Canadian Hydrogen Observatory: Insights to fuel…

What are the benefits and challenges of Middle Office Outsourcing?

Outsourcing continues to be a trend among asset and wealth managers. Managers see outsourcing as an opportunity to achieve a streamlined and robust operational infrastructure that supports the current and future needs of their business – often with lower overhead. While large managers have the resources, scale, and vendor partners to take on large scale outsourcing initiatives, for mid-sized managers, the path is often less clear. For these managers, full outsourcing solutions may be unnecessary and cost prohibitive. However, boutique asset managers still would benefit from outsourcing of particularly resource intensive or risky areas of their operations. In this paper, we will discuss important industry trends in middle office outsourcing and the key considerations mid-sized asset managers when navigating this process.

Traditionally, outsourcing meant a full lift out of an entire back and middle office. However, full outsourcing models can be impractical for smaller asset managers. It can be difficult to find outsourcing partners when looking to selectively outsource individual functions. Selective or functional outsourcing often doesn’t fit the operational model for institutional outsourcers and the lack of scale can make any outsourcing option expensive.

To fill this void, FinTech companies have begun to add managed service offerings to their typical SaaS model. In this model, the vendor assigns a team to service the function supported by their application. Often, the client retains critical supervisory functions while outsourcing the operation and maintenance of the application. Take, for example, a client reporting function that is supported with a managed service offering of this type. The application vendor would be responsible for resourcing the team, managing the workflow, generating and distributing the reports, and resolving issues. The firm would retain final review. In this model, the firm retains control of the process while reducing the overhead associated with running the function in house.

When considering outsourcing, firms categorize their activities between their core competencies that differentiate them from their competition and the processes that are simply required to support the business. Historically, this leads to a focus on the middle and back offices as the target for outsourcing. Recently, firms have begun to apply this rubric to the front office.

Functions like trade execution and hedging are prime targets for outsourcing. Many managers value their security selection and allocation abilities over their ability to execute trades making a case for outsourcing. Outsourcing vendors who have middle office capabilities often can take on trade execution duties. This can flip the economics of the outsourcing for smaller firms by allowing them to outsource the entire trading life-cycle and thus achieving the necessary scale to outsource.

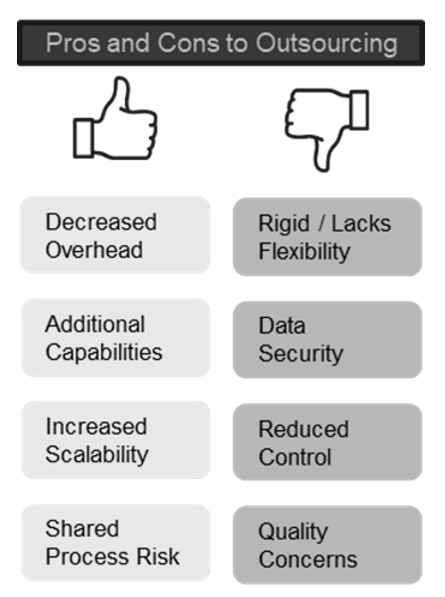

While the main driver of outsourcing continues to be cost, there are other benefits to outsourcing beyond the bottom line.

Outsourcing vendors capabilities are typically broader and more robust than in house functions. The vendor must continuously improve their service and capabilities to retain and win new business over their competitors. This will not only have a positive impact on the firm, but a clear benefit to the client’s experience as well.

Management’s focus and attention is not infinite and there is a hidden cost to keeping support functions in house. Beyond the direct salary and overhead costs, there is the time spent dealing with resource turnover, system upgrades, audits and other activities that take the focus of management away from the core competencies of the firm.

When choosing whether to outsource, what type of outsourcing model is optimal, and which provider to partner with, there are several important factors for mid-sized asset managers to consider.

It is important to objectively evaluate whether the company has clean and easily transmittable data. Providing clean data to the outsource provider will eliminate various issues with the outsourcing process from implementation to operation. The time and effort a vendor spends identifying data quality issues and waiting for new data is inefficient and makes it difficult to extract the value firms normally experience with outsourcing. To start, one should assess whether their firm’s core operational issues are data-related. If that is the case, it’s worth addressing that issue prior, as outsourcing will not solve it, but rather magnify it.

When considering outsourcing, one should also consider the strategic roadmap of the firm. Is there a plan to expand to new asset classes or investment offerings? What is the expectation for growth? These questions should drive your vendor search and can be used as a filtering criterion. If this isn’t considered prior to outsourcing, one might find themselves in a situation where within a few years, they either need to change providers, or even take the function back in house.

Sia Partners is uniquely positioned to help mid-sized asset and wealth managers navigate the consideration of outsourcing. Sia Partners has extensive experience with all phases of the outsourcing process. With these capabilities, Sia Partners can support an outsourcing initiative from beginning to end; starting with assessment and vendor selection and all the way through to implementation. By having a single team service the client for the duration of the project, timelines shrink and better outcomes are achieved.