Carbon Accounting Management Platform Benchmark…

Delve into the organizational and technical impacts of these new regulations. We describe the features and impacts of the regulations and detail how we help banks and financial institutions, both from a technical and a business perspective.

The Instant Payment Regulation (IPR) introduces a harmonized regulatory framework for instant euro transfers, representing a turning point across Europe.

On February 7, 2024, the Instant Payment Regulation (IPR) was approved by a majority of MEPs. The regulation is the result of an October 2022 European Commission proposal to make so-called "instant payments" available throughout the EU.

The regulatory framework has led to the following four major innovations.

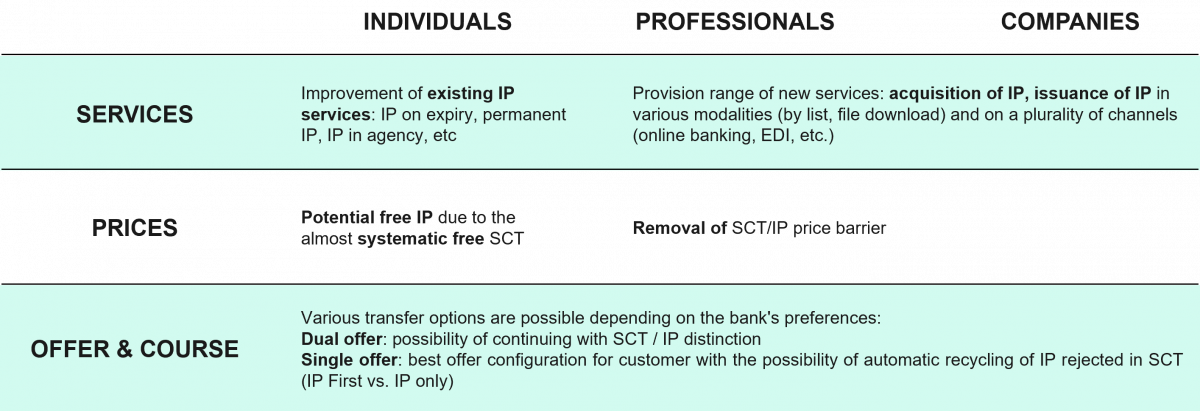

Customers will pay based on the same conditions between SCT Inst & SCT standard.

These new regulations will bring about an important increase of Instant Payments. This increase in volume had to be considered as soon as possible to best capitalize on the industrialization of this service.

The obligation to adapt to the use of Instant Payments introduced by the new European regulation will require adjustments of a technological, normative and organizational nature. The impacts will involve many structures within the organization that will need to review their current processes.

The new Instant Payments Regulation fits neatly within a regulatory framework that is already filled with numerous regulations that, taken together, are intended to regulate the entire payments and financial sector.

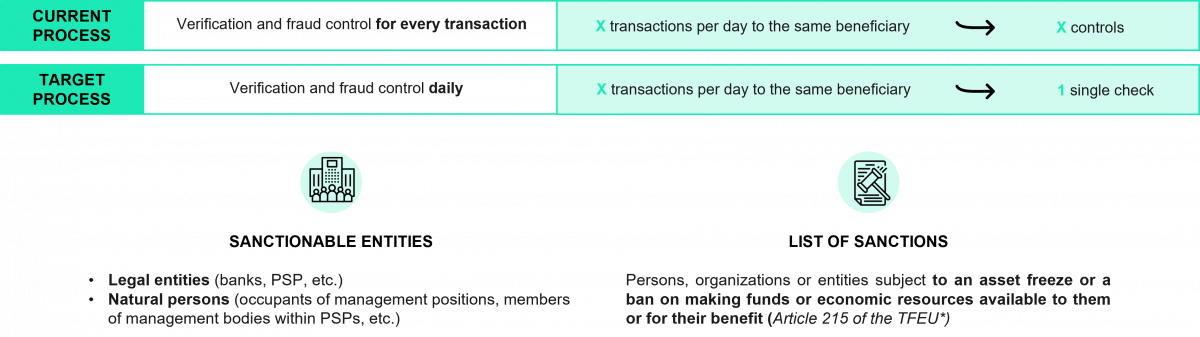

The new rules also require payment service providers to verify that the IBAN code matches the payee's name to prevent errors or fraud. The Regulations also introduce new and specific ways for PSPs to sanction screenings of PSUs for the purpose of verifying that payers and payees are not subject to restrictive financial measures.

Financial institutions should consider adopting a holistic approach to combating fraud, particularly in cases where existing anti-fraud solutions and processes may be based on batch processing or manual intervention. Below is an overview of the actions financial institutions should take.

A. Model

B. Customer Care

C. Fraud Management

Significant reduction in the number of frauds on Instant Payments by digital native banks, for three reasons:

-generally younger consumer base;

-more advanced fraud prevention tools;

-better customer contact through digital channels.

D. Awareness for Customers

Education and awareness around fraud, high budget spent on this issue.

Free training via webinar to describe how the service works and define how to reach out in case of fraud (to limit stolen identity and app compromise).

E. Operational effectiveness

Initial investment in a fraud management model: customer-facing with organizational interventions started earlier.

Pre-screening and list checks will remain active in addition to new controls required by regulations.

F. IT Investments

Evaluation of the adoption of new Open Finance tools (such as CBI services for Italy for example) to foster collaboration with other PSPs.

Enhance the use of AI tools to recognize fraud patterns. To date, positive effects are noted where they are introduced.

Change in solutions, from a reduced proportion of peers. Alternative applications are sought that enable predictive fraud insights (e.g., CLEAFY).

At Sia Partners, we support financial institutions in navigating the evolving landscape shaped by Instant Payments. Here’s how we can assist:

By partnering with Sia Partners, financial institutions can confidently address the complexities of Instant Payments, ensuring innovative growth and regulatory compliance.