Carbon Accounting Management Platform Benchmark…

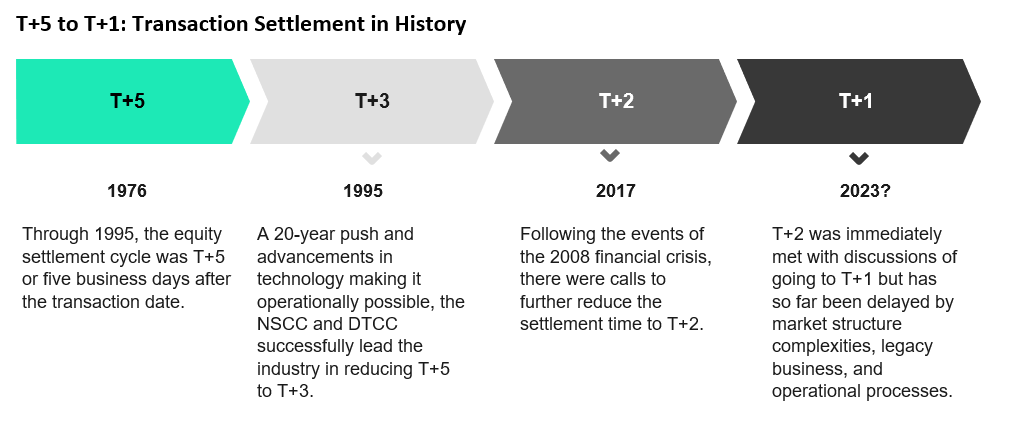

The timeline for T+1 adoption released by the DTCC (Depository Trust & Clearing Corporation) and lessons learned from previous efforts to reduce settlement periods highlight the key factors necessary for a successful transition at an industry level and the next steps firms must take.

The Depository Trust & Clearing Corporation’s (DTCC) recently released white paper, Advancing Together: Leading the Industry to Accelerated Settlement, outlines a two-year, industry-wide plan to adopt T+1. The adoption of T+1 would mean shortening the settlement cycle from two business days to one for U.S. equities.

Key benefits including increased efficiency and reduction in margin risk and volatility have supported the push for a shorter settlement cycle as outlined in our previous article on T+1. The combination of increased market volatility and value and trading limits due to the recent activity around stocks like GameStop (NYSE: GME) has caused capital requirements to support margin to increase. With the increase, costs also increase due to more liquidity needs. This has created an incentive for the industry to further decrease the time to settlement. [1] The previous shifts to T+3 and T+2 set the blueprints for how the migration should be executed.

With T+2 settlement, the securities industry has several critical processes which still largely happen at end of day on trade date or in an overnight batch cycle process. T+1 is used to clean up exceptions, breaks, book as-of trades, and much more, leading to high levels of settlement success on T+2.

For T+1 settlement to be successful the entire industry will need to get on board, meaning all processes need to move to real-time at an individual firm level, with breaks and cleanup happening on trade date, or worst case, before the market opens on T+1. With a move to T+1 settlement, failure to achieve complete and correct processing of all trades on trade date would mean that the firm would be buried in fails and other trade breaks.

Per the Securities Industry Financial Markets Association’s (SIFMA) May 4th press release on T+1, discussions with SIFMA members on the necessary steps to adopt T+1 have been ongoing since late last year and are expected to be cemented by Q3 2021, with a more definitive timeline to follow soon thereafter. [2] In preparation for the implementation, firms will be expected to be prepared and hit the ground running. A few critical actions that will establish a foundation of awareness include, establishing governance, a program management office (PMO), and conducting an internal impact assessment to align regulatory, business, and strategic objectives.

Align firms' settlement migration strategy with the proposed DTCC timeline around the move to T+1

Align Program Objectives with New Regulations

Establish T+1 Transition Program

Compare the current state to the requirements needed to facilitate a move to T+1

Sia Partners has extensive experience and a thorough end-to-end understanding of the US Securities Industry, from the Institutional Broker-Dealer, Wealth Management, Asset Management, Clearing Broker, Hedge Fund, and Prime Broker perspectives.

Our strong credentials and experience with major banks and broker-dealers on the T+2 implementation in 2015-17 would provide your firm with in-depth analysis, planning, and execution of the many challenges ahead over the next 2 years in implementing T+1.

Sia Partners has strong experience with technologies including blockchain, cryptocurrencies, and smart contracts. Our knowledge and expertise in working with these technologies span all stages of a product cycle including development, deployment, and testing.

Our experience includes delivering solutions on various open source technologies including Hyperledger Fabric, Ethereum, Corda, and Tezos, and consists of both backend and UI development.

Sia Partners has achieved considerable knowledge of the financial services space and their innovations through utilizing blockchain by working extensively with US banks, foreign banks, central banks, startups regulators, and stock exchanges. We have a successful history constructing proposals on technical architecture enhancement particular to the bank’s goals and needs.