Canadian Hydrogen Observatory: Insights to fuel…

Fierce competition and low interest rates incite European retail and private banks to look for market innovations in order to acquire new market share and increase margins.

In this context, the "mass affluent" market is becoming a top priority for big players. A potential market of millions of attractive customers can be seen as a banker's dream.

The definition varies a lot from one bank to another and between countries, but 'mass affluent' customers generally refers to individuals who dispose of €50.000 to €1.000.000 in liquid assets (fixed assets such as real estate are not included because of less financial flexibility).

In Belgium, more than 2 million individuals (flat over previous years) can be considered affluent. Of those, 48 thousand fall into the High Net Worth Individual category (more than €1 million in liquid assets). The mass affluent market is thus key for the retail banking industry, for which it represents 25% of Net Banking Income.

Today, mass affluent customers have some common attitudes. These customers are using several banks and have a stronger tendency to not be loyal to one, especially during recent years. Their banking behaviors have changed; they request more information, look for safe savings, show interest in new technologies and digital banking, and are interested in the international dimensions of banking offers.

Mass affluent clients also have common expectations in terms of relationship and products the bank can offer. They expect an available and stable relationship manager and are looking for competitive (safe products/high return) and dedicated products & services.

From a business point of view, the advantages of targeting the mass affluent for universal banks are considerable. Firstly it strengthens the relationship between the client and their bank. It allows the financial institution to secure new assets from these multi-bank customers and progressively equip them with tailored and more profitable products. Secondly, it helps to renew an aged client base with more active young and middle-aged customers. Finally, it creates and prepares a client pool that could one day be eligible for (profitable) in-house private banking.

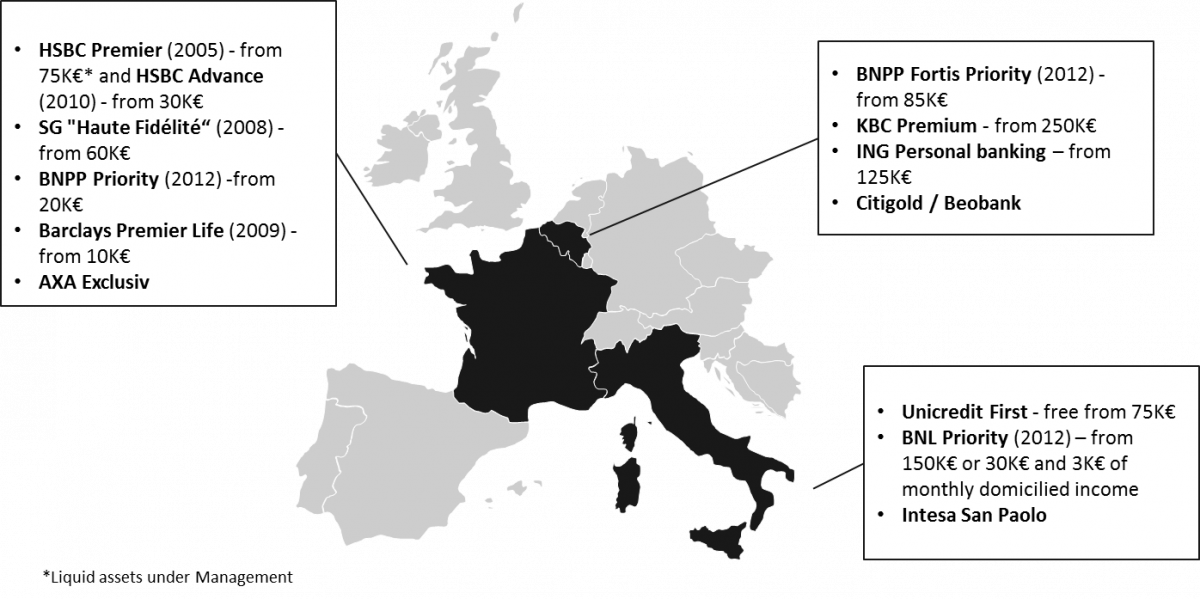

Retail banks have been targeting this segment for some time now. However, it is only during the last couple of years that competitive pressure on these customers became more apparent, with a clear increase in the number of offers developed by European banks.

Retail banks typically adopt two different approaches towards mass affluent customers:

Mass affluent customers need to see the difference in the offer they are presented. Thereby, a dedicated offer must be put in place.

New products and/or services need to be developed; marketing and communication strategy must be adapted and the full potential of multi-channels should also be leveraged in order to provide better access to these customers (e.g. dedicated space in existing branches, generalization of new digital channels).

Three key aspects must be taken into consideration when developing an offer targeting mass affluent customers.

Firstly, a client-centric service model, based on better accessibility and a tailor-made relationship with the relationship manager needs to be put in place. In practice, mass affluents should benefit from direct contact with the Relationship Manager and, outside of office hours, dispose of easy access to a specialized call center. Regular and proactive financial assessments will be proposed and carried out by the relationship manager in order to fit the clients' financial needs at any time.

Secondly, dedicated digital tools have to be developed to facilitate client-oriented processes. Thanks to their ease of use and portability, smartphones and tablets should be employed as specific investment tools.

Finally, a dual offer must be developed: it must be local and global. On one hand, the offer must be adapted to the needs and specificities of the local mass affluent market. For instance:

On the other hand, the offer must respond to the international needs of the mass affluent segment. A few simple initiatives allow continuity in the service level offered to these clients and are greatly appreciated. These include similar or better prices on partner banks' "classic products" (withdrawals, transfers...), specific international products (insurance/assistance), specific cards (premium, loyalty, cashback...), and partnerships with other banks to facilitate potential expatriation (easy account opening / same status).

Competition between big retail banking players will continue to increase in the mass affluent market. Banks will refine their models and criteria in order to proactively detect potential new "mass affluent" customers in their databases and optimize their communications to convince external prospects. But dedicated products and services bringing real value to the mass affluent segment will be the key to retaining existing clients and attracting new ones.