Canadian Hydrogen Observatory: Insights to fuel…

November 28th, 2016 | Hong Kong.

When it comes to innovation in insurance, making sure that it does add value to the business is quite challenging. In health insurance, the story is even trickier as human behavior is somehow erratic, especially in a context of rapid evolution of wearables technology and corresponding usage trends. Sia Partners had the pleasure to chat with Marine Boris, Head of Innovation & Partnerships at AXA China Region, whose team is currently tackling these fascinating challenges.

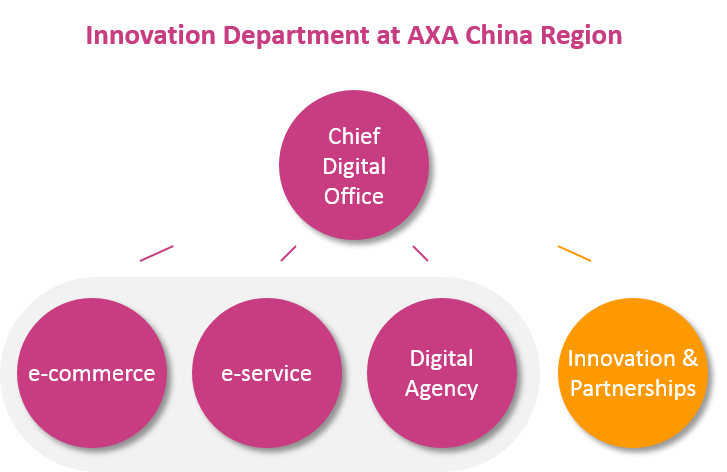

How is the Innovation & Partnership department integrated within AXA and what is your role?

AXA China Region created the Digital Department a year ago to accelerate innovation breakthroughs, by separating it from Marketing and having the Chief Digital Officer, Edouard Zuber, as a member of the Executive Committee. The department counts 4 different teams:

- E-commerce, which KPI is to foster online business;

- E-service, dedicated to loyalty & cross-selling;

- Digital agency, servicing both e-commerce and e-service as a studio, with developers, architects, etc.;

- Innovation & Partnerships, which is my team.

Innovation & Partnerships is like a start-up within the AXA machinery as our role is to take some risks through a test & learn approach. We start from the strategy – being global, regional or local – and cross it with technology and consumption tendencies to identify opportunities. From that point, we build business cases, seek the executive committee approval and start building.

What are your relationships with other AXA innovation bodies?

We are supported by all structures part of AXA’s innovation ecosystem, in different ways:

- AXA has two Innovation Labs, one in San Francisco and one in Shanghai overseeing all of Asia. Their role is to source tendencies relevant to our business at medium and long term, and to source fit for purpose start-ups. We work with them on a weekly basis, in an agile mode.

- AXA also has two Data Innovation Labs, one in Paris and one in Singapore which can support us on a given initiative or a given R&D topic.

- AXA Strategic Ventures is our Private Equity fund and we are free to propose a start-up in which we believe in, should such opportunity arise.

- Finally, we also have an informal brainstorming relationship with Kamet[1].

Before taking up this position, what role(s) did you play within the AXA group?

I am part of a “change makers” pool: my last four positions have been created as new roles. For the latest one, I was in charge of the strategy around youngsters for AXA France, through the program Switch by AXA. The ambition was to rejuvenate the portfolio and my mission was to demonstrate that the company was able to accelerate the acquisition of youngsters and to foster cross-selling as well as retention on this population. The youngsters being a tremendous lab for the digital transformation - they account for less than 10% of the portfolio but for more than 50% of the e-business – I tested lots of things: social media, digital partnerships, mobile apps including after sale service, etc.

I believe that under a test & learn approach, it is paramount to be able to say that something does not work, compared to projections or with regards to the teams’ bandwidth it takes. We dropped some partnerships along the way, which was a good thing, and some others turned out to be very successful.

I believe that under a test & learn approach, it is of paramount importance to be able to say that something does not work.

Do you see any similarities between Asia and Europe regarding innovation, or have you identified challenges specific to the Hong Kong market?

Whatever the market is, there is a need for a minimum of vision. It rarely starts with an idea for innovation. That’s actually the other way around: it starts from a business issue or a strategic objective and the innovation comes to serve this purpose. On both markets I have the same test & learn approach, humble and ROI-oriented. That being said, the risk-taking approaches are fairly different.

What is the latest innovation you are working on?

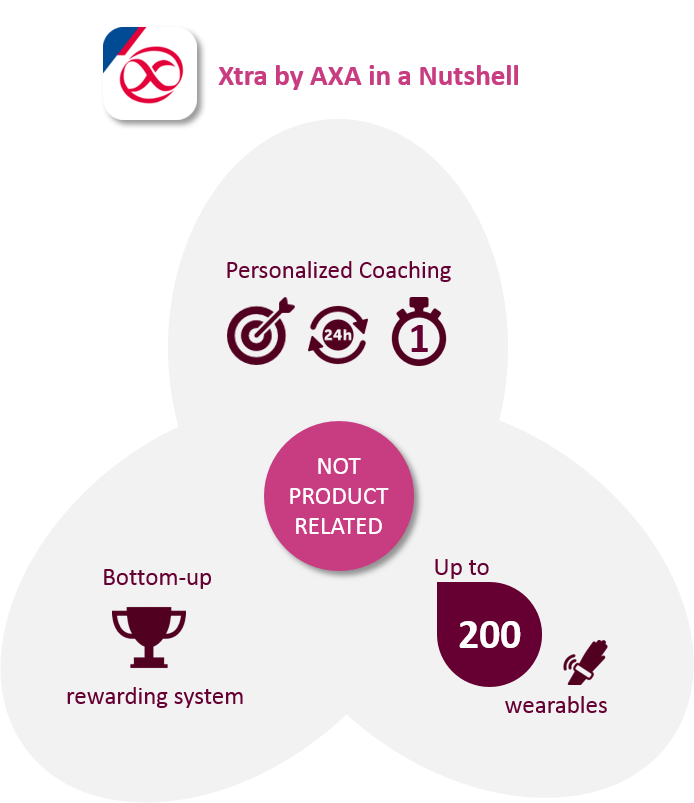

We just released Xtra by AXA, which is a mobile app we offer to every person in Hong Kong and rewarding healthy behavior. It is available in both English and Chinese.

The main differentiators from the market are the following:

- Xtra is not linked to any AXA product;

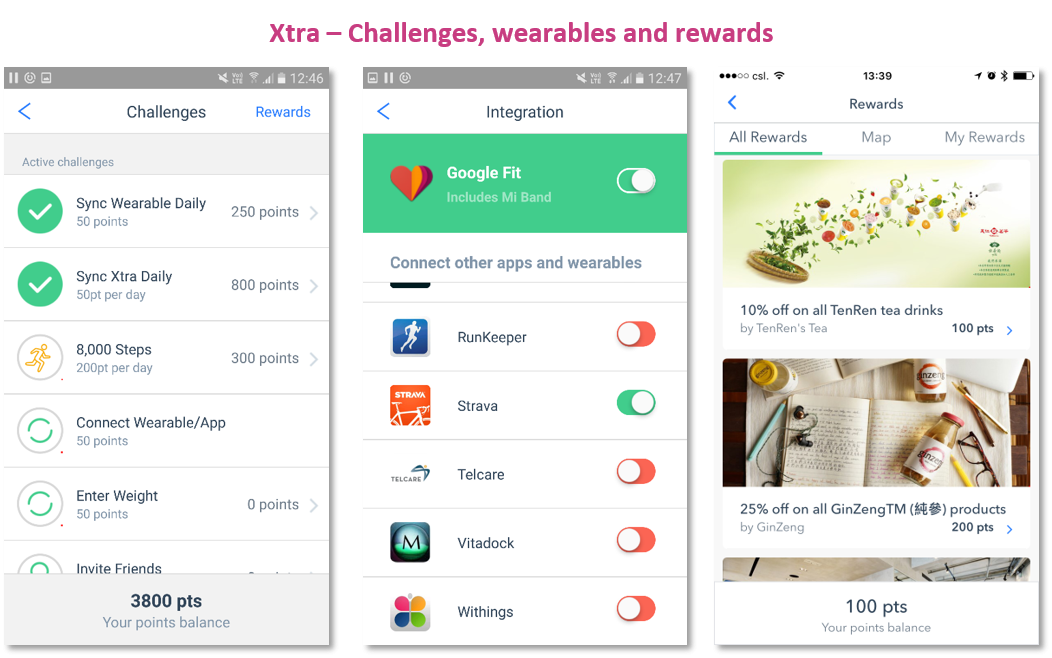

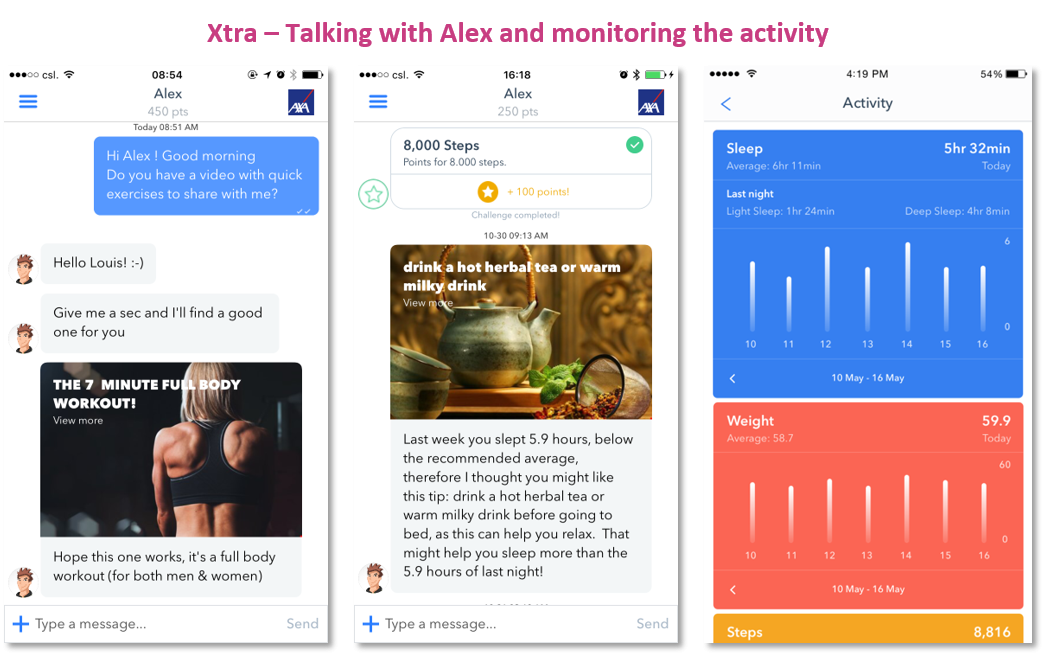

- It is the only app offering personalized coaching, by “Alex” who is a combination of human and artificial intelligence (AI) through machine learning. Via in-app messaging, Alex answers 24 hours a day, within the minute and according to the user’s personal objectives such as losing weight, gaining muscles, tackling back pain, being informed on sports events, etc. Alex is proactive, meaning he also asks questions and make suggestions.

- It can be connected to up to 200 wearables;

- The rewarding program is bottom-up, meaning test & learn based. We started with a limited range of rewards consistent with our DNA which will be refined monthly according to the users’ feedbacks and trends. Xtra rewards the behaviors we encourage: connect data, participate in challenges, invite friends, provide feedback, talk to the coach, etc.

Can you tell us more about the story behind the early stages of Xtra, from the idea to the project launch?

Different drivers explain the genesis:

- When I was setting up the team there was a strong appetite from the health department, which was an opportunity to create buy-in within the business.

- One of the key mottos of Thomas Buberl[2]’s strategy is to keep moving from a payer to a partner, which includes accelerating our prevention role. For health, the direct translation is wellness. Within that context, the strategic questions I have to answer the executive committee are:

How did you drive the innovation process behind Xtra?

Over the first quarter we focused on two tasks:

- Analyzing global, regional and local strategies to identify where we could bring value to our Entity;

- Screening innovation in Asia, with a particular focus on Singapore and Shanghai.

Once the approach was validated by the Executive Committee, we had to define how to roll it out. The Shanghai Innovation Lab, lead by Frank Desvignes put us in contact with StartUpBootcamp[3] where we were pitched by Boundlss[4], which triggered our willingness to include a coaching module.

As per the roll-out, we catch-up on a daily basis. On top of that, we have a comprehensive weekly committee including the start-up, the media agency, the advertising agency, my team and the business. There is no good or bad setup: there is only our capacity of analysis and our prioritization choices, with a start-up still under fund raising which asks us to make legitimate choices. Overall, I found out this adventure to be mainly people-driven, which is very exciting.

How do you intend to leverage Xtra to enhance AXA Hong Kong’s insurance activities?

We can set out three main business objectives:

- Leveraging prevention to reduce claims;

- Fostering retention;

- Accelerating acquisition.

That being said, this is the beginning of big data collection and Usage Based Insurance is of course a model we are looking into.

And finally… what’s next?

Well first of all, defining what Xtra will be in 6 months from now! The pilot phase will last until April, the next steps are under construction in collaboration with the Innovation Lab. Then we’ll have to define how to handover Xtra to a BAU team.

I will also look into accelerating digital partnerships - the other aspect of my team - with LinkedIn, Alibaba, etc.

And of course, I have lots of other ideas!

[1] Kamet is an InsurTech incubator dedicated to conceptualizing, launching and accompanying disruptive products and services for insurance clients. Kamet combines the power of a startup environment with privileged access to AXA capital – with an initial funding of €100m - knowledge and assets.

[2] Thomas Buberl succeeded Henri de Castries as CEO of AXA on 1 September 2016.

[3] One of the biggest accelerators in Asia, based in Singapore.

[4] Boundlss is an Australian start-up based in Australia. Their ambition is to become the preferred partner for insurance companies in Asia when it comes to health. They have offices in Australia, Singapore and Hong Kong.