Canadian Hydrogen Observatory: Insights to fuel…

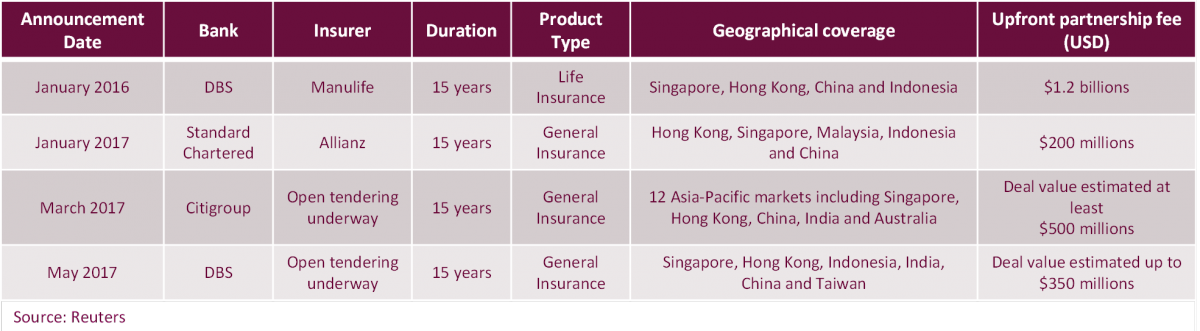

Bancassurance distribution is taking off in Asia, with a regional deal size expected to soon exceed US$2.25 billion since 2016. DBS and Citigroup are confirming the trend, as they are currently keen to seek regional GI partners.

“Bancassurance” refers to the selling insurance products through banks’ distribution channels. But why would insurers pay such a fortune for it? They will benefit from the below elements:

However, bancassurance presents specific challenges as insurers are not in a position to contact banks’ client bases due to data privacy concerns. Two banks were previously reported to have contravened the privacy ordinance in Hong Kong as their customer data were passed to their insurance partners for direct marketing1. Furthermore, despite the existence of aligned business targets and variable pays or claw back terms, the sales targets can still be stretched to achieve especially when bank are distracted to other business priorities.

Thus, how can insurers work with their banking partners to ensure their investments pay off?

RECOMMENDATION TO INSURERS #1 - Provide the right products to the right banks’ segments

Owning to the containment on customer’s wealth information, banks have a comprehensive customer segmentation strategy. In order to benefit the most from banks’ distribution channels, insurers should understand the customer proposition in each segment and offer the right products according to the perceived characteristics. Listed below the possible product offerings:

We even observed insurers tailor their product exclusively to particular segment. For instance, Hiscox offers to Barclays UK’s Premier customers exclusively a home insurance called Premier Home insurance2.

RECOMMENDATION TO INSURERS #2 – Offer banks easy up-selling opportunities

Sometimes banks are reluctant to conduct marketing solely on the third party products due to limited resources. To support banks in selling more without additional resources, insurers can provide offers which are deemed to add value for customers. Therefore, the insurance can effectively promote its products using the hands of the banks’ segment owner. E.g. Bupa’s offer on health insurance is seen to be one of the key pillars of the Hang Seng Prestige segment acquisition campaign3.

RECOMMENDATION TO INSURERS #3 - Face-to-Face channels: promote one-stop bank AND insurance integrated approach to offload the salesforce

In face-to-face channels, bank salesforce are incentivized with stretch targets on banking products and customers come to branch mostly for banking agendas. Therefore, insurers should integrate the insurance products selling process into the banking one.

As an example, home insurance would be distributed more easily if mortgage and home insurance application can share the same set of enrollment process. This can be facilitated by a straight through system integration, or a workaround in the mortgage application form. Citibank Hong Kong, for instance, adds a section dedicated to home insurance on its mortgage application for cross-selling purpose4. For GI insurers, the above integrated approach is also effective on health insurance cross over life insurance with additional efforts on a combined underwriting process.

Last but not least, bank salesforce are more willing to conduct cross-selling with solid training on insurance specificities and the onsite support from insurers.

RECOMMENDATION TO INSURERS #4 - Digital channels: Promote at the very right time in online banking journeys

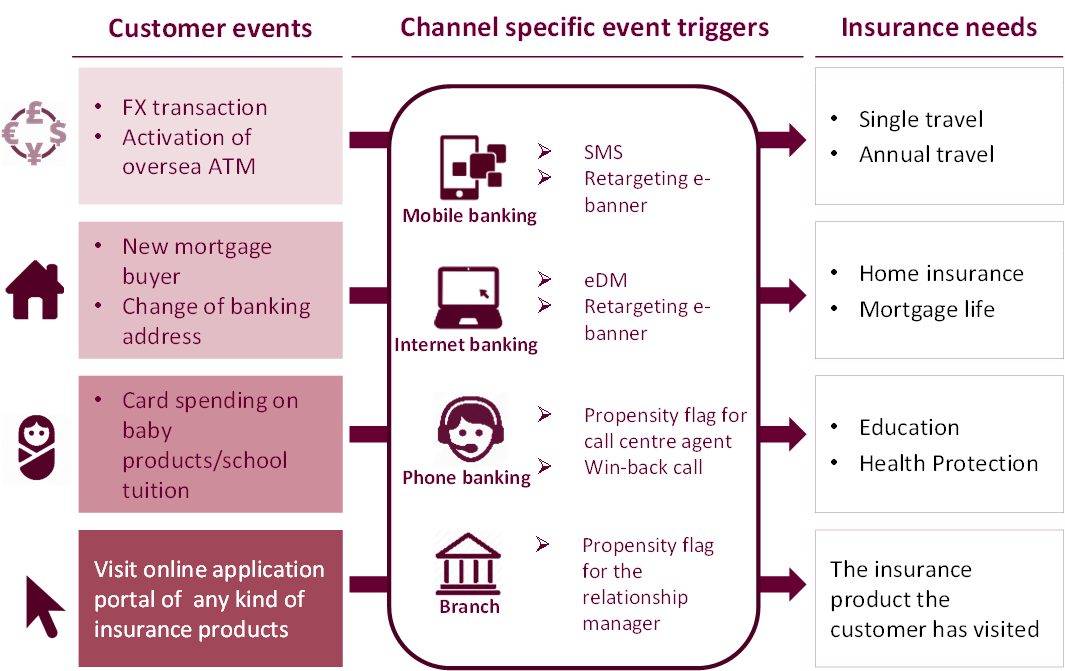

Banks have numerous customer touch points, which brings knowledge on customer behaviors. However, banks might not be an expert to identify the moments of insurance needs in which insurers have a key advisory role to play. Some of the effective event triggers are as below:

Research showed direct marketing on the event triggered list has 56% and 17% increase in response rate and campaign ROI respectively, compared with the list from profile screening5.

RECOMMENDATION TO INSURERS #5 - Digital channels: Invest to create customer awareness on the insurer-owned enrolment portal

It costs resources to banks to build up event triggers. Therefore, trust needs to be built to nurture collaboration from the banking partners:

To make the investments pay off, insurers should make good use of the bank’s customer segments and the knowledge on the customer behaviors to maximize the cross-selling opportunities. However, the bancassurance might encounter adversities when the banking partners find it difficult to collaborate. To accomplish a win-win situation, a successful insurer can proactively provide business ideas and incentives to facilitate its partners to move forward together along the same direction.

On its flip side, maintaining a successful bancassurance is costing the insurers huge effort across a long period of time and the increasing cost might already drive some insurers to explore alternative channels. It is expected that some other types of partnership will take place among the region in the near future.

===============================================================

1 Refer to the Personal Data (Privacy) Ordinance, published by the PCPD of Hong Kong.

2 Hang Seng Prestige Main Account and multiple Family+ accounts: Hang Seng Bank