Canadian Hydrogen Observatory: Insights to fuel…

Is your firm on board the Virtual Financial Advisor train? New technologies and changing customer preferences have created opportunities for a new approach to wealth management.

The traditional financial advisor model was built around the personal connection and long-standing relationship between an advisor and each of their clients. In recent years, however, advisory models have undergone a seachange. New technologies and changing customer preferences have created opportunities for a new approach to wealth management. The geographical barriers within the traditional model can be replaced in an emerging virtual landscape, with some of the largest wirehouses and advisory firms introducing call center based advisory offerings.

The aftermath of the COVID-19 pandemic, coupled with pre-existing trends like generational shifts and technological developments have created conditions that radically transform the financial advisory landscape.

These trends point toward an opportunity for firms that move away from the traditional FA model toward the more expeditious and self-reliant investment services of the new virtual model.

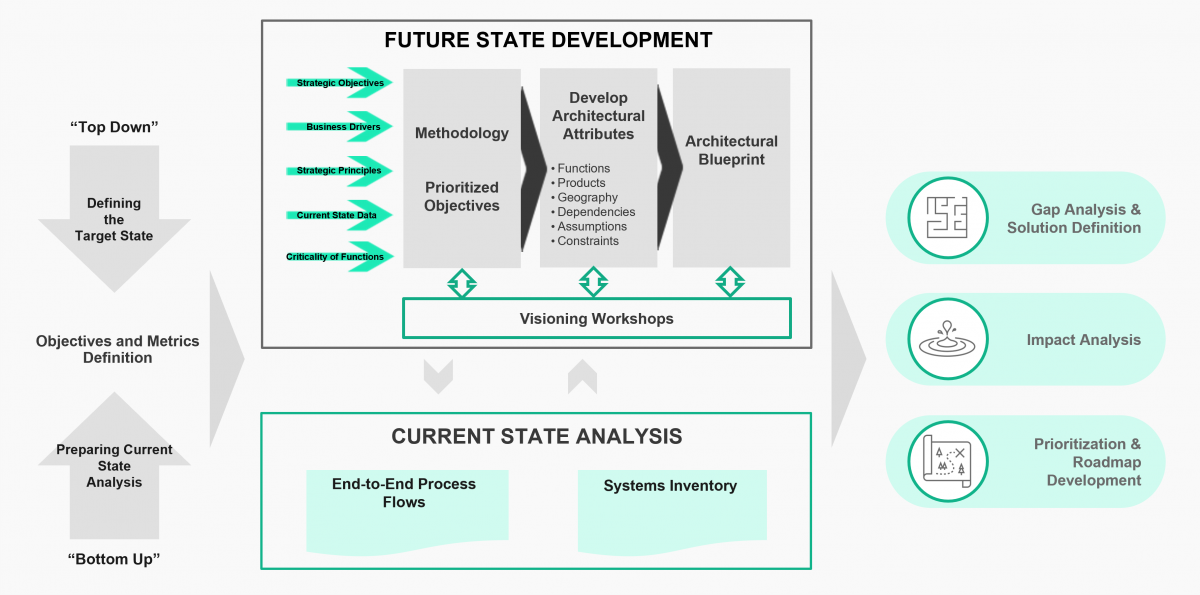

Virtual advisory has become a worthy competitor of traditional advisory due to a combination of existing capabilities. Sia Partners creates an operational diagnostic which can be curated to the business type and creates a detailed business case to substantiate a digital transformation plan. The model is broken into three phases:

In addition, the COVID-19 pandemic fundamentally altered the service offerings of Wealth Management firms and geared them towards utilizing virtual advisory to a greater extent. The pandemic, combined with the capabilities of various remote tools such as Zoom and Webex, allowed for virtual face-to-face meetings; elevated online banking platforms, virtual signing tools, and cloud-based drop boxes mimics the in-office experience of meeting with an advisor from the convenience of the client's home — all of which have allowed virtual advisory to become a growth in demand practice.

Virtual call centers create significant value for Wealth Management institutions:

Overall, the virtual call center model allows firms to better route and align FAs, resulting in productivity rates that are greater than conventional models, ultimately resulting in improved customer service, for which clients will pay a premium.

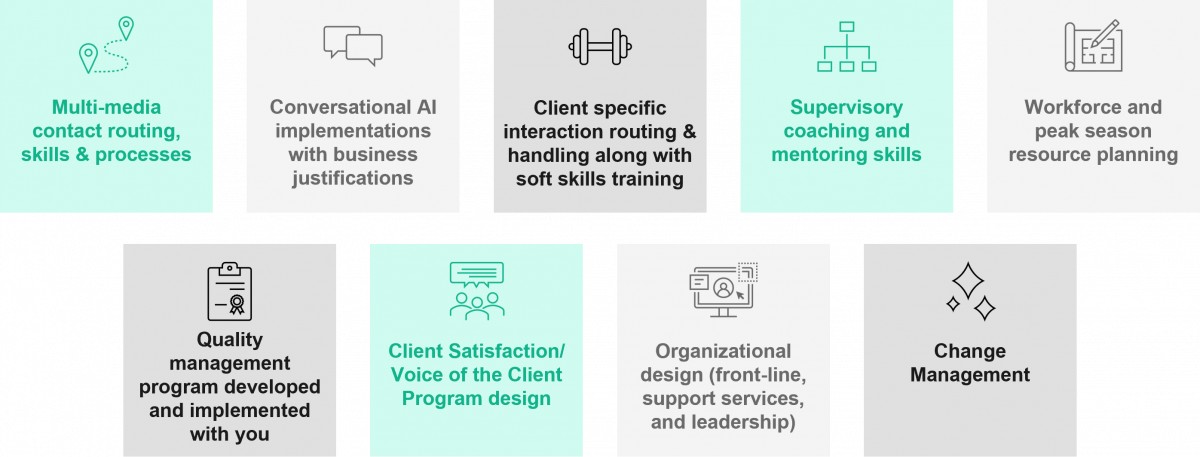

There are several factors that Wealth Management firms should consider when implementing a Virtual Advisory model:

Firms that have carefully considered if the call center model is right for them will be best prepared to take on the new opportunity.

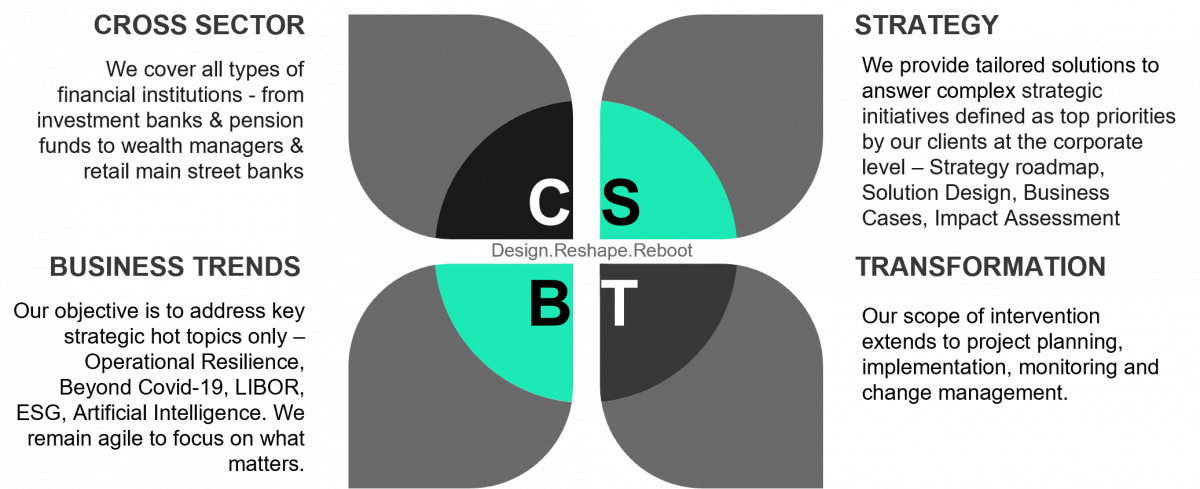

Sia Partners has extensive experience working with leading Wealth Management firms in establishing a solid virtual advisory practice. We’ve built a team of partners and professionals with deep operational expertise in this field to help our clients get the most out of their technology, processes, and team members.

With our global presence, Sia Partners is proud to have become a trusted advisor to some of the world’s leading Wealth Management firms. Clients across the financial services spectrum rely on Sia Partners’ industry-leading services to inform their business decisions and deliver maximum value to customers and stakeholders.