Carbon Accounting Management Platform Benchmark…

Balancing core operations with energy transition initiatives

As the world grapples with the urgent need for sustainable solutions amidst climate change, the Oil & Gas industry emerges under a piercing spotlight. This study delves into the investment strategies of eight major players — BP, Chevron, Equinor, ExxonMobil, Saudi Aramco, Shell, Suncor, and TotalEnergies — as they navigate the dynamic energy landscape until 2050.

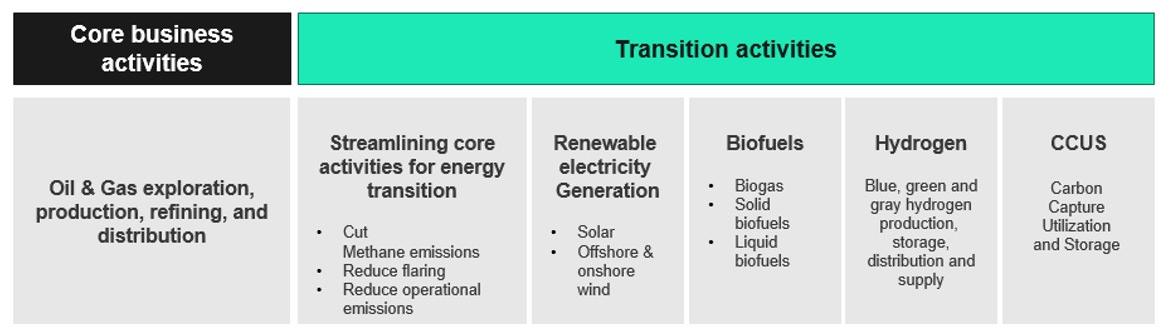

To gain insight into their strategic positioning, we distinguish their traditional carbon-intensive activities (referred to as the "core business") and their endeavors aimed at mitigating greenhouse gas emissions (termed "transition activities").

Activity segmentation for investment opportunities (within companies)

Although the COVID-19 pandemic triggered a significant revenue decline for leading firms, they demonstrated remarkable resilience, bouncing back with record profits.

Companies, rebounding from COVID-induced revenue declines, find themselves at a pivotal juncture, weighing the decision to prioritize investments in core operations or embark on substantial energy transition initiatives. Within companies, two distinct groups seem to stand out in terms of their strategies by 2025:

One group, the ‘Energy Transition Companies’, particularly European companies, pivot towards sustainable ventures, propelled by ambitious targets for renewable energy production. This group includes BP, Equinor, Shell, and Total Energies.

The other group, ‘Carbon Efficiency Companies’, prioritizes emission reduction while maintaining traditional economic models and plans to heavily invest in the core business. Chevron, ExxonMobil, Saudi Aramco, and Suncor fall within this group.

Finally, this study aims in discerning whether these trends endure or if companies are poised to enact significant changes in their approaches by looking at how investments are distributed among various identified subcategories (oil and gas, wind and solar electricity, biofuels, hydrogen and CCUS) while also exploring how these diverging strategies shape the landscape of energy transition [by 2050], highlighting the delicate balance between traditional revenue streams and the imperative to reduce carbon emissions.