Carbon Accounting Management Platform Benchmark…

Efficiency and Profitability Solutions for businesses.

An efficiency centric organization is one whereby every individual contributes to the organization’s objectives. responsibilities are clear and a creditable & comprehensive plan is built.

Efficiency centricity empowers everyone with the skills, framework, tools, targets and accountability to effectively execute on the plan and develop permanent capabilities to deliver continuous efficiency improvement.

Sia Partners’ 8 pillars of efficiency management and specific expense solution sets address this imperative and ensure the organization is able to deliver and maintain optimal efficiency.

With over 20 years of hands-on experience deploying and executing comprehensive efficiency programs, Sia’s team provides expertise to ensure your entire organization generates optimal sustainable efficiency

Design a program sponsored by senior management with the correct metrics to drive success. Form an Expense Leadership Committee. Ensure creditable plans are built and the entire organization, across businesses, regions and support functions, have shared responsibility to execute.

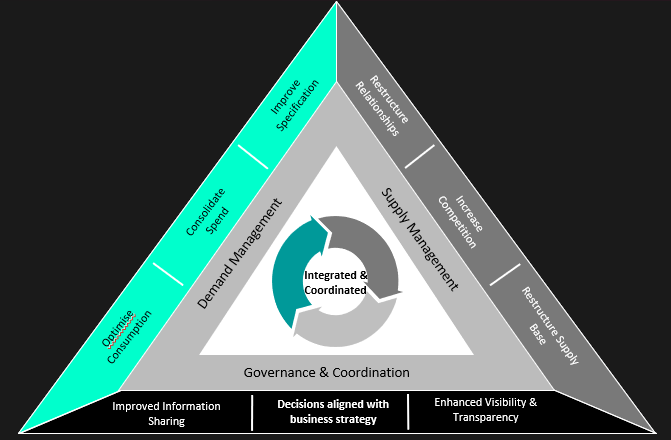

Eliminate communication gaps between those negotiating with vendors and those requiring (or no longer requiring) the services being procured.

A common financial language is necessary where the organization works with a standardized view of expenses and success metrics

Revise GL account structures, resolve mis-matches / mis-booking of accounting transactions to GL accounts. Create a management view of expenses (vs external reporting view).

Assess how your organization leverages data from category expense systems to empower the organization with necessary expense drivers to best impact expenses. Help select best-of-breed systems / build vs buy strategies.

Identify ELOs to ensure category efficiencies are maximized and category experts are leveraged. Define their roles and responsibilities

Eliminate unnecessary and oppressive bureaucracy (e.g., illogical approval processes, one-size fits all policies, etc.)

Identify how your firm compares to the most efficient operators and where relative underperformance exists.

After having implemented a global program incorporating this framework, a tier 1 global bank moved from 7th to 1st most efficient amongst its peers and achieved >$10 billion in sustainable efficiencies.

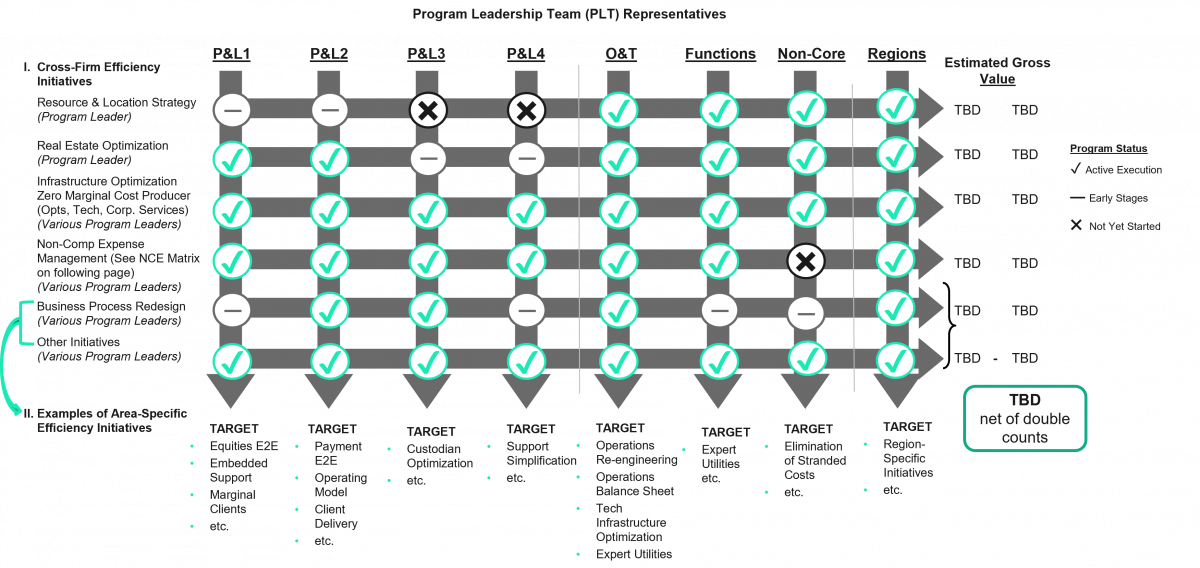

At the core of an efficiency program is Sponsorship and Leadership to ensure appropriate messaging, roles are clear, targets are aggressive yet attainable, and the program is managed consistently from Top of House.

Assign category and business unit owners where intersections between the two have clear transparency, targets and communication.

Manage all aspects of the Program’s execution and ensure targeted results are delivered including tracking & validating the status of initiatives; maintain a central database of initiatives.

Create a culture of excellence & high performance, including exceptional and continually improving efficiency

Often, organizations have ad hoc demand management programs that result in poor communication and coordination between demand and supply decision-makers. As a result, firms procure incorrect volumes compared against incorrect specifications.

A common financial language is necessary where the organization works with a standardized view of financials, targets, and success metrics. Empower every part of the firm with actionable and accessible data to drive efficiency.

Rigorous budgeting taking into account run/exit-rates, new investments, efficiencies and inflation

Define and design consistent financial management reporting across business units and support functions using a single business vocabulary to allow for improved transparency and effective collaboration.

Empower businesses and support functions with timely, actionable data to drive efficiency, accurately measure financial outcomes, and reliably linking those outcomes to actions

Design and maintain a logical GL structure and hierarchy that aims to improve operational management of expenses. Systems such as GL, Accounts Payable, and Wire Payments must be synchronized to avoid mis-posting. Accruals and allocations must be up to date and properly maintained to accurately reflect expenses in each cost center of the organization.

P&Ls of cost centers and businesses provide a detailed and appropriate level of visibility into expenses to better manage the business

Systems are reconciled in a timely fashion and mapped accurately to prevent incorrect postings between GL, AP and sub-systems.

Accruals and allocations are based on facts and reflect reality. Intercompany allocations provide transparency into expenses vs a “single line bill” from support functions

Leverage category systems to harness untapped data and metrics that are often difficult to access and interpret. Eliminate bureaucracy and friction from distributing actionable demand management data to consumers of expense across the firm.

Every category of expense must be managed by an expense expert who is accountable for driving efficiencies across the organization and coordinating with Business Unit Owners (BUO) to drive efficiencies into each business and support function.

Although every company has a unique culture as it relates to expense policies, approvals, and processing, it is critical that the firm ensures a proper balance between controls and unproductive bureaucracy. If not in balance, unnecessary frustration, wasted time, and negative sentiment of expense management will impact participation of every individual within an organization.

Expense policies are critical to maintaining efficiency across the entire organization. In addition to ensuring policies are appropriate and consistent across the firm, policies should also be benchmarked to competitors.

In many firms, the number of approvers even for simply requests is completely inappropriate (e.g., 10 levels of approvals for simply purchases such as office supplies.

Are the correct level of user profiles and approval systems in place so such processes as on/offboarding, P2P and R2R are effectively and efficient?

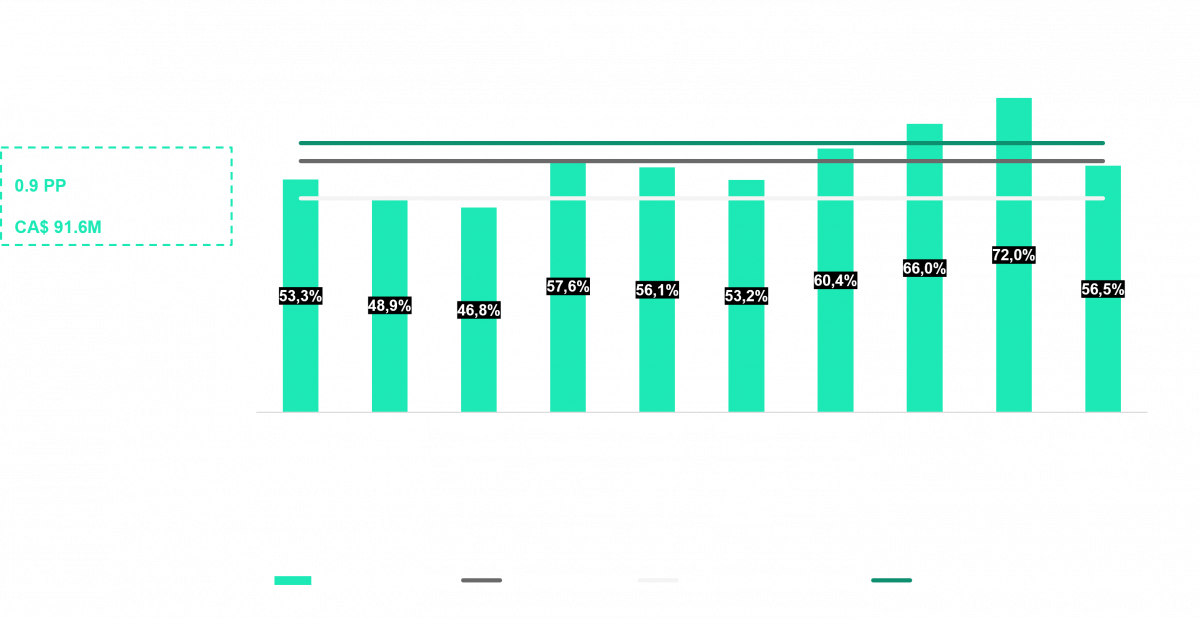

It is critical to measure how the organization is performing vis-a-vis its peers. In Financial Services, firms measure themselves against metrics such as efficiency ratios. Sia maintains a database of efficiency ratios across FIs including reported and adjusted (for non-operating costs) views.

The Efficiency Management Framework ensures that every expenditure is “owned” at three levels (Business, Functional Experts, Locally).

Implementing the Efficiency Management Framework

Sia Partners offers Financial Management Software to ensure that project and financial outcomes are managed, measured and validated. These softwares ensure that the organization is coordinated in its efforts, serves as a single source of truth and assures efforts are transparent in the organization’s P&L.

In addition to addressing category-specific efficiency opportunities and organizational competency in efficiency management, Sia Partners provides numerous efficiency and productivity programs across a vast array of disciplines.

From the front to the back office to support functions, we validate exactly what activities take place to support a business and identify functions, jobs and activities that are no longer required to support the business and its strategy.

Sia Partners' expertise in identifying RPA-appropriate workflows and implementing RPA will improve productivity and release resources to more value-add activities.

Sia Partners Procurement experts complement current Procurement teams to help benchmark suppliers, drive vendor negotiations and better incorporate demand.

Bad data leads to bad decisions. Sia Partners Data Management experts can identify ways to leverage better data processing to make smarter business decisions.

Sia Partners has extensive experience in resource & location implementations across numerous domains and Leverage Sia’s partnership with outsourcing provider FTP to provide an end-to-end R&L solution.

Within the Contact Center and Client Service Practice we perform an extensive front-to-back assessment of your current state contact center inclusive of each function within the contact centers along with the processes behind recruiting people, KPI's and metrics, staffing assessment, financial assessment, quality assurance programs, technology, infrastructure, training, etc.

Sia Partners’ expert capabilities extend to the technology infrastructure and can improve efficiency of IT systems, consolidate entity-wide IT efforts and remove redundancies. Sia can help identify the right technology to invest in and remove dependency on legacy / obsolete systems.

Through process design, business process management, and automation, we can simplify your workflows, accelerate creation & approval time, and improve budget forecast accuracy.

Sia Partners’ process optimization capabilities can help integrate APIs and automate KPI tracking. Sia is experienced in re-assessing business lines and entity-wide structure in order to eliminate unnecessary tasks and streamline entity-wide workflow processes.

Identify and prevent lost revenue via an end-to-end forensic review and re-engineering of billing processing, accounting and management. Streamline billing systems, improve straight-through processing and eliminate manual errors leading to accurate billing and improved client satisfaction.