Carbon Accounting Management Platform Benchmark…

From Niche to Mainstream: How Firms Should Think About a Product Offering.

As summarized in our 2021 paper on indexing strategy (The Next Generation of Indexing Strategy: Direct and Custom Indexing), the relevance of index investing has never been greater than it is today. While technology has continued to become more sophisticated, so too has customer demand and strategy. Rather than investing in the entire broad US stock market index, it is now possible to invest in a much more customized way.

By isolating certain portions of an index based on investor preference (often called Smart Beta), the marriage of technology and new strategies allows for peak flexibility and customization for clients, as well as scalability for firms.

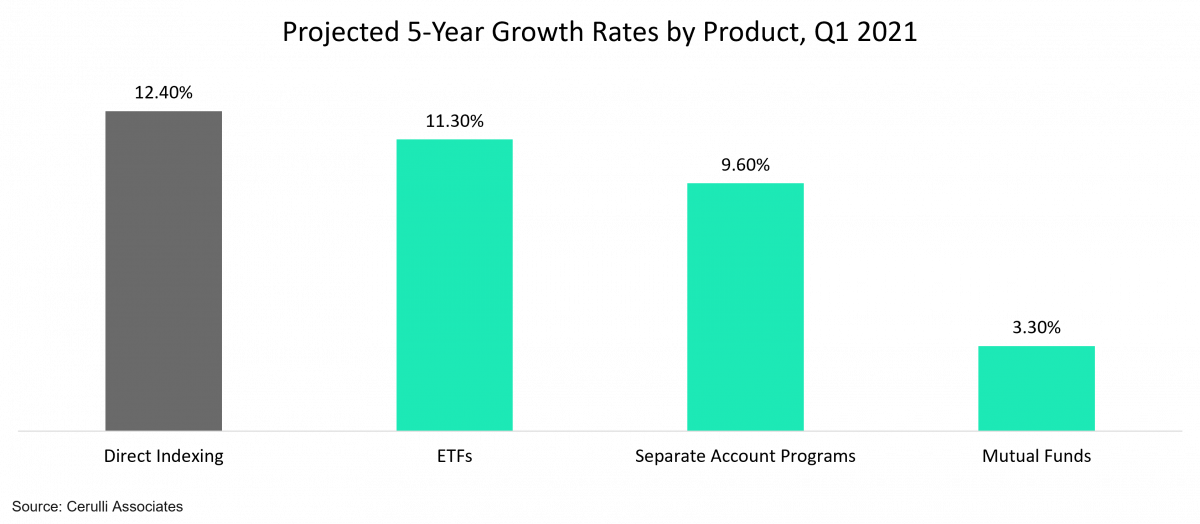

In 2020, Assets Under Management (AUM) in indexing strategies (mutual funds and ETFs) surpassed $10 trillion, and ETFs alone are projected to reach $50 trillion AUM by 2030. Within these strategies, Direct Indexing is poised to see the highest growth rate.

On both sides of the Wealth and Asset Management industry, firms continue to enter the direct indexing space through in-house development, or more commonly, by acquiring smaller firms for their existing technology platforms and customer bases. Morgan Stanley, BlackRock, JPMorgan, and Franklin Templeton all recently acquired companies focusing on direct indexing, building out their capabilities in the space. In keeping with this trend, 2022 continued to see explosive growth in the direct indexing space making it now more important than ever for firms to offer their customers these products and strategies.

One of the key factors driving the growth of direct indexing is the benefits it provides from a tax perspective, allowing investors to use a “tax-loss harvesting” strategy. This strategy involves selling investment positions that are less than their purchased value, then using the recognized (“harvested”) losses to offset capital gains from other positions. While this strategy isn’t typically available with index-tracking funds, many direct indexing platforms allow investors to systematically recognize tax losses year-round.

Another key factor in the explosion of direct indexing is tied to the ability of investors to customize investments to fit their investment objectives, picking companies that align with their personal or corporate goals. Unlike Mutual Funds / ETFs, investors can pick and choose individual stocks to suit their objectives, as opposed to accepting fund composition based on factsheet, prospectus etc. A common use case is an emphasis placed on investments focusing on Environmental, Social, and Governance (ESG) objectives. This allows investors to build portfolios that align with their ethical guidelines.

Finally, as the growth of direct indexing has increased, the product has matured to align with defined customer segments. Once solely used by asset managers and the ultra-wealthy, direct indexing has now become much more mainstream and can be found in the portfolios of retail investors. One of the leading factors in this shift has been the rise of fractional share trading, which allows investors to buy fractional portions of equities and ETFs.

These fractional portions provide the ability for investors to own a stake in higher priced shares they might not otherwise be able to access. Fractional share trading removes the dollar amount barrier to owning securities and diversifying portfolios, therefore allowing smaller investors to participate in a similar way to higher net worth investors.

As direct indexing trading volumes grow and investors look for new ways to invest their money, it is critical that firms consider the industry trends, ask the right questions, and ultimately determine if direct indexing is right for them.

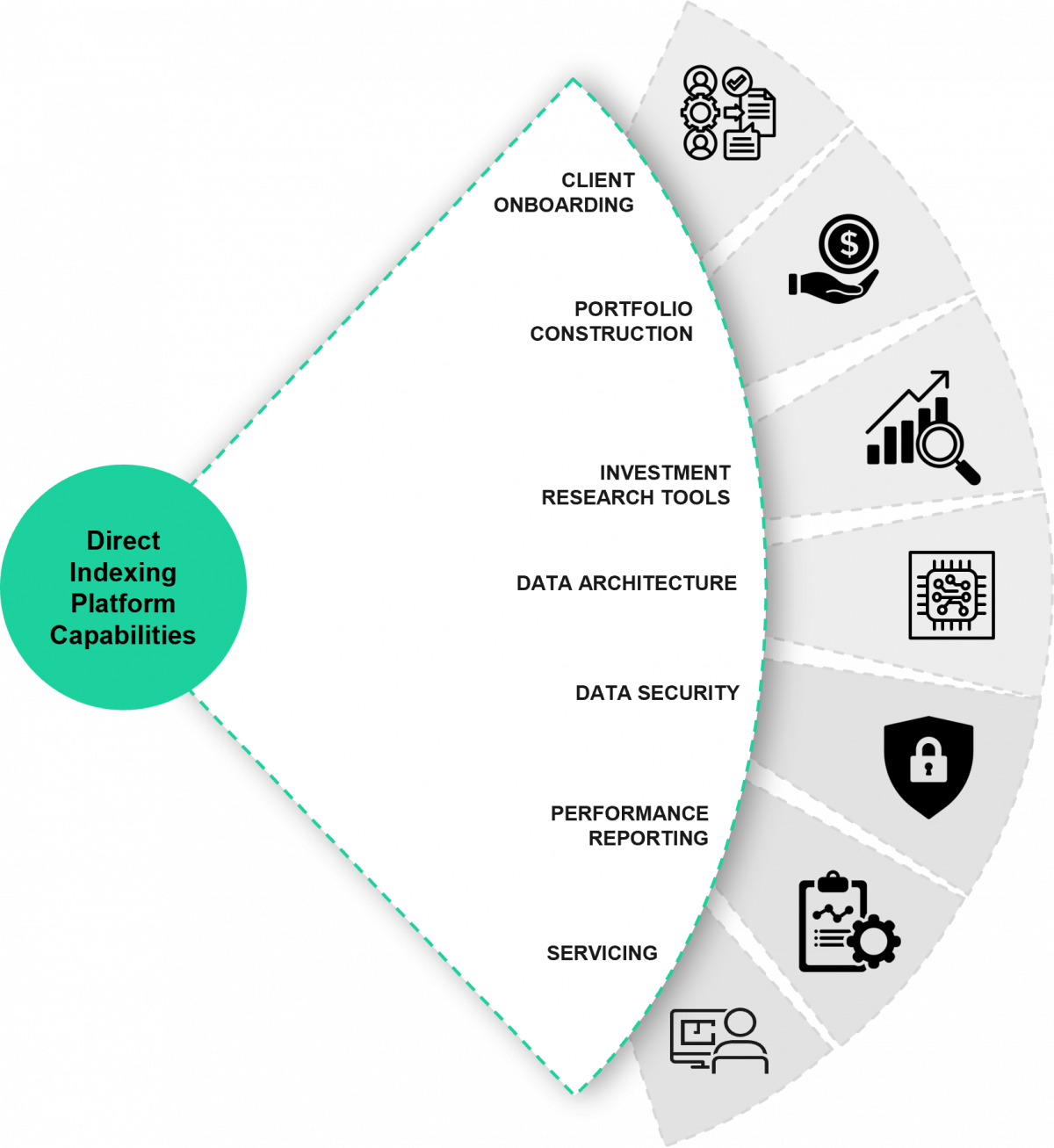

Once a firm makes the decision to offer a direct indexing product, they must then start to think about how to provide a top tier solution to their clients. In this next section we will discuss the platform capabilities, key considerations and important questions firms should think about when considering a top tier product offering.

Offering a best-in-class direct indexing platform will allow firms to remain competitive amongst their peers. Whether seeking to bring in a vendor solution or building out a platform in-house firms must strive to provide the best possible experience for their clients and financial advisors. Critical lifecycle components like onboarding, portfolio construction and execution, all the way through to performance reporting and servicing must be considered when planning to offer a direct indexing solution.

While the traditional direct indexing platforms mainly focused exclusively on tax benefits, their uses have since expanded and will continue to do so. The majority of direct indexing platforms today market themselves as providing a range of solutions; from strategic investing and tax-loss harvesting to the specific use case driven offerings such as ESG investing. In a constantly evolving environment, it is hard to determine which particular use cases will continue to thrive and which ones won’t. Some firms may choose to continue to expand their platform offerings more broadly. While others may seek a platform that spotlights a ‘niche’ by offering advanced tools for a particular use case like ESG. As firms continue to implement direct indexing solutions for their clients, they will continue to search for platforms that provide the most advanced tools and capabilities that best suit their needs.

When considering the impacts across business, operations, technology and even risk and compliance, there are several important questions/considerations that firms should be thinking through:

When direct indexing is self-directed, the number of solutions offered is typically lower than if a product is offered through brokerage / advisory. Firms need to think about which option will be best for their business.

The minimum requirement at firms differs, but direct indexing is typically offered to clients who have $100,000 or more in assets. Though in some cases it is available to self-directed investors with account minimums as low as $5,000.

For a client the strategy may lead to higher management fees than investing in similar ETF strategies. This is usually due to the level of customization involved in buying and selling securities which can lead to higher transaction costs. However, depending on the client’s individual portfolio, the potential tax savings from harvesting losses may help to offset those costs.

Depending on how a firm chooses to offer direct indexing, expenses will vary from firm to firm. Typical expenses include vendor partnerships, platform buildout, technology enhancements, or cost of acquisitions. These are determined when deciding to either build, buy or partner.

Controls built from robust analytics based on the decisions the client makes will impact the portfolio’s risk and return relative to the benchmark index.

The style and frequency of reports may differ from firm to firm, but overall, it should give clients accuracy and real-time visibility into their portfolios.

There are technology capabilities offered on platform that provide tax-aware trading and rebalancing. These streamline the ability to identify gains and losses from held securities within the managed index.

Sia Partners has a breadth of experience across a wide variety of topics in the financial services industry. Our firm helps clients to:

Keeping in mind the many challenges that businesses already face in today’s climate, it is vital to work in a well-structured and organized way. Therefore, Sia Partners is at your service when it comes to providing frameworks and roadmaps that will help you to work as efficiently as possible.

As investment solutions like direct indexing continue to evolve and impact wealth and asset management, all companies involved should consider the changes this brings to their clients, as well as to the services they provide. Sia Partners recognizes the need for support in this area, which is why we have incorporated the best practices from around the world into our offering. Sia Partners is able to provide the knowledge and expertise necessary to assist clients in the decision-making and implementation of these next generation strategies. Our unique Consulting 4.0 approach augments business advisory services with our Heka automation and artificial intelligence capabilities to provide clients with industry leading consulting and technology services and solutions.