Canadian Hydrogen Observatory: Insights to fuel…

To better understand the dramatic shifts in the way financial institutions interact with their clients, Sia Partners conducted a detailed survey of its employees covering key mobile app features across banking, digital payments, and brokerage services, leading to key findings across the industry.

The world has seen an unprecedented acceleration in the decline of brick-and-mortar banks and the use of paper currency having been replaced by banking and payment apps. Additionally, brokerage apps have changed the way firms operate in the retail trading space. To better understand these dramatic shifts in the way financial institutions interact with their clients, Sia Partners conducted a detailed survey of its employees covering key mobile app features across banking, digital payments, and brokerage services (collectively “finance apps”).

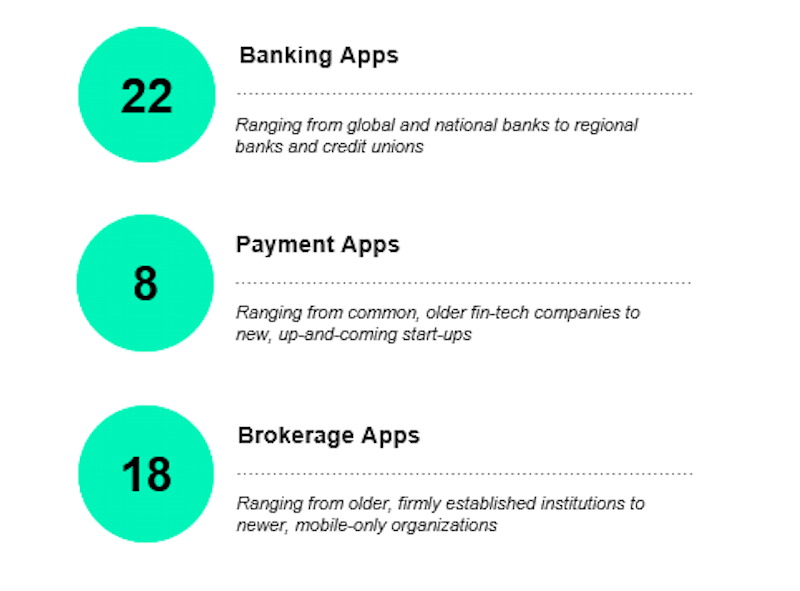

Extensive data was received on 22 banks, 8 payment service applications, and 18 brokerage applications. We have identified 20 key themes of which a few are shared in this paper.

As is true with any mobile application, the user experience functionality is key to the app’s success and growth. Mobile finance applications have gone through an immense amount of transformation in the past years to continue to improve how they function to make the user experience as seamless as possible. Our survey results support this claim, as the four areas associated with user experience (simplicity, navigation, design, and feel) scored the highest among all finance apps surveyed, and the top 5 responses to individual questions all resided under these categories as well. This is unsurprising since the COVID-19 pandemic accelerated use of mobile banking applications, with over 80% of customer’s interactions with their banks taking place via their mobile app[1].

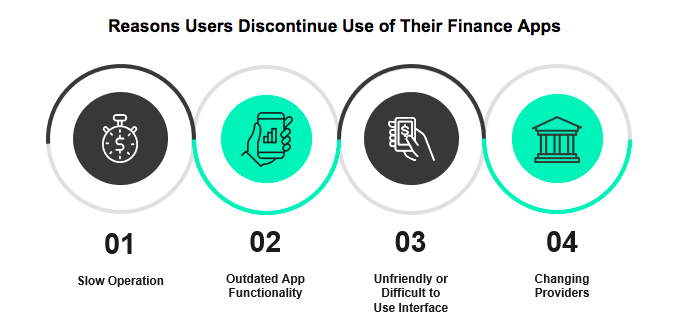

A comprehensive review of the user experience is essential to acquire and retain customers. Based on the results of our survey, the key factors that would encourage a customer to discontinue the use of a finance application would be: slow operation, outdated app functionality, an unfriendly or difficult to use interface and the need to change providers. Therefore, simplicity, look, design and feel of the app is imperative to its success. Mobile applications have also kept pace with advances in technology by offering fingerprint or facial recognition to log-in; this functionality has been shown to be present in both large banks, smaller regional banks and newer fin-tech firms.

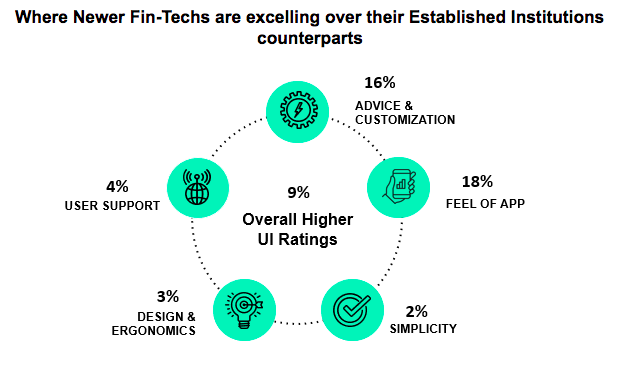

When working with extensive processes, such as opening an account, it is essential to have these as simple as possible. Our data indicates that larger national banks are ahead of their regional or credit union competitors in this area. However, newer fin-techs on average scored 9% higher in the overall user experience category, indicating that established institutions have work to do in re-invigorating their app to compete in this constantly changing environment.

One can argue that one’s financial information is the most private and important information that can be exposed to the outside world. Banks would be wise to improve their security alerts, including indications of potential fraud to protect their customers from the dangers of cyber-crime. In 2017 alone, over $500mm was lost to fraud involving payment applications[2]. Fraud and other crimes are not just limited to smaller fin-techs, as large banks also are targets for hacking.

Our survey results indicate that while some applications are doing well at securing their customer’s data and alerting them of potential fraud, others are not. The scoring for this area ranked in the bottom half of our responses, indicating there is still room for improvement. An example of the most pervasive of security breaches is identity theft, which has been exacerbated with the shift towards mobile banking and the majority of our respondents did not feel protected towards identity theft or have previously been victims of identity theft.

While the growth of the mobile finance app market is trending upwards, it is critical to understand to what capacity institutions are managing their security measures to keep up with growth. Building out systems that sufficiently provide the first line of defense against nefarious actors, in a continuously growing market of users, will prove instrumental to the success of institutions and the safety of their customers. Further growth in this space cannot be sustainable if customer’s valuable information can be compromised by hackers at any time. Newer fin-techs and older institutions, alike, have an immense responsibility to address these weaknesses and provide customers more peace-of-mind that their activity and data is safe.

Our survey results present opportunities to improve applications across a multitude of functional areas, one area is in drastic need of transformation. Banking and payment applications both scored the lowest in providing advice and customization to one’s investments. This may not be surprising for payment applications as these services have not been fully implemented, however, most banking applications offer the ability to invest directly through their retail app.

The results clearly indicate that the personalization feature within these applications is either not available or does not assist the investor with helpful insights. While one may assume that this functionality is only needed for brokerage applications, as banks increasingly expand their services, being able to offer their customers a seamless and customizable solution to their investments could be a differentiating factor between gaining a customer and losing one. Our data shows that participants want access to information and tools to do their own research along with educational materials to improve their own financial literacy.

Beyond investment advice, specific tips on spending, budgets, and market information are not at the level that consumers are looking for. The U.S. is far behind its European counterparts in their ability to stay ahead of customer demands and trends. Banks in various countries are implementing measures to track their user’s spending to help customize their advice. AI and machine learning is also being implemented across a variety of institution’s to help predict their customer’s behavior to personalize deals, offers and more.

Where do newer fin-techs compare to their established institution counterparts? On average, they scored 16% better regarding advice and customization proving that they are on the right track in identifying customer’s needs and assisting them become more financially literate. Nonetheless, both small and large finance apps have large improvement opportunities to assess the current digital environment and better compete with their European counterparts to retain customers and continually add value.

While overall functionality of banking and payment applications are not meant to utilize any investments, over 50% of our respondents indicated that they would like to see their banking application adapt functionality of their payment or brokerage application. This could be a major opportunity for banks to revitalize their apps as the investment category was 2nd to last out of all categories surveyed against. Unsurprisingly, brokerage applications scored higher than banking and payment applications, but which one’s reign supreme in the investment space?

The year 2020 saw a drastic increase in individual investors entering the market, making up an estimated 19.5% of the U.S. equity trading volume, up 4% from 2019[3]. This aligns with our findings as 63% of our respondents began using their brokerage apps within the last year. While this may indicate that newer fin-techs, such as Robinhood, would be the most favorable, our data shows mixed results as on average, established brokerage institutions averaged higher overall scores in the investment space. This can mainly be attributed to the additional variety that these institutions can offer their clients, such as ease of FOREX trading, futures, options and certificates of deposit.

Newer fin-tech brokerages did surpass older institutions in one key, transformational area: cryptocurrency. Our data showed strong correlation between newer fin-techs and their ability to trade cryptocurrency vs. the established institutions also surveyed. With 93% of cryptocurrency holders interested in using these investments for purchases, an immense opportunity arises for banks and payment applications to engage in partnerships to facilitate these transactions4. Some companies have already taken advantage of the boom, such as Square, Venmo and PayPal, which have begun allowing their users to trade in cryptocurrency. As regulations continue to evolve, expect more firms and banks to engage in the world of cryptocurrency.

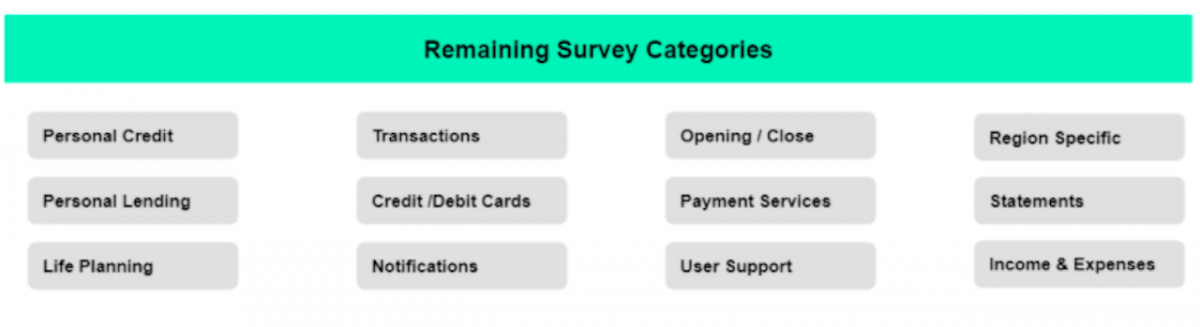

Our expansive survey covered a wide range of additional topics and categories, allowing our analysis to cover a wide range of themes. There are more opportunities for improvement in the finance app space besides the several themes already covered. The Sia Partners team is ready to present additional themes and data points to prospective companies looking to revitalize their finance apps and better compete in the digital world.

While there is fierce competition heating up between banking, brokerage firms and newer fin-techs, one would be smart to consider the likes of large tech companies such as Google, Amazon, Facebook and Apple to emerge in this market as well. As wallet capabilities expand, the addition of several key API’s could lead to an even greater usage of banking via your smartphone’s wallet. While beneficial for the customer, this may also limit the bank’s ability to customize and specifically target areas of the banking experience to their customers.

As these institutions continue to revolutionize the banking industry, the key for banks, brokerages and fin-techs is to provide an all-in-one solution. As previously mentioned, over 50% of our participants indicated that they would want their banking application to adapt the functionality of their payment and brokerage applications. Some applications are already ahead of the pack, such as Square and South Korea based, Toss, which are steadily advancing their banking services compared to their competitors.

Sia Partners has a full team of experts who specialize in the financial services industry. Our dedicated group of professionals, combined with our various data science & AI capabilities can help your institution revolutionize your mobile application and help you compete in an increasingly digital world. Whatever your need may be, Sia Partners can fulfill it. In addition to our immense team of consultants, we also have a full team that can create and transform your API’s, marketing, and more.

Sia Partners has collected and analyzed hundreds of data points with critical information on the industry as a whole and regarding specific institutions. If you would like to learn more about the survey, results or to see how your firm performed compared to your competitors, please reach out using the contact our experts form below.