Canadian Hydrogen Observatory: Insights to fuel…

A look into the new climate proposal from the SEC

“It’s about bringing consistency and comparability to disclosures that are already being made about climate risks, and investors seem to be today making decisions about this information, these disclosures.”

– Gary Gensler, Chair SEC

On March 21, 2022, The Securities and Exchange Commission proposed rule changes that would require registrants to include certain climate-related disclosures in their registration statements and periodic reports, including information about climate-related risks that are reasonably likely to have a material impact on their business, results of operations, or financial condition, and certain climate-related financial statement metrics in a note to their audited financial statements.

While the regulation has yet to be finalized, organizations are prepping for the sweeping regulatory requirements. The proposed timeframes for the effective application of the regulation would start in 2024 for large accelerated filers (2025 for accelerated filers).

The SEC proposed rule builds from the voluntary framework developed by the Task Force for Climate- Related Financial Disclosure (TCFD) which is used by companies and legislators around the world. The goal of the TCFD framework is to provide high-quality information on the impacts of climate change and the SEC is taking a step further striving to put more context to materiality and the resulting impacts to investors.

Although the TCFD guidance is voluntary, many regulators have turned to the TCFD for inspiration making some of the TCFD’s components mandatory, however, local regulators continue to put their own spin on how banks should be managing their climate-related risks.

It would be prudent for banking organizations to mobilize teams as more burdensome climate-related prudential regulatory requirements are expected. Beyond the SEC, the Fed has also started to prepare new guidance that would align with OCC & FDIC plans which encourage financial services organizations to understand, monitor and control the risks associated with climate change. The Fed also announced a 2023 scenario analysis activity with 6 pilot banks. During the pilot, firms will analyze scenario impacts on specific portfolios and business strategies to assess the resilience of financial institutions under different hypothetical climate scenarios.

And locally in New York, the New York State Department of Financial Services proposed its own guidance that would expand on its principles regarding climate change. The DFS proposition would apply to DFS regulated entities of all sizes and would basically follow most of the FBA’s principles which only concern entities with $100 billion in assets. Even with the sensitive political environment in the U.S., we see a wave of regulation and prudential-born climate-related activities coming to the U.S. which will require significant attention and resources within the financial services industry.

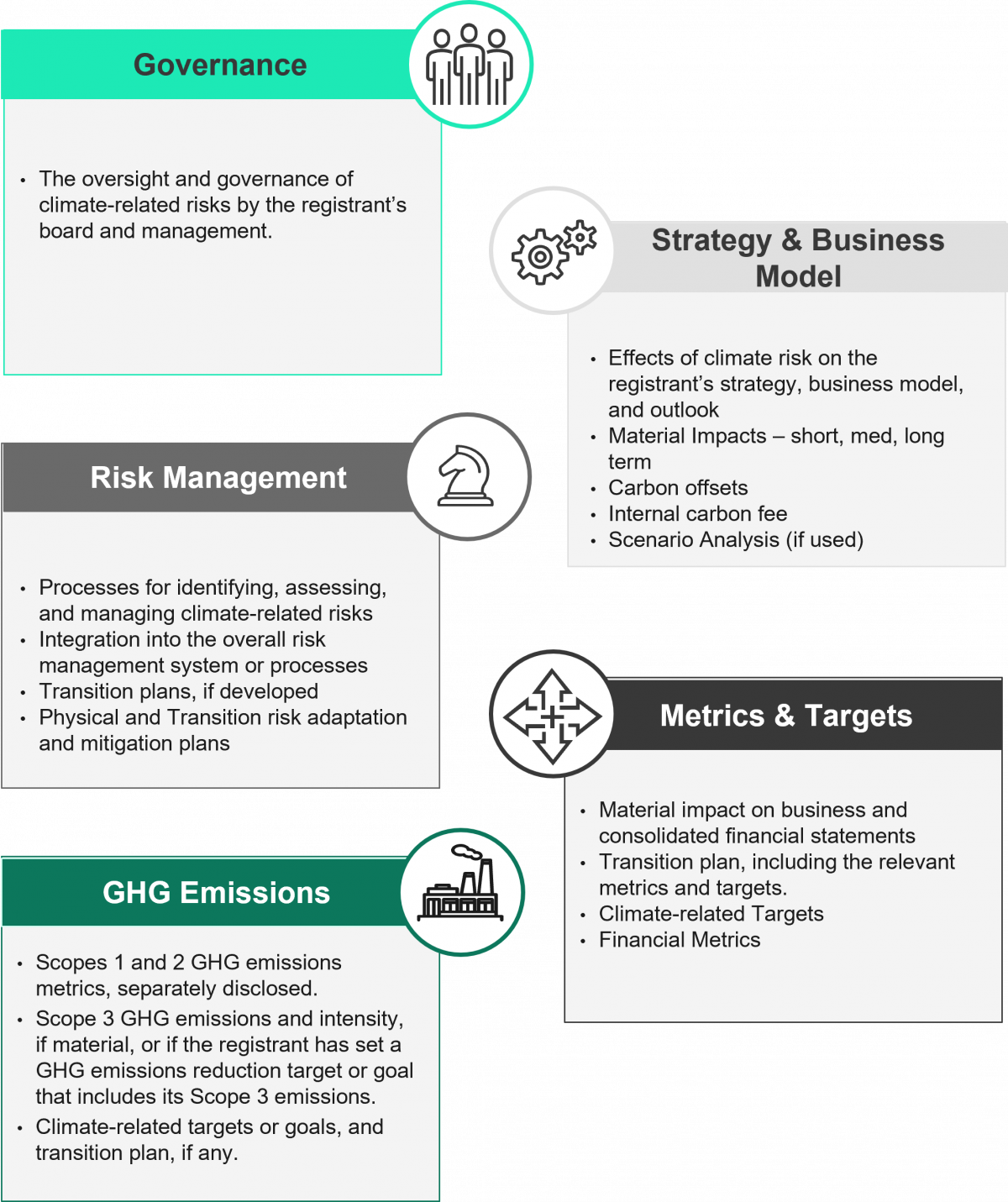

Under the proposed requirements, companies will be required to disclose information within 5 key pillars; Governance, Strategy & Business Model, Risk Management, Metrics & Targets and Risk management. This should be disclosed in its registration statements and periodic reports, such as on Form 10-K.

Sia Partners offers robust support to our clients to accelerate the move to compliant reporting, aligning your Climate Risk capabilities to globally recognized standards and regulatory taxonomies.