Agentforce, the GenAI Agent by Salesforce

In recent years, RPA has become a focus in financial services. The prospect of faster, more efficient, cheaper processes has attracted the interest of senior management. Projects have been initiated to implement emerging tools within different departments of banking and non-banking organisations.

Of all the processes which can benefit from increased automation in the banking sector, Finance and accounting processes seem to be a prime candidate. The Finance function covers the whole scope of the bank and all the products, activities and entities of the organisation, each of them possibly requiring a specific Finance process because of organisation, legal or accounting specificities. The potential for automation and the expected benefits for these processes are therefore relatively high compared to other functions. Whilst significant progress has been made over the last decade, many tasks remain manual and a significant number of manual procedures and Excel /Access models have been developed, generating operational risks and inefficiencies. The ROI of automation projects with RPA within the Finance function can therefore be considerable, both in terms of increased operational efficiency and mitigated risk, justifying the number of projects that have and continue to be initiated to develop process automation in most financial institutions. According to the Institute for Robotic Process Automation, an RPA software robot could for instance cost 66% less than hiring an off-shore worker and 80% less than hiring an onshore full-time employee (FTE), without taking into account the reduced error rate. [1]

Some tasks performed by Finance users are time-consuming and bring low-value to the organisation. With RPA (“Robotic Process Automation”), these tasks could be automated and would reduce the pressure on Finance employees as well as free some time for higher value-added tasks. The following activities could be addressed:

Within the Financial Accounting department of some financial institutions, some users still spend a lot of time extracting financial data from different systems and processes, calculating and consolidating the numbers according to general and local accounting rules in order to produce the organisation’s financial statements. These processes involve many manual tasks such as rule-based calculations, adjustments, corrections and consolidation of financial data which could be automated with RPA programs replicating what the user is doing.

This performance management reporting requires significant data processing and calculations and constant update to monitor the new products, change in the organisation. By automatically generating reports, Finance users could increase the frequency of reports, reduce the time spent on production and increase the time spent on analysis as well as the design of new reports and key performance metrics.

In the banking sector, regulators require various regulatory reports to be produced in order to assess the situation of a bank and measure its financial health. To fill in the templates defined by these organisations, the banks need to process and adjust the data in a very short amount of time. These processes, though increasingly automated, still involve manual calculations and adjustments. By automating most of the production of such reports with automated workflows, the Finance users can therefore focus on investigating outliers or unusual values to ensure the data reported to the regulator is correct and accurate.

A key activity in Finance involves performing controls and reconciliations to ensure that the data is correctly fed from operational to accounting systems, that the data is accurate and is up to date. Though controls and reconciliations can often be automated directly in the organisation’s systems, some reconciliations remain manually operated, particularly when the reconciliation involves data from external sources such as emails, websites, flat files, or because the ROI of automating these processes with a traditional IT solution is limited. In these cases, RPA can replicate at a lower cost the collection of data and perform the reconciliations, which allows the user to focus on investigating, reporting or correcting the breaks.

Manual tasks are subject to human errors, which then flow into the other processes and can have serious repercussions, leading to the production of incorrect financial information displayed in the financial statements in the worst case. Automation of these processing activities removes operational risk from mis-keying entries or omission of entries for example. In many instances to perform these processes, Finance users develop End-User Developed Applications or Computing (EUDAs or EUCs). These applications consist of complex models developed mostly in VBA or Access databases which are not formally supported or maintained by the IT department. However, as with manual processes which cannot be automated, these applications are exposed to significant operational risks.

By automating these EUCs through automated workflows, RPA enables the opportunity to considerably mitigate operational risk through removal of manual intervention.

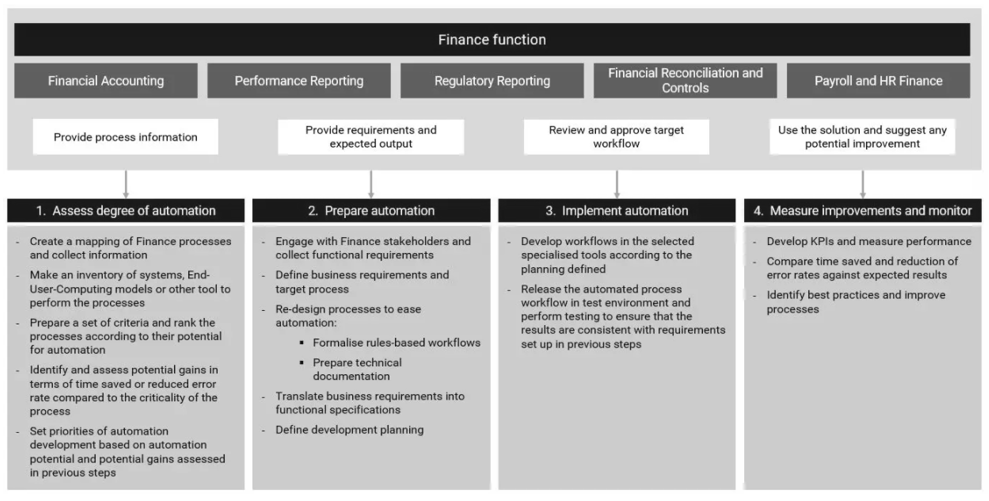

The potential benefits to implement RPA programmes within the Finance function highlighted above must not hide the complexity of such programmes. To effectively approach RPA, a 4-step approach could be implemented, enabling the mapping of the different processes, assessment of their potential for automation as well as the expected benefits. The automation can then be implemented according to a prioritisation list depending on feasibility and potential benefits.

Example approach to RPA implementation in the Finance function:

[1] Nick Ostdick , “RPA By the Numbers”, UiPath, 16 Aug. 2016.