Canadian Hydrogen Observatory: Insights to fuel…

Established by the Bank for International Settlement through the Basel committee on banking supervision, Basel II 2nd Pillar directives on Supervisory Review were designed primarily to make sure that banks estimate their equity needs as accurately as possible, taking into account their risk profile.

Within this regulatory context, the Economic Capital approach is a key element to enable banks to efficiently deal with profitability and solvability constraints, allowing banks to meet 2nd pillar requirements while keeping their specificities.

The regulatory capital:

The regulatory capital is defined by regulators and sets bank's minimum amount of equity. The calculation modalities are defined within Basel 2 framework. They are based, for IRBA, on two main data: the probability of default of the counterparty (PD) and the loss given default (LGD).

The economic capital:

The economic capital defines bank's amount of equity required to cover a maximum potential loss at a defined confidence level for a given time horizon.

It is calculated by the bank using an internal model and allows to improve the equity allocation to the business lines by providing a finer estimate with more granularity.

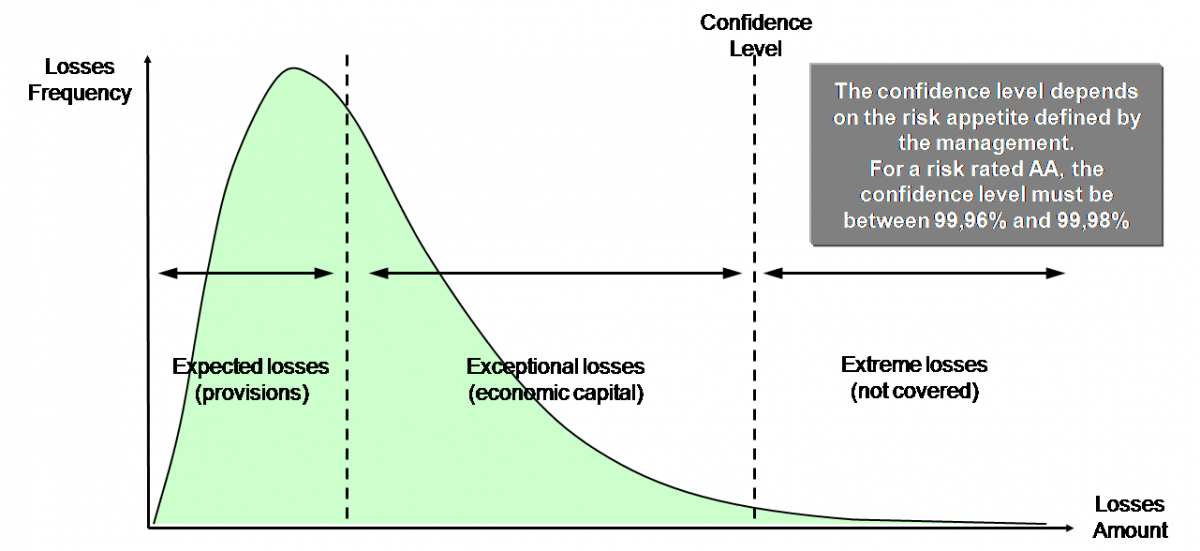

The economic capital aims only at covering exceptional losses. Expected losses should be covered by provisions, while extreme losses are not covered under this approach.

The internal capital:

The internal capital corresponds to the equity amount required to cover all risks identified by the bank. Its calculation is based on internal methods developed by each institution, taking into account its own specificities.

Internal capital differs from economic capital on two points:

For reminder, ICAAP (Internal Capital Adequacy Assessment Process) is a regulatory procedure which determines if the equities are sufficient to cover all the risks faced the financial institution. The ICAAP validation by local regulator is a mandatory step in the bank's Basel II certification process.

ICAAP must describe calculation and stress tests procedures for different risks encountered by the bank. The main risks which must be guided by ICAAP are:

The treatments relative to all identified risk types must be describe under ICAAP. The procedure must predict stress tests, minima, in the following situations:

The 2nd Pillar formalizes the principles of risk management governance. It allows banks to estimate at best their equity adequacy with their risk profiles. The approach is articulated around 3 axis:

The economic capital approach allows to cover unexpected losses (exceptional losses), for all risks types managed by the bank's risk department, even the ones not taken into account by 1st pillar. These risks should be integrated into regulatory capital calculations in order to meet 2nd pillar requirements.

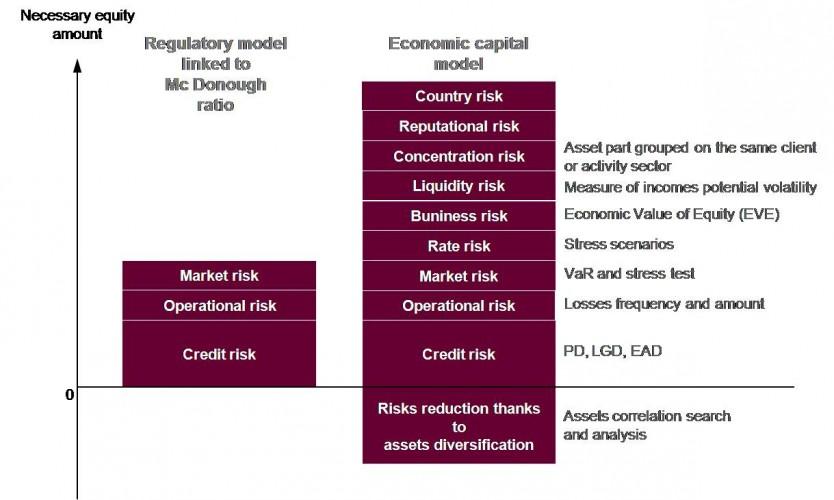

From a calculation perspective, the economic capital is different from the result of a sum of elementary risks; it deals with the correlation between different assets, which allows to reduce the global cost of risk's of a bank providing that it has a portfolio diversified enough as depicted on the figure below.

The economic capital approach is based on the evaluation of different scenarios to measure the exposition of the bank in terms of losses. The selected scenarios take into account the projected evolution of several macro-economic indicators and also cyclical conjectural effects. Finally, an expected probability is attributed to each scenario to help weight their relative importance.

The modelization of these scenarios using the "Monte Carlo" statistical method will produce the curve depicted above in Figure 1. It is then the role of the bank's management to define the confidence level acceptable to cover exceptional losses in line with the risk appetite and the mission statement defined for the bank.

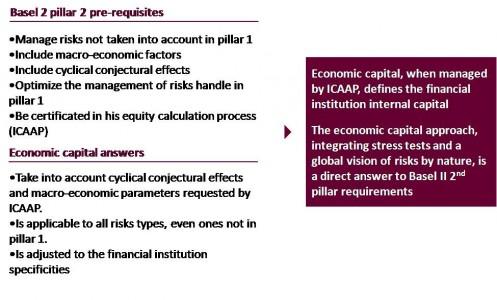

Although the economic capital approach is not mandatory, it can be used to improve the risk measure supported by a financial institution; the increased sophistication of the risk management framework being offset by the potential reduction of the cost of risk and, more importantly, by a better mastery of the risks incurred by the financial institution. It will also ease the financial institution to meet ICAAP's regulatory requirements which include the evaluation of macro-economic indicators and cyclical conjectural effects.

The interest in the approach resides also in the fact that it is applicable to risks not taken into account in Basel II 1st pillar. As the banks willing to complete Basel II certification must then integrate these risks in their risk management framework, be it in an approximate way in the internal capital calculation. They should also carefully consider the true advantages brought by the Economic Capital approach to meet these regulatory requirements, especially in the light of the expected Basel III framework.

Figure 3: Economic capital as answer to Basel II 2nd pillar requirements

The setup of the Economic Capital approach is not required to comply with regulatory authorities as such. However both ICAAP and Basel II 2nd pillar requirements prompt for the use of more comprehensive and sophisticated tools for risk management and, in any case, several topics have to be addressed in order to insure full compliance with the requirements.

The Economic Capital approach is a powerful tool, allowing to meet these requirements and offering a comprehensive solution, foundation of a global and integrated approach for risk management. Furthermore, the Economic Capital presents a real opportunity for financial institutions to optimize their equity allocation by business line, to refine their risks evaluation, understand better the risks they are facing and, ulimatly, to reduce their global risk's cost.