climate risk, 47% of participants have initiative activities to design scenario.

Respondents who participated in early regulatory climate stress testing exercises/pilots experienced difficulties due to:

Data Strategy

Data integrity remains one of the most significant challenges for participants as they develop climate risk strategies and frameworks. The industry is therefore heavily reliant on hybrid data strategies leveraging both internal and external data sources for climate risk management. Source, quality, and validity of data are core to the participants' ability to generate accurate climate risk figures for decision making. The survey findings revealed many firms are engaging third-party vendors in order to attain the desired quality of data; however, few believe their data strategy is in a target state.

Disclosures

Respondents in all categories prioritized clarity and direction from the public sector, requesting efforts to provide standardization for disclosure reporting. Many participants continue to rely on the TCFD guidance while other initiatives are being released. A considerable majority of our participants that have disclosure approaches in place did not believe their reports were sufficiently fulsome or aligned with established standards/benchmarks.

Regulation

In addition to the existing disclosure requirements, there are other public and private sector efforts being undertaken beyond those of the TCFD to bring standardization to the market. The most recent efforts out for commentary include those from the SEC, MSRB, and the NYDFS. These efforts are recent and the likelihood for standardization is likely a few years away, however an overwhelmingly majority of participants would like regulators to adopt more standardized or detailed disclosure rules. For participants who elected against a detailed ruleset, there was a concern that more detailed requirements would surpass firms’ abilities to effectively respond in a balanced manner.

Opportunities

Participants who had developed an initial or advanced governance structures, had assembled sales efforts for the distribution of climate products across their client targets. These efforts would have prioritized more climate savvy institutional providers and sovereigns who had the capacity to properly evaluate a product that was customized for them. This would include having a knowledgeable sales team on their side for that discussion; a research team to evaluate the proposal and advanced data capabilities to consider the risk impacts on their portfolio. On the sales side, those who tended to align well in those efforts would have been the larger European institutions who have been active in this space for many years and G-SIBs who would have built out the necessary sales infrastructure to offer those products globally.

Client Engagement

Globally for all institutions, just 45% of respondents confirmed they have engagement plans with their investee client companies, however, unsurprisingly the Investment Manager peer group had the highest response rate for those progressing their engagement models. The stewardship model has become an increasingly popular method for investors to use in developing insight and providing transparency monitoring, engagement, voting recommendations, and public policy best practices.

Exclusionary Policies

While many participants have begun modifying services by exiting the thermal coal and hydraulic fracturing industries, others conveyed a sentiment which is hesitant to set limits impacting performance at the business unit level. Other firms noted they were not likely to move in the direction of “restricting services” but building out a more ‘climate-positive’ approach where they would invest, rather than divest, to provide value as opposed to isolating where they should cut back on services.

Strategy & Governance

Risk Frameworks

Regulatory & Disclosure Reporting

Data Management

Green Product Distribution

Cultural Sustainability