Agentforce, the GenAI Agent by Salesforce

Preceded by a long period of negotiations, the Interchange Fees Regulation entered into force on the 8th of June 2015 and will start resorting important effects as of December 2015.

Preceded by a long period of negotiations, the Interchange Fees Regulation entered into force on the 8th of June 2015 and will start resorting important effects as of December 2015. The regulation is bound to have a considerable impact on the card based payment industry in Europe. Regardless of the common European market, large differences exist between Member States as to the costs of both national and EU cross border card based transactions, caused by interchange fees. These costs are currently estimated to amount up to 9bn euro. The regulation’s goal is to lower costs for both retailers and consumers and to create a level playing field in the EU for payment service providers intensifying competition and innovation in the sector

The European Union's (EU) internal market aims to guarantee the free movement of goods, capital, services, and people within its member states. The internal market is intended to increase competition, specialization, economies of scale and an efficient allocation of resources driving economic integration. In the area of the freedom of capital many steps have been taken to spur integration such as the creation of a European currency (€) and the Single European Payment Area (SEPA). SEPA aims to improve the efficiency of cross-border payments and to turn the fragmented national markets for euro payments into a single domestic market. Customers will be able to make cashless euro payments to anyone located anywhere in the area, using a single bank account and a single set of payment instruments.

As a result, the use of cash for payments in the EU is dropping year on year to the benefit of non-cash payment instruments of which the number of transactions has grown up to 100bn euro in 2013 (+6%, 2012 – 2013). A remarkable growth can be seen in credit transfers and direct debits (respectively 27% and 24% of non-cash transactions). However the strongest growth over the past decade can be attributed to card payments which number has tripled from 2000 to 2013; representing 2.2tr euro in 2013 (44% of the non-cash transactions). Visa and MasterCard are the dominant players in the card business with a market share of over 95% of total transaction value.

Use of non-cash payment instruments

(Source: ECB)

In line with the growth in use we see a large proliferation of card based payment instruments. The total number of card based payment instruments amounted up to 760m in 2013, which corresponds to c. 1.5 payment cards per inhabitant.

There are however large differences between the Member States in the adoption of cards as a payment instrument, e.g.:

Moreover, large differences also exist between Member States as to the costs related to the use of cards, which vary between 0,3% and 1,8% depending on the country.

Card use and adoption in some EU countries

(Source : Sia Partners)

The new regulation on interchange fees will introduce a cap of 0,2% for debit card transactions and 0,3% for credit card transactions, creating an important cost saving potential in almost all EU Member States.

Prior to going in more detail we will first explain the payment eco system.

The most common type of card scheme is the so-called 'four-party' scheme, see figure below. This scheme handles more than 95% of total card based transaction value. In the four-party scheme, the consumer pays the merchant the sum due for its purchase. The merchant in turn submits the card transaction data for authorization via the Payment scheme to the consumers’ Issuing bank. The Issuing bank approves or denies the transaction and in the first case transfers the money to the Acquiring bank via the Payment scheme, after deduction of the Interchange fee attributed by the Card company. The level of the Interchange fee is generally determined in a multilateral agreement between the Card company and different banks, hence the name ‘Multilateral Interchange Fee’ (MIF). The Acquiring bank subsequently pays the remainder of the value to the merchant after deduction of an Acquiring fee (smaller than the Interchange fee). Lastly, the Issuing bank and the Acquiring bank both pay a Network fee to the Payment scheme / Card company. The sum of the Interchange fee, Acquiring fee and Network fee is called the Merchant Service Charge (MSC).

(Source : Sia Partners)

The regulation applies to all card-based payment transactions between merchants (both offline and e-commerce) and consumers, whose Payment Service Providers (PSPs) are based in the EU.

There is a small number of cases to which the regulation does not apply, however they only represent 5% of the total transaction value.

The general rule caps interchange fees for both cross-border and domestic card based transactions to a maximum percentage of the transaction value, being 0.2% for debit purchases and 0.3% for credit purchases. The regulation has defined some exceptions to this rule for domestic debit card based transactions that allow Member states to adopt minor changes to the general rule. Their impact is expected to be low and temporary.

The regulation also stipulates a set of provisions that prohibit market and transparency reducing business rules, upheld by the payment industry.

The regulation prohibits licensing rules that limit the possibilities of merchants to acquire the services of PSPs in another Member State, e.g. where they are cheaper or better.

It also forbids the ‘Honor-all-cards-rule’ that obliges Merchant to accept all card-based payment instruments issued by the issuer, and as a result Merchants will be able to differentiate. However the merchant cannot refuse card based payment instruments of the same type when they have the same costs to the merchant, when they are of another bank or another Member State

Another important breakthrough is that business rules that reduce the possibilities of merchants to steer consumers towards the use of more efficient / cheaper card based payment instruments and to inform them of the costs related to the use of the different card based payment instruments will henceforth be prohibited.

In order to improve transparency, the regulation determines that merchants must receive a detailed transcription of their spend on MIFs, individually specified for different categories and different brands of payment cards with different interchange fee levels (unless payees request, in writing, to charge blended merchant service charges).

Taking innovation of the payment industry at heart, the regulation prescribes that the payment card scheme and processing entities must be separated. This will decrease their market power and increase possibilities for new players to enter into one of both businesses whilst making use of the services of other parties in the other.

The Interchange Fees Regulation has been voted in April and entered into force as of the 8th of June 2015. From that date Merchants are allowed to steer customers towards their payment instrument of choice, respecting the previously mentioned conditions. As of the 9th of December 2015 the caps-regime will apply to the MIFs and as of the 9th of June 2016 most business and transparency improving stipulations will start resorting effect.

The interchange fee cap is expected to enter into force as of end 2015, the business rules as of mid 2016

(Source : Sia Partners)

The regulation is binding, any kind of circumvention through measures bearing the same effect is not allowed. The regulation however does not affect all stakeholders directly. The extent to which the different stakeholders will be impacted directly or indirectly will be discussed hereunder.

Retailers will need to take action in order to reap the full benefits:

Other areas of impact:

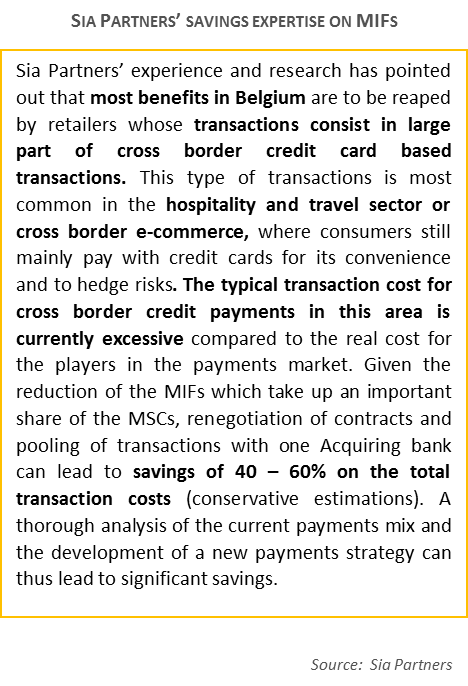

It is crucial that retailers, both offline and in e-commerce optimise their payment processes and contracts to take full advantage of the opportunities offered by the new Interchange fees regulation.

In order to ensure that the consumer benefits from the new regulation, the legislator has foreseen that:

The new EU Interchange Fees Regulation aims to bring about large changes in the European cross border and domestic card based payments market. Only retailers who grasp the opportunity to optimise their card based payment system and renegotiate their contracts will be able to reduce their cost base significantly. Retailers in expensive countries should focus with priority on domestic payments, while retailers in the less expensive countries should focus more on the cross border and credit card based transactions, on which savings of c. 50% are estimated to be achievable. To reach this goal the regulation foresees a number of provisions that lower and harmonise the costs for both domestic and cross-border transactions, improve transparency and increase competition between different service providers in the industry across Member States, leading to more innovative payment solutions.