Gen AI for Investment Management Research

The U.S., cryptocurrency entities are Money Transmitters, which are a category of Money Services Businesses (MSBs). This paper addresses regulatory requirements for cryptocurrency MSBs, covered by the Financial Crimes Enforcement Network (FinCEN) and state-level agencies.

In addition to being a year of historic volatility and economic disruptions, 2020 accelerated developments of various trends and emerging technologies, including cryptocurrencies.

Recent developments have shifted virtual currency technology from a disruptive trend to a mainstream idea, signaling a promising outlook for cryptocurrencies. Since their origination, virtual currencies have attracted much attention from the investing public, traditional financial institutions, and has challenged regulators with maintaining stability.

Following the explosive rise of their price and popularity, cryptocurrencies have come under increased scrutiny from governments and regulatory bodies. Within the U.S. Federal government, the focus has been at the administrative and agency level including:

Each regulator has its own stance on the regulation of cryptocurrency, or on the contrary, deregulation. Additionally, the different classifications of cryptocurrency by the regulators often makes it confusing. The SEC oversees digital assets that are considered securities; the CFTC treats virtual currency as a commodity, while the IRS treats it as property. This paper will do a deep dive into Anti-Money Laundering/Bank Secrecy Act (AML/BSA) and state licensing requirements for cryptocurrency entities.

FinCEN is the United States’ primary AML and Counter-Financing of Terrorism (CFT) regulator. FinCEN exercises its regulatory functions primarily under the BSA, and regulates MSBs.

The term MSB includes any person doing business, whether or not on a regular basis or as an organized business concern, in one or more of the following capacities:

On March 16, 2013, in response to questions and gray areas as to what constitutes MSBs, and in particular Money Transmitters, FinCEN issued Guidance FIN-2013-G001 – Application of FinCEN’s Regulations to Persons Administering, Exchanging or Using Virtual Currencies. In this guidance, FinCEN declared that virtual currencies are the same as traditional currencies. MSBs that deal with Convertible Virtual Currency (CVC) are defined as Money Transmitters and must register with FinCEN as well as comply with all relevant AML/CFT regulations. FinCEN also defined CVC as an unregulated virtual currency that has the ability to act as a replacement for real and legal currency. It has an equivalent value in fiat currency and can be exchanged for real money.

Each company mentioned earlier - PayPal, Google, Facebook and Coinbase – is considered a Money Transmitter, and must be in full compliance with the rules outlined below. This process can be demanding for cryptocurrency entities, both financially and operationally. The following are the major requirements with which MSBs, including Money Transmitters, must comply with under FinCEN in order to operate in the U.S.

The first step is to register with FinCEN as an MSB. This is accomplished by filing a “FinCEN Registration of Money Services Business” form through FinCEN’s BSA E-Filing System, and renewing the registration every two years.

FinCEN requires MSBs to develop, implement and maintain an effective AML Compliance Program that is reasonably designed to prevent entities from being used to facilitate money laundering and the financing of terrorist activities. At a minimum, this program must:

An MSB is obligated to report any activities of customers over $2,000 in value that it believes or knows to be suspicious. A transaction is considered “suspicious” if it:

Additionally, an MSB must monitor that its customers are not on, or do not conduct transactions with entities and individuals on, the Specially Designated Nationals and Blocked Persons List maintained by the U.S. Department of the Treasury’s Office of Foreign Assets Control (OFAC).

To operate as a Money Transmitter, an MSB must apply for a Money Transmitter License (MTL) for each state in which it intends to do business. While regulations at the Federal level are primarily designed to ensure financial security and prevent money laundering, the money transmission licensing at the state-level is directed towards protecting consumers, and ensuring safety, soundness, and solvency of the applicants.

There is no one-size-fits-all license to operate across the country. States have different approaches for defining and regulating virtual currencies. There is a lack of consistency among the state requirements for licensing, as well as their definition of “money” and whether it includes virtual currencies. Therefore, cryptocurrency entities might face a potentially expensive, and time-consuming, licensing process if they wish to operate across multiple states.

During the licensing process, most states require Money Transmitters to upload their state license application and additional documents to the centralized government website - the Nationwide Multistate Licensing System (NMLS). Despite great variance among states, minimum requirements for a licensing application generally require the following:

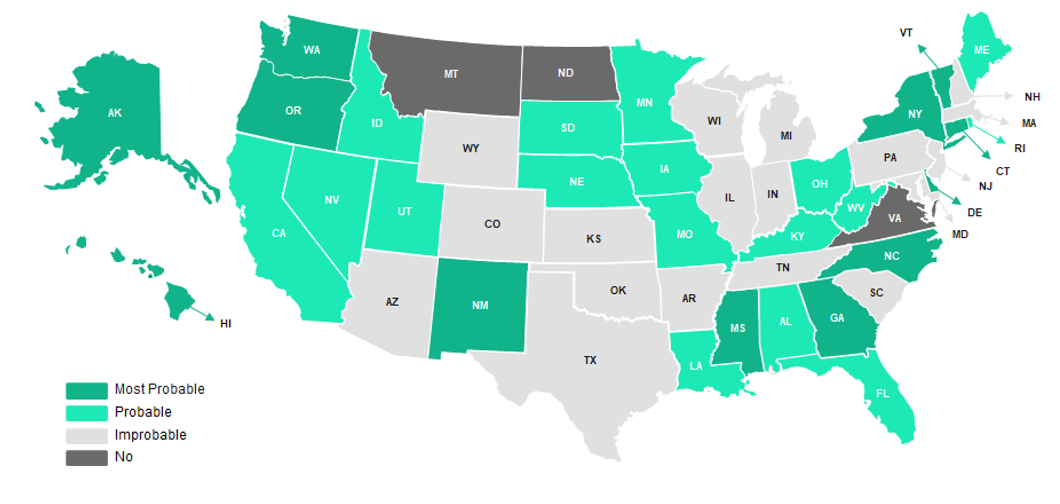

As of December 31, 2020, the heat map below shows the likelihood of cryptocurrency only entities being required to obtain Money Transmitter Licenses in each state.

States that Require Money Transmitter License for Cryptocurrency Entities

Although a few states are pro-virtual currency, most are neutral towards the industry, or have adopted strict regulatory requirements. In some cases, states are unclear as to their positions on virtual currencies, and whether they require an MTL. Below are examples of states from each category, to further demonstrate the differences among the classifications. The full list of states can be found in the Appendix (available to download at the end of this article).

| State | Regulatory Requirements |

|---|---|

| Oregon | Oregon law requires virtual currency businesses to obtain an MTL from the Oregon Division of Financial Regulation. Oregon consumers research these businesses on the state website to determine whether they have complied with Oregon law. Under the Oregon Money Transmitter Act, ORS chapter 717, those who are selling or issuing virtual currencies or engaged in the business of operating virtual currency exchange within the U.S. or to locations abroad by payment instrument, wire, facsimile, electronic transfer, or any other means, are required to obtain a money transmitter license. |

| Vermont | As of May 4, 2017, the term “virtual currency” was explicitly included in the definition of “stored value”, which is included in the definition of “money transmission”. Additionally, per the NMLS website, activities authorized under Vermont’s MTL explicitly include “issuing” and “selling” prepaid access in virtual currencies. |

| Connecticut | According to the state’s Department of Banking, “virtual currency” is defined as any type of digital unit that is used as a medium of exchange or a form of digitally stored value or that is incorporated into payment system technology. Depending on the firm’s activities, Connecticut General Statutes treats virtual currency similarly to fiat currency under the state’s money transmission scheme. |

It is probable that cryptocurrency businesses will be required to obtain their MTLs from the states of Florida and Kentucky.

| State | Regulatory Requirements |

|---|---|

| Florida | Florida's Money Transmitter Act does not specifically include the concepts of "virtual currencies" or "monetary value". Further, the State's Office of Financial Regulation has not given direct guidance as to the applicability of the Act on virtual currency users and issuers; but has suggested that persons who offer cryptocurrency "wallets", buy or sell cryptocurrencies, or exchange cryptocurrency for fiat are not necessarily outside the scope of the activity subject to the State's Money Transmitter Act. |

| Kentucky | Kentucky has not yet taken a position on virtual currency money transmission in connection with the Kentucky Money Transmitter Act (KRS § 286.11-001). The money transmission definition, however, includes the concept of “monetary value”, which is defined as “medium of exchange, whether or not redeemable in money”. |

It is improbable that cryptocurrency businesses will be required to obtain their MTLs from the states of Pennsylvania and Illinois.

| State | Regulatory Requirements |

|---|---|

| Pennsylvania | The state’s Department of Banking and Securities’ (DoBS) guidance from January 2019, defines “money” as limited to fiat currency. Virtual currency exchange platforms, Kiosks, ATMs, and Vending Machines are not considered “money transmitters”. |

| Illinois | Under the Transmitters of Money Act (TOMA), “money” is defined as a medium of exchange that is authorized or adopted by a domestic or foreign government as a part of its currency and that is customarily used and accepted as a medium of exchange in the country of issuance. Therefore, a person or entity engaged solely in the transmission of virtual currencies would not be required to obtain a license. Exchange of virtual currency for money does not qualify as money transmission. |

Crypto entities are not required to obtain MTLs from Montana.

| State | Regulatory Requirements |

|---|---|

| Montana | Montana is the only state that currently does not regulate or license the transmission of money, for both virtual and fiat currencies. |

Alternatively, the New York State Department of Financial Services (NYSDFS), requires a BitLicense, as well as a Money Transmitter License, for companies engaging in “Virtual Currency Business Activities”. This practice is known to be one of the most rigorous licensing procedures in the country. In August 2020, Louisiana became the second state, after New York, to adopt a licensing regime specific for virtual currency businesses, requiring licensure of businesses conducting virtual currency transactions in Louisiana (also known as the Virtual Currency Business Act).

Wyoming stands out as the most cryptocurrency-friendly state in the U.S. In the past two years, the state has passed a total of 13 laws enabling and promoting virtual currencies, making the state a champion in providing crypto businesses with a clear and transparent regulatory environment.

In most cases, cryptocurrency entities must contact state agencies in the jurisdictions in which they wish to operate, in order to fully understand state licensing procedures and overall compliance needs. The Appendix (available to download at the end of this article) illustrates the requirements for MTLs in each state and Washington D.C., as of December 31, 2020.

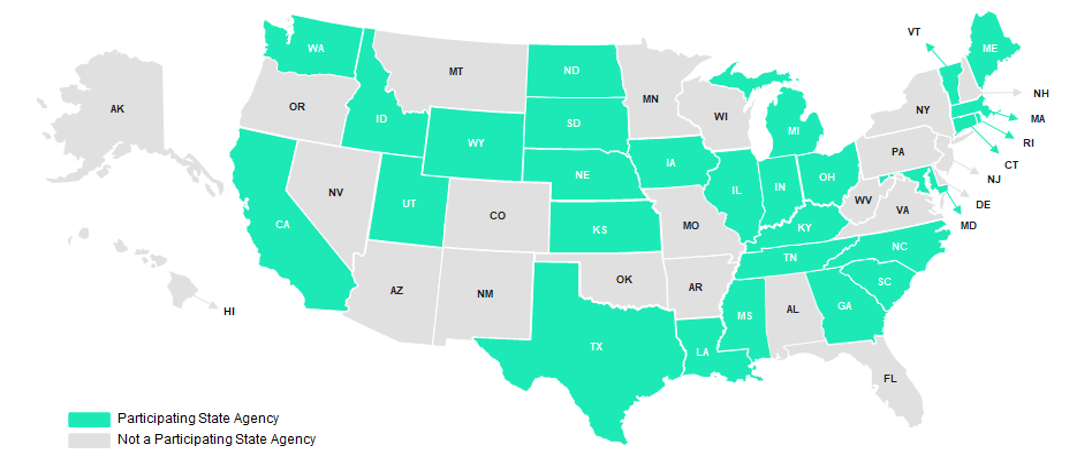

The MMLA Program [6] is a regulatory initiative aimed at simplifying, improving and accelerating the state MSB licensing process.

This program only applies to MSBs seeking to apply for 5 or more state licenses over the next 12 months, and which can be accessed through the NMLS.

Prospective multistate applicants interested in applying through the MMLA Program must submit their “Intake Form” to the Washington Department of Financial Institutions, which currently serves as the lead state for the MMLA Program.

The MMLA Program consists of two phases:

MMLA Program Participation

Upon the registration of a cryptocurrency entity with FinCEN, and obtaining licenses in all states in which it operates, it is equally crucial that the entity routinely monitors requirements to ensure that compliance is maintained on both the Federal and state-levels. This is a rigorous commitment because state regulations can rapidly change, often without consultation or a timely warning. As a result, cryptocurrency companies must constantly monitor changes in regulations, including reviewing the FinCEN website as well as NMLS and other state-specific reporting portals.

U.S. financial institutions are required to stay up to date with all Federal and state rules and regulations, and non-compliance can result in significant consequences.

18 U.S.C. § 1960 prohibits the operation of an unlicensed money transmitting business and provides that a five-year prison sentence can attach to any such violation. A violation can occur if the MSB fails to register with FinCEN, or operates in a state without the appropriate Money Transmitter License.

Most recently, in October 2020, FinCEN issued a $60 million civil money penalty for Larry Dean Harmon, the founder and operator of Helix and Coin Ninja, which are companies serving as “mixers” or “tumblers” for cryptocurrencies. These companies were not registered as an MSB, did not implement or maintain an effective AML program, and failed to show any suspicious activity reporting.

In light of the serious legal and financial consequences of non-compliance with FinCEN, and individual state regulations, it is critical businesses complete the required steps for Money Transmitter registration and cryptocurrency licensing accurately, efficiently and on a timely basis.

With our extensive abilities in compliance including former U.S. regulators on staff, Sia Partners is ready to assist you with your FinCEN and individual state registrations, and help manage all your compliance needs as a cryptocurrency entity. Sia Partners remains current on all state licensing processes and requirements applicable to cryptocurrency businesses, to provide you with the best MTL strategy and compliance solutions aligned with your business plans.

[1] “PayPal Launches New Service Enabling Users to Buy, Hold and Sell Cryptocurrency.” PayPal Newsroom, Oct. 2020,

[2] “Coinbase Card Comes to Google Pay.” Finextra, 17 Mar. 2020

[3] “Rise of the central bank digital currencies: drivers, approaches and technologies” Bank for International Settlements, Aug. 2020

[4] “Bitcoin Powers Through $30K. Will It Last?” Forbes, Forbes Magazine, 4 Jan. 2021

[5] Multistate MSB Licensing Agreement Program

[6] As of January 20, 2021, MMLA Phase One states include: Connecticut, Georgia, Kansas, Maryland, North Carolina, North Dakota, Tennessee, Texas, Vermont, Washington, and Wyoming.

[7] As of January 20, 2021, MMLA Phase Two states include: California, Idaho, Illinois, Indiana, Iowa, Kentucky, Louisiana, Maine, Massachusetts, Michigan, Mississippi, Nebraska, Ohio, Rhode Island, South Carolina, South Dakota, Tennessee, and Utah.