Carbon Accounting Management Platform Benchmark…

The shipping industry is the backbone of international trade and is of major economic importance to the world economy. Shipping volumes have been continuously on the rise for centuries due to worldwide economic growth and increasing globalization.

The shipping industry is the backbone of international trade and is of major economic importance to the world economy. Shipping volumes have been continuously on the rise for centuries due to worldwide economic growth and increasing globalization. The economic weight of the shipping industry, however, implies a heavy environmental footprint due to the emission of greenhouse gases and polluting substances resulting from the combustion of diesel oil. With climate change and pollution becoming increasingly important topics on public and private agendas, and international regulations following suit, the shipping industry is gradually being forced to explore environmentally friendly options. In this Insight, Sia Partners takes a dive into the pool of available alternative fuels for shipping, evaluates their potential use, and explores why the industry has been slow to adopt durable alternatives.

Shipping is by far the most cost-effective way to move goods around the world, and consequently over 80% of worldwide trade volume is carried by sea [i]. In the case of the European Union, almost 90% of the EU’s external freight trade is seaborne while short-sea shipping and inland barge transport respectively account for 40% and 7% of total intra-EU ton-kilometers transported [ii]. The added value of EU ports is thus significant. The Port of Antwerp alone, for example, is estimated to indirectly account for roughly 5% of the Belgian GDP and 4% of total employment in Belgium [iii].

The main negative externality caused by this diesel-powered activity is the environmental degradation caused by the emission of greenhouse gases (GHG) and polluting substances, such as sulfur oxides (SOx), nitrogen oxides (NOx) and particulate matter (PM). Though water transport causes fewer carbon emissions than road and air transport per ton-kilometer, large shipped volumes over long distances cumulatively account for a large footprint nonetheless. In the EU, maritime transport and inland water navigation respectively represent around 10% and 1% of transport GHG emissions. Also, roughly 3% of worldwide GHG emissions are generated by water transportation. Without actions, GHG emissions due to shipping are forecasted to double by 2050 compared to 2010, following increased globalization and trade volumes [ii].

Beside GHG, ships are also the main emitters of SOx, NOx and PM in the transport sector. This is mostly because the shipping industry has historically been much less regulated than land transport, and marine engines have consequently been adapted to run on cheaper, lower-quality fuels with much higher viscosity. These emissions pollute the air, cause many health-related problems for exposed populations, and degrade the environment through e.g. the formation of acid rain.

Several international regulatory measures have been instituted to reduce the shipping industry’s environmental impact. Most important in this regard is the MARPOL (Maritime pollution) Convention Annex VI regulation of the International Maritime Organization (IMO), which sets limits on the emissions of SOx and NOx from ship exhaust gases and contains provisions for Emission Control Areas (ECAs) for these substances [iv]. For SOx, there is currently a global limit of 3,5% and 0,1% inside SOx ECAs (SECAs), measured as a percentage of total fuel mass. These limits are gradually reduced at fixed intervals, and in 2018 it will be decided whether the industry will be ready for a move to a global SOx limit of 0,5% in 2020 or rather 2025. The EU has already announced the policy of a 0,5% sulfur limit in all EU waters from 2020 irrespectively of IMO regulation, and a 0,1% requirement is already in place for all EU ports and inland waterways. NOx emission standards have progressively been tightened and require marine engines to have NOx emission control technologies and exhaust gas treatment depending on the date of the engine installation. The current standard (Tier III) entered into force for engines built as of 2016 and is applicable in NOx ECAs (NECAs), while the Tier II standard for engines built as of 2011 applies on a global scale. Lastly, PM content is limited to a maximum of 0,1% in ECAs.

Currently, fuel consumption in ECAs is estimated at approximately 30-50 million tons of fuel per year, which will increase as ECAs are expanded. The mostly likely candidates are along Asian shores, but public authorities worldwide are setting up their own requirements [v]. These ECA emission limits, especially for sulphur, are currently the main driver for the adoption of alternative fuels. Eventually, economies of scale will result in more competitive prices for low-sulphur fuels and lead to an increase in demand.

Besides MARPOL Annex VI, various other regulations additionally aim to stimulate the use of alternative fuels in shipping. The European Renewable Energy Directive for example demands all EU countries to ensure that at least 10% of their transport fuels come from renewable sources by 2020 [ii]. Though this directive has left a limited mark on the marine fuel sector, it has led to an increased uptake of biofuels for road transport. Another important regulation is the EU LNG Bunkering Regulation, which obliges all member ports of the so called TEN-T core network to provide LNG fueling facilities by the end of 2025, and inland ports by the end of 2030 [iii]. Furthermore, a number of international rules also aim to improve the energy efficiency of ships, such as the Energy Efficiency Design Index (EEDI) and Ship Energy Efficiency Management Plan (SEEMP) [vi].

One missing measure that would significantly speed up the adoption of alternative fuels is a global or regional market-based measure for GHG emissions in shipping. Though the EU has outlined various ambitions, there is still no carbon tax for shipping, neither is the shipping sector included in the EU Emissions Trading System.

The EU has stipulated the ambition to realize a modal shift to move respectively 30% and 50% of European road freight travelling over 300 km towards rail or waterborne transport by 2030 and 2050. Another goal is to reduce EU CO2 emissions from maritime transport by 40% by 2050 compared to 2005 levels.

Dedicated forms of financing specifically directed to speeding up the development of the alternative fuel market are also available, especially on a European level. Subsidies for R&D in alternative fuels and dedicated lending through the European investment bank are increasing in popularity. Most notable is the EU Program for the development of Motorways of the Sea (MoS) within the Trans-European Transport Network (TEN-T). This program provides capital for the development of green bunkering infrastructure along EU coastline [vii]. In 2018, a seven-million-euro European subsidy was granted to The Dutch firm Port-Liner for the construction of six of the eleven 100% electric barge ships which it will add to its fleet. Shipping range is between 15 and 35 hours, depending on the size of the lithium battery and ship. A striking fact is that loading capacity is 8% higher than fuel oil vessels of comparable size. The world’s first 100% electric barge ship will be operational in August 2018.

Of course, switching to cleaner fuels is not the only available option to make shipping more sustainable. Continuous improvements to ship fuel efficiency through innovative designs and increased engine performance also help reduce emissions. In road transport, many innovative emission abatement technologies have already proven to be a success, for instance diesel particulate filters, exhaust gas recirculation systems and oxidation catalysts. However, due to the comparatively lower quality of heavy marine fuels, these exhaust treatment systems cannot be readily deployed for the use on ships. On the other and, other technologies, such as selective catalytic reduction for NOx reduction or SOx scrubbers are readily available for the use on ships. However, these scrubber systems are very space-demanding (thus reducing cargo availability) and costly to install, with a relative purchase price increase of more than 2% (which is very unattractive in a sector with historically low margins).

Additionally, many exhaust reduction systems for SOx, NOx and PM adversely affect fuel consumption and CO2 emissions up to 2-3%, meaning increased fuel costs and carbon footprint [viii].

Non-fuel-based innovations are thus an important aspect in the green transition, but the sustainability of the shipping industry depends to a greater extent on the adoption for non-petrol fuels.

The shipping industry is of course a highly diverse sector containing many different sub-segments. In terms of types of ships and their use, a first classification must be made between cargo ships, people carriers — i.e. ferries and cruise ships — and specialist ships such as tugboats (which maneuver larger vessels), bunkering vessels (which supply fuel to ships), research vessels, military ships, fishing boats, etc. As cargo ships consume 90% of global shipping fuel [ix], these ships form the focus of this article. Cargo ships can be further subdivided per operating area into ocean going vessels, which consume 83% of global shipping fuel, coastal vessels, and inland barges [ix]. Cargo ships can also be categorized per type of goods they transport, i.e. general cargo ships, container ships, bulk carriers, and tankers.

Over the past three centuries, ships have undergone a large transformation in terms of their propulsion source. The first boats were of course propelled by manpower, after which sail ships remained the standard until the industrial revolution. The last half of the 19th century witnessed the shift from sail to coal powered steamships, which had a drastic impact on global shipping due to the elimination of weather dependence and increased transit predictability. One century later, coal was gradually replaced by marine oils, which offered increased efficiency, easier handling, and relatively cleaner combustion. Since then, gradual evolutions in terms of fuel quality and engine efficiency have taken place, but a radical change of fuel standard on a global scale has remained absent.

Today, low-priced Heavy Fuel Oil (HFO) accounts for 80% of fuel use in marine shipping, while diesel is the dominant fuel type for inland barges. HFO is a residual fuel characterized by a very high sulfur content, and is mostly used as a propulsion fuel outside ECAs [ix]. Marine Gas Oil (MGO) on the other hand is a distillate fuel which is widely used inside ECAs, and has various quality brands with different low or ultra-low sulfur contents. These fuels allow compliance with current regulations, but are significantly more expensive than HFO, and are expected to become even more so once demand spikes after the introduction of the new global emission norms. Additionally, the low sulfur distillate fuels are still petrol based, and therefore do not solve issues relating to GHG emissions, long-term depletion of oil reserves, and import dependence on petroleum exporting countries. To solve these challenges, various alternative fuels must be examined as potential solutions.

The following section presents a comprehensive comparison of the leading alternative fuels for maritime transport, based on four key criteria: environmental performance, total cost, compatibility with ships’ operational profiles, and the fuels’ supply availabilities.

Evaluation factors for comparing alternative fuels :

Assessing the potential of alternative fuels for shipping requires an evaluation of a great many factors. The main ones are of course the environmental performance of the fuel vs the total cost of using it for all stakeholders. The operational profile permitted by a fuel is a next important factor to consider, as well as widespread and long-term availability.

Evaluating the environmental performance of a fuel means conducting a life cycle assessment (LCA) which assesses all emissions from well to propeller, i.e. along the entire fuel value chain of extraction, production, transportation, storage, and propulsion. This analysis also includes an equivalent LCA for all used materials in this process. For instance, in the case of biofuels, factors to consider are the net GHG balance due to land use change, water use and GHG emissions from fertilizers. A detailed quantitative analysis is beyond the scope of this insight. The high-level environmental comparison of the studied fuels in this article does however yield knowledge and practical guidelines for the shipping industry on the most promising alternatives.

The total cost of a fuel encompasses different cost components for various parties.

Opex relates to the projected fuel cost along a certain route for a shipper, which accounts to up to half of the total operational cost in shipping [x]. Several other operational costs are also indirectly influenced by the fuel choice, such as cargo capacity (which depends on a fuel’s energy density), and leasing cost (which is higher for adapted ships.

Capex attributed to fuel choice is partially carried by the shippers – who need to pay for the retrofitting cost of adapting the engine and shipboard fuel technologies to run on the respective fuel, or for the price surplus of an adapted engine newbuild – and by the ports – who need to supply the necessary bunkering infrastructure. Transport, storage, and bunkering infrastructure also differ per fuel, and while certain fuels allow current infrastructure to be used, other fuels require construction of new infrastructure. In conclusion, fuels that can be introduced without significant modifications to current machinery and storage facilities have a capital cost advantage, especially those which can be partially blended with the current fuels to allow for a gradual development of the necessary infrastructure, steady supply, and technologies.

A ship’s operational profile is another important factor when considering a fuel type, as it determines requirements with regards to range, speed, power, etc. The area of operation of the ship also influences the fuel choice through e.g. the temperature operability of a fuel and the time spent in and out of ECAs. For example, ships who spend more than 30% of their operating time in an ECA, surplus costs of different fuels are recovered within several years through fuel cost savings and savings of other compliance measures (e.g. scrubbers). With the anticipated stricter global emission limits, this payback time will even shorten [i,xi].

Finally, widespread, long-term, and steady availability of supply of a fuel, as well as adapted bunkering infrastructure at the served locations are factor shippers need to consider in order to choose an alternative fuel.

Overview of alternative fuels

The above figure is a graphical categorization of the alternative fuels to HFO and MGO discoursed in this insight, which all offer increased environmental fuel performance. This article focuses in-depth on LNG, biomethane (bio-gas), electricity and hydrogen.

Gaseous fuels like LNG (Liquid Natural Gas) and CNG (Compressed Natural Gas) are derived from natural gas, LPG (Liquefied Petroleum Gas) can be a by-product of both petroleum and natural gas, and biogas is obtained from bio-waste.

Overall, the use of gaseous fossil fuels drastically reduces emissions of SOx (up to minus 100%), NOx (minus 85%) and PM (minus 95%) compared to liquid fossil fuels, while GHG emissions are only reduced to a limited extent (~20%) [v]. From a cost perspective, NG originated fuels have the great advantage of being much less costly than MGO and even HFO per unit of energy, though the reduced operating cost (of up to -50%) is offset by a much higher (+30%) ship price for gas fueled ships [i]. NG reserves are also estimated to be much vaster than oil reserves [ii]. The security of the fuel source in Europe is moreover high due to the favorable locations of these reserves for the European market (e.g. in Norway or Russia). On the downside, gaseous fuel storage requires much more space onboard ships than liquid fuels for the same energy content, with LNG requiring double the space and CNG up to five times as much as fuel oil [xii]

LNG

Of all alternative fuels currently on the market for use in shipping, LNG has had the most substantial uptake over the past decade. The LNG shipping industry debuted in Norway at the start of the new millennium, and has mostly been adopted for use by ferries, platform supply vessels, and tug boats, but also by some containerships, gas carriers and oil/chemical tankers, mostly in Europe but with increasing interest in America as well. Though not a silver bullet due to still relevant GHG emissions and the depletable fossil fuel nature of the fuel, LNG is currently the most promising alternative in the short and medium term, especially for short and medium range shipping applications.

As of now LNG represents roughly more than 1% of total global maritime fuel consumption, but a strong industry growth for this fuel is expected to change this [v]. LNG is preferred over CNG and LPG in shipping, mostly due to its high energy density, which makes it the gaseous fuel of choice for the shipping industry.

The lower price of LNG compared to LPG – which could make use of existing infrastructure – is also an advantage.ix, Technologic development of LNG for shipping has now eliminated many of the initial drawbacks – such as methane slip and safety onboard. Furthermore, LNG fuel systems have been adapted to a wide range of applications. Finally, LNG bunkering infrastructure and LNG availability are becoming increasingly widespread, especially in countries where governments actively support this development or where private initiatives drive for change (e.g. Port of Antwerp).

As with the other gaseous fuels, one of the main hurdles for ship builders and shippers to embrace LNG is the high retrofitting cost required to allow ships to run the fuel. Because of this, many newbuilds are now being designed as “LNG ready”, meaning that they run on classic fuels, but can adapt to LNG at a much lower cost in the future. This presents a solution for shippers who still await short-term elimination of market barriers but nevertheless want to prepare themselves for a future switch. Others immediately order LNG retrofitted ships when the barriers to LNG do not pose an issue, such as absence of bunkering infrastructure at the served ports or loss of cargo space and reduced range.

Biofuels are fuels derived from renewable biomass resources and offer a potential solution to move away from fossil fuels in the long term. The list of available biofuels on the market grows continuously, and experiments with potential feedstock are conducted in an equally diligent manner. Since the start of the millennium, world biofuel production has increased by over 800% [v]. Guided by favorable regulations, this increase is mostly to be attributed to the energy sector and road transport sector, but the shipping sector has so far failed to follow suit.

Different types of biomass can be used as feedstock for biofuel: 1) edible crops such as sugar cane, palm oil, soy (which introduces competition with the food sector); 2) non-edible crops such as waste (which is limited in supply); and 3) crops harvested on marginal land or even in water, such as algae. Exhaust gases of biofuel combustion are significantly cleaner than diesel and depending on the land used for growing the biomass, they can be almost carbon neutral. They are also readily biodegradable and pose no risk to marine environments in case of accidental spills. Additionally, biofuels can be derived from various biomass feedstocks and can be locally produced with proximities to ports [xiv]. Liquid biofuels require little retrofitting and many of them are suitable for blending with conventional fuels. They are also relatively safer due to a high flashpoint and a non-toxic nature.

There are two critical issues that currently limit large scale adoption of biofuels: high fuel cost and doubts pertaining to the sustainability and security of supply. As the production process of producing biofuels is far more cumbersome than that of fossil fuels, biofuels are sure to keep their cost handicap until the introduction of some form of carbon taxing in shipping, though costs are nevertheless anticipated to drop dramatically as the sector modernizes and supply increases. On the supply side, securing the necessary amounts of biofuels to power an entire industry in a sustainable manner poses a huge challenge. To illustrate, the land surface required for sourcing the 2013 global marine oil consumption of 300 M-tons based on today’s technology would be slightly larger than 5% of total current agricultural land [i]. Given global environmental issues as mass deforestation, this thus presents an obvious hurdle for future development of biofuels. Innovative developments in the sector however, e.g. the use of algae for biofuels, aim to remediate this issue.

Examples of liquid biofuels include biodiesel (FAME), hydrogenation derived renewable diesel (HDRD), and bio-methanol, the last of which can be made as a byproduct of biodiesel and other biomasses. Biodiesel, of which the chemical properties make it mostly suitable for medium-speed engines, is already used by the Italian Navy’s offshore patrol vessels, and by a Maersk container vessel. HDRD is a fuel which employs the same feedstock as biodiesel but has a different processing method and chemical composition. With a higher performance than biodiesel on aspects such as low-temperature operability, this fuel has been used in a 50-50 blend with petroleum diesel by the US Navy.

Biomethane

Biomethane – also called biogas or bio-LNG – is the renewable counterpart of LNG, which can be derived from various types of bio-waste through anaerobic digestion. Chemically identical to LNG, it can be blended with fossil LNG and requires the same fuel systems and infrastructure. Biogas can be produced locally almost anywhere on earth and has the potential to be almost carbon neutral from well to propeller. It is therefore a high-potential alternative fuel for a gradual fade-in from fossil LNG in the long-term. However, current limited availability and high price imply that this fuel source is by no means ready for a large industry adoption yet.

Other fuels which have received attention as alternative fuels for shipping are methanol and its derivative dimethyl ether (DME). Both of these fuels reduce lifecycle NOx and SOx emissions and are price competitive with MGO [xv]. Methanol requires little ship retrofitting and is already employed as a dual fuel by ferry operator Stena Line. Methanol can be produced from natural gas, coal, or biomass. As the exact feedstock significantly impacts the GHG performance of the fuel, only bio-methanol offering a potential improvement as compared to conventional fuels. DME, which is dehydrated (bio)methanol, can also be used as a dual fuel in diesel engines and has an energy density superior to that of methanol, and though non-toxic, clean burning and sold at relatively competitively prices. However, this fuel is still in an early R&D phase without a vast market supply in place and has consequently not yet been adopted on a large scale.

Electricity

With electric road transport slowly taking off in many parts of the world, electric propulsion for ships can be considered a logical next step. However, the main drawbacks of electric transport remain the high cost of batteries, limited range, and the space requirements for the batteries. This obviously limits its use in the low-margin shipping sector, where long ranges of operation and maximum ship space utilization are often primary requirements. However, electric power does have potential application for hybrid cargo ships with operations primarily within ECAs, or for vessels operating along short routes and with frequent stops, such as tug boats, offshore service vessels and ferries.

In 2017 the world’s first full electric cargo ship was launched in Guangzhou. After a two-hour charge, the range is set to 80km and speed is up to 12.8 km/h. Though this range limit does not allow for long distance journeys, it suffices for sort distances in ECAs. It must be noted that the GHG savings of electric propulsion strongly depend on the electricity mix used to generate the electricity.

Hydrogen

Hydrogen is a fuel source which can be obtained from the electrolysis of water or by reforming natural gas. Though the only substance emitted by a hydrogen powered vehicle is water vapor, production and transportation of hydrogen do have a significant carbon footprint. This is due to the highly energy intensive practice of electrolysis of water. As a result, for a typical energy mix containing fossil fuels, well-to-propeller GHG emissions for hydrogen from electrolysis exceed those of oil-based fuels. Sourcing hydrogen from natural gas on the other hand can be done at roughly half the cost of electrolysis, while GHG emissions during production are also inferior with current electricity mixes [xvi]. Another disadvantage of hydrogen is its low energy density, which requires more than 7 times the storage space than HFO for an equivalent energy output, even though hydrogen has a very high energy to weight ratio [xvi]. These factors, combined with the price disadvantage of hydrogen as a fuel and its early development stage, imply a lacking application in shipping so far. Neverhteless, in 2017, ‘Hydroville’ made its maiden voyage in Antwerp, the world’s first passenger vessel powered by hydrogen in a diesel engine.

Market barriers and challenges :

With all the possible alternatives to polluting HFO, it is easy to wonder why none of the above mentioned alternative fuels have been adopted by the shipping industry on a large scale. The explanation lies in several barriers and challenges that inhibit deviation from the status quo.

A first difficulty is the information asymmetry which results from the complex nature of comparing the wide variety of alternatives over a large spectrum of interdependent factors, which requires a great deal of data, transparency along the entire value chain, and complex modelling. In a sector with low operating margins and high investments in ships with long life cycles (around 25 years [v]), it is understandable that few players want to commit to an alternative solution under high amounts of uncertainty. Therefore, most of the applications of alternative fuels in shipping have been in R&D projects or in tests by first-movers with favorable connections to a certain fuel.

A second major hurdle to the uptake of alternative fuels is the either comparatively higher cost of the fuels (e.g. biofuels), or the high retrofitting cost for running on relatively cheaper gaseous fuels, which thus limits economic incentives of switching from cheap HFO. However, this cost barrier is expected to fade from 2020 onwards, with the advent of stricter global emission norms. Economies of scale should in the long-term result in a decreased cost of biofuels and an increased access to capital for retrofitted ships that spend most their time in ECAs. Full price competitiveness of low carbon alternatives in the short- and medium-term can however only be achieved if GHG pollution in the shipping industry is being penalized by a set of carbon taxing measures.

The complex stakeholder structure and the international nature of maritime shipping creates a third market barrier which explains why alternative solutions have mostly been deployed locally under proprietary ownership. Many interdependent stakeholders – i.e. ship owners, ship operators, port authorities – each differently influence the choice of the fuel used onboard the ship fleet, driven by individual financial incentives and sustainability agendas. For example, ship builders and engine manufacturers influence the fuel choice by deciding on propulsion and abatement technologies onboard ships in the order fulfilment process. Next, the shipping operators, who either own or lease ships, order the fuel which is compatible with the ship’s propulsion technology and influence the fuel demand. Then, port authorities and terminal operators are responsible for providing necessary fuel bunkering infrastructure and fuel security at the ports.

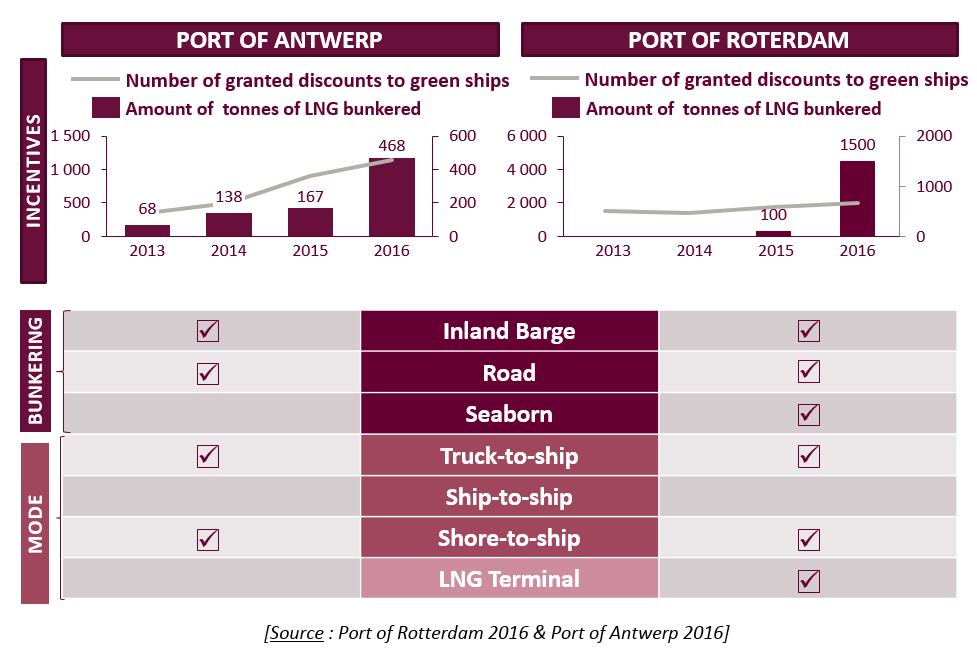

For an alternative fuel to be adopted on a large scale, especially in an international context, cooperation between these various stakeholders is thus essential. If not, the so-called “chicken-egg” situation will persist, where operators do not opt for alternatives as long as the infrastructure at ports is not at par with current bunkering infrastructure. Simultaneously, port authorities and terminal operators will not invest in new bunkering infrastructure as long as demand is not sufficient. The chicken-egg dilemma will continue to exist as long as important stakeholders in the value chain do not take of a first mover’s role. The port of Antwerp has for instance introduced an incentive scheme in 2012 which consists of discounts on harbor charges (up to 15%) based on ships’ Environmental Ship Index (ESI).

The figure above demonstrates how the volume of LNG bunkering at Port of Antwerp has consequently increased the past years. The port of Rotterdam has gone a step further and combines both incentives and penalties for “green ships”, with respectively up to 30% discount or 10% surplus on port fees.

As displayed in the figure, LNG bunkering facilities are available at Europe’s two largest ports, offering services to inland barges, trucks and sea-going vessels. This increases the ports’ service offering and confirms their role as the area’s key transport hubs. Depending on the available facilities and ship size, bunkering is done on-shore at the harbour, via delivery by truck, or via bunkering vessels.

The shipping industry has a range of solutions at its disposal to decrease its environmental impact. Abatement technologies and low-sulfur marine fuel oils help reduce the emission of polluting particles. Various alternative fuels are suitable for different uses, and each offer specific environmental benefits compared to HFO. However, every alternative also has its own downsides, and there is no silver bullet solution. This implies that, there is a need for more international governance that will allow the industry to shift ‘en masse’ to an alternative. Different solutions will continue to be applied depending on the context, which will lead to a diversified fuel mix in the future. As with the recent surge of LNG use in shipping, the transition to alternative fuels will mostly be gradual, though external disruptions by the likes of stricter global emission norms could speed up the uptake.

New solutions will also make headway. Electric propulsion will be adapted in routes with short distances and frequent stops. Next, (bio-)LNG is showing further promise for the medium-term, and biofuels are expected to be ever relevant due to the ability to blend with diesel and the long-term necessity to move away from fossil fuels and increase security of supply. This will make current solutions such as methanol and LNG – which have identical bio-counterparts – even more attractive. The alternatives that will acquire market share will be those that can guarantee both sustainable supply and competitive prices.

The shift to alternative fuels will necessarily require short-term investments by ship builders and port authorities, and depending on the type of fuel, operating costs can decrease/increase. Though alternative fuels will mostly develop locally at first, as was the case with LNG in Norway or methanol in Sweden, a coordinated international approach between different ports needs to be adopted for providing necessary fuel bunkering infrastructure. The international cooperation between leading container ports to ensure harmonized LNG standards proves that the private sector is already making the first steps to promote cleaner fuels.

Under current regulations the industry’s primary focus is compliance to emission norms inside (S)ECAs, leading to a use of dual fuel technologies that allow operators to switch fuels when entering or leaving an ECA. MGO has become a popular compliance fuel, while LNG has also enjoyed a strong uptake in recent years due to the fuel’s cost competitiveness. As global warming rises on public agendas, ECAs will expand, and the global emission limit will become stricter. The EU has already proven to play a key role in the energy transition for the transport sector by among other things subsidizing LNG bunkering projects and instituting strict emission standards. A combination of the carrot and the stick as the most potential, as proven by Norway’s successful NOx shipping scheme. The scheme combines emission capping regulation with subsidies for capital intensive investments such as bunkering activities. Finally, the introduction of a market-based approach via a tax or (carbon) trading system – through which the polluter pays – could make public support schemes budget neutral. Such initiatives furthermore bring private stakeholders together with governmental institutions for a further acceleration of alternative fuel development and uptake.

Sia Partners believes the move towards a greener shipping industry relies on the combination various axes.

Emission Control Areas must expand on a global scale to encompass all major shipping routes and setting up an international cap-and-trade carbon emissions system for shipping will provide market incentives to the transition while maintaining a level playing ground. The public sector can furthermore support the transition by investing in R&D and bridging the information asymmetry gap.

Ports must be first movers to provide required bunkering infrastructure and financial incentive schemes for “green” ships, which will stimulate retrofitting activity. In this, they must be aided by national and supra-national governments, with only minimal market distortion as a result. To accelerate such initiatives globally and stimulate network effects and knowledge exchange, a consortium of the largest ports with commitments to sustainability can furthermore be set up.

Next, because ships have a long lifecycle, shippers and ship builders will need to step up to the plate and make the necessary investments to retrofit ships. Payback for these investments has already proven to be competitive, as long as the ship’s operational profile permits the use of alternative fuels.

Finally, the upstream industry for the provision of alternative fuels must follow suit, with continued efforts in R&D to assure well-to-wheel sustainability of the developed solutions, and a combination of decentralized sourcing and production with volume economies to ensure supply security and cost reduction.

Overall, a combination of alternative solutions will be taken up both in the medium and long term in order to fully move to carbon- and emission-free shipping that is independent on fossil-fuels. For this, focus must be on scaling up the most promising alternatives, while maximizing efforts to ensure flexibility by design in a continuously evolving field.

[i] DNV GL, 2014. Alternative fuels for shipping. DNV GL Strategic Research & Innovation Position Paper 1-2014.

[ii] European Commission, 2016.

[iii] Port of Antwerp, 2016.

[iv] Dieselnet, 2016. Emission Standards : IMO Marine Engine Regulations.

[v] DNV GL, 2015. LNG as Ship Fuel: Latest developments and projects in the LNG industry.

[vi] IMO, 2016, Low carbon shipping and air pollution control

[vii] European Commission, 2017, Motorways of the Sea

[viii] McGill R., Remley W., Winther K., 2013. Alternative Fuels for Marine Applications. Technical report. A Report from the IEA Advanced Motor Fuels Implementing Agreement.

[ix] JRC Technical Report, 2016. Alternative Fuels for Marine and Inland Waterways.

[x] Ecofys, 2012. Potential of Biofuels for Shipping. BIONL11332.

[xi] Germanischer Lloyd, 2013. Study on Standards and Rules for Bunkering of Gas-Fuelled Ships: Final report.

[xi] American Clean Skies Foundation, 2012, Natural Gas for Marine Vessels. U.S. Market Opportunities.

[xiii] Kjartansson, S., 2011. A Feasibility Study on LPG as Marine Fuel. Chalmers University of Technology.

[xiv] Ecofys, 2012. Potential of Biofuels for Shipping. BIONL11332.

[xv] DNV GL, 2016. Methanol as a marine fuel: Environmental benefits, technology readiness, and economic feasibility, 2015-1197, Rev. 2.

[xvi] DNV GL, 2015. The Fuel Trilemma: Next generation of marine fuels. DNV GL Strategic Research & Innovation Position Paper.

- Corbett J., 2004. Marine transportation and energy use. Encyclopedia of Energy. pp 745–758. Elsevier, New York.

- Thomson H., Corbett J. & Winebrake J., 2015. Natural gas as a marine fuel. Energy Policy 87 pp 153–167.

- Lloyd’s Register, 2012. LNG‐Fuelled Deep Sea Shipping – The Outlook for LNG Bunker and LNG‐Fuelled Newbuild Demand up to 2025.

- DNV GL, 2014. Alternative fuels for shipping. DNV GL Strategic Research & Innovation Position Paper.

- Vanem E., Mangset L., Psarros G., Skjong R., 2012. Fan integrated Life Cycle Assessment model to facilitate ship eco-design. Advances in Safety, Reliability and Risk Management, Taylor & Francis Group, London, ISBN 978-0-415-68379-1.

- Pawlak M., 2015. Analysis of Economic Costs and Environmental Benefits of LNG as the Marine Vessel Fuel, Solid State Phenomena, Vol. 236, pp. 239-246.

- Van Der Graag P., 2012. Analysing Challenges of Producing Bio-LNG and building the Infra for it.

- Rijksoverheid Nederland, 2017, The Netherlands to receive European grant for infrastructure

- China Daily, Fully electric cargo ship launched in Guangzhou