Canadian Hydrogen Observatory: Insights to fuel…

“A cloud rarely looks like a cloud” (Ylipe). Investment in the cloud is expected to exceed 500 billion euros this year, with an upward trend and a steady stream of migrations.

Having become an obligatory step with costs that are often difficult to control, it is in the transformation of its own functions that organisations must seek ROI. Be more efficient, enhance performances, develop analytical skills… A vast majority of finance departments have already partially or totally adopted the Cloud with these objectives, but not all have managed to extract the quintessence of this technological shift. So how can CFOs find new performance levers? What are the secrets of a successful digital transformation in the cloud?

The COVID-19 pandemic has turned everything upside down and pushed companies towards more and more remote operations. Geopolitical uncertainties and cyber risks have finally convinced the last holdouts.

Although the adoption of the cloud is becoming more widespread, too many players still see it as additional bandwidth, a set of shared public data centers, or a simple cost-cutting lever. However, it has become an essential part of any digital strategy. Without the Cloud, because of the heterogeneous, siloed, and multiple nature of data, its exploitation would be unlimited. The Cloud offers a unique platform for hosting applications and data, computing power unmatched by traditional architectures, and unprecedented performance, opening the way to new uses.

It enables new algorithms and tools for Cloud Analytics, which can offer unparalleled power for relevant, informed, and instantaneous decision-making. Cloud Analytics (or Cloud Computing) frees businesses from the siloed nature of on-premise applications. It is at the heart of useful and effective decisions and thus contributes to performance by generating gains.

The Cloud is not only a scalable, cheaper, and more efficient IT structure, it has become the main catalyst for business transformation. All of these technologies pre-existed in decentralised IT architectures such as servers or workstations, but cloud migration facilitates their implementation in a single environment where computing capacities are increased tenfold.

So in concrete terms, what are the advantages that finance departments will gain from the operation? What are the impacts on processes, organisations, and staff skills?

Depending on the type of Cloud chosen (public, private, hybrid, multi, serverless), organisations will be able to exploit the advantages offered by the latest RPA, AI, and ML technologies, and thus positively impact financial processes by generating added value. A few examples from pioneers in high-volume BtoC companies: telecoms, banks, energy, and utilities:

Few companies are committed to harnessing the power of data at a strategic level. Executives who see data as an asset in their own right are using it as a lever for growth while redefining new priorities. New analytics tools, capable of leveraging all data via data hubs and data marts, for example, can easily extract, consolidate, format on demand, and scale this information on an “à la carte” basis. Once configured and made available to data analysts, data marts process complex queries and extract information making it available to analytics tools.

In order to best serve the needs of data exploitation, the data hub must offer data marts that are:

This enables a shift from a reactive to an anticipatory mode and makes data a competitive lever.

In addition, security is always a concern because of the sensitive nature of the information (customer, governance, legal). Good security management is proving to be a competitive advantage.

Good data hub governance should:

For example, the early adopters of the data hub include companies with heterogeneous or poorly integrated information systems that have to reconstruct coherent data universes from juxtaposed transactional tools.

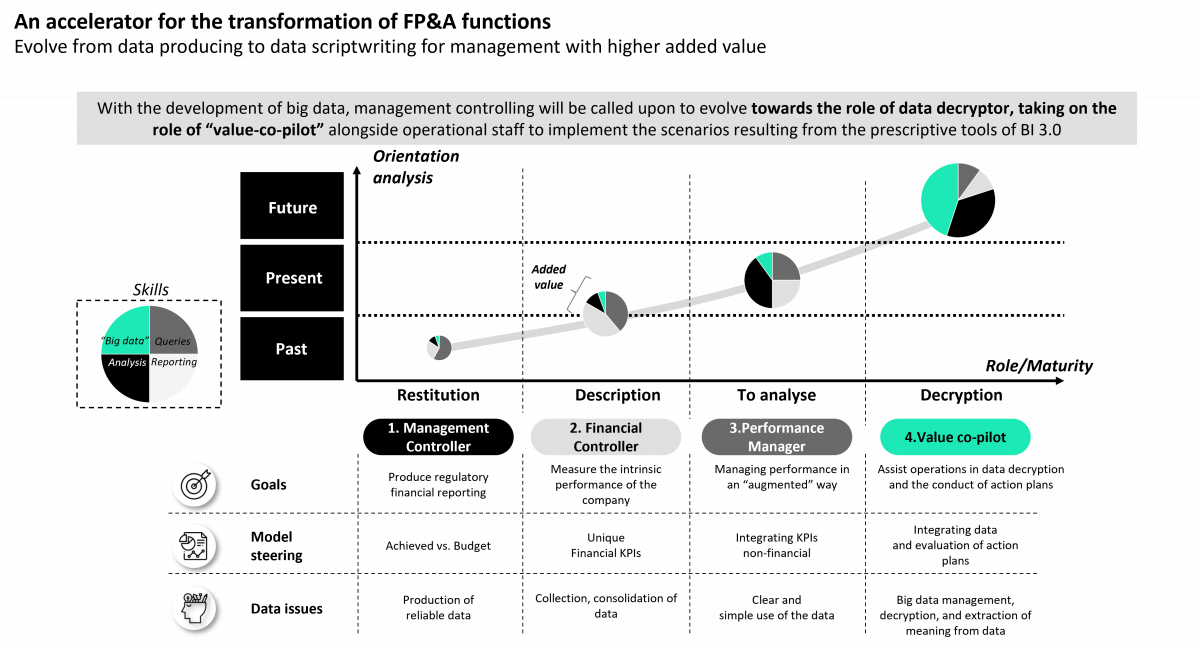

All these transformations will change the nature of activities and tasks of finance teams. Procedures and job descriptions must also be adapted and reviewed. Once trained in these new technologies (robots, etc.), the teams can allocate more time to data analysis. Employees can evolve to become real partners in the strategy (see illustration below).

Finally, the use of new digital finance tools enables operational and accounting transaction operators to refocus on higher value-added activities (management control support, internal control, data enrichment, etc.). It also allows organisations to reduce their dependence on outsourced and offshored activities.

The technological illusion should not, however, blind us. A successful move to the Cloud takes the form of a transformation of the finance sector that is less trivial than it might at first appear.

"Augmenting” an accounting function that has become an operator of robots or transforming a management controller into a data analyst capable of designing a data mart to answer a question from management, or handling statistical models to automate forecasts, will be neither immediate nor easy.

New CFO jobs will emerge with their own profiles, know-how, and specific training. At the crossroads of data science, IT, and project management, they will have to keep a strong economic awareness and handle the art of sharing it with the rest of the organisation. Ultimately, the cloud is accelerating the transformation of the sector and helping to make it more attractive.