Canadian Hydrogen Observatory: Insights to fuel…

Bank & trust

As a reaction to the ongoing credit crisis in the Eurozone, the ECB, headed by Mario Draghi, launched a first round of non-standard long term refinancing operations (LTROs) in December 2011 and a second round in March 2012 to provide liquidity to its member banks and alleviate pressure on the re- financing rates of some peripheral Eurozone governments (Italy, Spain, Greece, Portugal).

While there were some initial positive effects on government bond yields in the Eurozone periphery, Spanish yields rose above pre-LTRO levels in April 2012 and Spanish bank Bankia requested a € 19 billion bailout in May 2012, indicating that more efforts are needed to safeguard the euro-system.

The mechanism behind the LTRO has existed since the inception of the euro, providing liquidity on a monthly basis to Eurozone banks. In these transactions, a central bank provides short-term (maturity of 3-months), asset-backed loans to European commercial banks. The European banks have to pledge collateral in order to receive the loan from the central bank. Through a repurchase agreement (aka repo) between the two parties, the lending bank is required to buy back the collateral at a price greater than the original sale price. The difference between both prices represents an interest (repo rate).

These refinancing operations are carried out through a monthly auction mechanism. The ECB can specify the interest rate, called a fixed rate tender, or the interest rate is not fixed and banks bid against each other to access availably liquidity, called a variable rate tender. The refinancing operations were relatively small before the crisis erupted in 2008, representing only 20% of the liquidity provided by the ECB. Whereas in December 2011, the ECB announced non-standard re-financing operations (here: LTROs) with a maturity of 36 months at an fixed annual interest rate of about 1% (overnight rate during the loan period) and the option of early repayment after one year. Banks were allowed to borrow unlimited funds as longs as they could provide eligible collateral.

The requirements for the collateral provided by banks for the LTRO loans were in turn loosened to A-rated securities. The collateral, usually sovereign bonds, could be pledged to the ECB or the national central banks of the borrowing banks to reduce the ECB's credit risk and increase collateral availability.

In 2011 the interbank lending market and the repo-market gave significant signs of contraction with shortages of collateral showing up for some small and medium sized banks.

With the ECB base rate at 1%, the rationale was that Euro-system banks could lend at 1% in exchange of low-rated collateral while investing in peripheral debt, which was trading at 5-6% at the time. That way, banks could clean up their balance sheet to improve their access to the interbank lending market. Peripheral governments, on the other hand, would be able to auction their sovereign debt at better rates to these banks. Since the ECB doesn't have a mandate to buy straight out government debt, the LTROs provide a handy backdoor for the ECB to support government bond prices. Ultimately, as stated by Mario Draghi, the objective was to improve lending to the Eurozone private sector in order to boost employment.

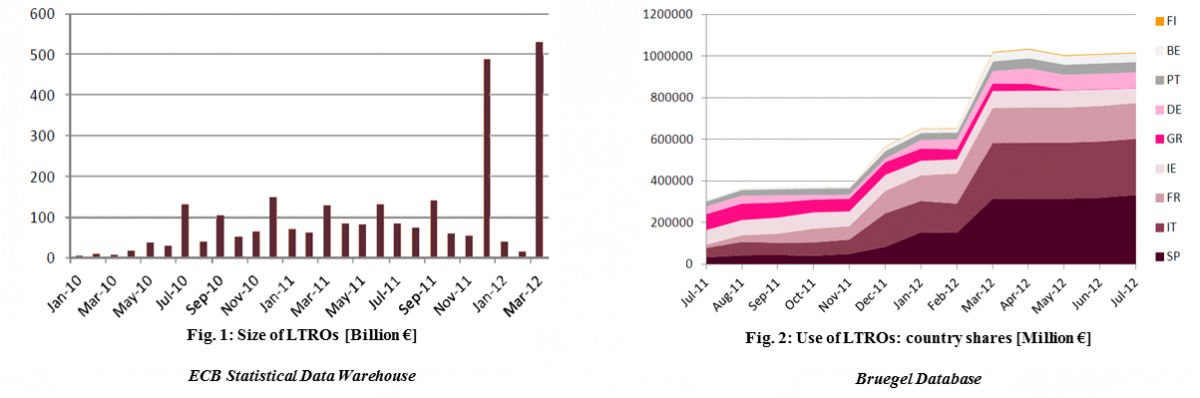

The overall size of the operation reached about €1 trillion euro's, with €489 billion allotted to 523 bidders in the first LTRO round and €530 billion going to 800 bidders in the second (figure 1). The net liquidity increase in the financial system was only €510 billion since the other half of the amount was used to re-finance maturing short-term credit. This amount corresponds €600 billion in collateral, taking a 15% haircut into account.

In reality, the LTROs had a direct impact of €350 billion of collateral in the "private" repo-market since peripheral credit backed by government guarantees is not tradable. Italian and Spanish banks were the biggest recipients of the LTROs, picking up € 280 billion of the total amount of € 510 billion (figure 2). With the loosened collateral requirements, these banks could use their country's lower-graded government debt as collateral. Greek bonds, for instance, could not be used since they were given the junk status by Standard & Poors.

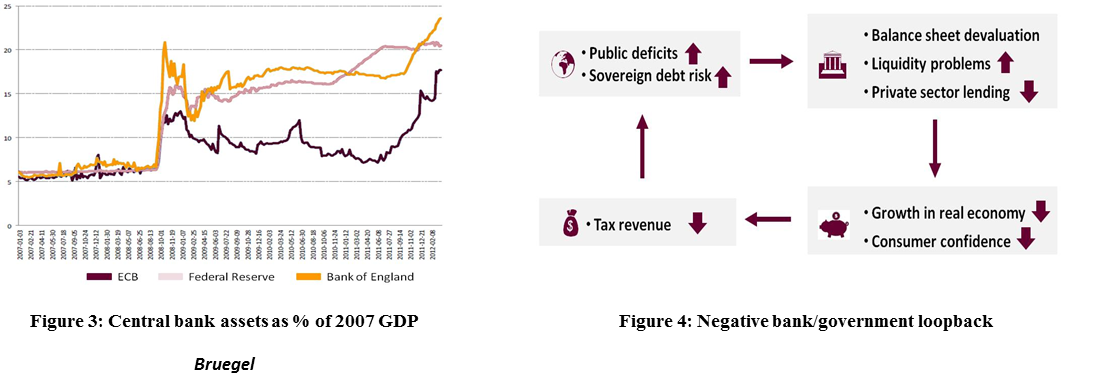

The expanding liquidity provision from the ECB to Eurozone banks shows that the ECB had to step in to replace a dysfunctional interbank market. The ECB solved the acute funding needs of these banks, but did not alter the underlying problems. While Italian and Spanish banking stock reacted slightly positive after the first round of LTRO, they sunk rapidly after the second round (figure 3) due to the deteriorating financing conditions of their countries, with Spain's 10-year government note rising from 5% in March 2012 to 7.6% in July 2012. This drop is coupled to the hefty rise of capital outflows from Spain, indicating that trust in Spain's banks has not been restored.

The ultimate goal, a positive impact on the real economy, has not yet been achieved. Credit growth to non-financial corporations and households remains very weak. Eurozone banks deposited a large amount of liquidity, obtained at a 1% rate, at the ECB, which offers 0.25% for this deposit facility. In other words, banks preferred to incur a loss of 0.75% than to pass the liquidity on to the economy. Data does not suggest that this trend will change soon as banks have chosen the long path of deleveraging to clean-up their balance sheets before turning towards the economy.

The responses to the crisis by central banks of the industrialized economies have resulted in strong increases in the size of their balance sheets (figure 3). While the ECB has relied mostly on lending to financial institutions through collateral repurchases (notably LTROs), the Federal Reserve and the Bank of England turned to more untraditional operations like large-scale purchases of government bonds. The total balance sheet of the ECB and the 17 national central banks has grown to €3 trillion in 2012, surpassing the balance sheet of the Federal Reserve ($2.8 trillion). This shows that the ECB has replaced much of the interbank activity.

With the loosening of collateral requirements, the growing and possibly deteriorating quality of the ECB's balance sheet poses a long-term risk to the financial stability of the Eurosystem. The ECB's exposure to weaker Eurozone economies was estimated at about €900 billion in April 2012. The plausible default of one of these countries would turn some of the ECB's holdings into toxic assets.

Secondly, through the liquidity provided by the LTROs, periphery banks have massed on their possessions of sovereign debt, binding their fate to the financial situation of their countries and creating a possible vicious cycle (figure 4). In June, for instance, Fitch downgraded Spanish banking giants Santander and BBVA to BBB+ after lowering Spain's long-term credit rating the week before.

Finally, there is the issue of moral hazard. By launching such large-scale operations, the ECB relieves pressure from governments and banks without removing the underlying causes. It is essential for banks to strengthen their balance sheet by meeting capital adequacy requirements while governments put in place structural reforms to bring back their deficits. Frequent use of non-standard measures by the ECB might undermine the dynamic of such efforts.

The non-standard LTROs, launched by ECBs, have eliminated short-term liquidity risks for Eurozone banks, but they did not address the problem of solvency. Time was bought to continue the deleveraging process and the improvement of capital ratios, as pressed by the financial regulators. The LTROs did not, however, ensure credit growth needed to stimulate the economy.

After mounting pressure on peripheral countries (notably Spain), the way was paved in September 2012 for unlimited bond purchases by the ECB, with the European Stability Mechanism (ESM) intervening in the primary market and the ECB in the secondary market. Although this decision was welcomed by the markets, longer-term risks still linger with regard to a bloated ECB balance sheet and the issue of moral hazard.