Gen AI for Investment Management Research

It’s been a crazy week on Wall Street, with extreme gyrations in the stock prices of small companies nobody had ever heard of, pushing their values to billions of dollars. Here’s our analysis of what’s been going on, and why.

The New York Stock Exchange (NYSE) saw large swings in the stock price of GameStop (NYSE: GME) and similar stocks with relatively small amounts of revenue and negative earnings.

Hedge Funds such as Melvin Capital reportedly have large remaining short positions of $11.7bn in these stocks (estimated 136% of GameStop’s market value for example) after having already lost $19bn in the past few weeks. Reddit forums such as WallStreetBets mobilized day traders and retail investors to aggressively buy these stocks. This causes the Hedge Funds to book losses on their short positions and have to put up more collateral to support the trades. Note: Melvin received a $2.75bn of new capital from Citadel and others on Thursday.

Responding to the high volatility in these stocks, on Thursday 01/28 the Depository Trust & Clearing Corporation (DTCC), put up the collateral required for member firms to clear trades, to 100% of the market value of the trades. As a result— Robinhood and other firms had to curtail trading. Note: GameStop and similar stocks fell 44% on Thursday 01/28.

Robinhood raised $3.4 billion of additional capital from its investors, and was able to resume new trading activity. Once retail customers were allowed to resume trading, GameStop and other stock prices rebounded sharply.

This article outlines the credit risk and settlement mechanics underlying these events, and outlines potential regulatory issues.

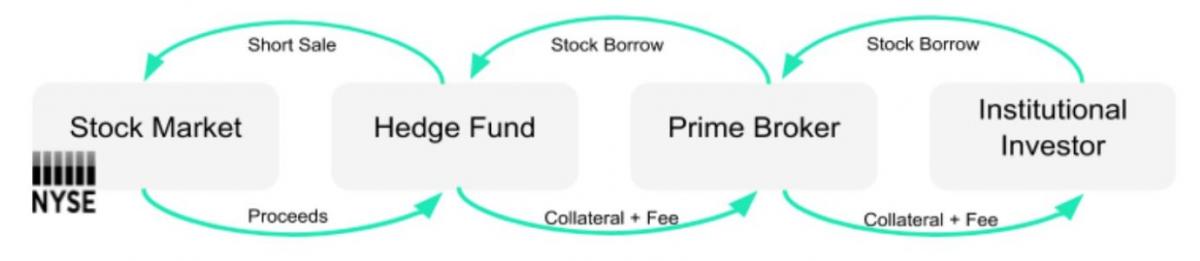

Hedge Funds and other investors can sell short, in compliance with SEC Reg SHO, provided that their Prime Broker is able to borrow the stock, typically from an Institutional Investor. Borrows are generally “open”—the borrower can return the securities, or the institutional lender can recall the securities at any time.

The Hedge Fund pays a borrow fee and has to put up collateral to the Prime Broker under Fed Reg T. The Prime Broker has to collateralize the stock borrow with the Institutional Investor, with a spread or haircut in addition to the market value.

As the price of the stock rises:

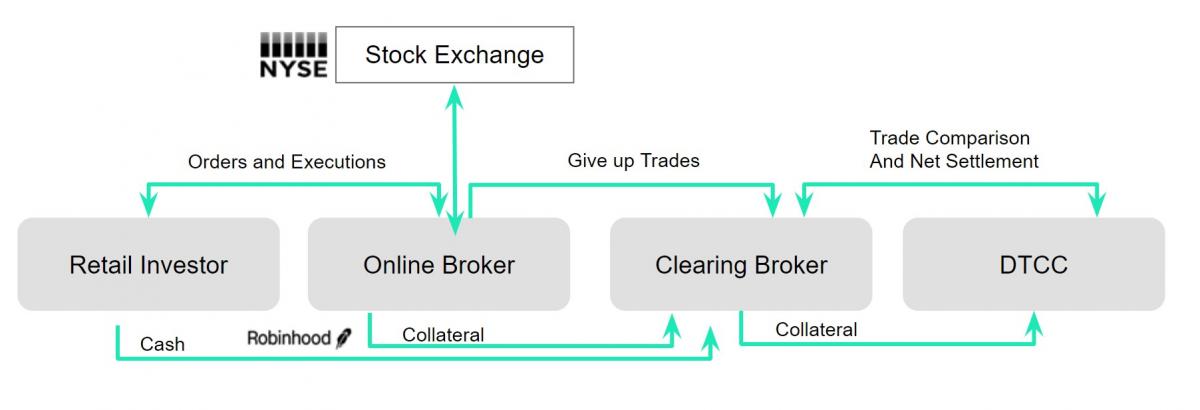

Purchase (and sale) trades done by retail investors through brokers such as Robinhood, are “given up” by the online broker to a Clearing Broker. Provided the investor has sufficient cash in his/her account on settlement date, the Clearing Broker is required to deliver securities to the investor’s account.

The retail investor trade is executed on an exchange, and the Clearing Broker also has responsibility for settling the exchange or “street-side” leg of the trade. All street-side trades received by the Clearing Broker for all its clients are compared and netted in the clearing system, resulting in a single net settlement on settlement day at DTCC.

Because of the risk that a broker (or a Clearing Broker) might go bankrupt between trade date and settlement date, DTCC requires Clearing Brokers to post collateral based on the volatility of the securities being settled. Clearing Brokers therefore require firms like Robinhood to post collateral with them. As volatility of stocks like GameStop have risen dramatically, DTCC is now requiring 100% collateral on the settlement of these stocks.

Provided that SEC Reg SHO requirements are met, short sales in themselves do not violate any SEC or FINRA rules. Robinhood and other brokers that had to restrict trading on Thursday were not violating any rules. However, their retail customers became distressed.

“I’m looking at the Robinhood contract, and it says in black and white they can block or restrict trades at any time,” said Jeff Erez, who runs a Miami-based law firm specializing in securities-fraud litigation.

Similarly, there is nothing in the rules prohibiting retail buyers from buying stocks with no earnings, and/or at price levels far above the company’s net worth or future prospects (see dot-com bubble in 1995-2000). Finally, short squeezes have happened from time to time in various market sectors, as have price spikes due to a wave of buying in an illiquid security.

"What is new, is the retail “crowdsourced” nature of the short squeeze."

The SEC’s mission is to “protect investors and maintain fair, orderly, and efficient markets”. The market events of last week would not be described as “orderly”, or “efficient” in terms of price discovery —what is GameStop or AMC really worth?

In a statement on January 27, the SEC vowed to protect individual traders and to scrutinize actions taken by brokerages that may “disadvantage investors or otherwise unduly inhibit their ability to trade certain securities…We will act to protect retail investors when the facts demonstrate abusive or manipulative trading activity that is prohibited by the federal securities laws.”

Systemic risk

Large losses might cause retail or Hedge Fund customers to default, leading to brokers and potentially Clearing Brokers defaulting. DTCC stated that they increase margin requirements when volatility increases to protect the entire industry against defaults and systemic risk.

Market Manipulation

If “influencers” on WallStreetBets and other forums are ramping stock prices. “If they are all egging each other on using a social-media platform, they are effectively engaged in a crowdsourced pump-and-dump scheme,” said Daniel Hawke, a partner at Arnold & Porter Kaye Scholer LLP

Investor Protection

Massachusetts state securities regulators have filed a complaint against Robinhood saying that it “aggressively markets to inexperienced investors and failed to implement controls to protect them.”

Per John Maynard Keynes “The market can stay irrational longer than you can stay solvent.” The short squeeze on GameStop and similar shares will likely continue until one or the other side runs out of financial backing and firepower, with regulators and DTCC taking further action, if needed, to protect against systemic risk.

Now that the power of internet forums to move markets has been demonstrated, expect further concentrated waves of buying or selling driven by these forums. Apparently starting with the silver market the morning of February 1.

The SEC and FINRA will likely bring market manipulation charges against those they perceive as leaders of this activity. Regulators will likely develop rule changes covering short selling, market manipulation and customer protection. Expect Hedge Funds to become a lot more cautious in short selling illiquid stocks!

John Gustav

Partner

+ 1 (516) 810 8719

John.Gustav@sia-partners.com

Joseph Willing

Managing Director

+ 1 (347) 380 3960

Joseph.Willing@sia-partners.com

Gordon Wong

Manager

+ 1 (647) 917 7791

Gordon.Wong@sia-partners.com

Zoya Ashirov

Managing Director

+ 1 (917) 330 5536

Zoya.Ashirov@sia-partners.com