Canadian Hydrogen Observatory: Insights to fuel…

How a shift away from the traditional brokerage model will force firms to explore non-traditional products and services.

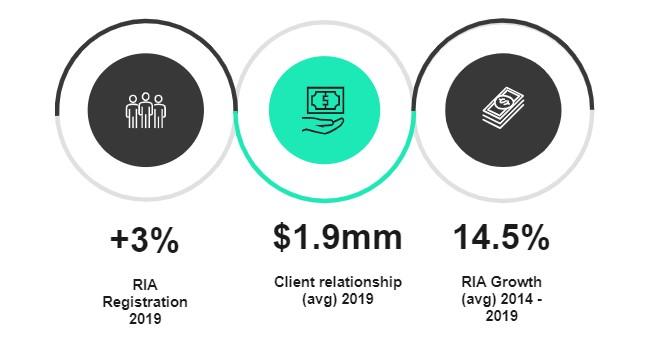

The wealth management industry is in the midst of a substantial realignment – moving away from the traditional commission-based brokerage model that charges commission on individual trades in favor of a fee-based advisory model where clients pay a flat fee to retain an advisor’s services. Annual growth in Assets Under Management (AUM) for Registered Investment Advisors (RIAs) has been 14.5% over the last 5 years, compared with 9.4% overall [1] and the average client relationship grew from $1.77 million in 2017 to $1.90 million in 2019. RIA registration has also increased by 3% in 2019, while FINRA broker-dealer membership decreased by 3%. [2]

There are a few significant drivers fueling the growth of fee-based advisory accounts. These are especially important as firms view this through the lens of offering additional products in the Advisory space.

New regulations, such as Regulation Best Interest (Reg BI), are shifting investment accounts of all types away from the traditional financial advisor recommendation-based investment process towards a fiduciary standard. This shift is expected to continue as the market moves toward relationship management and monitoring over individual security recommendation. Various state requirements will also continue to drive the federal agenda towards more stringent and consistent policy. Differences among standards creates a challenge for firms to operate consistently and a burden to regulate. As stated in the 2018 FINRA regulatory examination priorities letter, firms are and will continue to face increased scrutiny to defend their recommendations when transitioning clients from brokerage to advisory accounts. This encourages a need for certain (if not all) products to be offered in the Advisory space. To comply with these ever-increasing regulatory requirements the expansion of product offerings to advisory clients strengthens advisors’ ability to uphold their fiduciary duty.

Traditional brokerage advisors managing 39% of assets are expected to retire in the next decade, putting a potential $8 trillion in client assets up for grabs. At the same time, a massive transfer of wealth between baby boomers and their children – roughly $68 trillion – presents another opportunity, since most children are unlikely to retain their parents’ financial advisor.

Since the 2008 financial crisis, trust in the traditional wealth management structure has been decreasing, making RIAs who are independent and bound by a strict fiduciary duty (compelling them to act in the customer’s best interest) more attractive. 62% of investor households reported preferring fee-based payment over commissions. [3] Clients are using their wallet to voice their desire to move away from sales-based relationships, toward transparent fee structures and holistic investment and goals-based strategies.

Providing your advisors with a greater variety of products will be the key to driving client acquisition and retention

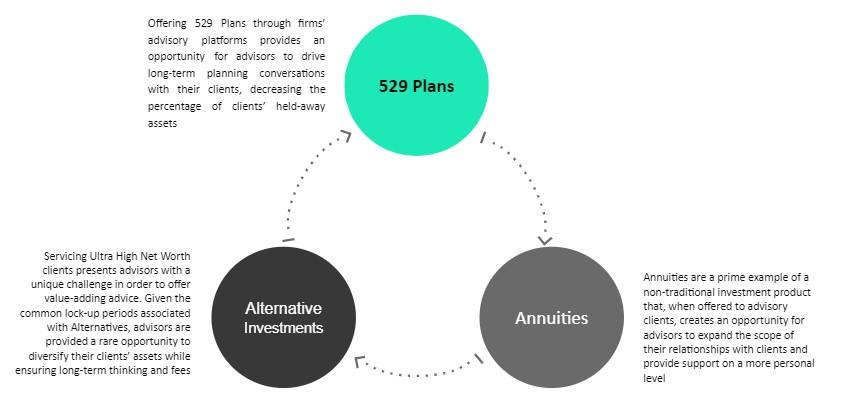

The industry trends discussed above all combine to not only encourage but make it imperative that firms look to expand their Advisory offerings. As clients and financial advisors continue to shift their business, a distinguishing factor for firms will be to offer a robust selection of products. This includes more traditional investment products that may be missing from advisory programs, such as offshore mutual funds or unit investment trusts as well as non-traditional products that the industry typically hasn’t considered. Examples include annuities, 529 plans, alternative investments and other structured products. By investing the time and effort to offer more products in their programs, firms will see benefits in several ways.

As firms look to expand their advisory programs and product offerings, it is important to take into account many different factors and considerations when choosing which product to offer to clients, and how to offer it. Depending on the product there may be certain unique attributes and features that require a deeper analysis of the value proposition itself, and just how it might fit into the advisory structure when it comes time to build and launch the product. Some of these considerations should include:

Sia Partners has extensive expertise in the Wealth and Asset Management space, with proven execution of large-scale platform and product integration, and launching new products in Advisory programs.

Design and Target Operating Model: Implement, assess, design, develop the target operating model for the product(s) across Business, Operations, Risk, Finance and Compliance

PMO / Governance: Provide end-to-end project management, governance for product / platform design and workstream structure

Product / Domain Expertise: Extensive experience on a broad range of Investment Products (Advisory, Mutual Funds, 529s, Insurance, Annuities, Alternatives, Stock Plan, Money Markets etc.)

Implementation: Execution throughout the entire product launch process including platform selection / integration, technology harmonization, and field engagement and adoption

Bharat Sawhney

Partner | Wealth & Asset Management Practice

314-749-5755

bharat.sawhney@sia-partners.com

Steven Mazza

Manager | Wealth & Asset Management Practice

917-414-6022

steven.mazza@sia-partners.com

Thomas Conover

Supervising Senior Consultant | Wealth & Asset Management Practice

908-612-1390

thomas.conover@sia-partners.com

Michael Lloyd

Senior Consultant | Wealth & Asset Management Practice

973-897-3311

michael.lloyd@sia-partners.com

Sources:

1 Shift from sales to planning fuels fee only business

2 "2019 Evolution Revolution: A Profile of the Investment Advisor Profession"

3 Have fee based models won the battle or the war