Canadian Hydrogen Observatory: Insights to fuel…

Despite the COVID-19 pandemic disturbing many normal processes in 2020, regulators have adapted and continued their enforcement activity throughout the year. In this article, we’ve covered key SEC and FINRA enforcement trends observed in the third quarter of the year.

Despite the coronavirus pandemic hitting the broker-dealer industry harshly in 2020, the SEC and FINRA were nonetheless steadfast in their cracking down on industry-wide infractions. In this newsletter, we have covered key trends seen in the third quarter of 2020 that pertain to fines handed out by both regulators, notably with respect to fiduciary duties, supervision of representatives, overuse of 12b1 fees, AML, and exploitation of flippers. Then, we highlighted upcoming rules that are to be enacted in the following quarters. This was a busy quarter for regulators, and there were several common infractions that are important to keep an eye out for in the coming months.

In service-based industries such as financial services, the phrase “fiduciary duties” is often lost in the shuffle. A breach of “fiduciary duty” is at minimum a violation of ethics and trust between an investment manager and his/her clients. At worse, however, it is a serious violation that can lead to the imposition of disciplinary actions from the appropriate regulatory authority. In the financial services industry, a fiduciary duty binds and obligates a professional to act in the best interest of his/her clients. Even before the SEC’s publication of Regulation Best Interest, also known as “Reg BI”, under the Securities Exchange Act of 1934, the financial services industry had an obligation to make sure that their actions were either suitable for the customer or were in the customer’s best interest. Reg BI established a "best interest" standard of conduct for broker-dealers and associated persons when they make a recommendation to a retail customer of any securities transaction or investment strategy involving securities, including recommendations of types of accounts. [1] In the third quarter of 2020, fiduciary duty violations were particularly prevalent amongst some of the industry’s most well-known firms.

In fact, US Bank, BNB Wealth Management and VALIC Financial Advisors were fined nearly $40m in the third quarter alone for various fiduciary duty breaches. Particularly, a common factor in these scenarios was breaches of fiduciary duties in connection with managed mutual fund share classes, including receipt of fees for shareholder servicing. Clearly, fiduciary duty is a topic that the regulators will continue to make a top priority. Financial services participants should pay closer attention to controls surrounding this responsibility that, if not done correctly, can ultimately cost firms far more than money and reputation.

Despite ongoing communication from the SEC and FINRA, reminding firms that supervision remains a high priority, this past quarter shows that firms both small and large are continuing to have challenges in supervising their registered representatives (RRs). Firms have incurred fines totaling over $6.5M during Q3 alone for failing to supervise their RRs in various capacities.

A New York-based brokerage firm previously registered with FINRA was expelled for failing to reasonably supervise the trading of its representatives, leading to RRs excessively trading in customer accounts. A brokerage and clearing company based in Los Angeles was fined for failing to establish and maintain a supervisory system designed to achieve compliance with securities laws and FINRA Rule 2010. The largest network of independent wealth management firms in the US was fined for failing to establish and maintain a supervisory system, as well as failing to establish, maintain, and enforce WSPs that were reasonably designed to supervise the suitability of representatives’ recommendations to customers for early rollovers of Unit Investment Trusts (UITs). [2]

One of the largest US banks was fined for failing to establish and maintain a supervisory system designed to achieve compliance with its obligations under the applicable FINRA rules in connection with its sale of volatility linked ETPs.2 A stock brokerage firm based in NYC was fined for failing to establish and maintain a supervisory system, including written procedures, reasonably designed to achieve compliance with the rules governing the recording of order times, and failing to enforce its WSPs regarding the disclosure of compensation on customer confirmations.3 A NYC-based broker-dealer was fined for failing to supervise the representative who conducted multiple undisclosed private securities transactions. [4] The findings stated that the private securities transactions were part of a Ponzi scheme that the representative orchestrated that resulted in millions of dollars in losses to its victims, including several customers of the firm. An investment bank based in NYC was fined for failing to establish a reasonable supervisory system and written procedures for review and approval of research report disclosures. [4] A large multinational bank headquartered in Paris was fined for failing to establish, document and maintain a system of risk management controls and supervisory procedures reasonably designed to manage the financial risks of its market access business activity.

One of the largest US banks was fined for failing to supervise a registered representative who recommended short-term trades of corporate bonds and preferred securities in customer accounts.[3] Despite ongoing communication from the SEC and FINRA, reminding firms that supervision remains a high priority, this past quarter shows that firms both small and large are continuing to have challenges in supervising their registered representatives (RRs). Firms have incurred fines totaling over $6.5M during Q3 alone for failing to supervise their RRs in various capacities. Sia Partners | Broker-Dealer Regulatory Briefing | 3rd Quarter, 2020 | 3 This is just a sampling of supervision related challenges that firms continue to encounter. Firms should regularly assess their supervisory systems and controls, including sampled testing of such systems and controls, via compliance testing or internal audit. Subsequent to assessing and identifying breakdowns in control frameworks, firms should prioritize correcting the identified issues in a timely manner.

Money laundering compliance remains a top priority for U.S. regulators, including the SEC and FINRA. Both regulators stated in their respective examination priorities letters for 2020 that money laundering will remain a continued focus. Despite numerous challenges presented by the COVID-19 pandemic, the SEC and FINRA continued enforcement of money-laundering violations. One such example is the case brought against Interactive Brokers in August 2020. The discount broker was hit with a combined $38 million penalty in settlements by the SEC, FINRA, and CFTC over a number of anti-money laundering breaches, including suspicious activity report (SAR) failures. According to the regulators, Interactive Brokers had weaknesses in its supervision systems covering the handling of trading accounts, as well as the failure to file SARs and enforce anti-money laundering controls that have been in place for years. Importantly, the regulators highlighted that Interactive Brokers failed to recognize red flags concerning suspicious transactions, failed to properly investigate suspicious activity, and failed to file SARs timely. As this case illustrates, despite having an established supervisory infrastructure and controls, firms may experience challenges remaining in compliance with money-laundering regulations. Firms should continue to remain vigilant and test their own systems to flesh out possible breakdowns in controls.

Exploitation of 12b-1 fees has been prevalent in the industry for over 10 years and has caused banks millions of dollars in fines. Although FINRA has been steadily cracking down on transgressors, institutions continue to violate best practices and exploit the 12b-1 fees for their brokers’ benefit. In Q3 alone, four broker-dealers were charged a combined $22.3M in the form of fines to the SEC and retributions to clients for advising clients to invest in share classes that charge 12b-1 fees, when there were more favorable share classes available for the same funds. Today, the 12b-1 fee is mainly used to reward intermediaries for selling a fund’s shares, but several firms have been exploiting this fee to pay added commission to their brokers. In addition to the steep fines brought on by the SEC, the negative impact on firms’ reputations and subsequent client mistrust after being accused of advising less-than-ideal share classes to clients should make this an unappealing approach for institutions. It would behoove brokerdealers to avoid engaging in this practice in the future, as regulatory agencies continue to crack down on this malpractice and are positioned to enact stricter penalties for similar infractions. Further, it is important that companies train their professionals and establish proper controls to mitigate this issue.

Over the past ten years, FINRA and the SEC have cracked down on several highprofile cases involving broker-dealers trying to exploit the short-term bond allocation benefits of flippers to gain an unfair edge on their competitors, yet companies, to this day, continue to employ this tactic. The practice of “flipping” in the financial services industry is viewed as highly speculative and is frequently avoided by large broker-dealers who can afford to pool their risk in favor of higher long-term returns. The appeal of achieving potential short-term returns via higher-priority bond allocation with flippers is unavoidable, and firms tend to find themselves in unenviable positions when trying to capitalize on this approach. In Q3 alone, several broker-dealers, including a GSIB, were fined a combined $10.2M in the form of fines to the SEC and retributions to clients for allocating municipal bonds intended for retail customers to “flippers” - accelerating the banks’ priority in the bond allocation process. In the GSIB case, the firm undermined the retail order period intended to prioritize retail investors’ access to municipal bonds and justified the regulator’s pursuit of the violation. The brokerdealer selected flippers that were higher up on the bond allocation list to get quicker access to the bonds. And these banks avoided the underwriting syndicate when placing customer orders, instead allowing flippers to place customer orders on their behalf. The flippers then obtained new issue bonds from the banks and immediately resold them for a profit. It seems this issue continues to persist in the industry, despite regulators’ repeated pursuit of these violations. Firms should ensure supervisory systems and controls are adequate to catch these transgressions early on.

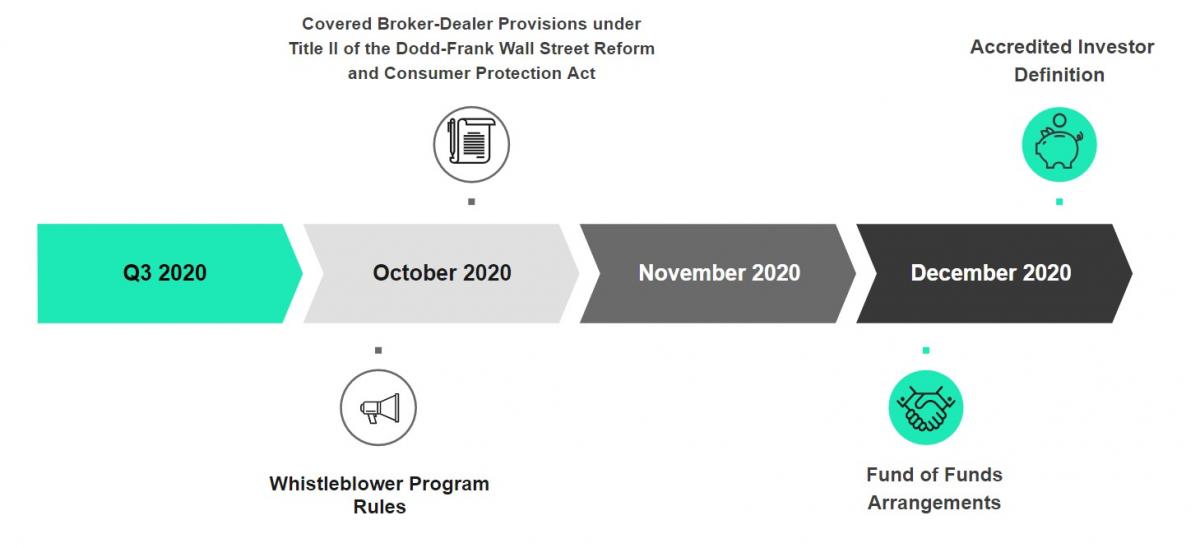

In the third quarter, a number of rules were finalized with effective dates looming in the coming weeks and months. We’ve selected a few noteworthy ones, which are mentioned on the timeline below. Specifically, we’ve highlighted the Whistleblower Program updates, the Covered BrokerDealer Provisions under Title II of the Dodd-Frank Act, the Fund of Funds Arrangements, and the SEC’s amended Accredited Investor definition. Sia Partners is well positioned to help industry participants to navigate these upcoming changes and stands ready to discuss any of the content in this briefing.

Amendments to 10-year-old whistleblower program that will primarily enhance claim processing efficiency and bring greater transparency in the framework used to determine award amounts.

FDIC and SEC, in accordance with section 205(h) of the Dodd-Frank Wall Street Reform and Consumer Protection Act (“Dodd-Frank Act”), are jointly adopting a final rule to implement provisions applicable to the orderly liquidation of covered brokers and dealers under Title II of the Dodd-Frank Act (“Title II”).

Streamline and enhance the regulatory framework applicable to funds that invest in other funds (“fund of funds” arrangements), as well as create a consistent and efficient rules-based regime for the formation, operation, and oversight of fund of funds arrangements.

Amendments to the definition of “accredited investor” to include new categories of qualifying people and entities, as well as more effectively identifying investors that have sufficient knowledge to participate in investment opportunities, even without the rigorous disclosure and procedural requirements. Added amendments to the “qualified institutional buyer” definition to expand the list of entities that are eligible for qualification.

Zoya Ashirov

Senior Manager

+1 (917) 330-5526

zoya.ashirov@sia-partners.com

Eileen Tarasco

Manager

+1 (516) 647-4823

eileen.tarasco@sia-partners.com

Stephen Dimarco

Consultant

+1 (718) 213-0422

stephen.dimarco@sia-partners.com

James Frank

Junior Consultant

+1 (646) 981-5164

james.frank@sia-partners.com

[1] FINRA. (n.d.). Regulation Best Interest (REG BI) Overview. Retrieved November 23, 2020.

[2] FINRA. (2020). Disciplinary and Other FINRA Actions - August 2020 [Brochure]. New York, New York: Author.

[3] FINRA. (2020). Disciplinary and Other FINRA Actions - October 2020 [Brochure]. New York, New York: Author.

[4] FINRA. (2020). Disciplinary and Other FINRA Actions - September 2020 [Brochure]. New York, New York: Author.