Agentforce, the GenAI Agent by Salesforce

In 2018, one third of the top 250 energy companies in the Platts ranking publicly reported their involvement in at least one blockchain project. This figure was still close to zero almost two years ago. So what initiatives have emerged? What trends are emerging in this new ecosystem?

Sia Partners analysed, on the basis of publicly available data, the initiatives of the main utilities in the world. The panel brings together the 250 largest companies in the energy and environmental sectors (2017 Platts ranking) to which around fifty energy companies identified as active in the blockchain sector (blockchain projects, participation in consortia and association with blockchain start-ups) have been added. In the end, the public data of a sample of 300 companies worldwide have been analysed. Herein are the first set of results.

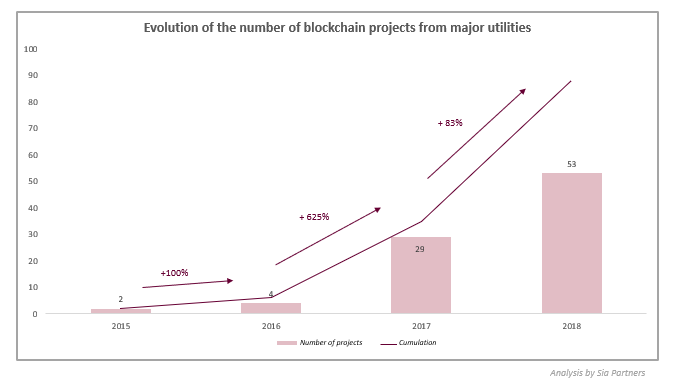

From LO3 Energy's highly mediatized Microgrid Brooklyn project in 2015 to the various initiatives of Powerledger or Ponton, the first point of contact between the energy and technology sectors and blockchain technology was made without major utilities. Many startups initiated the exploration of possibilities long before the enthusiasm of major companies such as Engie or EDF, who launched their first tests in 2016. Energy companies’ growing interest was reflected in 2017 with a +600% increase in the number of initiatives over a one year period. It remained very strong in 2018. In total, we have more than 90 unique initiatives involving utilities with different levels of maturity and a wide variety of use cases.

After having shaken up the banking sector, blockchain technology has also established itself within that of energy, even if the approach remains somewhat different. Initially, utilities tested the technology individually on small initiatives and a few joint projects were developed. The blockchain take-off came later to the energy sector, with a 2 to 3 year delay compared to the banking sector.

Figure 1: The rise of blockchain energy initiatives among utilities really began in 2017

Has the innovation been lagging behind or was there a simple mistrust of a technology that could replace their role as intermediaries? Utilities were indeed initially reluctant to accept this new decentralized solution. They have been slow to invest in such projects, due to an immature technology and the difficulties in finding relevant use cases. An overwhelming majority of applications are hence still at an experimental stage to determine the viability of their blockchain application.

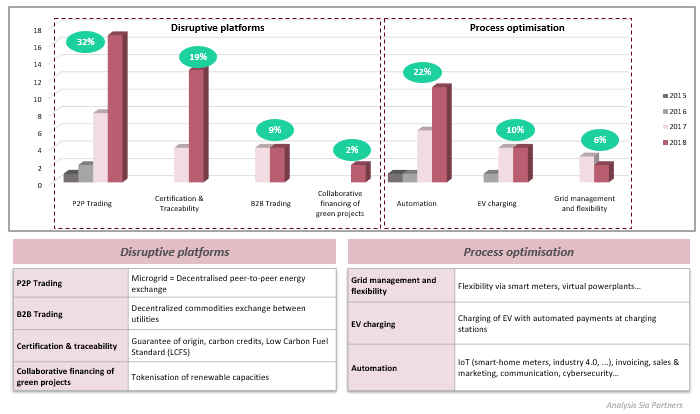

Seen from a utilities perspective, the main use cases tested are on the power grid where blockchain provides greater flexibility. Two use cases stand out: certification platforms (in particular "green energy") and P2P trading solutions. The latter represent 32% of the projects identified with a high multiplication in 2018. Showcase of blockchain energy solutions, these P2P energy exchanges are very close to the desire to disintermediate the blockchain and make it a logical application. But then why would utilities encourage this type of project? On the one hand, they acquire a mastery of technology and thus do not let themselves be outdone by new entrants. On the other hand, this use case requires the management of physical flows and technical installations that only utilities have control over. Their involvement in the various projects, as well as for certification - in second place with 17% of projects - is crucial to bring legitimacy and real stability to subsequent physical flows.

Apart from this type of solution, blockchain is also used by utilities among themselves within B2B energy platforms such as Enerchain or Wien Energy. They represent nearly 9% of the identified projects. This figure may seem low but it reflects a different desire: instead of multiplying themselves these projects aim to grow in number of players using the platforms in order to achieve a liquid market place. Utilities thus retain their role; it is the intermediate actors who disappear, making exchanges more fluid and reducing transaction costs.

Finally, automation projects represent a total of 22% of initiatives. They are not necessarily specific to energy, such as automatic invoicing processes, but essential for the sector and easy to duplicate. These projects will be more transparent for customers and will optimize the utilities' internal processes. The intended aim is then more to improve processing times and reduce costs for the company than to develop new energy uses.

This analysis remains nuanced due to the methodology used. Although P2P trading seems to largely dominate current initiatives of energy leaders, it is clear that the application to microgrid networks is both understandable to the general public and combines several current trends (smart grid, distributed generation and renewable energy). Companies communicate more easily on it in order to build an innovative image around their brand and associate it with the term blockchain. Each project is therefore made public and an actor can have several initiatives of this type in opposition to B2B platforms. At this stage, no use case seems to be fully applicable though.

Figure 2: Distribution of blockchain initiatives of utilities by use case since 2015

Blockchain technologies are promising to meet the challenges of decarbonization, decentralization, digitalization and democratization of the energy transition. However, utilities face several challenges in the large-scale adoption of this breakthrough technology:

To overcome the technological gap and enter a phase of industrialization of blockchain projects, utilities have chosen to form alliances. Indeed, cooperation and co-creation are proving to be key success factors in order to accelerate their skills development and pool efforts to develop technical solutions.

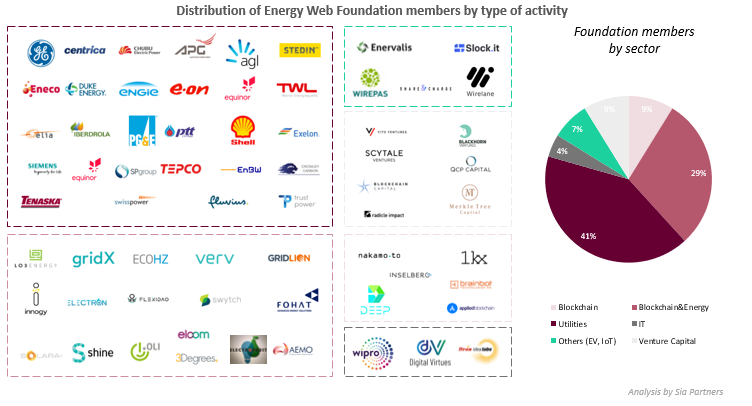

Thus, since its creation in 2017, the Energy Web Foundation has quickly established itself as the leading consortium for the energy sector. Today, more than 50 members - about 60% utilities and 40% technology companies - are organized in communities around an open-source blockchain platform. Named Tobalaba, this consortium’s blockchain seeks performance (up to 750 transactions/sec) and confidentiality management ("secret transactions"). With its ambitious roadmap, the non-profit foundation encourages the alignment of blockchain initiatives, currently dispersed in the energy sector: after testing Ethereum and/or developing their own decentralized system, some projects are testing or migrating to the EWF blockchain based on proof of authority. This is the case in particular for the Share & Charge and Electron projects, which each include several major European utilities. However, it is still in an experimental phase. The "genesis" block is scheduled for the second quarter of 2019.

Figure 3: Distribution of Energy Web Foundation member actors by type of activity

The energy blockchain ecosystem is therefore now in the transition from a first phase of exploration to a phase of accelerating POC development. The first ROIs are still pending and will condition the transition to large-scale deployment. What will ultimately be the use cases retained by utilities? The current cases identified give us a relevant indication but it still seems too early to draw conclusions. Technological developments, particularly consortia-specific projects, will also have a strong impact on emerging projects. All these topics leave the field open to companies and promise an exciting future for blockchain usage in the energy sector!