Carbon Accounting Management Platform Benchmark…

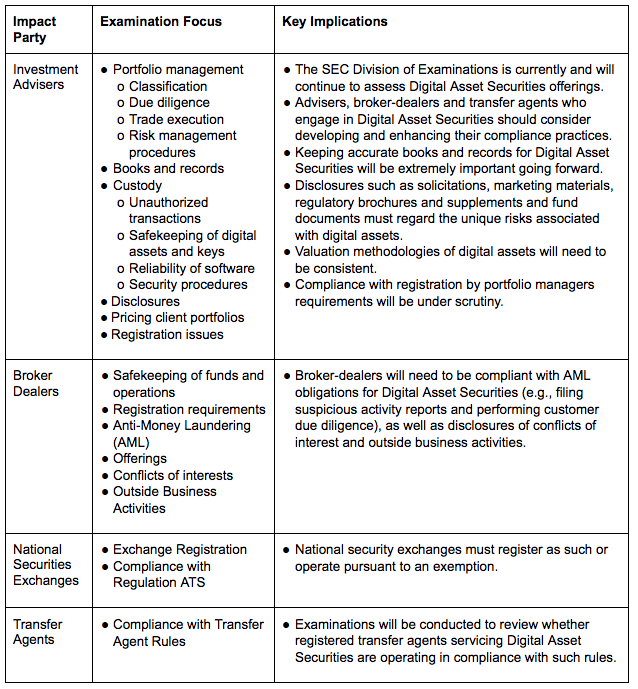

In February 2021, the SEC Division of Examinations issued a risk alert on Digital Asset Securities that determined the offering, selling, and trading of digital assets as securities present unique risks to investors. Their division's examination will scrutinize all who are involved in these products

On February 26th, 2021, the SEC Division of Examinations issued a risk alert on Digital Asset Securities ( digital-assets-risk-alert.pdf (sec.gov)). The Division of Examinations concludes that the offering, selling, and trading of digital assets as securities present unique risks to investors.

The division plans to launch an examination into Digital Asset Securities, which will scrutinize investment advisers, broker-dealers and transfer agents who are involved in these products. The announcement comes as more securities industry participants seek to engage in digital asset-related activities.

Considering recent SEC enforcement actions and the SEC Risk Alert highlighting digital assets, investment advisers, broker-dealers and transfer agents that engage in digital asset-related activities should evaluate the adequacy and completeness of their internal controls and overall regulatory compliance across the following areas:

Sia Partners has hands-on experience assisting financial services clients with their needs in cryptocurrency and digital asset compliance. Sia Partners is positioned to support organizations with their Digital Asset Securities risk and compliance across the following:

The SEC heightened regulatory focus on digital assets will demand tighter compliance and operational controls for the various market participants. It is critical that market participants focus on their end-to-end processes related to digital assets, the adequacy and completeness of their controls, and the enhancement of compliance procedures/policies to align with latest regulatory guidance. Sia Partners is positioned to support your organization in related uplift activities to ensure your digital asset business is consistent with industry best practices.

The Division of Examinations recommends that advisers, broker-dealers and transfer agents who engage in Digital Asset Securities develop and enhance their compliance practices.

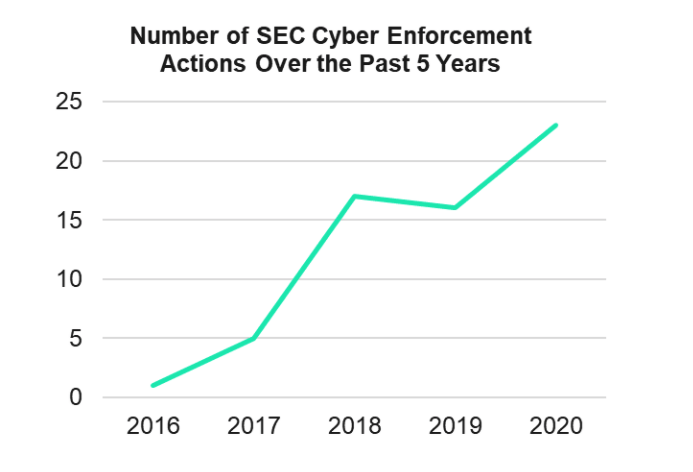

Recently, the SEC has cracked down on industry participants they felt have violated existing regulations.

On February 17th, 2021, the SEC charged digital asset application Coinseed, Inc. and its co-founder and Chief Executive Officer, Delgerdalai Davaasambuu, in connection with Coinseed's fraudulent offer and sale of Digital Asset Securities.

On December 23rd, 2020, the SEC filed a cease and desist proceeding against Texas-based blockchain startup Tierion, Inc., for conducting an unregistered offering of securities ("tokens"). Tierion has agreed to return funds to investors, pay a $250,000 penalty and disable trading in its "tokens".

On December 22nd, 2020, the SEC filed an emergency action and ordered an asset freeze against Virgil Capital LLC and its affiliated companies in connection with an alleged securities fraud relating to Virgil Capital's flagship cryptocurrency trading fund, Virgil Sigma Fund LP. The SEC alleges that the fraud was directed by Stefan Qin, who owns and controls Virgil Capital and its affiliated companies.