Canadian Hydrogen Observatory: Insights to fuel…

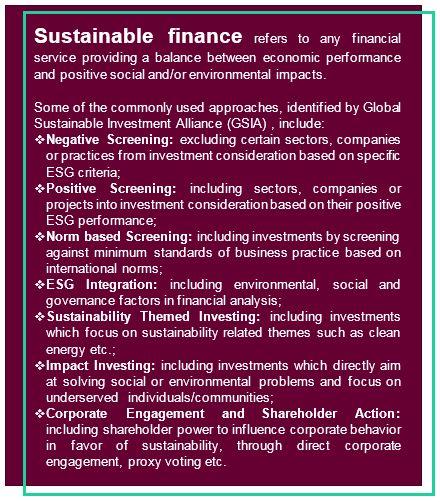

Sustainable finance is coming to the forefront of the financial services industry, as evidenced by the growing rate of sustainable finance market over the years. Global sustainable investment assets reached US$30.6 trillion at the start of 2018, a 34% increase from 2016.

In light of this growing momentum, there has also been an accelerating regulatory focus to integrate sustainable finance in the mainstream framework of governments, multinational corporations and predominantly the financial services industry.

This article looks back at the growth of the sustainable finance market, notably the key trends that emerged in 2019, dwells into Europe’s role as the undisputed leader and highlights the overall direction the industry is taking in the Asian markets. It also addresses what the industry may expect in 2020 and what can help catalyze the growth further in this ever evolving landscape.

[1] 2018 Global Sustainable Investment Review (GSIR) report by Global Sustainable Investment Alliance (GSIA)

Sustainable finance has developed into one of the fastest growing markets in global banking and asset management. Since the Paris Agreement was signed in 2015, there has been high mobilization within the financial services industry to include sustainable investing in the overall mandate of the industry. This growth is not only limited to the market participants but encompasses regulators and policy makers across the globe. The financial services industry as a whole is recognizing the long-term benefits and the opportunities provided by transitioning to a more sustainable economy, and is adapting its operating frameworks to meet these new expectations.

According to the latest reports from the Principles for Responsible Investing (PRI) database, the number of policy interventions related to ESG issues (voluntary or mandatory) has been increasing. There are now over 730 hard and soft-law policy revisions, across 500 policy instruments relating to ESG factors [2]. In relation to the market participants, investors are heeding the call for responsible investing. By June 2019 the number of signatories to PRI has grown to 2450, representing US$82 trillion in AUM, compared to 63 signatories in 2006 when the initiative was launched.

In terms of the size of sustainable investment funds, there is a continuous growth trend across all asset classes. According to the International Monetary Fund’s (IMF) latest report in October 2019, ESG funds account for around US$850 billion in assets (Illustration 2).

Moreover, total assets invested in ESG ETFs and ETPs listed globally rose 9.97% in January 2019, to reach a record level of AUM of US$25 Billion [3] (Illustration 3).

Source: ETFGI Research Data

Equity funds have been early adopters of ESG factors as compared to fixed income. However, sustainable fixed income investing is also gaining momentum with the issuance of multiple sustainability linked bonds. Green bonds currently are the fasted growing segment of ESG linked bonds (Illustration 4).

[2] PRI’s (Principles for Responsible Investment) regulation map

[3] ETFGI Report on ESG ETFs and ETPs

Europe continues to be at the forefront of sustainable investing with the biggest pool of sustainable investing assets globally in 2018 (Illustration 5). Sustainable investing has been broadly adopted in this region and has reached a higher level of maturity compared to any other region.

Source: Global Sustainable Investment Review 2018 by GSIA

Moreover, in view of a perceived lack of global leadership in integrating sustainable finance in the mainstream frameworks of financial institutions, European regulators have taken the lead to develop a comprehensive action plan to direct more capital towards ESG initiatives and encourage the financial industry to operate in a way that reduces environmental risks.

On May 24, 2018, the European Commission released the Sustainable Finance Package - a set of legislative proposals focused on financing sustainable growth. These measures were part of the European Commission Action Plan of March 2018 [4] and cover the following key guidelines:

1. Unified EU classification system

In June 2019, a Technical Expert Group (TEG) from the European Commission issued a report [5] which sets out the basis for a future EU taxonomy in legislation. It details the methodology for evaluating substantial contribution of an activity on climate change and how to classify financial products as “green” or “brown”. Following the assessment of open feedback on their methodology, the TEG provided their final recommendation to the European Commission last year. In December 2019, the final recommendations from TEG were formally accepted by the European parliament in the form of legislation which defines an EU-wide classification system for sustainable investments. It sets out a framework for what can be classified as an “environmentally sustainable economic activity” [6].

2. Investor's Duties and Disclosure

The proposal aims to introduce consistency and clarity on how institutional investors, asset managers or advisors should integrate environmental, social and governance (ESG) factors into their investment decisions. It will also require asset managers and institutional investors to demonstrate how their investments are aligned with ESG objectives and disclose how they comply with their duties. In March 2019, the European parliament outlined new regulation on disclosure requirements which is built around three pillars:

3. Low-carbon benchmarks

The proposal aims to create a new category of benchmarks of standard indices, which will help companies to differentiate their carbon footprint between low-carbon benchmark and positive carbon benchmark. In September 2019, the TEG published its final report which recommends a list of minimum technical requirements for the methodologies of ‘EU Climate Transition’ and ‘EU Paris-aligned’ benchmarks. It also recommends a standard format to be used for reporting ESG disclosures.

4. Impact on MiFID II and IDD with EU Action Plan

The proposal aims to provide a legal basis for how ESG considerations must be taken into account in advice given by investment firms and insurance intermediaries. On April 30th, 2019 EIOPA and ESMA provided their technical advice to the European Commission on integrating sustainability risks and factors in MiFID II and Solvency II.

In addition, a number of voluntary guidelines have been issued. For instance, Network for Greening the Financial System (NGFS), issued in October 2019 a sustainable and responsible investment guide for central bank portfolio management following their publication of first comprehensive report in April 2019. [7]

[4] European Commission Action Plan

[5] TEG Report on EU Taxonomy

[6] Sustainable finance: Commission welcomes deal

[7] NGFS Guide for Central Banks’ Portfolio Management

Few countries in the Asian market, such as Japan, were amongst the early adopters of ESG investing. This still remains true as sustainable invested AUM grew by 300% between 2016 and 2018 in Japan. Now, sustainable investing is gaining more traction in other Asian countries as well, with a number of new developments over the last couple of years. This is evident by the strong proportional growth in UN PRI signatories between 2016 and 2018 [8] in Asia (Illustration 6).

Source: UN PRI, UBS, as of August 2019

In addition, China is now the second biggest green bond market in the world, with total issuances reaching US$42.8 billion at the end of 2018, a 12% year-on-year rise (Illustration 7).

Source: IMF Global Financial Stability Report - October 2019

Considering the fragmented nature of the Asian market compared to the EU, local supervisors and regulators have unique and different approaches towards legislating sustainability solutions. Big contributors to high carbon footprint like China, India etc. are now moving in the direction of mandating the incorporation of ESG strategies in investment decisions as opposed to voluntary guidelines in the past.

For instance, the Asset Management Association of China issued official guidelines for green investment in November 2018. These cover investment methodologies, investing strategies, regulations, benchmarks and evaluation. China will also make it mandatory for listed companies to disclose environmental information by 2020 in line with Guidelines for Establishing a Green Financial System.

Moreover, Chinese stock exchanges have joined the UN Sustainable Stock Exchanges initiative. Following its mainland China counterpart, the Stock Exchange of Hong Kong made considerable changes in December 2019 to its ESG disclosure requirements, which will be effective after July 2020. These modifications not only make it mandatory for listed companies to disclose on ESG matters but explain to the exchange how they complied with their Social and Environment KPIs, among other requirements.

In Hong Kong, the Monetary Authority (HKMA) on May 7, 2019 announced at the HKMA Green Finance Forum, three sets of measures to support and promote HK green finance development [9]. These measures include:

Other jurisdictions such as Singapore, Australia have also launched initiatives to promote sustainable investing. Monetary Authority of Singapore (MAS) launched in 2019 a US$2 billion green investments program. As part of this action plan, MAS will also publish guidelines on Environmental Risk Management via a consultation paper due in Q1 2020. Australia launched its novel initiative Australian Sustainable Finance Initiative (ASFI) to recommend policies and frameworks for meeting their sustainability objectives.

Illustration 8 provides Sia Partners’ overview of the landscape of international guidelines, standards, principles, and proposals affecting various actors across the financial services industry value chain while distinguis

Conclusion

hing between the voluntary commitments and potential regulatory obligations. This is not an exhaustive list of guidelines.

[8] UN PRI, UBS data as of August 2019

[9] HKMA press release

With a growing number of ambitious roadmaps on sustainable finance within financial institutions (FI) and regulatory bodies, 2019 saw the next wave of action. ESG policy will be a major agenda item for FI’s boards in 2020 as the regulatory requirements to implement the defined guidelines will take effect from this year. European parliament will review the other two proposals on taxonomy and low carbon benchmark in 2020. If accepted, this will help mitigate some of the major challenges faced by financial institutions in Europe when incorporating or reporting material sustainability related strategies. In view of Europe’s mature agenda, other regions especially APAC need to follow suit to mitigate the existing challenges of fragmented policies, norms related to ESG across the region, as well as to continue to push the industry to realize wide commercial opportunities from incorporating ESG factors in their investment decisions. It has become essential now that regulatory interventions and market players’ active participation in growing sustainable investing should go in tandem.

Integrating ESG policies in the core business processes of FIs, including strategy, compliance, risk management and operations, require not only a deep dive into existing processes but a launch of an end to end transformation program followed by effective change management to get the desired results. Sia Partners has expertise in driving such transformation programs globally as well as experts who can help you understand the impacts of these new international guidelines on your end to end business value chain. Contact us to know how we can help you in your journey towards a sustainable future.

FABIENNE SAYARATH

Manager

+ 852 96887 6329

fabienne.sayarath@sia-partners.com

AKRITI BHATNAGAR

Senior Consultant

+ 65 8722 3692

akriti.bhatnagar@sia-partners.com