Carbon Accounting Management Platform Benchmark…

Once thought of as a nice-to-have platform functionality, Digital Wealth Management has evolved to such an extent that finding an efficient and effective method of combining human advice with digital tools is a crucial aspect of a firm’s capability in the advisory space.

In recent years, Digital Wealth Management (DWM) has grown to encompass much more than it used to. Those firms who fail to develop a robust platform are poised to lose the battle for client market share and top industry talent. In this paper, we outline the latest features brought to market across different types of players in the wealth management industry, which key components of a digital wealth platform firms looking to compete should consider, and how Sia Partners can help.

Digital Wealth Management is no longer solely synonymous with Robo-advisors offering low-cost, managed ETF asset allocation strategies. The trend towards large-scale digital enhancement and integration, accelerated by the impacts of COVID19, is now a necessary part of a firm’s product offering, including managed/advisory accounts and platforms in order to stay competitive.

Wealth management firms including banks, asset managers, wirehouses, IBDs and RIA firms seeking to acquire and maintain clients and advisors should invest heavily in their digital infrastructure and offerings. The launch of DWM platforms by large industry players like Morgan Stanley and Bank of America (Merrill Lynch) have set the bar by giving advisors and clients access to a suite of wealth management tools (appointment scheduling, tax services, portfolio construction / selection, client reporting, etc.) through an intuitive, single-point-of-entry platform. Advisors also get access to proprietary insights driven by advanced data analytics such as suggested trades for specific clients, check-ins driven by market risk indicator thresholds, and whitelabeled marketing pieces.

Asset managers are also engaging in the wealth management space by providing their own DWM solutions. BlackRock and Vanguard, the world’s largest and second-largest asset managers, respectively, each offer their own solutions, albeit with a key difference. BlackRock works with firms by providing their advisors with turn-key, separately managed portfolios based on a client’s investment goals along with client-approved performance reporting and trade rationale. They also provide insights into capital gains avoidance and tax-loss harvesting opportunities as a service, regardless if the advisor is invested with them. At Vanguard, they have hundreds of Certified Financial Planners on staff for clients who open accounts directly with them, which are invested into Vanguard ETF asset allocation strategies through their Personal Advisor Services (PAS) platform. Clients who are concerned that low-cost DWM providers lack an actual human to talk to have found a home in Vanguard’s PAS platform; AUM for the platform exceeds $118.5bil, the largest in the digital / robo advisory platform space. Advisor Group, who has encouraged a focus on holistic wealth planning rather than portfolio management, recently rolled out Reg BI compliance features (templated Form CRS, e-signatures, etc.) on their platform making it easy for advisors to show they’re acting in the best interest of their clients.

Robo-advisors disrupted the market by providing low-cost “set it and forget it” digital investment solutions, and now they are expanding their reach for wallet share. Platforms such as Acorns and Stash now offer cash and stock incentives for investors to set up direct deposits with them in either their checking or retirement account options.

As the industry’s race to release more robust feature functionality to their Digital Wealth Management platforms heats up, firms are heavily invested in their advisory account platforms, with Morgan Stanley’s WealthDesk and the recent launch of Client Engagement Workstation by Bank of America (Merrill Lynch) serving as the most prominent examples. This is where we explore the key components of digitally enhanced managed account platforms outlined below.

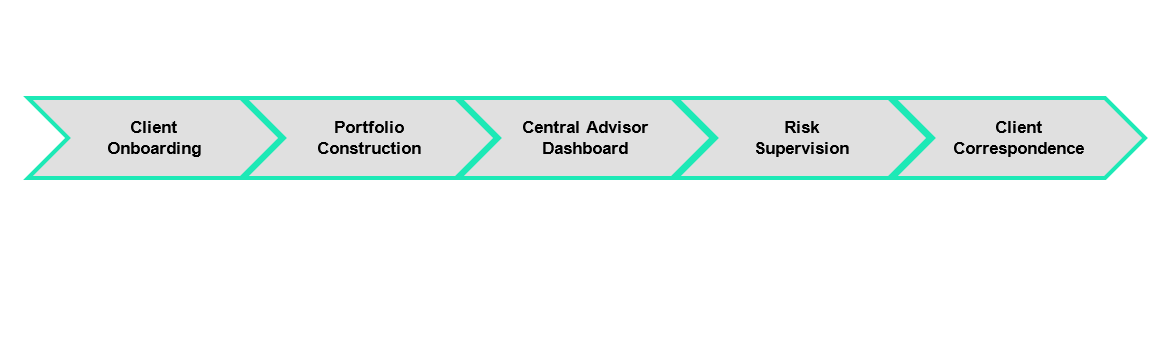

An integrated Advisor Platform starts at a single-point-of-entry and consists of several separate applications that seamlessly transition between each other, providing the Advisor the ease and flexibility to service their clients throughout each stage of the client relationship lifecycle.

A seamless, yet comprehensive process for turning prospects into clients is key for firms to successfully onboard clients. Onboarding includes KYC collection, Risk Profiling, AML checks, defining investment goals and objectives, account inception, and e-Signature integration. The digitization of client onboarding functionality improves the speed and accuracy of which the client’s information can be stored. Once the client’s profile is established, the advisor can then navigate between applications while keeping all of the client’s information in context.

An updated portfolio construction tool grants advisors a way to easily create portfolios for their clients based on their risk profile. Advisors have the flexibility to create their own strategies or utilize turn-key, separately managed asset allocation strategies to provide the client with the right portfolio for their needs. By passing along the client’s risk profile between applications within the platform and integrating advanced data analytics, the advisor can ensure that the portfolio meets all of the needs and requirements of their client.

The Advisor Desktop sits at the center of the ecosystem, allowing advisors to monitor their entire book of business while providing the ability to drill down into more granular client details. Additionally, the desktop serves as a launching point for each of the integrated applications.

Advisors are able to pull in risk analytics to fully understand their client’s portfolios through an integrated risk monitoring tool that provides features such as security-level risk scores, portfolio-level risk scores, and portfolio concentration risk evaluations. Additionally, the advisor will be prompted into action when their client is trending outside of their risk profile or investment objectives, giving advisors time and information to assess their next best action. Regulatory changes can create additional needs for monitoring account and advisor behavior. For example, the passing of Regulation Best Interest increased the fiduciary standard for wealth managers, forcing firms to enact more robust monitoring over client portfolios. Firms that leverage digital solutions will be better suited to position themselves and their advisors to meet regulatory standards and minimize risk.

New regulatory requirements have increased the number of disclosures and reports that advisors must provide clients. Client reporting tools must now provide quarterly and annual statements, additional performance exhibits, and increased regulatory disclosures to give clients as much information as possible to demonstrate the firm is acting in the client’s best interest. These reports also act as a key conversation tool for clients who have questions about their performance and must have the ability to be created ad hoc for any situation. In addition to reporting, a fully digitized platform offers multiple ways of contacting and communicating with clients, such as interactive client portals that give clients further access to their advisors via instant messaging, video chatting, and commenting on their current portfolios.

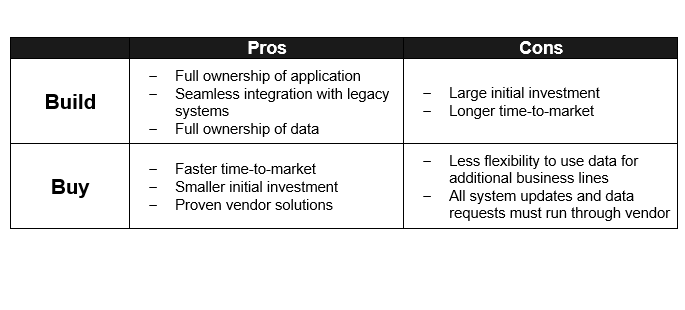

Firms may decide to implement their platforms in a few ways, mainly either building the end-to-end infrastructure themselves, buying vendor solutions to mold together into their platform, or a combination of build and buy. Building an end-to-end digital platform requires a substantial investment that takes a longer period of time to launch. However, by building a platform internally, firms have much more flexibility with how their infrastructure can be set up and tailored directly to the needs of their business. The platform is entirely owned and controlled by the firm and can more seamlessly integrate with existing systems. As a result, valuable data is also owned by the firm, free to use for identifying trends and insights and continually building out innovative solutions. Any enhancements and maintenance can occur as needed without requiring a lengthy back-and-forth request process with a vendor for support. By building this platform from the ground up, firms have much more ownership and flexibility that may warrant a greater cost and time.

Firms may also consider using a vendor to integrate into their platform. Vendors provide proven solutions often at a lower initial cost than building in-house. Given that the solution is already live and functioning, firms will be able to substantially increase their speed to market. Firms should consider the final vendor solution when building their overall platform, as the vendor may not be able to change their solution drastically to fit every specification required by the firm. Any data provided from external vendors may only be applicable for certain situations, leaving firms without the flexibility to leverage the data source for other business lines and insights. Additionally, any enhancements should be run through the vendor and may take up a lot of time to process.

A hybrid approach may also be a viable option for companies that do not have the need to search for a full solution. Firms may decide to put together a patchwork of legacy applications with vendor solutions that will enhance their digital infrastructure. As with vendor solutions, firms may struggle to achieve full integration between applications and should consider the time it takes for vendor enhancement requests for any upgrades to the platform. Ultimately, there are numerous routes for firms to take as they build out their advisor platform. Firms should consider their cost and time constraints, vendor relationships, and data availability options in order to make the best decision.

The coronavirus pandemic has forced most firms to adapt to a work from home model of engagement with advisors and clients. With so many advisors now accessing their workstations remotely, digital capabilities have skyrocketed to the top of firm priorities. A robust platform must now be built to support remote working at a higher volume than ever before as remote access and omni-channel adoption becomes a mandatory facet of the industry in response to the pandemic. In addition, client correspondence has relied heavily on digital interaction. Firms will need to look to digitize communication and other client-facing processes that were previously done in-person, such as hardcopy delivery of disclosures as well as retrieving physical signatures. As a result of the increase in digitization, investment into cyber security measures is pivotal as employees access firms’ systems from outside of the boundaries of a physical office and firm devices.

Digital wealth management can take on forms both large and small and the approach for implementation can and should vary by firm. Sia Partners has assisted clients including wirehouses, RIAs and RIA Custodians, IBDs, Asset Managers in all aspects of digital transformation including strategic analysis, market entry strategy, build vs. buy assessments, vendor assessments, program management and implementations.

Sia Partners’ unique Consulting 4.0 approach augments business advisory services with our Heka automation and artificial intelligence capabilities to provide clients with industry leading consulting and technology services and solutions.

Contact us to discuss how Sia Partners can assist you in your Digital transformation.

Matthew Yee

Managing Director

+ 1 (516) 241-8118

matthew.yee@sia-partners.com

Frank Gomez III

Supervising Senior Consultant

+ 1 (631) 275-3641

frank.gomez@sia-partners.com

Kevin Kiley

Senior Consultant

+ 1 (914) 462-8744

kevin.kiley@sia-partners.com