Carbon Accounting Management Platform Benchmark…

Australia’s $22 billion private hospital sector faces its biggest challenge in decades, with over 70 services closed in the last five years.

At its heart, the sustainability crisis is driven by simple economics: labour and input costs are increasing much faster than industry revenue. While there is a complex web of root causes and solutions to this crisis, Sia Partners analysis shows that one underutilised area of significant opportunity is through the adoption of proven, low-cost artificial intelligence (AI) tools. In addition to consistency of care uplift, our analysis indicates that these solutions alone could increase hospital operating margins by an average of 4.7%.

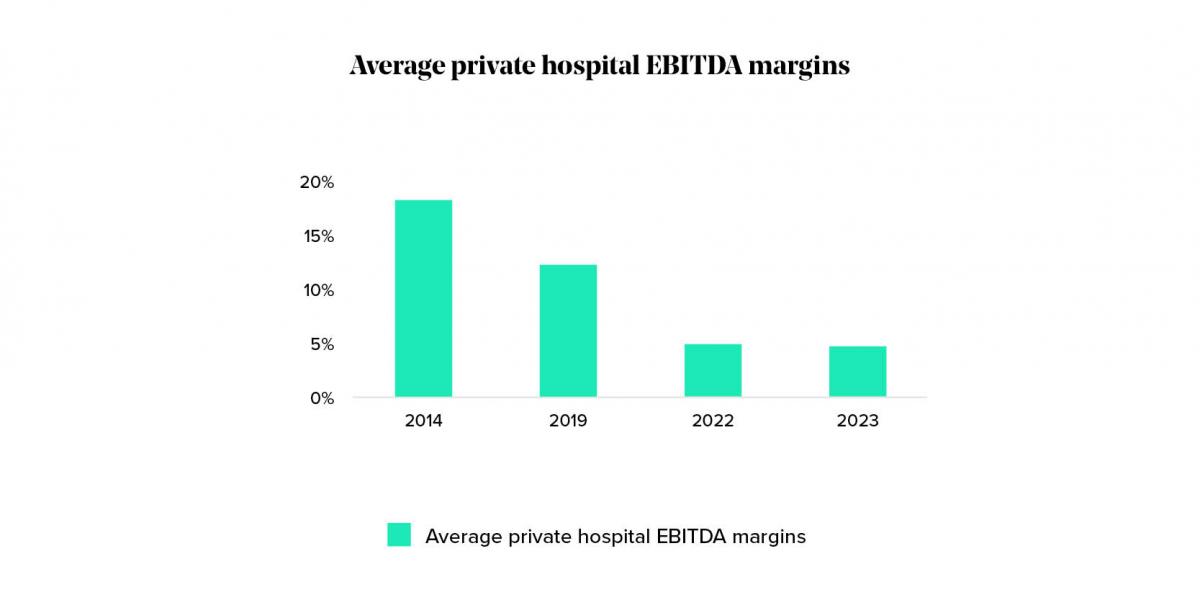

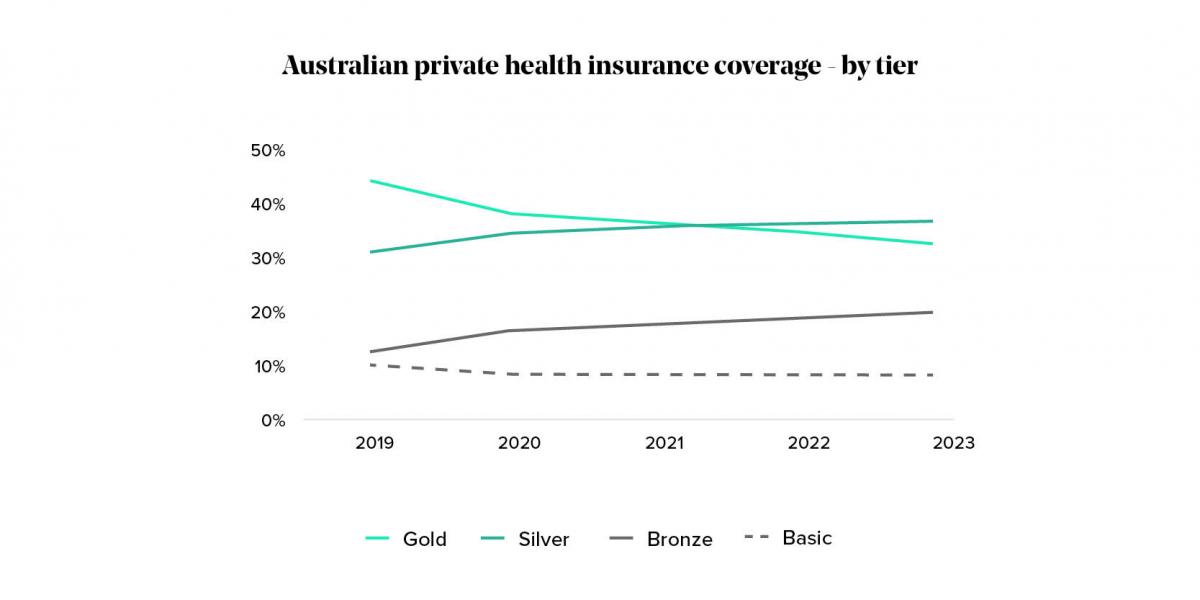

Many Australian private healthcare providers are facing significant margin pressures, with over 70 private hospital services closing over the last five years. The story of Australia’s private health crisis is well told. Shrinking margins (see figure 1) are being driven by both lower revenue and higher costs. On the revenue side, the industry is facing declining uptake of gold-tier private health insurance coverage (see figure 2), and limited revenue increases as legislated by the Private Health Insurance Act, 2007. Despite increased media and political attention, a pathway towards a legislative solution is not clear, let alone its feasibility before the next federal election. By this time, it is likely that not only will more hospitals close, but the industry as a whole could be on life support.

Figure 1: Margins degrading across all hospital groups

Figure 2: Private Health Insurance tiers falling

Freeing up resources to enable increased focus on higher value work is a key lever that many private hospitals are pulling to ease margin pressures in the short term. Shifting to lower cost out-of-hospital care models or increasing the scope of services nurses can deliver are both examples of highly promising, yet longer term efficiency measures being considered by industry.

Using AI to reduce the time and cost of existing practices is a shorter-term option that leading healthcare providers, especially in the US are turning to for efficiency improvements. Multiple studies cite that hospitals could harness savings of up to 10% within the next 5-years through AI alone. This would significantly reduce margin pressures faced by Australian private hospitals and doesn’t even consider the revenue enhancing opportunities AI also presents. But how realistic is this, given the low digital and data maturity of the Australian private healthcare system and the current policy environment?

In this article we assess the hype and the reality around AI in healthcare in an Australian context and how it may help solve the current crisis.

Sia Partners views Acute Healthcare AI opportunities in three key domains (see figure 3):

Figure 3: Sia Partners Australia framework for AI in Healthcare

We have observed adoption of use cases within each of these domains accelerate in recent years, particularly in the US and China.

What many of these use cases have in common is that they rely on electronically stored patient data, primarily with the use of Electronic Medical Record systems (EMRs). In Australian private hospitals, however, adoption of EMRs is the exception rather than the rule, with paper-based patient history documentation continuing to be commonplace in many Australian private hospitals. This means that AI use cases that rely on EMRs are largely out of reach for Australian private hospitals.

But does this draw a line in the sand for the benefits AI can bring to Australian hospitals? Sia Partners believes that the rapid growth of lower-cost, lower-risk Health Tech solutions, enabled by the recent AI boom, provides new hope for Australia’s private hospitals to improve margins.

If they aren’t already, healthcare leaders should be asking their transformation teams to ensure that pilots are underway in each of these domains to ensure that they remain at the forefront of AI-led efficiency gains.

Back-office administration, for example:

Clinician administration, for example:

Patient scheduling and demand management, for example:

Diagnosis and clinical advice, for example:

Back-office efficiencies and AI scribes are just some use cases that don’t require mature digital storage of patient medical records to deliver benefits to the hospital. As such, these tools have the added benefit of being low-cost and, for some, face low regulatory barriers.

The use of AI in administrative activities has already proven itself to be a major cost-saver across most industries. For example, ~35% of financial service providers have already leveraged AI to reduce annual administrative costs by 10% with use cases including chatbots, claims processing and fraud detection.

This is a massive opportunity for healthcare providers, where administrative costs take up 15-25% of healthcare spending in the US. Examples of use cases already in play include:

Documentation can take up to 35% of a nurse’s shift (e.g. head-to-toe assessments, admission intakes and vitals charting), and a physician's time (e.g. referral letters, care plans, note taking).

The use of AI to transcribe and summarise clinician-patient interactions is being commercialised in American healthcare facilities, including hospitals, and is significantly reducing the amount of time clinicians spend on documentation. For example, in the Permanente Medical Group, clinical speech recognition technology has shown it can save physicians one hour a day by summarising patient interactions.

While healthcare AI use cases from the US have been historically discounted as in-applicable in the Australian context given poor access to capital, regulatory constraints and data and digital maturity, AI advancements in the last 24 months have changed the game. Solutions are better, cheaper to run and faster to mobilise. While systems integration remains a challenge, benefits have grown significantly.

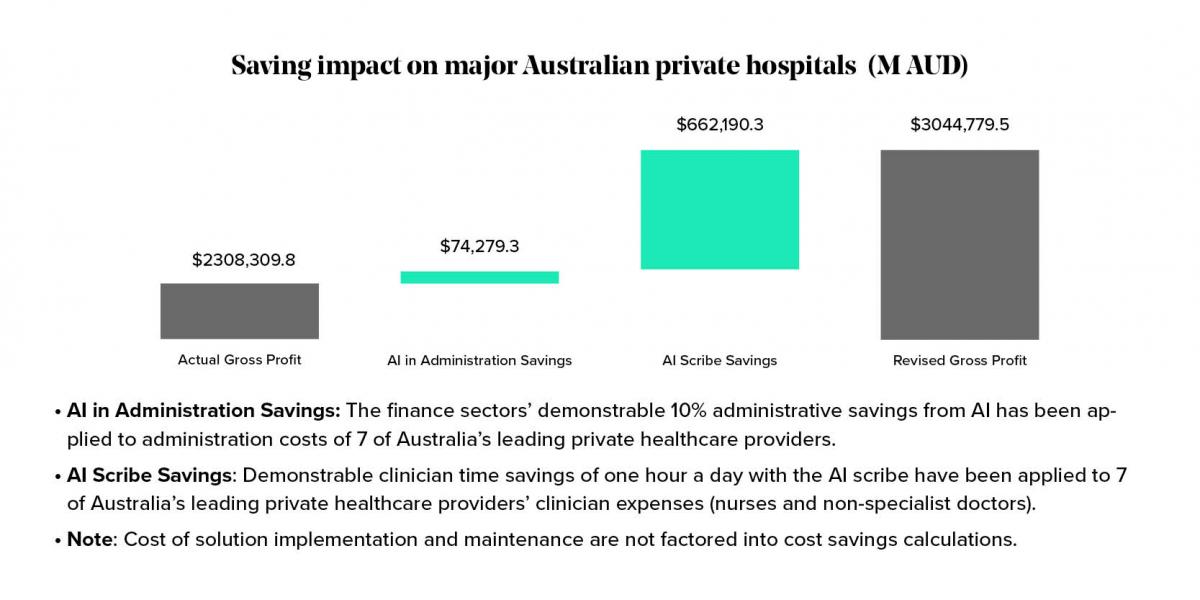

To see increased efficiencies translate to cost saving, staffing level policies would need to adjust to reflect clinical staff-members' increased capacity. If these changes were adopted, Sia Partners estimates savings for Australia’s top seven private hospital groups of $736.5M per annum, or an average of $93M each (see figure 4). This could see an operating margin relief of 4.7%. Todd Mairs, Sia Partners’ lead Health Care partner in Australia, commented: “The scale of AI opportunities in Australia’s private hospital system is immense. There are no silver bullets here but the solution to our current crisis must include AI and technology-enabled productivity improvements within the hospital setting.”

Figure 4: Australian private hospital cost savings from quick win AI solutions

Productivity benefits of AI are increasingly apparent, and global peers are benefitting. Sia Partners recently conducted a set of interviews with a range of global and local healthcare executives. The sentiment of these conversations was that Australian hospitals are falling behind. Leading US based healthcare providers confirmed wide-spread adoption of these use cases in their hospital and community health settings, while in Australia, the application of AI solutions in leading private hospitals was limited to back office uses cases such as CV scanning. Outside of pilots, Sia Partners is not aware of the large-scale applications of any AI Scribe solution in Australian private hospital settings at the time of publication.

Australian private hospitals must rapidly catch up with global peers in the adoption of AI enabled productivity solutions. From our discussions with global and domestic leaders, Sia Partners believes that the first step involves low cost, high benefit solutions like the two solutions highlighted above. To get started, we outline key enablers that hospital executives should consider when kick-starting their AI journeys.

AI relies on strong data maturity, can be costly to implement and, in a clinical setting can require regulatory approvals. The more advanced the use case, the greater these barriers become. For cash strapped Australian private hospitals with low digital and data maturity, this makes considering AI seem like a pipedream.

The recent democratisation of AI (i.e. the rise of Generative AI), however, has accelerated the adoption of ready-to-use AI solutions by enterprises. User-friendly application programming interfaces (APIs) and intelligent automation as a service (IAaaS) platforms enable companies to rapidly integrate AI functionalities, eliminating much of the complexity and investment involved and raising public awareness of the potential of AI.

AI will increasingly become an integral part of Australia’s healthcare ecosystem. For instance, recent years have seen a growing number of AI Scribe providers entering the Australian market, including Lyrebird Health, Heidi and ConsultNote.ai. Sia Partners are leaders in the application of AI and have identified the below key enablers for success.

Establish a clinical continuous improvement team to explore, test and coordinate the approval of AI use cases. Having clinical involvement not only ensures the right expertise is involved but also helps build up clinical ownership and comfort over the use cases. This is particularly important in an Australian context, where clinician trust in AI is cited as a key barrier to adoption.

Budget constraints can pose a significant barrier to AI adoption, especially for Australian private hospitals that require significant improvements to their foundational digital and data maturity. To overcome this challenge, hospitals can learn from global examples of innovative funding models, such as:

Peer Co-investment: For example, a Digital Consortium formed by nine US health systems has partnered with a private equity firm to develop digital health solutions that address specific health system needs. Over the last 3 years the Consortium has built and developed four companies spanning patient engagement, women's health, AI-enabled diagnostics, workflow automation, and emotion analytics.

Alternative Funding Options: Exploring negotiations with private health insurers (PHIs) or the provision of targeted government subsidies can help pay for AI solutions. In the US, for example, the government provided subsidies to support EHR implementation.

Invest time up-front to select target use cases that are aligned with your business’ broader strategic goals and informed by a sound understanding of your business’ current digital/data maturity. These parameters must consider organisational, human, cultural, data and technical factors.

By identifying relevant use cases and assessing maturity, we support our clients to build A value-oriented AI roadmap using the below steps.

1. Defining AI Strategy

The world of AI is vast and rapidly changing. While there is lots of opportunity, businesses must ensure they a clear view of how AI will support business objectives. This involves:

Establishing a clear framework that creates and aligns the AI strategy with the overarching strategic goals of the organization. This ensures that future AI projects contribute to the company’s long-term vision and competitive advantage.

Identifying and prioritising AI technologies that offer the highest potential for impact. This includes evaluating which core AI technologies (e.g. AI automation, machine learning, natural language processing, computer vision) best suit the strategy and sought value.

2. Diagnosis of Existing Capabilities

The second step is diagnosing your business readiness to deliver AI initiatives. This involves:

Conducting a thorough assessment of the organization’s current AI maturity. Using Sia Partners’ AI maturity model, businesses gain a strong understanding of the state of their existing capabilities and gaps that need to be closed.

Gather detailed insights into the organization’s strengths, and weaknesses through stakeholder interviews, surveys, and workshops. This helps identify critical focus areas.

3. Use Case Identification and Prioritisation

The third step qualifies and prioritises concrete use cases based on their relevance, value and feasibility. This involves:

Evaluating potential AI use cases based on their expected value and feasibility, aligned to the ambitions (step 1) and ability to deliver (step 2). This includes a high-level cost-benefit analysis for priority items.

Prioritise use cases based on expected value and effort. Plotting all identified use cases on a value/effort matrix identifies the most promising use cases to commit to delivering first.

4. AI Roadmap

The final step is developing an AI roadmap by plotting the necessary capability uplift initiatives and prioritised use cases on a cohesive roadmap. This involves:

Define the technical and organizational capabilities required to support use case delivery and operationalisation. This includes identifying necessary infrastructure (e.g., cloud computing, data storage), tools (e.g., AI platforms, analytics software), and skills (e.g., data scientists, AI engineers).

Prioritize AI initiatives based on strategic importance, potential impact, and resource availability. This involves creating a detailed roadmap based on use case and capability uplift priorities.

Sia Partners is a leading healthcare consulting firm in Australia. If you wish to discuss our experience and lessons learned from transformation in the healthcare setting, please contact us.