Carbon Accounting Management Platform Benchmark…

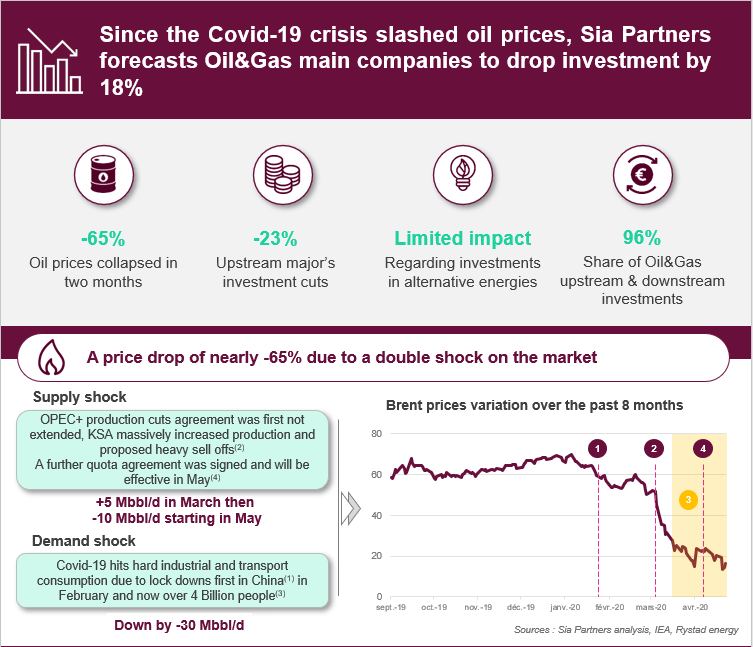

The oil industry is today facing what could become the biggest crisis of its entire history! But first, let’s come back to what happened over the last two months.

Beginning of March, Brent is around 50$. Russia refuses to cut its oil production to cope with demand drop and to strengthen prices. In response, Saudi Arabia increases its production and engages a war price. At that date, none of them has fully understood how significant the impact of the COVID-19 on oil demand is going to be. On the 9th, Brent drops below 35$.

Mi-march, the whole world discovers the magnitude of the pandemic. Governments establish the state of health emergency and settle containment measures for most of the population. Oil demand falls… by nearly 30 Mbbl/d. By the end of the month, the oil price collapses below 25$.

On April the 9th, Russia and Saudi Arabia set their divergence apart and agree on a reduction of oil production of nearly 10 Mbb/d, starting in May and for two months. But markets believe in what they see and despite a rebound, Brent varies between around 20-25$.

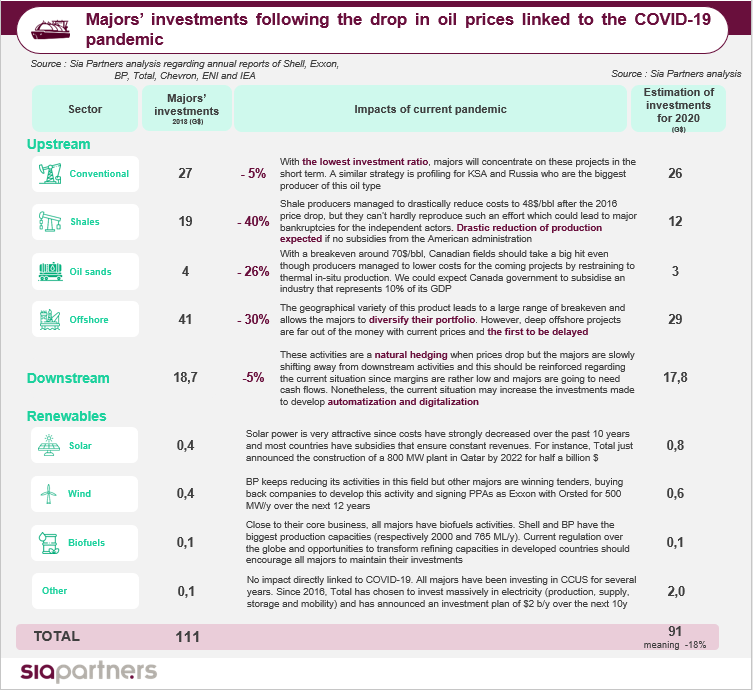

In that context, Sia Partners believes that Oil&Gas major companies will have to cut their total investments by 18% in 2020. Upstream investments will drop by 23% as majors will focus on conventional oil and small existing projects. Indeed, capitalistic projects will be heavily impacted; and investments in shales may drop by no less than 40%! On the other side, downstream activities will be far more resilient with decrease of 5% “only”.

Majors may also look with more interest to alternative investments. If it still represents a small share of the majors' investments (4% of total), the associated business model is less risky and revenues are fairly constant thanks to subsidies. Total, the major that invested the more in alternative energies, has been one of the most resilient in the current COVID-19 crisis. Adding the growing pressure of shareholders and citizens, all majors may develop alternative activities in the coming years to diversify their portfolio and reduce their risk exposure to the oil price.

In the short term, some alternative energy projects might be delayed because of the slow-down of activities in China, the main producer of solar and wind technologies, and the lockdown measures. Nonetheless, up to date no major project has been cancelled.

In the longer term, demand might also be impacted by the current crisis. For instance demand for more environmental friendly products (biofuels, less plastics...) might increase. This could furthermore encourage majors to make some long term investments in order to develop these activities.

In any way, the coming government objectives and policies regarding climate change will have an important impact on the Oil&Gas majors’ long term strategies and their investments in alternative energies.