Canadian Hydrogen Observatory: Insights to fuel…

The current climate of increased uncertainty and volatility is pressing the case to take a fresh look at planning, budgeting and forecasting.

The Finance function has always aspired to move beyond the scorekeeper role, fastidiously recording and reporting performance, to become the true strategic partner to the whole

organisation, playing a key role in mitigating risks, driving strategy, and adding value.

Since the turn of the century ever increasing turmoil in geopolitics and ‘black swan’ events such as the financial crisis and the recent pandemic have forced this aspiration into the realms of necessity as organisations grapple with rapidly changing events and increased uncertainty, even in the short term.

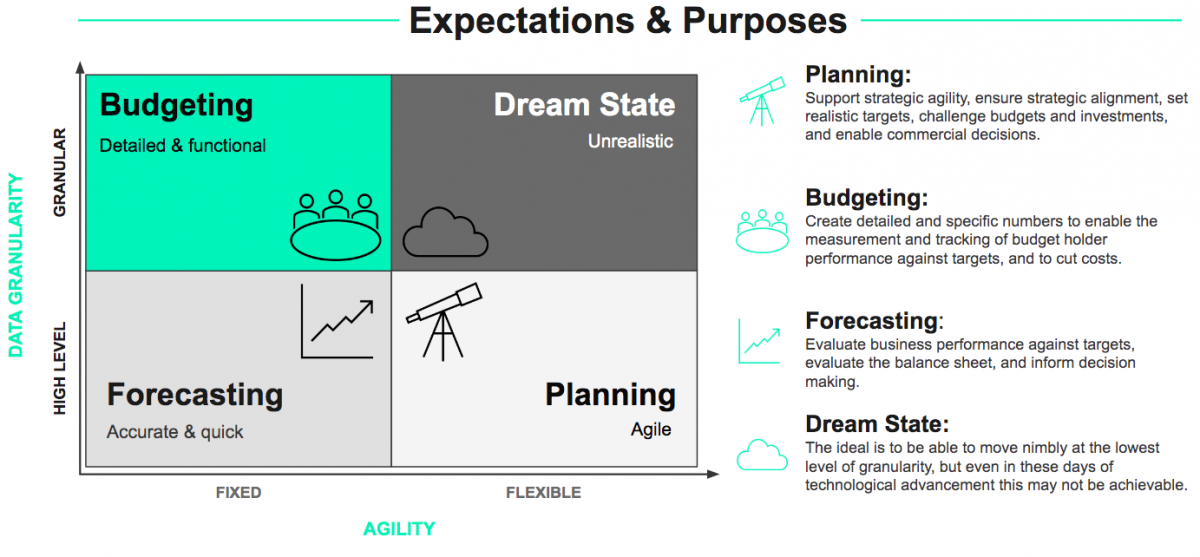

Arguably, the centre piece to a best in class finance function that seeks to play the role of trusted strategic partner is the planning capability for the long term, supported by the forecasting capability for the short term. However, it has been common practice for many years to group planning, budgeting and forecasting together because they are broadly the same, right?

Plans are worthless, but planning is everything.

Ask anybody in Finance and they will wholeheartedly agree, but on closer inspection the historic grouping together of planning, budgeting, forecasting has led to them being, essentially, the same process, re-badged. More painfully, it is really the budgeting process re-badged.

“We redo the budget 3 times a year and call it forecasting, then we do some budgets for the next couple of years and call it planning” - Disgruntled FP&A Manager

Budgeting is, arguably by necessity, slow moving, involves lots of people both inside and outside Finance, beset by horse-trading and political manoeuvring and tends to be built bottom up and to the penny.

Whilst this may suit budgeting, the reality is, planning and forecasting have distinct requirements in terms of ownership, political buy-in, speed of execution as well as the skills and capabilities needed to execute and analyse the results. Without these differences clearly catered for many Finance functions suffer significant overlaps in activity, repeated tasks, a suboptimal allocation of skills and worst of all, a missed opportunity to really provide that strategic insight to the business when it’s really needed.

As you might expect, the homogenisation of PB&F is aided and abetted by a single toolset. Typically this is the bolt on EPM tools that all the major ERP vendors offer, and although these tools have the capability to allow PB&F to be run and managed differently, the drive for efficiency within large organisations leads to usage of one tool in one way.

The result is often a well-controlled and data intensive machine that produces oodles of analysis and forecasts that wither on the vine in terms of usefulness and are unable to provide the insight needed to respond to internal or external changes quickly.

The effect of this is a proliferation analysis in the shadows, often outside of Finance, built in spreadsheets and other desktop tools that are of course highly responsive, but ungovernable. This leads to the confusion, duplication of effort and multiple versions of the truth that PB&F toolset was meant to eradicate.

If you have to forecast, forecast often.

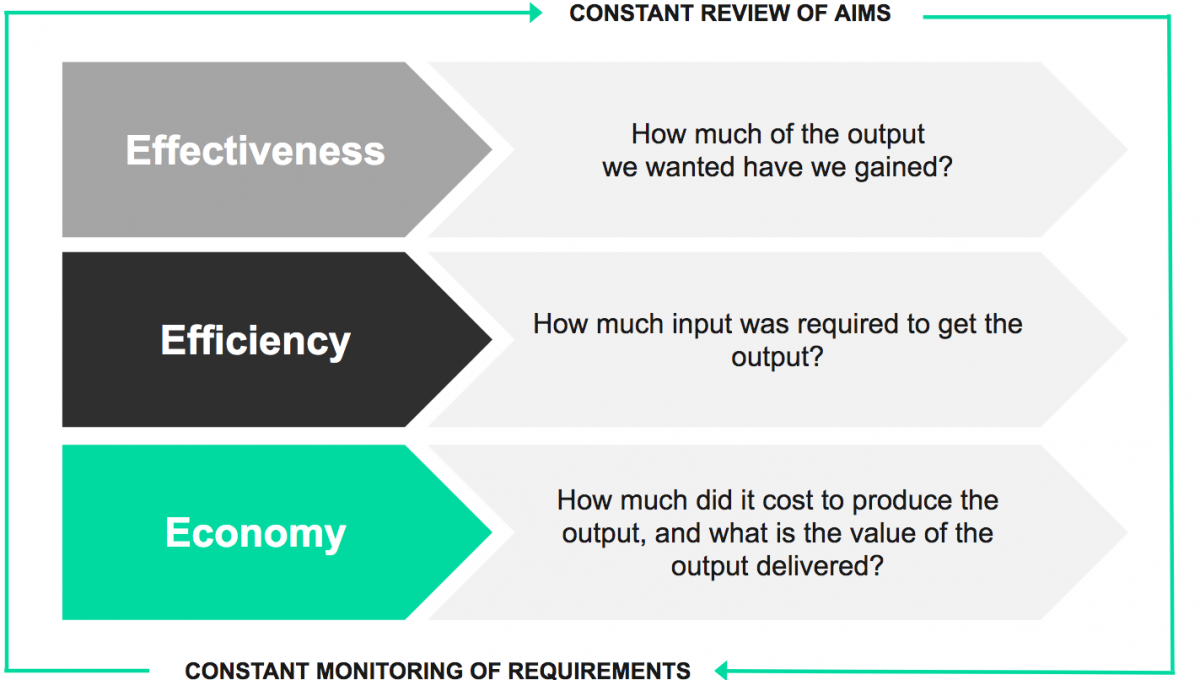

Firms need to abandon the idea that just one process and tool can be used to solve all their problems and focus on how to understand what they want to achieve from each process and what tool, or maybe multiple tools, can best enable those desired outcomes. To do this, firms should follow the 3-E model: effectiveness, efficiency, and economy

Effectiveness – assess whether, and to what extent, the outcomes produced from using tools are what they require. It is vital to consistently review your aims, assess the requirements, and then evaluate the value of your outputs.

Efficiency – As we have seen, the ‘one size fits all’ approach to efficiency can nullify overall effectiveness, but that’s not to say efficiency should not be a goal. Opportunities for automation should be a key consideration for planning, budgeting and forecasting as standalone processes, particularly where it makes time for increased insight and analysis

Economy – It’s hard to quantify the benefits of well sorted processes, but agreeing the outcomes upfront and making sure they are consistently delivered over time, as well as making sure all costs associated with implementation and ongoing operation can support the case for value and avoid discussions becoming about cutting costs

It is imperative that all finance functions overcome these two main issues if they are to maximise value and deliver on their rising expectations. Solving the issues of untailored approaches and misuse of tools, will strengthen the relationship between finance and business teams, and enable planning and forecasting to provide valuable insights to steer the business, whilst leaving budgeting to hold the business to account. Clearly establishing the different roles and expected outcomes of Planning, Budgeting, and Forecasting will result in a better allocation of skills and better quality outcomes, whilst reviewing and ensuring that tools are used correctly will maximise the value of outcomes, enabling quicker and more accurate analysis and forecasts.

Dan Bolland

Associate Partner

Dan.bolland@sia-partners.com

Stuart Evans

Senior Manager

stuart.evans@sia-partners.com

Katie Bentley

Manager

Katie.Bentley@sia-partners.com

Priya Nagra

Consultant

Priya.nagra@sia-partners.com