Carbon Accounting Management Platform Benchmark…

An advanced tool for sustainability strategy and compliance

To elevate sustainability strategy and compliance, the approach to materiality assessment is evolving rapidly. Traditionally, companies have focused on identifying which sustainability issues are most financially critical to their operations, through frameworks like SASB, or how their business impacts sustainability issues, using frameworks like GRI. However, recent regulatory shifts, such as the mandatory requirements of the CSRD in the EU, have combined those approaches into the double materiality assessment.

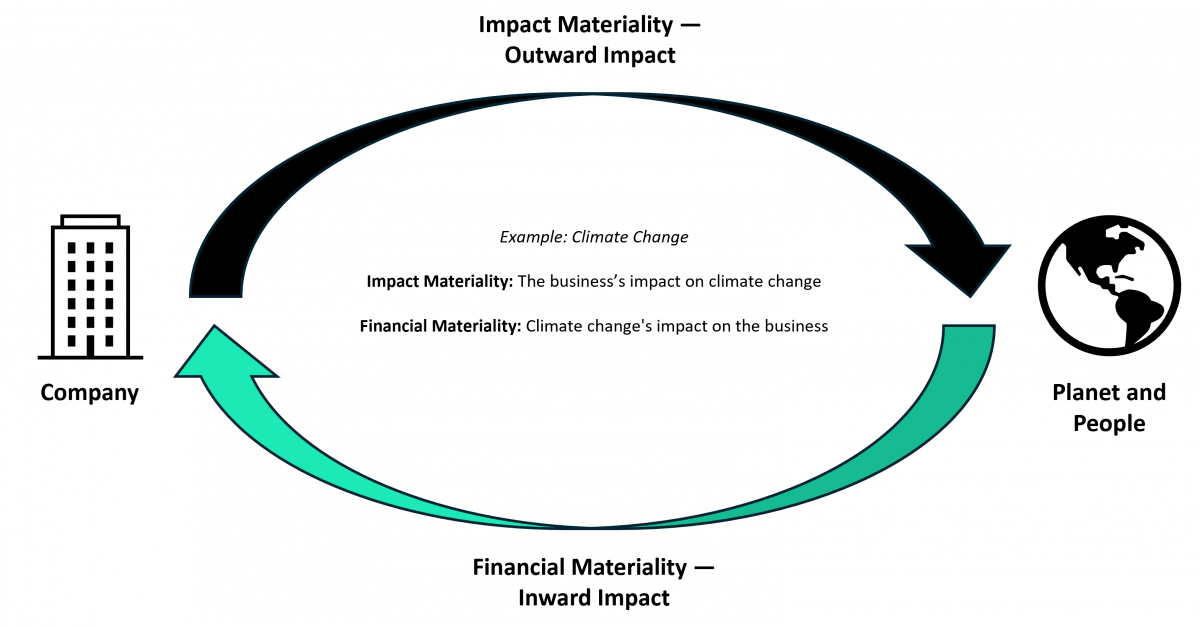

Double materiality encompasses both the financial impacts of environmental and societal factors on a company (financial materiality), and the impacts that the company has on the environment and society (impact materiality).

This dual perspective mandates a deeper analysis tailored to each company's circumstances. Companies must delve into the details of their sustainability-related impacts, risks, and opportunities; assess the scale, scope, likelihood, and irremediability of each one of these; and set thresholds to determine what is material for the specific company. This upgrade in analysis makes the exercise a dynamic, complex, and context-specific process. It also makes the outcomes useful for business strategy beyond compliance, helping companies strengthen their value proposition.

The upcoming Corporate Sustainability Reporting Directive (CSRD) framework provides a structured yet flexible foundation for conducting Double Materiality assessments. Unlike traditional approaches that prescribe specific metrics, this framework encourages companies to define their own impact metrics, aligned with their industry dynamics, business models, supply chains, geographic locations, and size. As a result, each assessment is unique to the company. As part of the assessment, companies should:

Sample double materiality assessment graphic prioritizing material topics

To maximize the benefits of double materiality, it is crucial to align material issues with enterprise risk management (ERM) processes. This ensures that sustainability considerations are integrated with the overall corporate risk management strategy. The double materiality assessment can also help to articulate clear ESG strategies supported by robust goals, KPIs, policies, and organizational structures. Companies can use the resulting strategic framework to allocate appropriate budgets and resources to meet those goals.

Double materiality represents a paradigm shift towards a more holistic and integrated approach to sustainability strategy and compliance. By embracing this nuanced methodology, companies not only mitigate risks and seize opportunities, but also strengthen their resilience and relevance in an increasingly complex global landscape. As regulatory frameworks evolve and stakeholder expectations heighten, double materiality is a transformative force driving sustainable business practices into the future.

Sia Partners offers comprehensive sustainability strategy services. These include tailored materiality assessments, stakeholder engagement, and integration of sustainability metrics into business processes. With our expertise in aligning sustainability efforts with enterprise risk management (ERM) frameworks, Sia Partners ensures that businesses are well-positioned for both compliance and long-term strategic growth.