Carbon Accounting Management Platform Benchmark…

The transition to a decarbonised electricity system brings unprecedented changes to conventional electricity value chains. The subsequent adaptation of System Operator roles may trigger significant transformations in their governance and business models.

Electricity Transmission System Operators (TSOs) are often considered to be natural monopolies. These companies own and operate large asset bases that require investments in high voltage networks as the entry of new players in the transmission business is limited. As a consequence, it is a highly regulated business: revenues and investments are thoroughly scrutinised by regulatory authorities and the TSOs businesses are underpinned by complex governance structures. Regulatory regimes may include the design of performance and innovation incentives for TSOs.

Transmission System Operators often have a national scope and are organised in different governance models. More than 40 Independent or Unbundled TSOs have been created since the early 1990s, namely in the US and Europe. Vertically Integrated Utilities are the most common governance model in electricity systems in emerging markets worldwide.

Vertically Integrated Utility (VIU): The TSO is integrated into a wider electrical utility that also comprises generation, distribution and supply businesses. The VIU may be state-owned or private.

There is an opportunity for economies of scale but there is little or no competition in the electricity market and there may be a perceived lack of transparency in investments and access to networks. China State Grid and Eskom are VIUs, although an unbundling process is ongoing in the South African utility.

Unbundled TSO (UTSO): The Transmission company is a subsidiary of a utility, directly supervised by a regulator (or another independent entity). There is a company with a business model focused on transmission and optimisation of resources and expertise, but there may be risks of conflicts of interest and limited transparency on access to networks. In France, RTE is an Unbundled TSO.

Independent TSO (ITSO): the TSO is fully independent of other utilities. This allows for competition in access to network and coordination in planning and operations, but there may be conflicts of interest in case there is more than one TSO in one country. The System Operator may be legally separated from the Transmission Network Owner. In Europe, TSOs like Elia (Belgium), REE (Spain) and National Grid (UK) are Independent TSOs.

Regional Coordinator (RC): these non-profit organisations complement the national TSOs with any of the other models.

The RC concept implies significant operational independence and facilitates market competition by leading cross-border coordination and optimising network capacity. RCs usually have limited roles in balancing and advice in network planning. Coreso and TSCNET are two examples of Regional Coordinators in the EU.

The first signs of transition emerge when renewable electricity generation hits the mark of 30-40% of the generation mix. Cross-border interconnection expands and is enabled by TSOs to facilitate wider market integration. With the multiplication of small-scale generation embedded in distribution networks, there is a rising need for greater levels of coordination and planning between TSOs and DSOs. At these stages, TSOs focus, firstly, on the effective operation of high voltage networks and balancing electricity generation and demand in real-time, and secondly on the administration of network codes and the development of energy markets.

In a decarbonised system, clean energy sources will ensure 100% of the generation mix. Fully functional markets will be underpinned by platforms sharing data transparently. The participation of consumers in electricity markets (prosumers) will be enabled by the differentiation in electricity supply products, via utilisation of the latest technologies such as smart meters and electric vehicle charging points (V2X). Electricity systems will become interconnected at all levels to other energy systems, e.g. Power-to-Gas. The efficient operation of electricity systems will be supported by the management of millions of data points, part of a widely integrated “system of systems”.

Thus, in the later stages of the Energy Transition, the characteristics of energy systems will require wider responsibilities for Electricity System Operators. Sia Partners has identified 5 key TSO roles in future electricity systems.

TSOs will play a key role in the Digitalisation of the Grid, leading the digital transformation of the overall industry, as well as managing an increasingly dynamic network in real-time, anticipating issues and maintaining the reliability of a low carbon electricity system. Pioneer projects are making use of data, smart grid and blockchain technologies to transform the ways TSOs maintain and operate their networks.

The Infrastructure Evolution and the optimisation of the increasing number of network interventions will be critical to reduce outage times and to enable effective access to networks. The integration of renewable energy sources exacerbates the challenge of building or expanding infrastructure in remote, protected areas, as TSOs take a key role in the sustainable development of territories and communities.

With regards to Coordination and Energy Market, TSOs optimise the functioning of their national grid and regional grids under challenging dynamics. This will bring growing importance in coordinating stakeholders around shared future scenarios and integrating the company within market evolutions.

TSOs will play a greater role in Third-party service offers, by developing new services for market actors, supporting the development of new uses for networks and co-build innovative solutions with other industry players. With a higher stake of renewable energy generation in the electricity system, the need for flexibility increases and thus the need for innovative products and services.

TSOs become Enablers of the Energy Transition by a number of key roles: facilitating the connection of renewable energy sources (RES), managing RES intermittent generation profile, The wider transformation requires local and national strategies that ensure positive social impact and environmental sustainability.

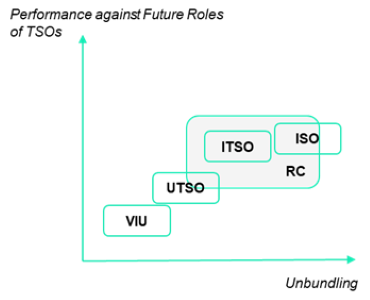

Analysing the performance of TSOs in their future roles in regards to the level of unbundling allows us to establish a qualitative view of the efficiency of each governance model.

Digitalisation of the Grid: vertically integrated utilities could facilitate economies of scale and potentially save costs for digitalisation. Although, further independence of SOs underpins wider competition and better innovation, enabling the rapid adoption of new technologies to optimise network operation.

Infrastructure Evolution: the Energy Transition will require unprecedented levels of investment in networks to enable the timely integration of renewable energy sources. Vertical integration of utilities could enable economies of scale and reduce costs, as well as facilitate the design of incentives. Although, wider investments will require efficient and consistent network planning; greater independence of SOs brings transparency in network access and investment decisions, as well as avoiding conflicts of interest.

Coordination and Energy Market: future energy systems will have multiple stakeholders and millions of data points, across different regions and countries. An entity with a wider and independent view such as an ISO (RTO) or an RC brings benefits to the functioning of competitive energy markets. Traders will benefit from further System Operator transparency in clarifying and anticipating their operational actions and minimising their market impact, which will in principle be translated into greater welfare.

3rd Party Service Offer: greater independence avoids commercial distortions and conflicts of interest, and facilitates new entrants to markets, benefitting the development of new services and products for an optimal network functioning and the development of smart grids.

Energy Transition: the availability of renewable energy primary resources (sun, wind, water flows, access to geothermal) in an energy system has a significant impact on the need for transformation. In energy systems dominated by conventional fossil fuel-based generation, vertically integrated utilities may find obstacles in facilitating decarbonisation. The fundamental energy system transformation will require a high level of innovation and rapid implementation of new, clean energy technologies, which could be limited by a lack of competition and transparency that may be perceived if a single company integrates the whole value chain. Further independence of System Operators facilitates the development of fully functional, competitive markets that will enable the levels of innovation and transparency required for a cost-effective energy transition.

Performance against Future Roles of TSOs reflects the estimated performance of the TSO in each of the Future Roles of TSOs mentioned above; Unbundling reflects the level of separation between the System Operator and parent utilities.

The RC model complements national models (ITSO, UTSO, ISO), and its performance against the future roles of TSOs greatly depends on the number of responsibilities accorded by regulatory authorities. It has the potential to enable decarbonisation at a cross-border, regional level, enabling fully functional markets and anticipating wider challenges for security of supply, as well as enabling significant savings in system developments.

The ITSO and ISO models offer the best performance against the Future Roles of TSOs. Further unbundling from ITSO to ISO allows for greater transparency and full independence in key decisions for system planning and operation. Although, the transformation towards Independent System Operators must consider all levels of interactions between industry players, authorities and consumers.

National Grid Plc is a multinational utility company operating in the UK and in the US. In the UK, NGET and NGESO have different business models: while NGET fundamentally owns and manages the high voltage network assets, the autonomous NGESO operates the GB electricity transmission system. The UK energy system is under one of the fastest decarbonisation roadmaps worldwide: renewable share of electricity generation went from 24.7% in 2016 to 43% in 2020. The rapid phase-out of coal power plants, as well as the decreasing levels of transmission demand due to the decentralisation of energy resources, were reflected in an increase of 46% in system operation costs for the same period. Adding to this increase in costs, the blackout in 2019 and the announcement of the most ambitious decarbonisation targets in the World justified the Review of GB Energy System Operation by the regulator Ofgem and the Consultation on Proposals for a Future System Operator Role by the UK Government (BEIS) and Ofgem. The public authorities advocate that enhanced responsibilities in long-term planning and policy advice shall be given to the System Operator, but shall be fully independent from the National Grid Group to avoid conflicts of interest.

A ringfenced ISO would bring the advantages already mentioned, but there are key questions on the business model of the future entity. It will be imperative to design efficient regulatory regimes and funding models that allow for full independence and avoid lobbying of the policy advice role. Worldwide benchmarking and the experience of the GB energy industry drive to a key conclusion: a System Operator that is fully independent of private interests and political agendas, focused on promoting and implementing a decarbonisation roadmap together with industry stakeholders, is the most effective model to facilitate the transition to a Net Zero energy system.

The following points provide an overview of the ways that the energy transition impacts the governance of electricity systems operation, bringing challenges that must be solved at all levels of interaction between industry players: