Carbon Accounting Management Platform Benchmark…

Banks have a crucial role in financing a green transition, presenting them with several challenges and opportunities. Our previous article focused on the climate challenges that banks must face. This article will focus on seven main opportunities for banks in relation to climate change.

The EU has set out a number of international commitments on climate objectives under the European Green Deal in which sustainable finance plays a key role. Among these commitments are the UN 2030 agenda and sustainable development goals, and the Paris climate agreement. To achieve these climate objectives, the EU will channel private investments into the transition to a climate-neutral economy. Moreover, the European Commission has presented the European green deal investment plan (as part of the Green Deal) to mobilize a staggering amount of €1 trillion of sustainable investments up until 2030. This will create favorable conditions for investments to enable a climate-neutral economy. In addition, green finance is vital for the sustainable recovery from the Covid-19 pandemic. As such, a number of opportunities for banks arising from climate change will be touched upon in the sections below.

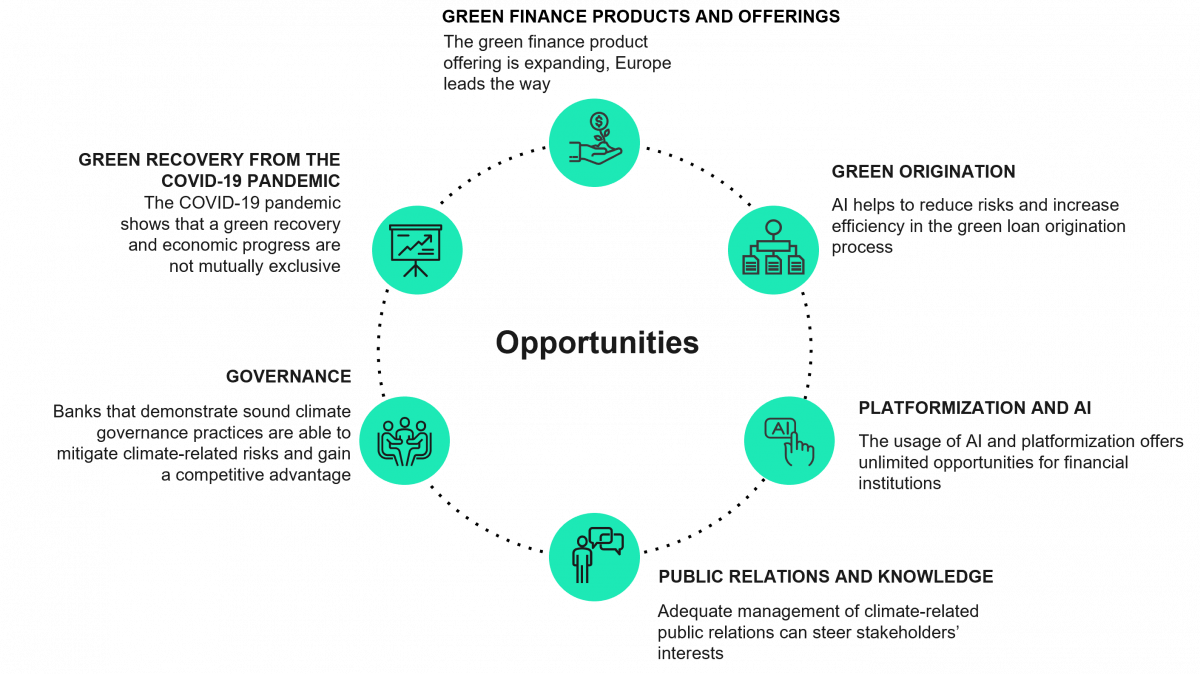

Figure 1. Overview of opportunities for banks regarding climate change

Carbon emissions funded by financial institutions can be 700 times higher than their direct emissions according to the climate non-profit CDS. Banks are critical in financing the transition to a net-zero carbon future. Global green investments are still largely insufficient to achieve global climate goals and mitigate global warming, so the dynamics of green finance must be strengthened. Europe is leading the way in green finance with a supportive regulatory environment to boost green investments, therefore paving the way for other regions to strengthen their green finance activities.

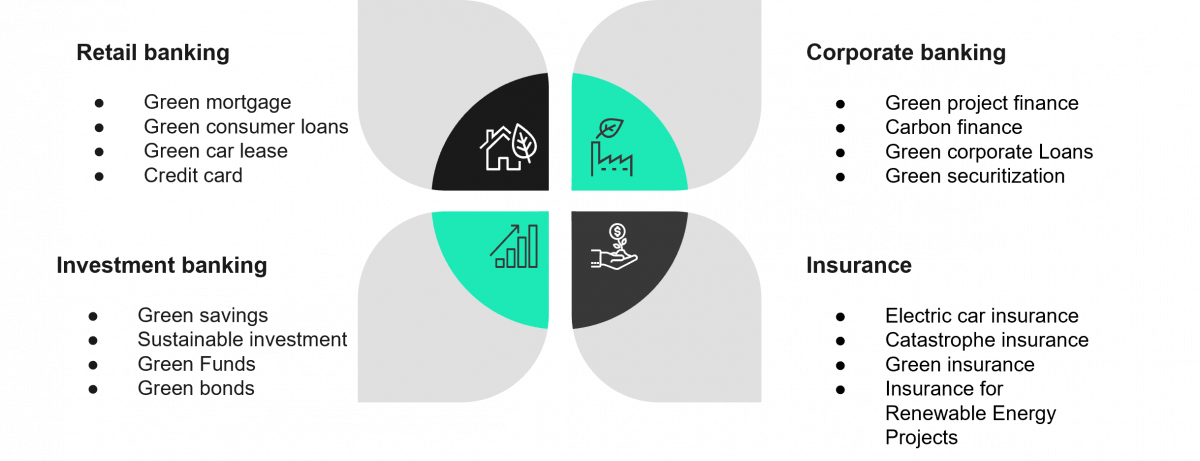

The below overview presents the multiple green finance products and service offerings which banks can construct. Banks will need to adjust their product offerings to the local customer needs, and the momentum of the green transition and dominating industries within their market. Retail banks can focus on creating advantageous products to finance low-pollution vehicles or sustainable real estate improvements. Retail clients are increasingly willing to switch to a ’green’ account and investment even if it costs more or offers a lower return, according to Sia Partners` recent study conducted in France, the United Kingdom, the Netherlands and Belgium. The research in these countries found that 48-58% of the respondents would be willing to swap to a green account. Customers under the age of 35 show an even higher willingness to swap, with 56% in the Netherlands.

Furthermore, product offerings could enable impactful sustainability projects. These could also be combined with the facilitation of partial crowdfunding of projects, where individuals would also take part in financing green or solidarity projects.

Figure 2. Green finance offerings

Loan origination, the process that occurs when a buyer obtains a loan from a lender, involves several stages. The process starts with the loan application by the borrower and ends with the final funding of the loan, incorporating many other steps in between.

Green loans differ from traditional loans in that they are a form of financing that seeks to fund projects that have a distinct environmental impact, or in other words, ‘green projects’. However, the concept is broader as it concerns a green-oriented methodology across the loan origination process as well. An industry benchmark is represented by the criteria set out in the ‘Green Loan Principles’, published in 2018 by the Loan Market Association. The Green Loan Principles creates a high-level framework of market standards and guidelines, providing a consistent methodology for use across the green loan market.

Banks must consider Environmental, Social, and Governance (ESG) factors and associated risks during the loan origination as outlined in the EBA Guidelines on Loan Origination and Monitoring. To enhance the consistency and increase the speed of this process, artificial intelligence (AI) could be used progressively. AI could play a vital role in sourcing ESG factors such as granular climate risk data analysis or energy certificates. The ability to reduce risks and increase efficiency is an attractive proposition for financial institutions.

Sustainable banking starts with technology and data. Through the recently published regulations, which were mentioned in the previous article, the disclosure of ESG data is advancing. By utilizing this data, banks could steer their clients to make more informed, sustainable decisions. By the same token, banks could also set a good example for society in terms of operation and offerings.

The usage of platformization and AI could offer unlimited opportunities. Integrating third-party solutions into offerings can make customer decision making much easier and might result in upselling. Banks can for instance help their clients to deal with sustainable home upgrades by using third-party solutions in order to calculate the most financially attractive option.

Another example is Greenly, a start-up in partnership with Sia Partners that can help companies and customers understand and manage their CO2 footprint. Banks could integrate AI logic like Greenly into their general banking and budgeting applications which can help clients make more conscious decisions. (Figure 3) Notwithstanding, a deeper understanding of the CO2 footprint should be a concern for the bank’s own operations as well.

Figure 3. Greenly UI integration mock-up

As investors point out how the management of ESG factors can be of use when identifying new opportunities and managing long-term investment risks, the requests for businesses to report on climate-related financial risks are rising. By means of transparent reporting, banks aim to achieve a level of consistent messaging across external reporting mediums (e.g. corporate reporting, financial reporting, and sustainability reporting). This consistency might be an important tool to convey trustworthiness to stakeholders.

Moreover, disclosing climate-related risks can result in significant benefits to banks regarding knowledge sharing and raising awareness. As such, by actively disclosing these risks, directors are made more aware of their fiduciary duty.

Finally, financial institutions like banks can play a role in actively shifting the focus areas of external stakeholders. In this way, banks can align the content of their disclosures with the sustainable interests of long-term investors. They might even shift the focus of investors and shareholders towards forward-looking assumptions, methodologies, opportunities, and strategies by openly reporting on sustainability and climate-related factors.

As previously mentioned, board members might reap the benefits from gaining ESG-related knowledge by being able to pursue responsible governance. As such, it is crucial for board members to demonstrate their responsibilities to stakeholders. Climate change forms a strategic risk to banks and should be identified and managed as such by the board. Over the years, inaction from banks has resulted in greenwashing claims, lawsuits, and transition management. If this trend were to continue, banks with inadequate governance would expose themselves to legal and divestment risks. Banks that have adequate and comprehensive climate governance practices in place are able to mitigate climate-related risks and even gain a competitive advantage.

In a way, successfully aligning with a strategy that is aimed at reducing carbon emissions can become an indicator of a company’s governance. Banks could use their communication channels to signal their adequacy and governance to a variety of stakeholders. All in all, these findings showcase the necessity for boards to pursue sustainability and climate management in order to make appropriate strategic decisions.

While banks are still coping with the COVID-19 pandemic, the threat of climate change continues to loom large and requires a substantial transformation. In fact, the pandemic offers an excellent opportunity to accelerate the transition to a climate-neutral economy through an economically sustainable or “green” recovery. Currently, financing costs are relatively low due to the low-interest rates which makes sustainable investments more appealing.

The pandemic has seen a huge decrease in the amount of CO2 emissions worldwide. While everyone is ready to restart the economy and get back to normal, now might be the perfect time to start something new. Research from Belgium, a small and open economy, shows that sustainable investment is more beneficial at this time than ever before. It suggests that the impact of investing in sustainability measures in the construction sector on reducing emissions is bigger than the reductions caused by the pandemic. Furthermore, executing a policy while the world has not yet returned to normal generates a more positive effect on CO2 emission reductions than in the absence of a pandemic.

One of the main arguments against green innovation is that it is not rewarding economically. However, the Belgian paper finds that a green investment program can actually positively affect GDP and the national budget. These findings prove that green recovery and economic progress are not mutually exclusive. As banks have a prominent role in boosting investments, now is the right time for them to take responsibility and help the country forward with regard to the economy and sustainability.

Moreover, banks can use the pandemic to enhance their comprehension of the vulnerability of their balance sheet to climate risks. That comprehension might lead them to improve their alignment with the Paris Climate Agreement regarding their investment and lending policies. Besides, banks play another important role in a potential green recovery; they provide financial support to companies and individuals and, as such, might be able to help their customers develop more sustainable business models while recovering from the pandemic.

All in all, a green recovery and economic progress can work together. Green technologies are maturing and low-carbon energy is starting to compete with fossil fuel-based energy prices. Recent evidence suggests that green projects might have higher short-term returns compared to conventional projects. Finally, the costs of inaction or late action on climate change far outweigh the investment in climate change mitigation today.

Combating climate change requires action from the financial sector as well. Progressive financial institutions can position themselves as leaders in the climate finance evolution. Furthermore, as climate actions and investments will further accelerate, financial institutions have room to innovate and change.