Gen AI for Investment Management Research

Has corporate performance during the pandemic demonstrated the nexus between operational resiliency and their ESG score?

There is nothing like a global pandemic to underscore the need for an effective operational resilience strategy in the face of unprecedented crises. Seemingly overnight, businesses internationally faced challenges across the enterprise that tested even the most resilient and well-prepared teams.

Operational resilience, defined as “the ability to prepare for and adapt to changing conditions and disruptions” [1] includes the ability to withstand and recover from deliberate attacks, accidents, or naturally occurring threats or incidents. A proper operational resilience framework is robust and comprehensive, covering critical areas including business continuity management, cyber resilience, risk management framework implementation & third-party risk protection. Having this type of extensive framework in place ensures that an organization is more likely to anticipate emerging risks, prepare accordingly, and then mitigate the impact of those risks quickly and effectively.

In particular, COVID-19 highlights the importance of thorough and effective business continuity planning and how it helps mitigate external threats to a corporation’s infrastructure, process, and assets. In a Gartner survey released on March 10 [2], just 12% of more than 1,500 respondents believed their businesses were highly prepared for the impact of coronavirus, while just 2% of respondents believed their business could continue as normal. Developing, testing, and implementing effective formal process and technology can mitigate your business from disruptive events such as the pandemic.

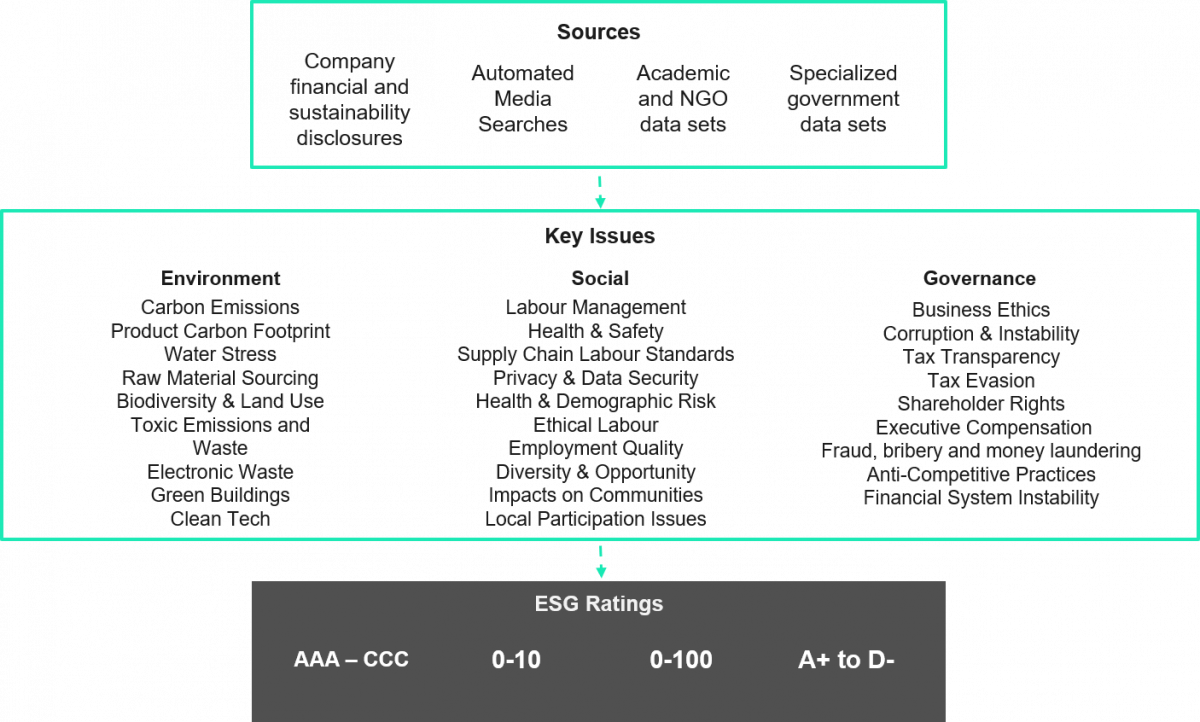

ESG ratings are evaluations of a company based on a comparative assessment of their quality, standard, or performance around the following three concepts: environmental, social, and governance (ESG) issues. ESG scores became much more popular after the UN Paris Agreement in 2015 as climate change and ethical investing became a concern for investors. Today, all global financial data providers such as Bloomberg, MSCI, MorningStar, and Rep Risk have their own proprietary ESG scores. There is no international standard currently on ESG scores; some are rated AAA-CCC and others are on a scale of 0-10. While there are similarities in their methodologies and calculations, generally these data providers use a scoring process displayed in Figure 1.

While the pandemic has underscored the obvious need for a strong and developed operational resilience program, COVID-19 has also made it evident that resilience and ESG principles go hand in hand.

Although ESG scores originated with the purpose of appeasing ethical investors, is it possible that ESG scores have become a valuable resource for all investors? Never has there been a resource for investors that is calculated with (A) corporate financial and Corporate Social Responsibility disclosures, (B) news sentiment and automated negative news screenings, and (C) sourcing from academic, NGO and government data sets to assess a prospective investment.

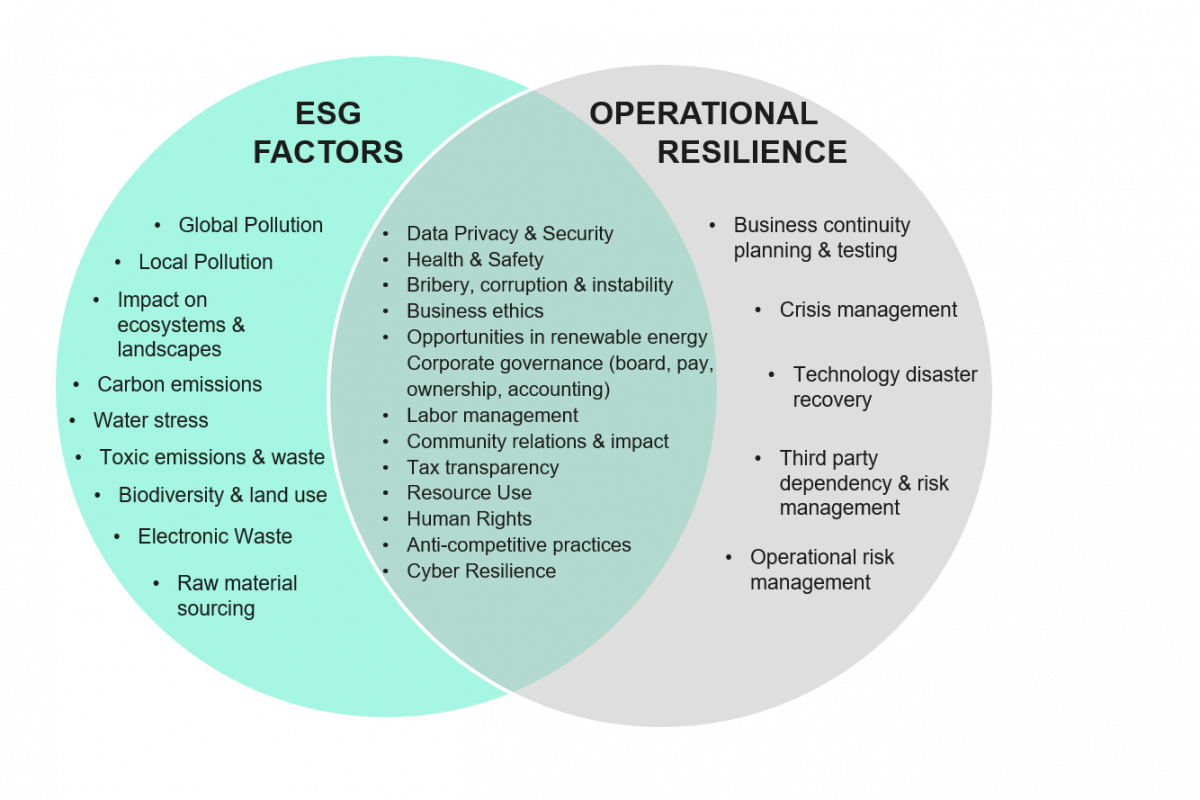

Traditionally, when one thinks of ESG scores the first thing that comes to mind is carbon emissions, carbon footprint, and other environmental impacts. However, due to the strong demand for more accurate scores as well as competition among proprietary data providers, ESG scores have become increasingly more encompassing and exhaustive. Many top data providers’ scoring methodologies now consider factors such as data privacy & security, corruption, money-laundering, shareholder rights, discrimination in employment, supply chain standards, and many more.

Figure 2 illustrates the overlaps in commonly used ESG scoring factors developed by Morningstar, MSCI, and RepRisk, and traditional operational resilience characteristics of a firm. Notice how these ESG ratings factor in several issues directly related to a firm’s operational resilience model, including privacy & data security, human capital development, health & safety, and corruption & instability. The pandemic has further strengthened the connection between operational resilience and ESG, as in S&P Global ratings view [3], “strong ESG performers with stakeholder-focused and adaptive -governance structure are likely to remain resilient amid rapidly changing dynamics.”

Figure 1 – ESG Scoring Process

Since the beginning of the outbreak, social considerations, including prioritizing employee health and safety as well as employee engagement, have guided many business decisions that have potential financial and reputational consequences. How companies have addressed and responded to these challenges COVID-19 has presented vis-à-vis their employees will be remembered for years to come and can potentially have a lasting impact on future employee behavior including engagement, productivity, retention, and loyalty.

Figure 2 – Overlap of ESG Factors and Operational Resilience Characteristics [4] [5]

An April 2020 Survey [6] by the Human Resource Executive showed how companies are turning to new or enhanced benefits to help their employees through the pandemic.

The survey reported that 47% of employers were enhancing healthcare benefits and 45% were expanding their existing well-being programs. Additionally, 33% were planning to make changes to paid time off or vacation programs. Many companies offered extra paid time off for those who were sick or self-quarantined, while others offered employees childcare support and caregiving leave. Employee health, wellbeing, leave and safety were key concerns across all industries, and proper management could have many future positive impacts and help build resiliency while mismanagement could have the opposite effect.

Stakeholder engagement is crucial, and the manner, speed, and frequency in which a company communicates with its internal and external stakeholders can have significant effects. BlackRock research that explored the performance differences between ESG indices and their core, non-ESG versions found that most ESG-tilted portfolios had outperformed their non-sustainable counterparts during this year’s market downturn. [7] The report emphasizes how this outperformance was driven by strong performance in themes including customer relations, firm culture, and board effectiveness. The pandemic has tested companies’ board and management, revealing how they handle disruptions, risk management, and oversight in times of crises. Throughout the pandemic, dozens of executives around the world voluntarily lowered or forwent their salaries, offered financial assistance to employees, and donated supplies to front line workers. The intersection between the “S” and “G” factors comes into play as well, as the different ways in which management and the board have been dealing with their employees, customers, and local communities during the crisis can affect a company’s reputation depending on what is perceived as socially acceptable by stakeholders.

To preface, even before the pandemic, evidence had been mounting for decades that ESG investments yield greater and more stable returns. According to a research paper co-written by Deutsche Asset & Wealth Management and the University of Hamburg, out of 2,200 studies on ESG, 90% demonstrated that ESG has a “positive relationship to corporate financial performance (CFP) or at least no negative relationship”. Additionally, as per JUST Capital study, top quintile ESG companies demonstrated approximately 18% - 22% lower volatility in returns than the bottom quintile of ESG scores. This shows that corporations with greater ESG policies will better protect investors from downturn risks.

Some skeptics may argue that since there is a lack of industry standardization for ESG methodology, studies cannot accurately compare returns of different ESG funds. It is true that the ESG industry still faces many challenges, such as ‘green-washing’, but ESG reporting is becoming more standardized. Common industry standards have been developing over decades, such as the UN PRI Signatory guidance (United Nations Principles of Responsible Investing) and SASB reporting standards (Sustainability Accounting Standards Board). Additionally, international regulators like the European Parliament have set hard deadlines for standardization by 2022. In the United States, the “Disclosure Simplification Act” is awaiting Senate hearing, and if passed, will force all public companies to disclose their ESG data. As ESG gains new prominence, asset managers and investors must stay informed of the new standards that will be implemented. [8] [9] [10]

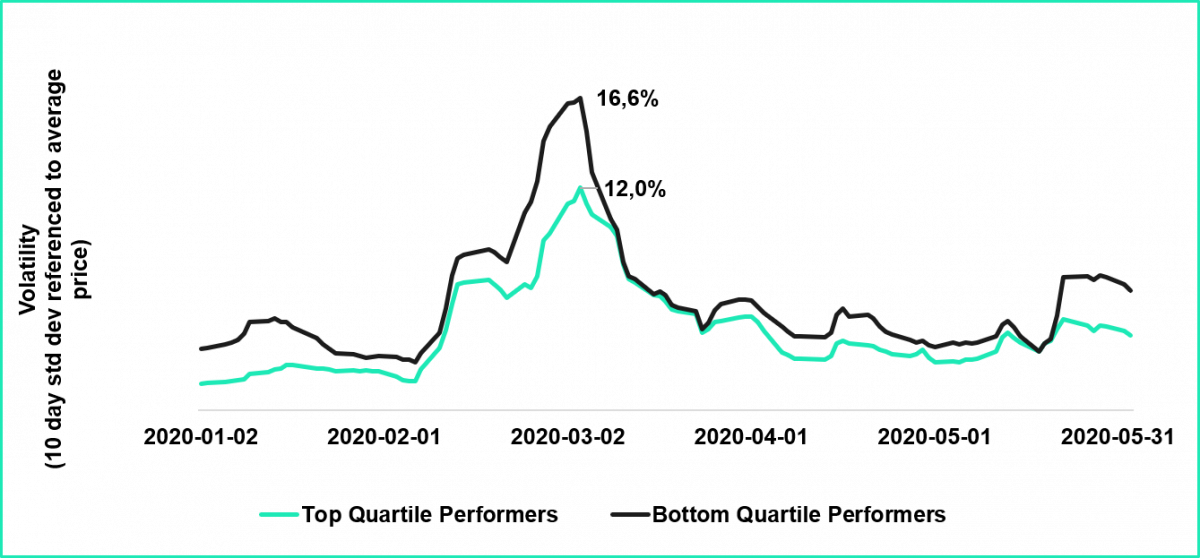

The question of causality between a corporations’ ESG score and their operational resiliency is difficult to answer. Some of the greatest challenges to quantifying this intersection are (A) presently, there is no international standardization of ESG ratings criteria and (B) it is difficult to quantify the operational resiliency of a corporation. In Figure 3, in an analysis of public Sustainalytic ESG scores we saw that top ESG performers had a 4.4% lower 10-day average volatility than the bottom ESG performers during the steepest pandemic sell-off in March 2020. This analysis demonstrates that ESG scores may be another deciding factor for more risk-averse investors. Although this review only touched on the volatility and not the returns, there is a wealth of studies such as the BlackRock report [11] mentioned above that demonstrates a correlation between ESG scores and financial performance. It may be that ESG-focused funds yielded more stable returns during the pandemic because they consist of companies that:

Figure 3 - Volatility of Top/Bottom ESG Performers [12]

The COVID-19 pandemic upended businesses and prompted unprecedented changes to economies and countries across the world. While businesses internationally face these new challenges, this has brought to light the significance of a thorough and prepared operational resilience strategy to maintain business functions through unprecedented crises such as COVID-19. The pandemic has exposed those businesses who were not prepared, and there is evidence that those businesses have suffered both operationally and financially as indicated in their stock performance.

Throughout the stock market’s volatility, it has been shown that ESG mandated portfolios have typically outperformed their non-ESG counterparts through the pandemic. This outperformance provides further evidence of the potential correlation between ESG factors and the pillars within operational resilience.

As part of “Consulting for Good”, Sia Partners carries experience in policies and regulations surrounding ESG and corporate social responsibility. With expertise in risk management, operations, compliance, data analytics, and regulations, Sia Partners can help develop ESG policies for your company to acclimate in this new environment.

Additionally, Sia Partners’ operational resilience solutions serve to help develop, strengthen and evolve your operational resilience program. Working across five critical areas – business continuity, technology disaster recovery, threat / risk Assessment, cyber resilience, and third-party risk – we can support your business in becoming resilient by preparing for, responding to and remediating disruptive events.

John Gustav

Partner

+1(516) 810-8719

John.Gustav@sia-partners.com

Rob Rowland

Managing Director

+1(917) 532-5886

Robert.Rowland@sia-partners.com

Avigail Yerushalmi

Junior Consultant

+1(305) 890-9495

Avigail.Yerushalmi@sia-partners.com

Matthew Fok

Consultant

+1(780) 707-2953

Matthew.Fok@sia-partners.com

[1] Ffiec. “Business Continuity Management.” FFIEC IT Handbook InfoBase

[3]S&P Global Ratings, 20 Apr. 2020

[4] “RepRisk ESG Business Intelligence.” Rep Risk. April 2015

[5] “Thomson Reuters ESG Scores.” Thomson Reuters. May 2018

[6] “Here's How Employers Are Changing Benefits Due to COVID-19.” HRExecutive.com, 12 May 2020

[7] BlackRock

[8] “How does the Coronavirus Global Pandemic Impact the Sustainable Investment Revolution?”. Sia Partners. April 2020.

[9] H.R.4329 – ESG Disclosure Simplification Act of 2019

[10] JUST Companies Exhibit Lower Investment Risk. JUST Capital. May 4, 2017.

[11] “Sustainability - Resilience amid Uncertainty.” BlackRock,

[12] Analysis completed with data from Morningstar / Sustainalytics.