Agentforce, the GenAI Agent by Salesforce

Finance functions at large are under pressure to shrink costs, improve speed, deal with increasing volumes of complex data and bring new value to business partners through actionable insights.

RPA/AI (Robotic Process Automation / Artificial Intelligence) is providing finance functions with new opportunities to achieve these aims. You'll find in this article an overview of applications of RPA and AI in Finance.

RPA/AI is often associated with the pure automation of processes when in fact, this is only part of the story. Robotic Process Automation is defined as: “the application of flexible tools to automate manual activity for the delivery of business processes or IT services”. In this context, RPA could be seen as a virtual worker, trained to perform any given repeatable and standardised work flow. This definition covers the traditional automation-related interpretation of RPA/AI.

Rules based software robots are being used to undertake processes such as data gathering, reporting, matching and reconciliation, and complex multi-faceted processes such as period end closes.

Stemming from the types of processes that are candidates for automation, general finance function tasks that lend themselves to automation include:

Operational accounting

General accounting

Financial reporting

Planning, budgeting and forecasting

Treasury processes

Additionally, the latest advances in RPA can gather data from different sources including anything from company databases to images and videos; this greatly increases the scale and scope of available data.

While the examples above focus on how automation is being employed by finance functions, we believe there is extensive scope for Artificial Intelligence solutions to increase the impact that finance has on the overall business.

Due to its ability to benefit the finance function, AI will become commonplace within the finance function within the next five years.

Sia Partners expects the following areas to be of high priority:

| Opportunity example | Practical example |

|---|---|

| Driver-based forecasting using historic learning | AI algorithm to adjust drivers used in planning budgeting and forecasting based on historic performance, trends and market variables |

| Within retail, live Price Volume Mix (PVM) analyses with sensitivity-based PVM adjustment recommendations | Daily snapshots of revenue, volume, price, and product mix performance are automatically loaded to a program daily, from POS and ledger systems producing live PVM recommendations |

| Intelligent risk-based alerting and communications | High risk transaction types are flagged in real-time, as they occur, following a defined events path |

| Automated competitor product category and channel price-mining and analysis | Internet-based data-mining software could be used to provide live analysis against defined product categories |

| Automatic invoice processing, classification, and filing | Invoices are scanned automatically and matched to supplier and PO codes, after which it is electronically sent for approval to the a defined based on value |

| Auto-approvals for transactions intelligently defined as low-risk with continuous learning functionality | Transactions are categorised by risk based on multiple parameters, which impact individual approval level and oversight. Exceptions are identified and the system ‘learns’ a new definition of risk over time |

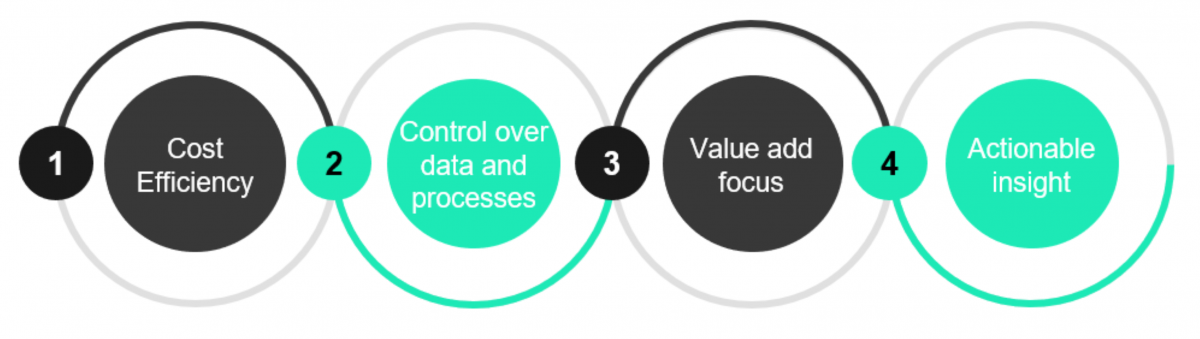

RPA and AI in finance can deliver real benefit if implemented effectively. We have identified four distinct areas of benefit:

Cost Efficiency

It is possible to install RPA systems on top of existing IT systems without replacing core line-of-business and ERP tools.

From a maintenance perspective, RPA is often considerably cheaper than employing IT systems or full-time employees (cost estimated to be of offshore FTE, or of onshore FTE)

Control over data and processes

Automating processes as an alternative to offshoring has several benefits:

Data is stored locally

Immediate data availability for local processes and inquiries

Less coordination between teams needed

Eliminates human error

Supports standardisation and compliance

Value add focus

RPA can automate high-frequency tasks and move operations to downtime (i.e. overnight); this can reduce processing time (up to 50%-70%) and free employee capacity. Capacity can be re-employed on value adding activities for which human judgement is key.

Actionable Insight

Artificial Intelligence, layered on top of RPA and existing IT infrastructure, can uncover actionable insight that can improve the overall performance of a company through the interaction of finance and the organisation at large.

In contrast to the previous three areas, tied to process automation, few companies have explored how self-improving artificial intelligence approaches can digest increasing amounts of data to identify trends that inform decisions that range from pricing and marketing strategies to fraud detection. Sia Partners believes that the largest benefit of RPA/AI application to the role of a finance function stems from applications of Artificial Intelligence.

These are some examples of its impact on costs and speed:

The insurance industry has seen companies adopting RPA to cut the time it took them to compile reports; in one instance one insurer managed to reduce lead times from 90 to 12 minutes and eliminated report errors by adoption RPA.

The Financial Services industry have automated high-frequency tasks such as Daily P&L reconciliation; one company has seen a 50%-70% cost reduction to carry out this task. A specific example is offered by Barclays Bank which cut its annual bad debt provision by £175m and saved over 120 ‘full-time equivalents’ with the help of robot servers.

Verizon is said to have reduced finance department costs by 21%, automating and centralising its finance operations at two locations and closing more than half of its 200 back-office locations

RPA/AI offers broad possibilities of improvement and direction is dependent on functional objectives. Below are steps that can be taken to identify and subsequently implement RPA and AI in finance:

Review finance processes and systems to identify opportunities where RPA/AI can add the most value.

Review finance function business partnering relationships to identify value enhancement opportunities with key stakeholders and departments within company.

Thus, identify areas where AI can add actionable insight to drive better business results.

Key implementation challenges

A ‘data driven revolution’ will lead to significant changes in how finance functions operate in the coming years. Key items to consider:

Data quality is key – Companies need a data strategy and data management policy to ensure that the increased information volume is correct, traceable and reconcilable.

Required skillsets will change – Finance staff will need to refocus towards more value adding activities with an understanding of data management and analytics (review and analysis of data, decision making, tech skills to manage RPA)

New ways of working arise – Staff will have to accept new way of doing things; change management is key to ensure acceptance and, in turn, results.

Divisional structures will change – The renewed importance of data gives rise to the need for a sufficiently capable team to manage data and its analysis. This team will impact the structure (and role) of the finance function, from the way teams co-operate to the way forecasts are built and translated into actions.

More information about our Finance Process Automation offer here.