Carbon Accounting Management Platform Benchmark…

The Financial Services industry in Singapore is facing multiple challenges; the COVID-19 crisis, changing customer needs, rapidly changing competitive landscape. We outline why innovation is critical for the Financial Services sector and how to approach innovation to scale successfully.

Under the combined effects of the COVID-19 induced economic recession, record low interest rates and soaring labour costs, Singapore’s financial services industry has experienced a decline in profits in 2020. Meanwhile, emerging technology disruptors (e.g., the four newly formed Digital Banks including the Grab / SingTel consortium, FinTech start-ups such as StashAway, etc.) are exerting an increasing amount of pressure on traditional financial institutions. To face the “new-norms” of challenging market conditions, shifting customer demands and evolving technologies, many financial institutions in Singapore have taken systematic actions to innovate by adopting new business models. Examples of this includes the multi-purpose digital platform “DBS Marketplace” and accelerating technological developments in Artificial Intelligence (AI) and Data Analytics across the end-to-end business value chain while overcoming the difficulty of moving from legacy core infrastructure to new technological capabilities.

Due to the lockdowns and social distancing rules to combat COVID-19, the shift to digital channels has accelerated for financial institutions in Singapore, requiring them to increase their capacity and quality of digital products and services. Driven by the cultural shift in customer needs and the macro ecosystem involving government and regulations, financial institutions in Singapore need to continuously reinvent themselves by building a robust innovation capability to design new business models, offer new digital products and services, and improve operational efficiency.

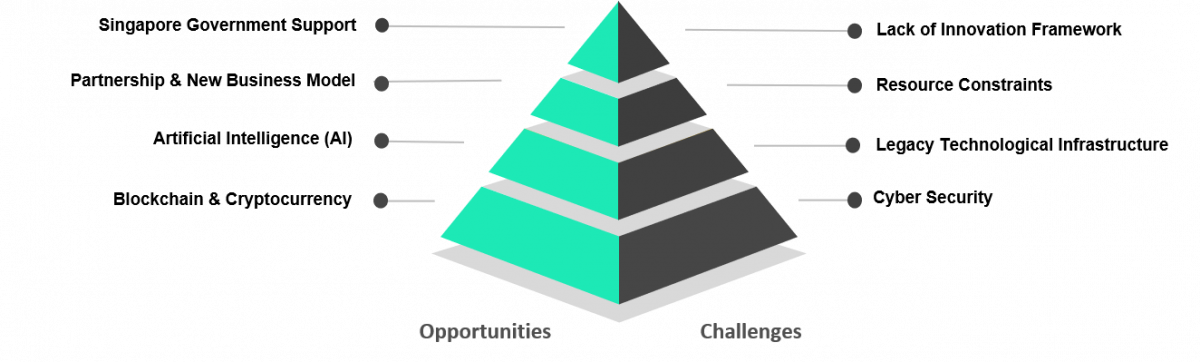

There are multiple opportunities that could help catalyse digital innovations of financial institutions, such as:

Singapore Government Support: The government of Singapore and the Monetary Authority of Singapore (MAS) are strongly supporting the digital innovation of financial institutions with subsidies, regulatory sandboxes and FinTech support. In August 2020, MAS committed S$250 million over the next three years under the enhanced Financial Sector Technology and Innovation Scheme (FSTI 2.0) to drive technology and innovation-driven growth.

Partnership and New Business Model: With financial institutions venturing into multi-purpose platform businesses (e.g., DBS Marketplace) and Digital Bank licenses granted to technology players (such as the Grab/SingTel consortium), traditional borders between finance and technology have become blurred, and it presents a new way of building hybrid business models.

Artificial Intelligence (AI): The adoption rate for AI, data analytics and FinTech solutions at financial institutions is increasing. For example, utilising AI-driven metrics to determine credit risk scoring and leveraging AI-driven transaction surveillance to review risk alerts, AML, CFT & KYC compliance effectiveness could be easily upgraded.

Blockchain and Cryptocurrency: Singapore has emerged as the cryptocurrency hub in Asia, due to its sound legal framework and strong digital infrastructure. DBS launched the world’s first cryptocurrency exchange in December 2020, fully backed by blockchain technology.

At the same time, financial institutions should also consider the key challenges that they must overcome to achieve tangible innovation results, such as:

Lack of Enterprise-Level Innovation Framework: Financial institutions must make efforts to bridge the gaps and break the silos caused by poorly coordinated innovation initiatives, which often involve cross-functional teamwork and alignment of business and technological goals. In short, innovation has to be driven by the “pull” from tangible business and customer needs, not the “push” from Technology’s desire to launch new products and services to utilise their available budget.

Resource Constraints: With tight budget controls and limited local talent pools, financial institutions in Singapore need to plan and execute their innovation strategy with realistic targets and pragmatic timelines.

Legacy Technological Infrastructure: State-of-the-art innovation has to be built upon up-to-date hardware and software to achieve the targeted results, which means upgrading legacy systems is a constant and urgent need.

Cyber Security: With data at the centre of most innovations, cyber security must be constantly enhanced to ensure sensitive and valuable data utilised by innovation teams will not be abused or stolen by malicious parties.

Given this context, how should companies tackle innovation to reap the benefits and overcome the challenges? We believe that the key to achieve innovation starts with having a clear process and methodology to generate ides and transform them into viable products and services.

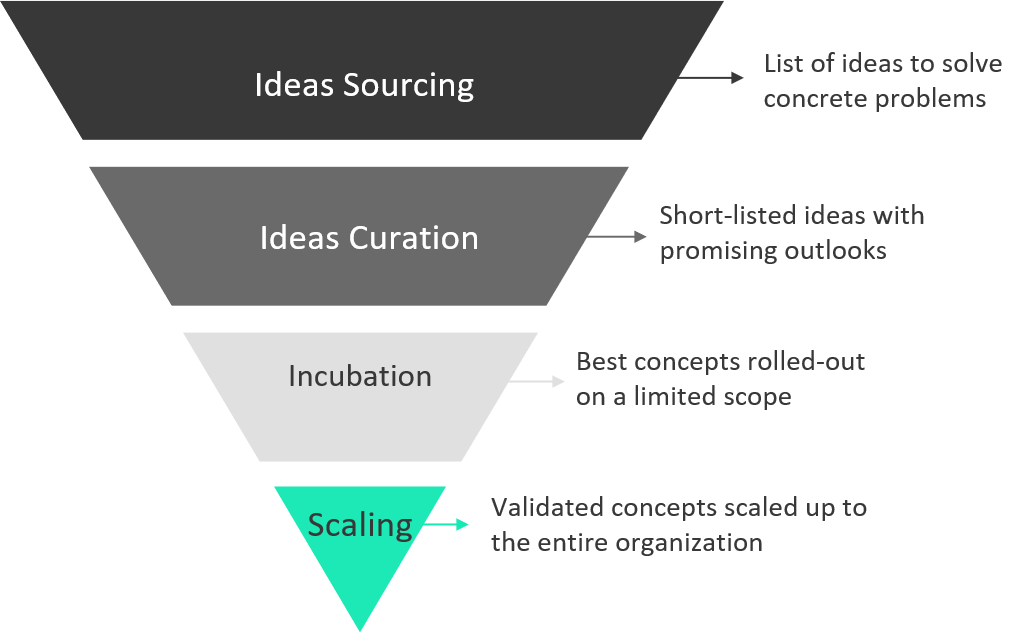

Innovation requires discipline and an innovation process is key. While unconstrained ideas and thinking outside-of-the box are often good ways to find great concepts, it is key for organisations to have a clear process that is self-regulating and evidence-based to ensure the best ideas get to the scaling stage. This will guarantee that decisions are based on good evidence, such as a prototype or customer feedback, not on personal preferences. Typically, this process covers the following steps:

Ideas sourcing: The focus will be on developing a deeper understanding of the problems to be solved, prioritising them and proposing ideas that could be good remedies, in an unconstrained way. This step should take no more than 2 weeks.

Ideas curation: This step will focus on eliminating all ideas that cannot be viable or that don’t really serve the purpose, various techniques can be used here, such as building a prototype or a minimum viable product (MVP), conducting customer reviews or focus groups to gather early-stage feedback. An assessment of the cost of building the final product and estimate of potential returns should also be done. Based on these inputs, a prioritisation can be carried out to define which ideas have the best chances to be well received by customers and ensure reasonable returns. A committee will typically review the ideas that go to the next step. This step should take no more than 6 weeks.

Incubation: At this stage, only a few highly promising ideas will still be in the pipeline. The objective here is to further build the MVP, get more mentorship from leadership and sufficient resources to test the idea in a real context. Typically, this results in a small offering or service that real customers will be using. This phase can take 2-3 months or more based on the needs, and at the end leadership will decide to scale up the idea or not.

Scaling: The last step in the innovation process and the starting point of the integration of the idea into the existing organisation. Here, companies put even more resources and focus to ensure the idea is fully embedded into the existing landscape.

Sia Partners has created a unique ecosystem around innovation. For each assignment, we mobilise a combination of methodologies and tools most relevant to our client issues, bringing a unique combination of expertise to support disruptive innovation.

With our consulting 4.0 framework, Sia Partners developed extensive experience and the required capabilities to support companies and governments in effectively translating ideas into actions across all steps of the innovation process.

Find out more about our proven expertise in Artificial Intelligence, Open Innovation, Growth & Innovation, and our unique consulting by design offering.