Carbon Accounting Management Platform Benchmark…

On February 9th, 2022, the SEC proposed to shorten the current two-day trade settlement cycle to a one-day trade settlement cycle (T+1). This change will come into effect in the US on May 28th, 2024. It is critical for firms to make operational enhancements to meet the demands of T+1 settlement.

On February 9th, 2022, the Securities and Exchange Commission (SEC) proposed to shorten the current two-day trade settlement cycle (T+2) to a one-day trade settlement cycle (T+1). The proposed change will come into effect in the United States on May 28th, 2024.

The DTCC and key industry participants have been actively preparing for the transition to shorten the trade settlement cycle. The benefits of the transition to a shorter trade settlement cycle include increased efficiency and trading speed within the market as well as higher liquidity and reduced credit risk, market risk and capital requirements.

The transition to a one-day trade settlement cycle will be an industry-wide exercise, requiring early and precise planning to achieve a seamless transition. Broker dealers need to be proactive regarding operational and technological enhancements with the goal of sustainably meeting the demands of T+1 settlement and aligning with all market participants.

The shortened trade settlement cycle will have varying impacts on broker-dealer client accounts. In addition to improving their own systems and procedures, broker-dealers will need to ensure their clients have modernized trade settlement systems and procedures to handle the technical changes related to T+1.

Critically, the window to repair trade breaks will decrease from approximately 30 hours to 6 hours--between 4pm and 10pm on Trade Date (T). Broker-dealer clients, such as asset managers, should work closely with their service providers and counterparties, to improve the efficiency and effectiveness of their systems and procedures. Failure to do so may result in a significant increase in Fails-To-Receive (FTR) and Fails-To-Deliver (FTD) leading to unwanted consequences such as potential buy-ins, increased interest costs, increased operational costs, interest claims and reputational risk.

The transition from T+2 to T+1 will lead to changes to trade execution, confirmation, clearing, netting, settlement instructions, delivery, and reconciliation. Broker-dealer clients will need to make necessary adjustments to their internal processes related to trade settlement.

Below is a breakdown of the current T+2 Settlement Lifecycle compared to the T+1 Settlement Lifecycle. Clients will need to adjust their operations and push more settlement responsibilities to happen on “T” to ensure a successful transition to the new settlement cycle in preparation for the go-live date.

With the shorter settlement cycle, post-trade processing will need to occur on trade date. Post-trade allocations and affirmations must be completed on the day of the trade in order to avoid additional DTCC charges. Allocations should be made as soon as possible after order execution to ensure ample time for affirmation processing. Standard Settlement Instructions (SSIs) need to be accurate and complete for all client accounts on Trade Date.

Operational risk will increase as funds will be released quicker as trades will settle the day after trade date. Both broker dealer and buy side operations will have one less day to complete necessary actions which will lead to the risk of increased trade fails throughout the settlement cycle. Operational risk will continue to increase if firms persist to operate with manual procedures. Automation features/tools are being adopted by sell-side and buy-side firms across the US to help expedite operations surrounding allocations and affirmations. These tools will serve a key role in ensuring firms are able to settle their trades on time.

Accelerated trade settlement will impact broker-dealers and clients in both positive and negative ways. Well-prepared broker-dealers can put themselves at an advantage by reviewing client accounts and settlement instructions to mitigate any risk related to clients prior to the transition to T+1. Poorly prepared firms may face significant operational and reputational risk. It is crucial for broker-dealers to leverage the current period before the go-live date of May 28th, 2024, to identify any accounts which currently struggle within the T+2 trade settlement environment and work with these client firms and counterparties to ensure they are up to standard to settle efficiently on T+1.

Between 2001 and 2022, fails-to-deliver averaged $3.8 billion per day and fails-to-receive averaged $3.0 billion per day. With the shortened settlement cycle, these numbers could increase dramatically.

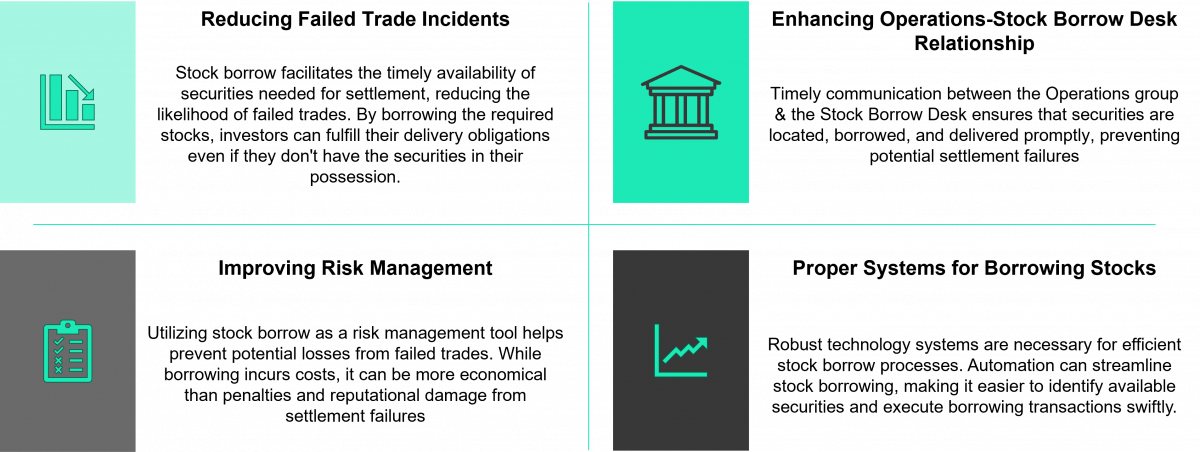

Utilizing Stock Borrow capabilities can assist with strengthening the collaboration between the Operations Group and the Stock Borrow Desk, implementing proper systems, and mitigating the risks associated with failed trades.

With the shorter settlement cycle rapidly approaching, firms have less time to correct mistakes and allocate trades. Firms will need to operate more efficiently and utilize existing concepts like Stock Borrow to ensure that failed trades are kept at a minimum.

Broker Dealers and their clients should be looking to automate key pieces of the settlement cycle including trade matching mechanisms to identity trade breaks in real time, automated trade settlement workflow and real time reference data to reduce the volume of fails.

Process improvement and automation, aided by technology, will play a significant role in helping firms achieve compliance with the accelerated trade settlement cycle. Both clients and broker dealers will need to enhance automation to decrease the risk of trade fails.

The transition to T+1 will require broker-dealers to evaluate not only all internal processes and system capabilities, but also trends of their clients. Firms should be proactive in the current T+1 testing period by assessing the behavior of clients within the T+2 environment. By identifying poor performers in a T+2 environment, firms can look to minimize risk and make operational improvements to their own processes and settlement instructions.

Sia Partners has been proactively anticipating the pending shift to T+1 trade settlement and can work to build an effective framework for our clients. We have extensive experience leading large-scale Business, Technology, and Regulatory transformational projects across the Financial Services Industry. Additionally, Sia Partners has helped our clients meet the demands of similar trade acceleration initiatives - designing a comprehensive and effective game plan, identifying impacted areas, enhancing processes, and providing technology solutions. We welcome the opportunity to partner with you on major strategic and operational initiatives, providing a variety of solutions to meet all your business needs.