Canadian Hydrogen Observatory: Insights to fuel…

On November 15, U.S. President Joe Biden signed his $1.2 Trillion Infrastructure Bill into law. Among other things, the bill will impose sweeping reporting requirements on cryptocurrency brokering and trading by 2024.

On November 15, U.S. President Joe Biden signed a $1.2 Trillion "Infrastructure Investment and Jobs Act" commonly referred to as the Infrastructure Bill. Among other things, the bill will impose sweeping reporting requirements on cryptocurrencies by 2024 if upheld. In this latest regulatory update, we provide background on cryptocurrencies, explain existing and proposed regulatory frameworks, and offer our expertise to navigate these regulatory challenges.

On November 15, U.S. President Joe Biden signed a $1.2 Trillion Infrastructure Bill into law after months of intense legislative deliberation. The bill will have implications not only on physical infrastructure such as roads and bridges, but also on the cryptocurrency industry. Among other things, explicitly changing the classification of many cryptocurrency participants to 'brokers' and requiring reporting of cryptocurrency transactions greater than $10,000 by 2024.

The S.E.C. and Gary Gensler have been accommodating of cryptocurrencies lately, allowing the first-ever U.S. Bitcoin futures ETF to begin trading in October 2021. However, the Biden Administration has taken a hardline approach, invoking uneasiness and confusion as to what cryptocurrency regulation will look like at the federal level. In the past, regulators scorned the cryptocurrency market because of errant players such as unlicensed cryptocurrency exchanges, scammers, hackers, and individuals using cryptocurrencies to fund illicit activities and engage in money laundering (see Appendix A).

Some of the essential regulatory questions facing cryptocurrency investors include whether the key articles of the Infrastructure Bill will be upheld by 2024, if federal capital gains laws will change, if physically-backed crypto ETFs will be approved to trade, if banks get clearance to put crypto-assets on their balance sheets, and if major central banks will launch their own central-bank digital currencies (CBDCs).

As a result of these looming questions, many institutions are scared to enter the market, over worries that increased regulation will restrain innovation and free enterprise. Institutions have primarily been forced to stay on the sidelines because of a lack of regulatory clarity, while retail investors enjoy this lucrative market.

In this article, we provide background on cryptocurrencies, explain existing and proposed regulatory frameworks, and offer our expertise to navigate these regulatory challenges.

In 2008, as the world economy recovered from the worst financial crisis since the Great Depression, the first-ever cryptocurrency, Bitcoin, was invented. Developed by an anonymous group of coders who refer to themselves as Satoshi Nakomoto, Bitcoin is a form of private peer-to-peer money that exists outside the confines of government-issued currency. Cryptocurrencies are:

Over 12,000 cryptocurrency offerings have launched in the last decade, each offering its unique innovation. Despite being viewed primarily as a vehicle for investment and speculation, cryptocurrencies perform many of the most central financial services functions - but in a decentralized form.

Some of the most popular uses of cryptocurrencies include saving, speculating and investing, hedging and derivatives, lending, borrowing, earning yield, currency exchange, transacting, insurance, art, and enforceable digital contracts.

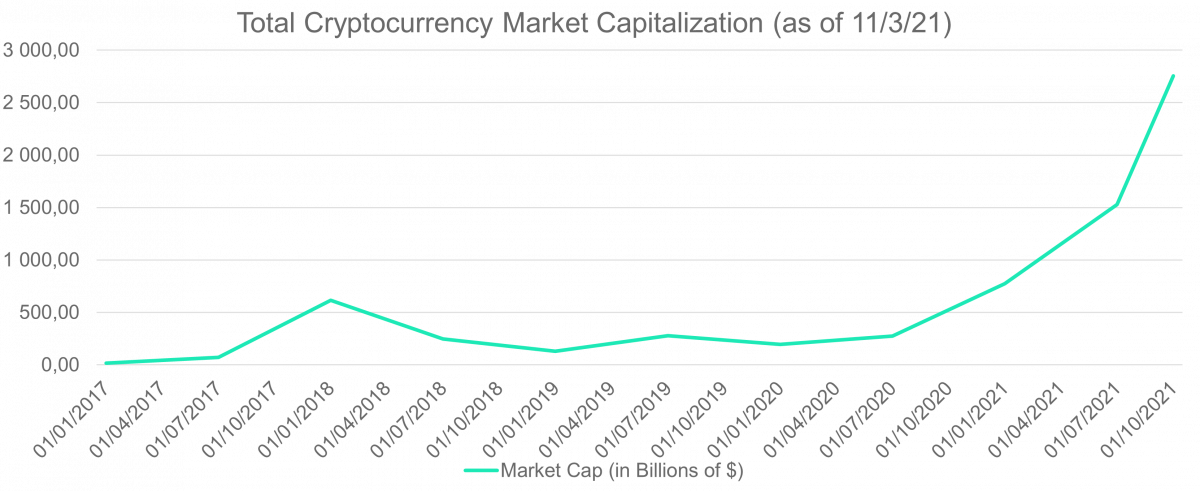

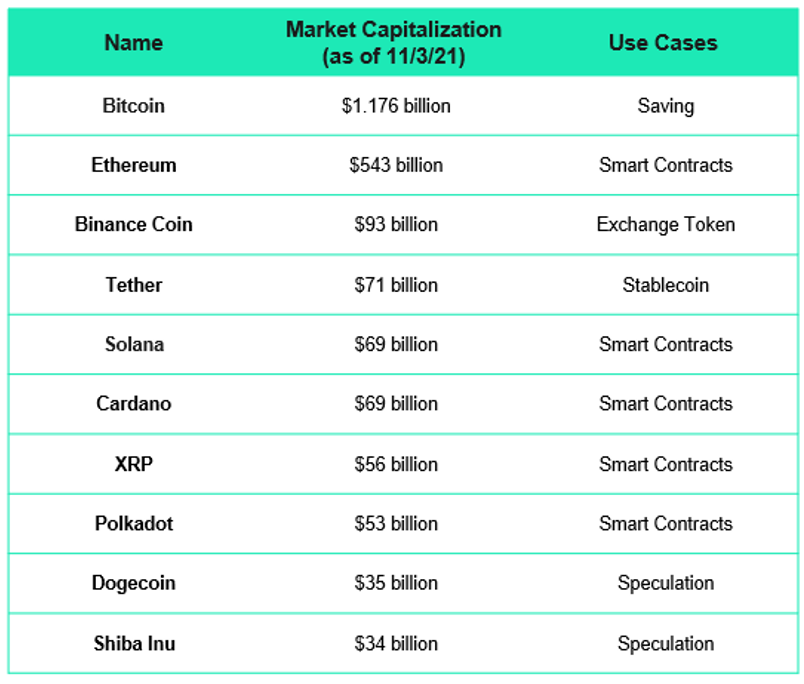

The market capitalization of cryptocurrencies has grown considerably over the past five years, from approximately $12 billion in October 2016 to $2.7 trillion today. Behind industry leader Bitcoin, Ethereum, Binance Coin, Solana, and Cardano have the most market capitalization.

The cryptocurrency market comprises several key stakeholder groups, including individuals, institutions, exchanges, and governments. At a deeper level, the market engages retail investors, direct custodians, asset & wealth managers, broker-dealers, exchanges, ETF operators, miners & node operators, central banks, treasuries, sovereign wealth funds, and national regulatory agencies.

There are approximately 250 million cryptocurrency users worldwide, with over 60 million users on leading U.S. exchange Coinbase as of Q2 of this year. In October, the number of active Bitcoin addresses rose 19%, continuing its parabolic run this year.

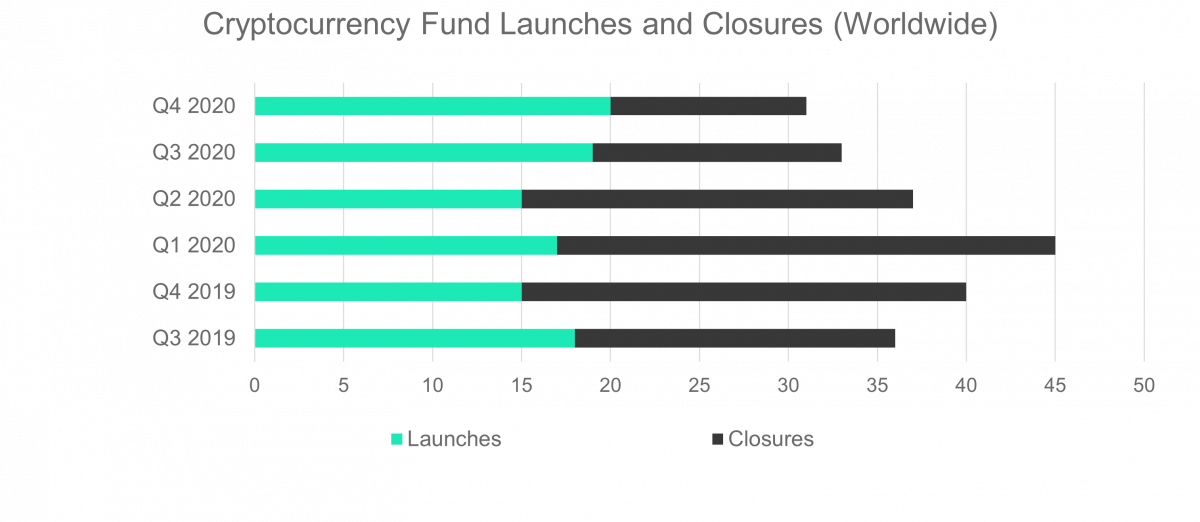

In 2017 and 2018, nearly 600 new cryptocurrency fund offerings were launched, compared with only 88 in the two years prior. Although a slowdown followed in 2019 and 2020, 2021 has continued the boom in cryptocurrency fund offerings. One key consideration is the improved turnover of fund launches and closures. While Q3 2019 and Q2 2020 saw 93 fund closures versus 65 launches, the latest data from Q3 2021 shows that 19 funds launched with only 14 closures.

The 1039-page Infrastructure Bill contains four pages - Section 80603 – that amend Section 6045, 6045A, 6724, and 6050I of the Internal Revenue Code of 1986 (the "Code"), expanding broker and general information reporting obligations to apply to digital asset transactions. The amendments generally apply to returns required to be filed and statements required to be furnished after December 31, 2023.

Section 8062 creates an ambiguous definition of a broker to include "any person who (for consideration) is responsible for providing any service effectuating transfers of digital assets on behalf of another person." For these purposes, "digital asset" is defined as "any digital representation of value which is recorded on a cryptographically secured distributed ledger or any similar technology."

This expanded language most likely includes U.S. cryptocurrency asset exchanges, digital wallet providers, and potentially non-broking parties such as decentralized finance software developers, miners, nodes, transaction validators, currency miners, validators, and developers. This would subject non-brokering parties to register with the Securities and Exchange Commission and the often burdensome and extensive reporting obligations of brokers.

By amending the definition of "broker," the Act concomitantly expands the requirement for them to send an annual information return Form 1099-B to customers and the I.R.S. Form 1099-B reports the following information for each sale or disposition of a cryptocurrency asset:

The law requires brokers to issue these forms annually beginning in 2024 reporting the prior year's transactions.

Before the passage of the Act, Section 6050I of the Code required businesses that "receive" over $10,000 in cash (or other untraceable instruments like cashiers' checks and money orders) to file a Form 8300 with the I.R.S., which includes the name, address, and taxpayer identification number, among other information, of both the payer and the beneficiary (usually the recipient) of the transaction. Importantly, Section 6050I does not apply to transactions at financial institutions, which are subject to parallel requirements under the Bank Secrecy Act. See 31 U.S.C. §§ 5312, 5313. Nor does it apply to traceable electronic transactions involving credit cards, debit cards, or peer-to-peer payment services like PayPal and Venmo.

The Infrastructure Bill amends Section 6050I's definition of "cash" to include "digital assets," thereby requiring persons that "receive" greater than $10,000 worth of digital assets in the course of their trade or business to file Form 8300 reports. This new reporting requirement will not take effect until 2024. Failure to comply with Section 6050I can result in civil penalties of up to $3 million per year—with much higher penalties possible if the failure is due to "intentional disregard" of the filing requirements. In addition, willful violation of Section 6050I is a federal felony, with violators facing up to 5 years imprisonment and corporate violators facing fines of up to $100,000.

Brokers transferring securities to another broker are required to provide a transfer statement to the other broker, including a customer's cost basis and holding period. Under the Infrastructure Bill, transfer statements are required to transfer digital assets (including cryptocurrency) to other brokers and non-brokers. This will likely result in transfer statements being required when customers move tokens from an exchange to an electronic wallet.

Many in Congress believe the language in Section 80603 of the Infrastructure Bill is badly flawed because it imposes reporting requirements on certain participants who cannot comply because they don't have the information. The current Congress is not passing legislation that could impact cryptocurrency businesses and consumers. The $1.7 trillion reconciliation bill, officially known as the Build Back Better Act, is expected to address cryptocurrency again and may pass Congress before the end of the year. Also, the Department of the Treasury can clarify issues because it is ultimately responsible for interpreting the law and writing it into the United States Tax Code.

Sia Partners will monitor and report all developments related to changes to and implementation of Section 80603.

Financial services firms need to adapt quickly to this new reality and to offer cryptocurrency products across their business lines. Firms that do not stay relevant by adopting cryptocurrencies will see increased competition and customer attrition from first movers in financial services and tech. As part of the launch of these new offerings, firms will need to develop new governance, risk, compliance, and legal protocols within their management frameworks.

While several cryptocurrency regulations are already in place, including licensing, tax, and Anti-Money Laundering ("A.M.L."), we believe that the regulatory environment will become increasingly stringent over the next 3 to 5 years. As such, it is imperative that firms become compliant with the current regulations and partner with a trusted subject matter expert such as Sia Partners to plan ahead.

Strategic Support

Given the rapid development of decentralized finance, it can be challenging to keep pace while mitigating any potential risks. Our multidisciplinary capabilities in Change Management, Digital Transformation, Governance, Risk Management, Audit, Compliance, and A.M.L., Sia Partners can support your team through these uncertain times. Among other things, we can help your firm develop:

Its journey to crypto-assets understanding;

A strategic roadmap and business plan; and,

A well-developed and complete risk management plan

Sia Partners has capabilities to support its clients across the decentralized finance ecosystem, including helping your firm develop and integrate decentralized networks or applications, introduce crypto-related products, manage the risk associated with those offerings, and navigate current laws and regulations through our compliance and A.M.L. capabilities.

Proper licensing is fundamental to any cryptocurrency business activity. Sia Partners has assisted some of the largest cryptocurrency exchanges and stable coin issuers in obtaining operating licenses around the U.S. We have the capabilities to develop the A.M.L. procedure documents and frameworks required in the licensing process.

Security is the cornerstone of any application handling crypto assets. Our team supports its clients in choosing 3rd partners, counterparties, and vendors to assure asset and sensitive information protection. We have well-developed risk-management capabilities that can aid you and your firm in understanding the risks of these developing and uncertain markets.

As a pioneer of Consulting 4.0, Sia Partners is a thought leader in emerging technologies and Consulting For Good. Our financial services consulting professionals can help educate your firm on all aspects of the emerging trends of FinTech, cryptocurrencies, DeFi, and blockchain technology across these various employee groups: