Canadian Hydrogen Observatory: Insights to fuel…

Request-to-Pay is the last piece of the SEPA ecosystem, designed to streamline payment and collection processes.

Since the Single Euro Payments Area (“SEPA”) project, several payment schemes and regulations have been introduced, like the SCT scheme to enable Instant Payment and the PSD2 directive to foster open banking. The latest part of this ecosystem is called 'SEPA Request to Pay', a messaging scheme designed to streamline payment and collection processes for a variety of use cases. It was rolled out in 2021.

In this article we shed light on the potential benefits of SRTP, providing an overview of the main initiatives being analyzed, and sometimes implemented, around the world by different payment institutions or providers, and possible use cases and applications within the payments sector.

The European Payments Council (EPC) developed four euro payment basic schemes: SEPA Credit Transfer (SCT), SEPA Direct Debit (SDD) Core, SEPA Direct Debit Business to Business (SDD B2B), and SEPA Instant Credit Transfer (SICT).

Rolled out in late 2017, the instant credit transfer solution (SEPA Instant Credit Transfer or "SICT") eliminates time constraints typical of traditional credit transfers and guarantees immediacy and certainty in the crediting of funds for the beneficiary. Transferring up to 100,000 in funds within 10 seconds, 24/7/365 without cut-off made the tool of significant use in a short time.

Following the SICT rollout, the Payment Services Directive (PSD2) has significantly reshaped Europe’s digital payments sector. PSD2 was one of the first regulatory initiatives in the world to open bank-held account data through the use of APIs to third-party service providers such as fintech and e-commerce businesses. Open banking and instant payments go hand in hand. Thanks to open banking, account-to-account payments are quickly becoming a competitive payment option as it cuts out the acquirer and additional costs and fees.

SEPA Request To Pay (SRTP) is the last piece of the European payment ecosystem. As a messaging scheme, it aims to optimize the payment experience and the collection process and could be powerfully associated with payment initiation and instant payment.

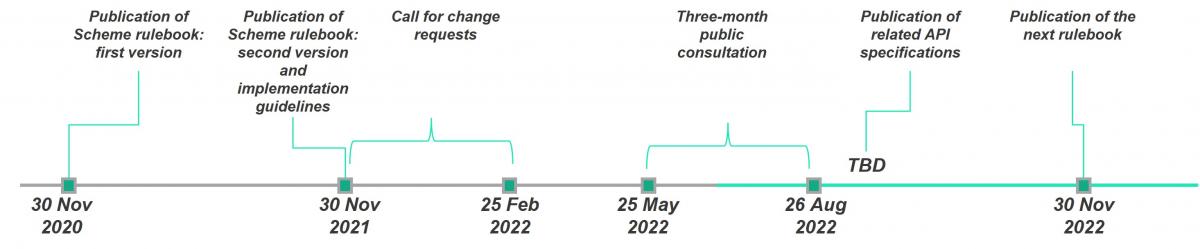

The EPC issued a second version of the Scheme Rulebook on 30 November 2021 after a “call for change” and public consultation from the initial implementation guidelines which were released in November 2020. A second phase of the “call for change” closed in February 2022 and the three-month public consultation is underway. A new version of the Rulebook is planned for November 2022.

As defined by the European Payment Council’s Scheme Rulebook, SEPA Request-to-Pay is a way to request the initialization of payment by the Beneficiary to the Payer for a certain amount resulting from a service provided in a range of physical and online use cases. It is not a payment means or instrument, but a messaging functionality supporting the end-to-end process due to its position between an underlying commercial transaction and the payment itself.

The purpose of SEPA Request-to-Pay is to streamline and digitize the payment process, specifically the exchange of information and messages before payment itself, which is currently managed separately.

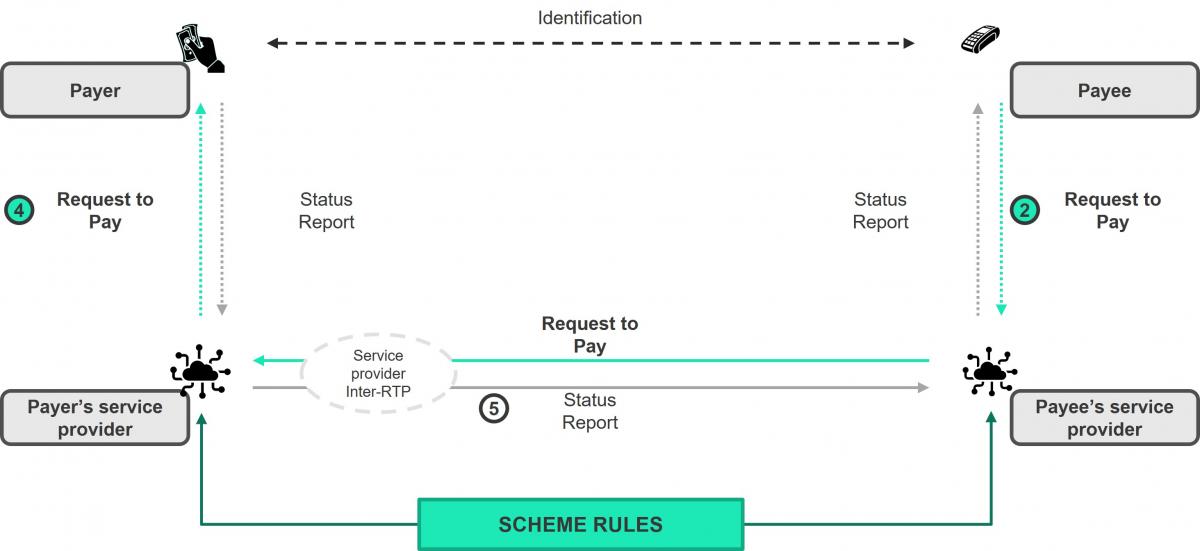

As can be seen from the macro flow, the activation of a Request-to-Pay implies:

As defined within the Scheme Rulebook, therefore are four main actors that come into play.

RTP Service Providers are not necessarily Payment Service Providers (PSPs).

There are 5 fundamental steps that allow the interoperability of the SRTP scheme as presented in the Scheme Rulebook (in Chapter 4 we will see the model applied to different use cases).

The above-described model illustrates the RTP flows in a generic 4 corner ecosystem. Is it possible to also have a 3 corner model, in which the Payee and Payer use the same RTP Service Provider, or Payee/ Payer direct models, in which the RTP is directly exchanged between the Payee and Payer without any provider.

The benefits of the use of Request To Pay are many for both the Payer and the Payee. SRTP is available 24/7/365 and applicable across all SEPA-abiding countries. With RTP, the use of credit transfers is complimented for a better end-to-end payment user experience in payment transactions.

RTP also allows Payee to express his payment preferences in terms of timing aligned to his needs. The Payee may in fact request immediate payment or not, generating different possibilities and use cases (e.g.: pay now/ pay later). The Payee and his RTP Service Provider can also send a Request for Status Update if no reply was received by the expiry date/ time.

Other additional benefits of the Request To Pay can be found in the technical architecture of the service. SRTP is independent of the payment channel.

In parallel to the European SRTP initiative, both payment institutions and payment providers around the world are taking the first steps to implement different types of Request to Pay services. They can be based on public or private initiatives and are related to different use cases.

Pay.UK is the recognized operator and standards body for the UK’s retail interbank payment systems. Following the launch of the RTP final framework by EPC, Pay.UK started to offer its own RTP solution based on the EPC guidelines in 2020.

Nevertheless, despite recognition of RTP’s potential, adoption is slow among UK banks and PSPs, as only 27 percent of them plan to offer Request-to-Pay services within the next 12 months. Upgrading existing payment systems and setting a clear strategy aligned with business objectives are mentioned as the key challenges to accelerate RTP implementation.

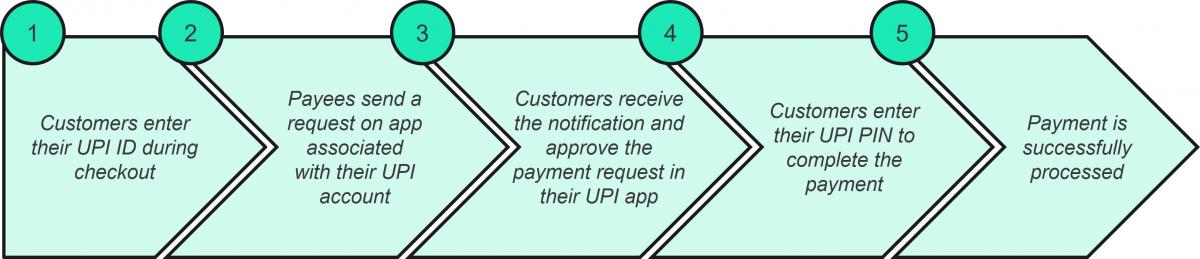

In India Request to Pay is referred to as “Collect” UPI payments and it is implemented on top of the real-time payment rails.

UPI (Unified Payment Interface) is a payment system developed by the National Payments Corporation of India (NPCI) that allows instant funds transfer from one Bank account to another via mobile devices on a 24x7 basis. In order to use the UPI system, it is necessary to have a UPI ID, a virtual payment address (VPA) that uniquely identifies a person. It is feasible to send and receive money simply by using this ID.

With the ‘Collect Money’ feature, it’s possible to send a payment request where the amount is pre-filled by the requester. The main use cases covered by Collect UPI are P2P and P2B payments.

Considering the P2B use case, it can be seen that with online payments via UPI merchants can save the interchange costs and fees charged by conventional card schemes and, at the same time, they can encourage a greater volume of online purchases. Merchants can initiate a collect request after customer confirmation; the process is quick and easy.

The Clearing House (TCH) is a banking association that owns and operates core payments system infrastructure in the United States, running cross-bank payment transactions and helping set payment policies and standards.

TCH has implemented Request for pay (RfP) on its Real-Time Payments Network (called RTP) payment rail. TCH is the nation’s most experienced payments company and settles more than $2 trillion each day on US-based payments networks such as wire, ACH, check, and RTP. In May 2021, 23 CEOs of leading financial institutions committed to delivering the RfP initiative in conjunction with the TCH RTP network. Today, you can find some of the deliverables in action:

While the scope of the above use cases is limited, there is a continued effort to expand RfP services as consumers and businesses alike are demanding streamlined, safe, secure, account-to-account transactions with the click of a button.

Canada’s real-time payments system, Real-Time Rail (RTR), will go live in 2022. Payments Canada has chosen Interac, a payments exchange provider, to support its RTR payment message functionality. Payments Canada is a public purpose organization that owns and operates Canada’s payments systems which include the Bank of Canada and all chartered banks operating in Canada.

The partnership with Interac will leverage the existing payments ecosystem and connect to nearly 300 financial institutions. RTR will also feature Request to Pay (RtP) which allows any individual or business wishing to receive a payment, to send a digital payment request to the debtor.

Request-to-Pay enables a further digitization of payments processing and exchange of (payment) information for various users - individuals, businesses, or public administrations - through several use-cases that can be customized to offer unique payment experiences to parties involved depending on their needs.

The following use cases are identified by SRTP as the most relevant:

For Request-to-Pay in general and for some use-cases in particular, key benefits can be identified along with key success factors to be fulfilled to further leverage these benefits.

Better Reconciliation and payment follow-up (Business and Public Administrations): Because Request-to-Pay modalities allow business and public administrations to insert themselves some payments/billing/receipts information before sending it to the payer, reconciliation will be easier for the companies due to a harmonization of the information provided. In line with a better reconciliation, the follow-up on unpaid payments will be easier as well.

Replace/ Complement current SDD: With (1) more control over the approval of any debits to the payee’s account, (2) an increased payment certainty (e.g. if combined with instant payments) and (3) more flexibility (e.g. possibility for the payer to accept or reject a payment now or at a later stage and to pay now or later and for some specific use-cases to change payment information such as the amount, due date, etc.) compared to direct debits, RTP combined with Instant SCT could progressively replace or at least complement SDD.

Increased customer experience: As an additional service offered to the payee, Request-to-Pay provides an enhanced digital journey to all the actors (individuals, business, and public administration) and also proposes end-to-end automation of the payment processes for some specific use-cases (e.g. Recurring Payments). Additional features such as Direct approval by the customer through fingerprint or PIN, flexibility to offer payment in installments /on a pre-set date or to extend payment deadlines, possibility to process large-value payments digitally can also enhance the customer experience. Authentication is a key issue as well, given that PSD2 requires a full strong authentication for each request sent (above 30€).

Exchange of information beyond transaction messages: Including additional information in the Request-to-Pay exchange such as payment receipt, invoice reference, product/merchant reference, merchant contacts, links to General terms and conditions, technical or legal information, information about return conditions, delivery notification and read notification could be a real added value of RTP, especially in comparison with the current SDD.

Payment Certainty: To be fully adopted by the payee, Request-to-Pay should provide guarantees for payment certainty; ensuring that amount will be transmitted. Payment certainty could be systematic use of SICT, the possibility to convert an RTP into a direct debit after expiration of requested payment execution date/ time, a fallback mechanism or retry in case funds are not present, methods ensuring payments irrevocability, etc. These payment guarantees could also contribute to decreasing the number of payment reminders sent to payers, the related checks as well as the number of refused collections in case of SDD.

Market penetration and end-user acceptance: A strong positioning of Request-to-Pay offering can be achieved by, for instance, providing additional features such as combining RTP with other SEPA schemes (e.g. SDD by converting unanswered RTP into direct debits, SICT for ensuring payment certainty, SEPA Proxy Lookup (Directory services interoperability within SEPA) for sharing more easily payer information such as email address, phone number, IBAN, etc., (2) Defining a good positioning of RTP against the existing SDD by highlighting the increased digitization, flexibility, instant payment, and payment certainty. Besides, there is a need for communication campaigns towards actors and to make sure everyone is equipped with the necessary devices/apps, etc.

Born out of the need to improve the customer experience and reduce friction in payments, RTP, with a dynamic that changes from push to pull, offers benefits to both the payer and the payee, reducing costs and enabling greater control and ease in the payment transaction. For these reasons, RTP is promising to be widely used soon, from consumers to merchants, in e-commerce, invoices, POS payments, and B2B and P2P payments.

Nevertheless, in Europe, preparatory work is still ongoing, as EPC stakeholders are trying to fix the priorities in terms of use cases and key functionalities. Indeed, in Europe and all regions with well-established payment services, like credit cards or direct debit, finding a specific path to ensure adoption will be a major challenge. By contrast, in emerging countries experiencing a fast transition to brand new digital payments, like India, RTP or equivalent services could quickly gain traction within the payment ecosystems.