Canadian Hydrogen Observatory: Insights to fuel…

Can Europe reduce its energy dependence on Russia?

Over Q1 2022, the Ukraine conflict fueled oil & gas markets dynamics. Uncertainty suddenly rose and analysts now wonder whether Europe can move away from cheap Russian energy and how such a strategy could be executed.

| 2020 | 21Q2 | 21Q3 | 21Q4 | 22Q1 | 22Q2 | ||

|---|---|---|---|---|---|---|---|

| Crude Prices | Brent ($/bbl) | 41.8 | 68.8 | 73.5 | 79.6 | 92 | 118 |

| Rig Count | World | 1352 | 1259 | 1421 | 1537 | 1669 | 1706* |

| Demand (mmb/d) | Total | 91.9 | 96,3 | 98,8 | 100,5 | 98,9 | 98,8 |

| OECD | 42,0 | 46,1 | 45,8 | 46,7 | 45,9 | 45,4 | |

| Non-OECD | 48,8 | 51,2 | 53,1 | 53,8 | 53,0 | 53,4 | |

| Supply | Total | 93,7 | 94,1 | 96,3 | 97.9 | 99,3 | 98,9 |

| OPEC+ | 47,9 | 48,0 | 49,3 | 50.9 | 52,1 | 50,9 | |

| Non-OPEC+ | 45,9 | 46,1 | 47 | 47.1 | 47,2 | 48,0 | |

| Excess(+)/Deficit(-) | 1,8 | -2,2 | -2,4 | -2,6 | 0,4 | 0,1 |

*Sia Partners' forecast

The first quarter of 2022 has suffered from the war on Ukraine, leading to disrupted energy markets, uncertainty about the future of supply and high crude prices, averaging $92/bbl. Depending on the evolution of negotiations and the intensity of future sanctions, the barrel price will move but should remain above $100.

The demand-supply imbalance has shrunk, mostly due to the future potential withdrawal of Russian barrels from the market, which could reach 3 MMb/d according to the IEA. The required quantities could first come from non-OPEC+ countries (with 0.8 MMb/d added to the market between Q1 and Q2 2022); with OPEC+ production rising again starting from Q3 2022.

| Location | Spot Price | This month future | Next month future | Next 2 coming months futures | Same period last Year |

|---|---|---|---|---|---|

| Henry Hub (US) [$/mmbtu] | 5.56 | 5.56 | 5.59 | 5.64 | 2.562 |

| TTF (Europe) [€/MWh] | 116.00 | 103.83 | 104.78 | 104.05 | 17.78 |

| JKM (Asia) [$/mmbtu] | 34.43 | 34.43 | 34.43 | 30.85 | 7.02 |

Pressure from both Asia and Europe have had an impressive impact on Henry Hub futures. At this period, natural gas is usually in its cooldown phase, where production is higher than consumption. However, lack of investments, unexpected cold weather and the Ukraine conflict have led to explosive volatility.

The European gas market is the biggest victim of this once in a lifetime period. During the sanitary crisis, prices have shot up by 2300% since the start of the pandemic to the end of March. Maintenance works on gas infrastructure in Norway, shortfall of wind-powered electricity generation and the conflict in Eastern Europe has put immense pressure on the European gas market since June 2021.

The Asian market being extremely correlated to the same supplier as the Europeans, gas price has seen similar volatility. However, with an increase in Australian output which is essentially exported to Asia, the increase hasn’t been as big as the one in Europe.

Oil and gas prices have soared during Q1 2022 amid volatility both in the market and in global geopolitical developments. Brent crude prices, which reached $139.1 on March 7, are nearly the highest in history, second only to 2008, when they hit $147.5/bbl. Gas markets, too, have seen fierce volatility. On January 27, Henry Hub gas prices skyrocketed 72% (from below $4.50/mmbtu to $7.50/mmbtu) in less than two hours, and between January and March, the Dutch TTF gas price shot up 328%, from €70/MWh in January to over €300/MWh upon the start of the Ukraine conflict in early March.

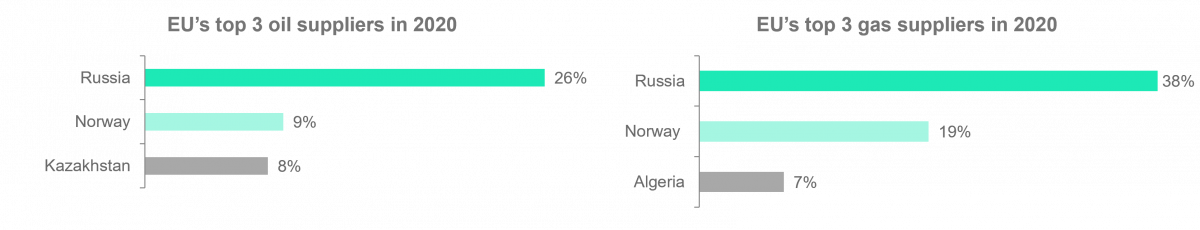

With Western sanctions on Russian oil and gas ratcheting up, so too are the questions about Europe’s energy dependence on the federation. Russia is the world’s second-largest oil exporter and largest gas exporter.

Source: Eurostat

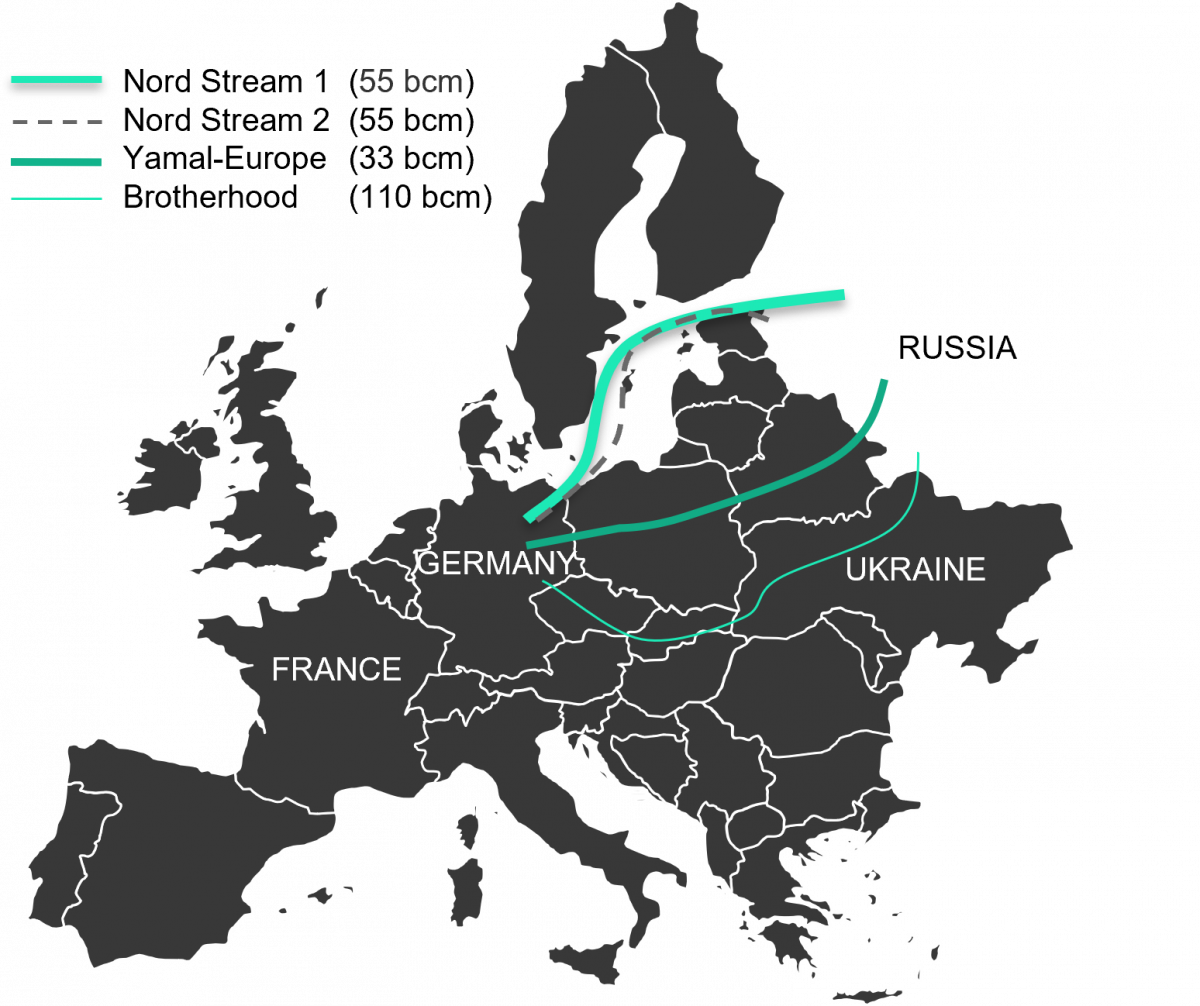

“We are not at war with ourselves,” Belgian Prime Minister Alexander De Croo said, implying that sanctioning Russian energy imports to Europe would cause a spike in energy prices that would hit harder at home than in Russia. “Sanctions must always have a much bigger impact on the Russian side than on ours,” he aptly stated of the continent’s heavy reliance. Between 2014 and 2022, Europe’s domestic gas production decreased by 47%, while its supplies of Russian gas rose by 10%. In 2021, Europe’s gas consumption amounted to roughly 500 bcm, of which 155 bcm were imported from Russia. Prior to Russia’s amassing of troops on Ukraine’s border, the European dependence on Russian gas was expected to rise a further 50-60%.

Now, weeks into the full-scale conflict in Ukraine, the EU commission is seeking to sidestep the impact sanctions of Russian energy imports would have on local economies by announcing its intention to replace two-thirds (102 bcm) of its Russian energy imports with alternative pipeline suppliers and LNG by the end of the year, but the commission’s goal is overly ambitious.

![Europe Gas Supply and Demand in 2021 [bcm] Europe Gas Supply and Demand in 2021 [bcm]](/sites/default/files/styles/freeratiomedia_1200/public/image/picture/2022-04/oil%20analysis%202.png?itok=MKjLUXKC)

Europe Gas Supply and Demand in 2021 [bcm]

Source: Reuters

Alternative pipeline supplies could potentially replace 10 bcm – a tenth of the objective – by the end of the year thanks to Europe’s other prominent gas suppliers, including Algeria, Libya, Azerbaijan, and Iran. (Europe imported a total of 60 bcm via pipelines from these suppliers in 2021 – a modest fraction of the total 500 bcm consumed on the continent and roughly a third of what Russia supplied that year.) The scant increase would do little to end Europe’s energy dependence on Russia, and given that Russian gas has historically been the cheapest, these new supplies would still drive up costs.

Gas pipelines between Russia and Europe (pipeline capacities)

Source: Reuters

Alternative sources of LNG are not any more promising. The quantity of gas the EU Commission aims to replace for 2022 is equivalent to 20% of all LNG quantities traded globally. With demand for LNG soaring, the EU will face fierce competition with Asia to obtain LNG from the biggest producers of the resource (Australia, Qatar, and the US). Importing LNG on a larger scale also requires infrastructure that Europe does not yet have in place. Even Spain, which has the largest LNG import capacity, lacks pipeline connections with the rest of Europe: out of a 40 TWh capacity to import, the country can only export 5 TWh per month.

According to the International Energy Agency, from April, Russian oil output could be shut in by 3 million barrels per day. The organization said that this market shortage could be taken over by OPEC+ countries, with a production increase of 4.7 MMb/day, coming mainly from Saudi Arabia and the United Arab Emirates. However, OPEC+ countries have been sticking to their July 2021 decision of gradually increasing production by 0.4 MMb/day every month, pointing out the fact that surging prices have not been the result of a tangible market gap between supply and demand.

Can American shale oil play a role of swing producer this time? It is unlikely. US shale companies seem to prioritize generating returns for investors rather than increasing oil output. As for strategic reserves, their current low level of stocks will likely push OECD members to consider this an emergency measure with limited impact over time. Over the long term, the removal of Russian oil could pave the way for an Iranian come-back to the international oil market, particularly amid widespread reports that the US and Iran may soon reach a nuclear deal.

With sanctions on Russian oil from western nations, Moscow could consider deeper commercial ties with Asia. Before the Ukraine conflict, the Russian oil exports were mainly split between Europe (more than 50%) and Asia (with 20% for China). The recent demand drop from European traders for Russian oil has pushed the Ural crude price down: this declining price has attracted Asian countries such as India which has quadrupled its imports in March.

So far, crude oil exports from Russia to Europe have continued, especially the 1 MMb/day crude transported through the Druzhba pipeline, and subject to forward contracts, which are still in force. Russia’s oil production has remained stable despite sanctions and the resulting pressure on its storage infrastructure.

With soaring commodity cost over Q1 2022, retail fuel prices in Europe have experienced a significant ascent. This adds up to the original upward trend: from March 2021 to March 2022, average retail fuel prices in Europe have increased by 30% for unleaded 95 (from €1.21/L to €1.57/L) and 37% for diesel (from €1.13/L to €1.55€/L). The increase of diesel price has been remarkably high since January 2022, with a 17% rise within the last two months (compared to +11% for unleaded 95 over the same period of time).

Average retail fuel price in Europe

Source: Sia Partners

The surge of retail fuel prices is a real challenge for low-income households that have settled outside of expensive economic urban centers and need to drive on a daily basis. In France, an average of 12,200 km/year/vehicle associated with a mileage of 7L/100km, means a €300 to €360 impact on a vehicle owner’s budget, if today’s prices were to be compared with last year’s.

Europe’s fuel consumption profile is uncommon: diesel accounts for 50% of all fuels consumed vs. an average of 28% globally. Europe is actually the first market for diesel, ahead of China and Russia. Even though European refineries provide the vast majority of demand, 20% must be imported (mainly from Russia). As a result, diesel prices in Europe are more impacted by the Ukraine conflict. In addition to this structural context, European fuel stocks are currently low, which may imply prices will remain high over the medium term.

In response to the emergency of surging energy prices, European’s countries implemented policies aimed at supporting citizens’ purchasing power. Tax decreases are applied on diesel and gasoline (€0.12/L in Sweden, €0.15/L in Italy, €17.5/L in Belgium, €0.18/L in France) and inflation allowance are granted in Sweden (€95 for those who own a car, and €143 for low-populated areas) and in the Netherlands (exceptional energy allocation of €800 for low-income households). The assumption behind such expensive policies is that high energy prices will soon return to levels seen in 2021.

The urgent need to decarbonize the European economy is now being reinforced by the sudden pressure generated by Q1 2022 energy crisis and its tightening effect on EU members’ budgets and lower citizens’ purchasing power. It is now very likely that the European Union will give a big push to implement its ‘Fit for 55’ roadmap, in order to promptly decarbonize its economy… and reduce its energy dependence.