Carbon Accounting Management Platform Benchmark…

The aim of this article is twofold:

To give a general overview of the nature and main features of software maintenance costs

To present the Third Party Maintenance alternative, its main providers and current clients

Key points to highlight in this analysis are the following:

Maintenance costs can represent over 50% of total software budget on a yearly basis

Due to increasing maintenance costs, companies are looking for alternative solutions and third party maintenance (3PM) is becoming popular among small and multinational companies

Currently 3PM services are mainly provided for Oracle and SAP software products

3PM providers claim savings from 50% to 90% on maintenance costs compared to software vendor fees

Rimini Street is the leading provider, with a global coverage and multinational companies among its clients

Third party maintenance can be an important negotiation leverage in front of the software vendor, using it as an open option in the contract agreement

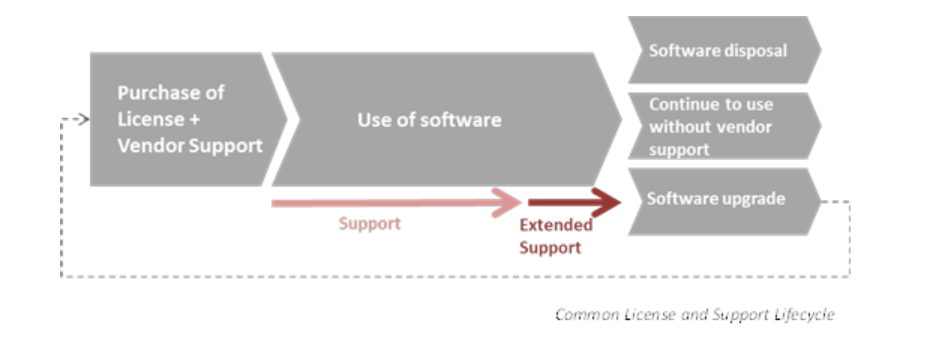

For every software, a license lifecycle can be described.

3 main phases can be observed:

Besides the license lifecycle, there is the software support lifecycle. The buyer will typically purchase the software maintenance and support in addition to the enterprise software license. This gives the user the right to get operational support, fixes, patches and small updates whenever needed.

In the case of SAP, this price of this support amounts to 18-22% of the initial license price per year, plus annual adjustments for inflation. The support is renewed automatically every year, and this for a certain amount of years (usually 5 years). When the support ends after this period, the user can choose to renew the maintenance agreement for a couple of additional years (mostly 2 years), at the original maintenance price + an additional fee (approx. 5%). After the period of extended support, the software vendor will not offer additional maintenance for the old version anymore. Instead, the vendor will propose an upgrade or a new software product, where support will be granted.

When this support lifecycle comes to an end, the software user has to make a decision. He has three options:

The purchase of software implies not only direct but also indirect costs. The Total Cost of Ownership (TCO) calculates the financial effect of deploying a software product over its lifecycle. It defines the cost for procuring the software but also for implementing and maintaining it. Service costs (including consulting, training, etc.) linked to maintaining the software and day-to-day operational expenses are also included in the TCO. It is clear that the price of the software license itself is relatively low compared to the TCO.

Maintenance costs are a substantial part of the TCO, industry studies show that it can mount up to 60%. The Total Cost of Maintenance (TCM) can be split into different main components;

Below you can find a general example of evolution of TCO and TCM over 10 years. Figures do not refer to any specific company. Main assumptions are the following:

Maintenance costs are just one part of the total cost that a company has to face during the period. However, maintenance fees cumulate year after year, achieving the original cost of the license (1M€) after 5 years. This makes maintenance the most important cost. It can mount up to between 50% and 80% of the software budget, on a yearly basis.

For vendors like Oracle or SAP, maintenance revenues provide steady income even without new software sales. Over time, vendors have established virtual monopolies on this product support and maintenance. They have been changing their business models, shifting the revenue portfolio from products to services, including maintenance. It is very likely that recurrent maintenance fees have surpassed new products sales revenues. This was further reinforced by the trend of outsourcing and/or automating the software support in order to reduce costs.

Introduction

As maintenance is a substantial part of the TCO, the option to buy software support at a reduced price from a third party maintenance provider (3PM provider) may be more cost-effective for software users in certain cases. This presents a 4th option:

In the late 90ties, Seth Ravin got the idea to offer third party software support. This idea grew from his job at PeopleSoft. The board gave Ravin permission to secretly sell customers an extra package of support, on top of their regular maintenance fee, in order to let them keep using the older releases of the software. Like this, Ravin got the idea to create a company that sells maintenance and support for older software, independent from the software vendor. The target group for his business was enterprise software users that run older but stable software versions and that don’t have the desire to go through the cost and difficulties of upgrades. The idea was to offer this client application expertise and patches when needed, at a much lower price.

The first third party software support provider was TomorrowNow, co-founded in 1998 by Seth Ravin. TomorrowNow offered Oracle support and maintenance at a low cost. The company was sold to SAP in 2005 but did not survive the lawsuit filed by Oracle (for illegal downloads by TomorrowNow workers from Oracle’s support site) and the following hard court case. It stopped all activities in 2008.

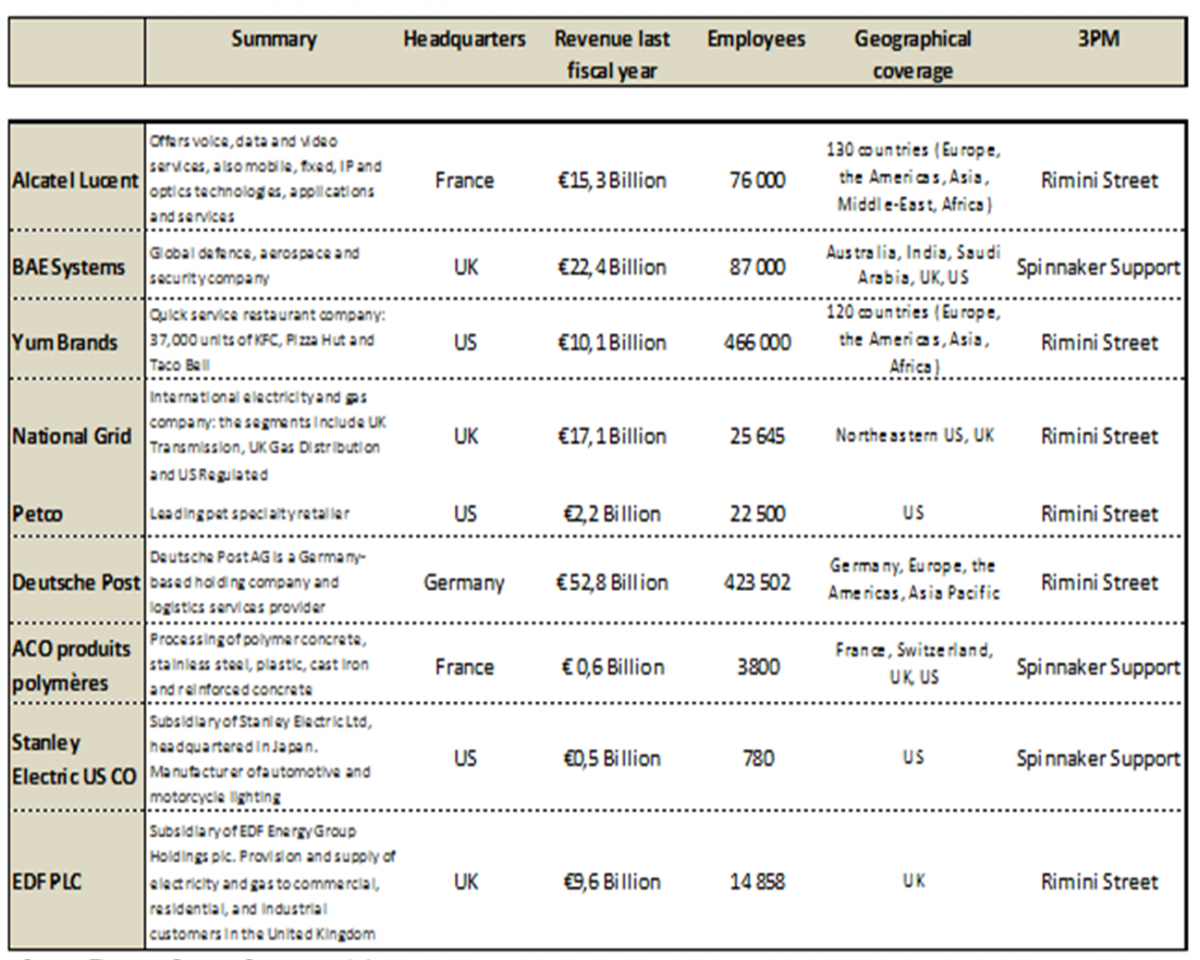

In 2005, Seth Ravin founded Rimini Street, which is currently the leading third-party provider of enterprise software support and maintenance services for Oracle (including PeopleSoft, Siebel, JD Edwards) and SAP licensees. The headquarters are located in Las Vegas, Nevada. The company serves Fortune 500, midmarket, small, private, and public sector companies. Some examples of clients are Yum Brands, Deutsche Post/DHL, Petco, PetSmart, Alcatel-Lucent, National Grid and EDF Plc (Source: Rimini Street website). Rimini Street supports client operations in more than 60 countries. Rimini's standard offering includes 24h support, tax and regulatory updates, installation and upgrade process support and fixes for documentation and customizations.

The Rimini Street success story has a downside too. Oracle claims that Rimini Street uses the same "corrupt business model" as TomorrowNow and filed a lawsuit against the company in January 2010. Nevertheless, Ravin gives a confident impression saying that Rimini Street acts within the boundaries of their customers' license agreement with Oracle. Further, he states that the company is prepared and ready to battle Oracle in court. The lawsuit does not have any outcome yet, but if the final decision would be in Rimini Street’s favor, this would be an enormous step forward for the entire 3PM market.

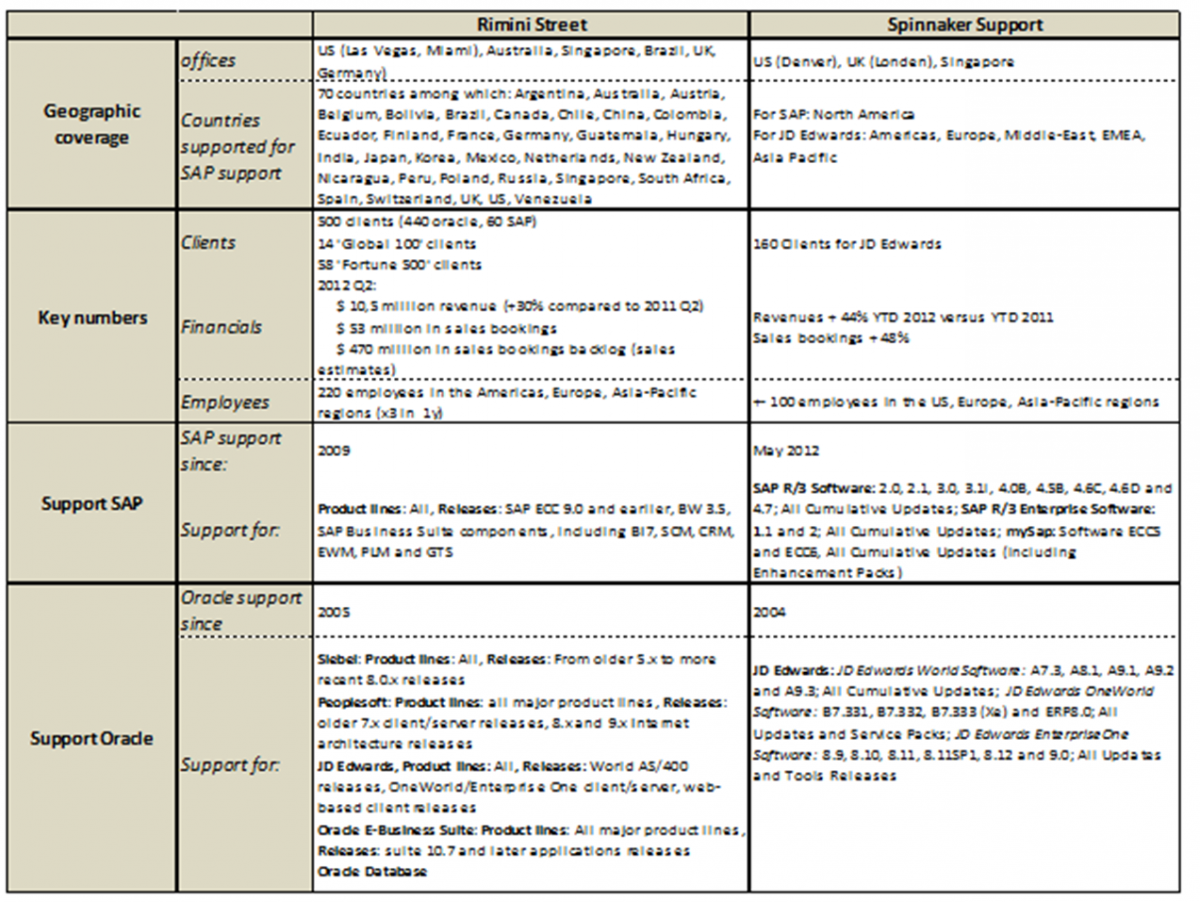

Rimini Street’s biggest competitor is Spinnaker Support (CEO: Matt Stava), which provides third party support and consulting services for SAP (since May 2012) and mostly Oracle’s JD Edwards software. In this context, it acquired Versytec, another provider of JD Edwards third party maintenance, in March 2012. Spinnaker Support is active in the Americas, Europe, Middle-East, EMEA and Asia Pacific. Examples of clients: Stanley Electric US Co, ACO Produits Polymères, Filix Products, Kellstrom Industries, BAE Systems (Spinnaker Support website).

Other smaller 3PM providers that offer SAP support are BCSynergy (Malaysia) and ITelligence (Germany). NetCustomer provides support for Oracle’s PeopleSoft, JD Edwards and Siebel, Precision Solutions Group Inc. offers support for IBM System i-based business applications. Two other providers are CedarCrestone (PeopleSoft) and Systime (JD Edwards).

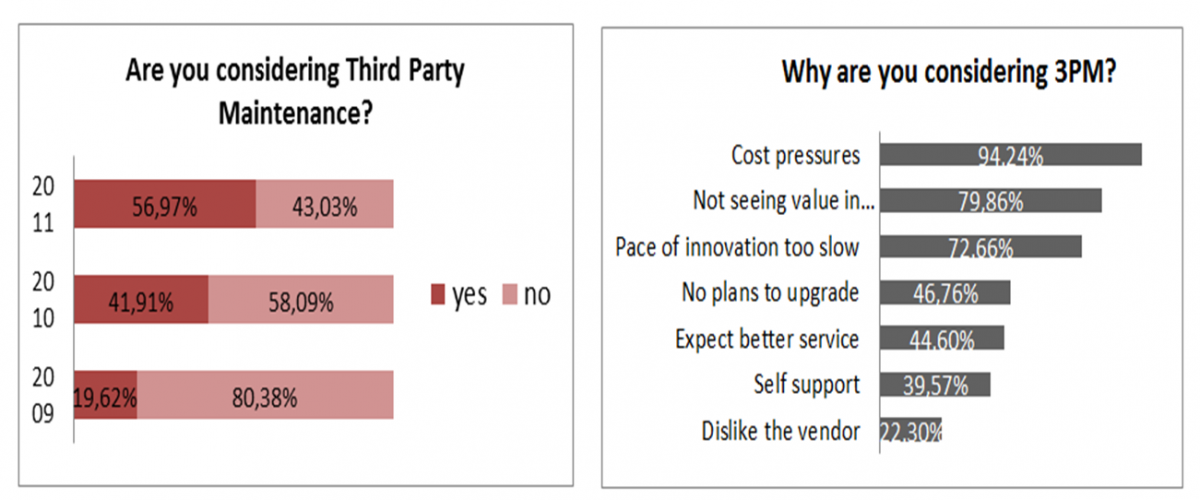

Growing interest in 3PMGrowing interest in 3PM

On the one hand big ERP vendors acknowledge the existence of 3PM, but they believe that their customers will remain on vendor maintenance support and keep upgrading because of their need for innovation. On the other hand, the lawsuits against 3PM providers show that vendors are not very comfortable with the rise of the 3PM market.

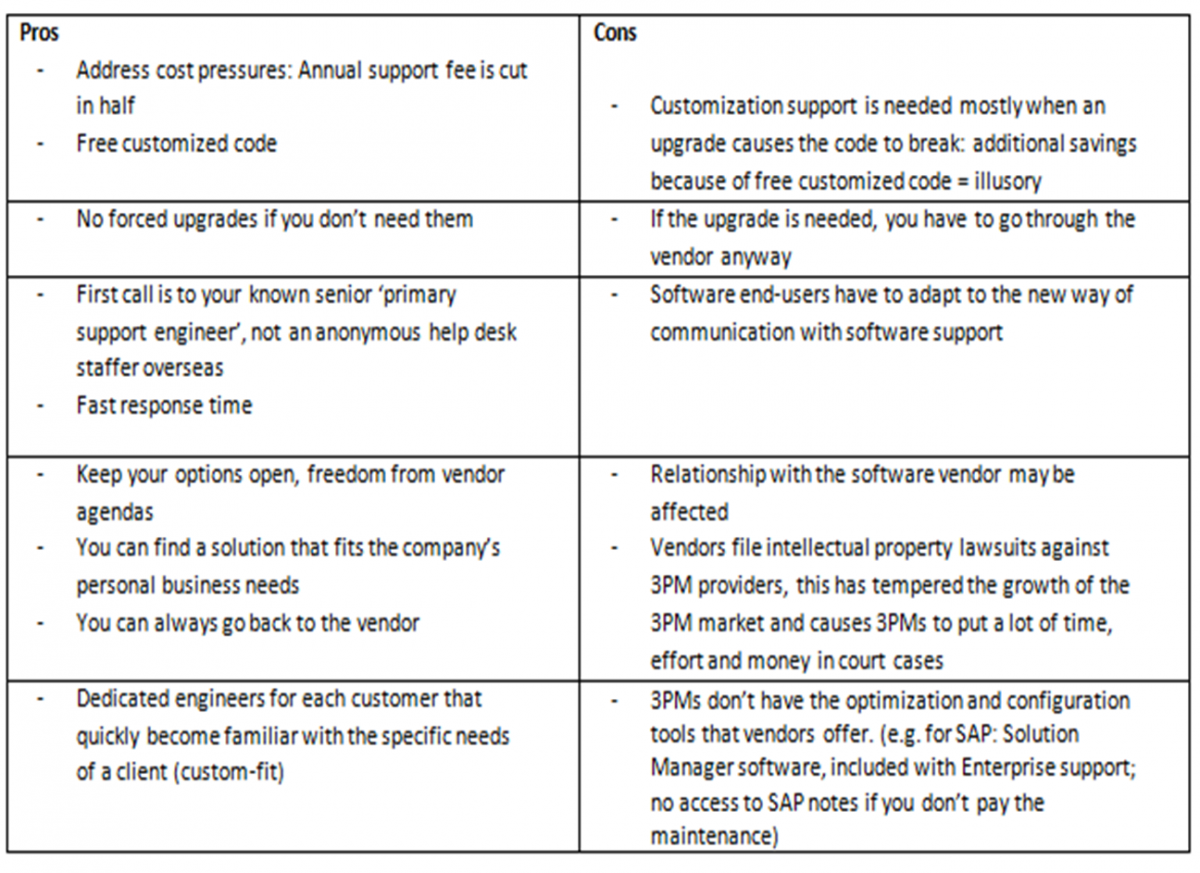

Pros/cons

The table below presents the pros and cons of moving towards 3PM :

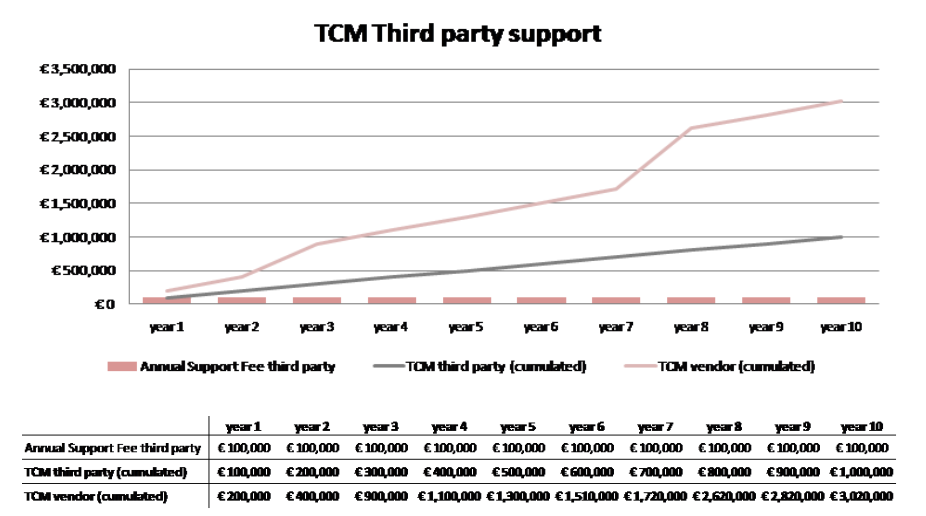

Comparing third party and vendor maintenance fees

The third party maintenance option allows cutting in half annual support fees and does not include additional upgrade fees which are sometimes considered unnecessary. On a 10-year period, maintenance can even be reduced by two-third.

Key information and figures

Currently, the two main providers of Third Party maintenance are Rimini Street and Spinnaker Support

Comparative analysis of Rimini street's and spinnaker support's main clients

Even though lawsuits against 3PM providers are slowing down the boom of the 3PM market, both Rimini Street and Spinnaker Support have important companies among their clients.

At the end of the software lifecycle, it is possible that software users have the feeling that the cost of upgrading their current software release, in order to maintain software maintenance and support, outweighs potential benefits. In the past, the only solution was to go through the effort and expense of a forced upgrade in order to stay on vendor maintenance. For those software users, 3PM can be an option.

The fact that the software user knows about the possibility to change to 3PM, can improve the negotiation leverage towards the software vendor. Industry experts and insiders generally agree on the fact that keeping the option open to move towards 3PM in the future, by including a specific clause in the license and maintenance contract with the vendor, is a smart move.

Sia Partners recommends the following for enterprise software users:

3PM is a young industry and some aspects of this new service still remain unclear. Recent legal actions from software vendors have prevented companies to move to 3PM, but it is general consensus that a favorable outcome for 3PM providers would give a positive impulse to this upcoming market.